Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

The Shapella upgrade brings significant changes to the Ethereum network, introducing new withdrawal options for validators in the form of full withdrawals and partial withdrawals. This article delves into the details of withdrawal eligibility, the step-by-step process for withdrawals, and what to expect in the immediate, mid-term, and long-term future. We also explore the potential impact on the activation queue, withdrawal queue, and APR dynamics, as well as the various factors that may influence these aspects of the Ethereum ecosystem.

The Shapella upgrade introduces two types of withdrawals: full withdrawals (also known as exits) and partial withdrawals (staking reward collection).

Core withdrawal concepts

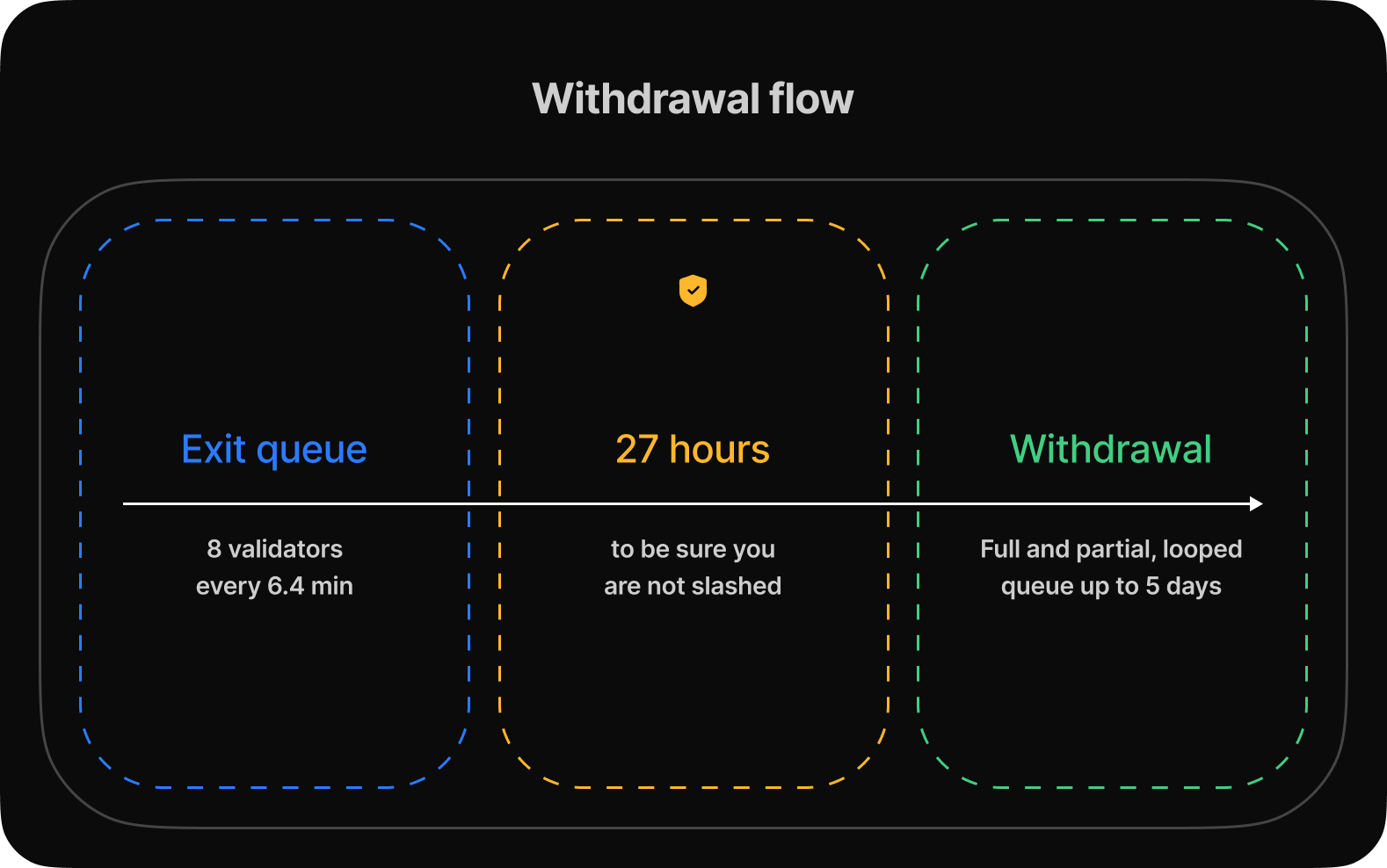

Validators must use withdrawal credentials with the 0x01 format, introduced in March 2021, to be eligible for withdrawals. Validators with the older 0x00 format will be able to switch to the 0x01 format after the Shanghai upgrade, limited to 16 switches per block. It may take two days for every validator to switch their credentials and another two to three days for most staking rewards to be withdrawn.

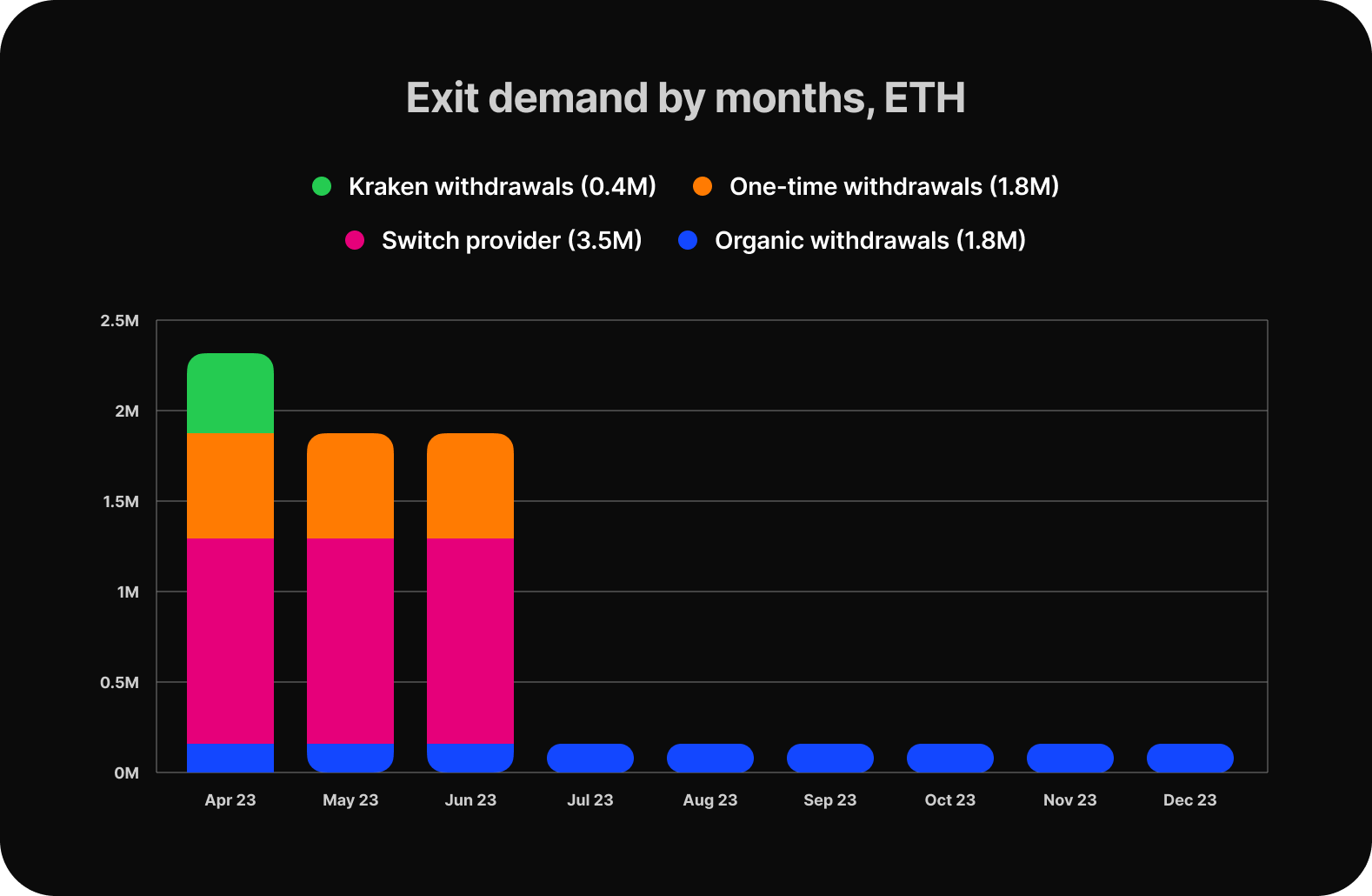

Various factors affect the demand for staking withdrawals. We have selected the most important ones, in our opinion, and tried to evaluate their effect on the market:

Below we have analyzed our assumptions in detail:

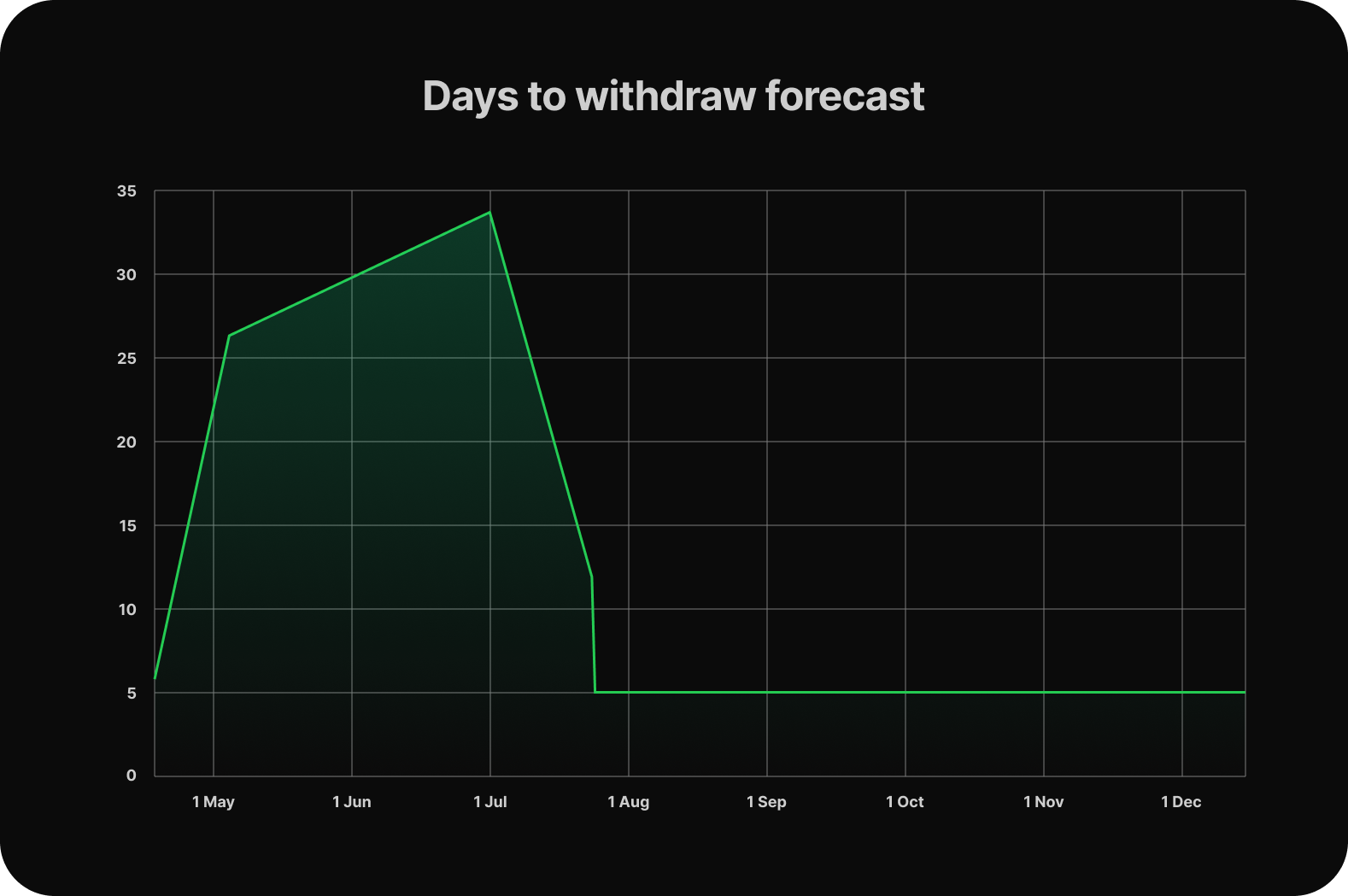

Considering the assumptions above and the fact that the maximum unstake bandwidth is 57.6k ETH daily, we’ve calculated the potential exit queue for the upcoming month.

The current percentage of staked ETH is low (15%) compared to other chains like Solana (68%) and Polygon (43%). The Shanghai upgrade should unlock pent-up demand from investors who have been reluctant to lock their ETH. A larger proportion of staked ETH will provide greater network security over time.

Yields from staking are higher than those from the largest and safest DeFi protocols. After the Shanghai upgrade, the risk of locking funds through staking will decrease, making it more attractive to investors.

In addition, partial withdrawals allow validators to withdraw rewards regularly and restake them, utilizing compounding. Validators can restake these rewards promptly to maximize their returns.

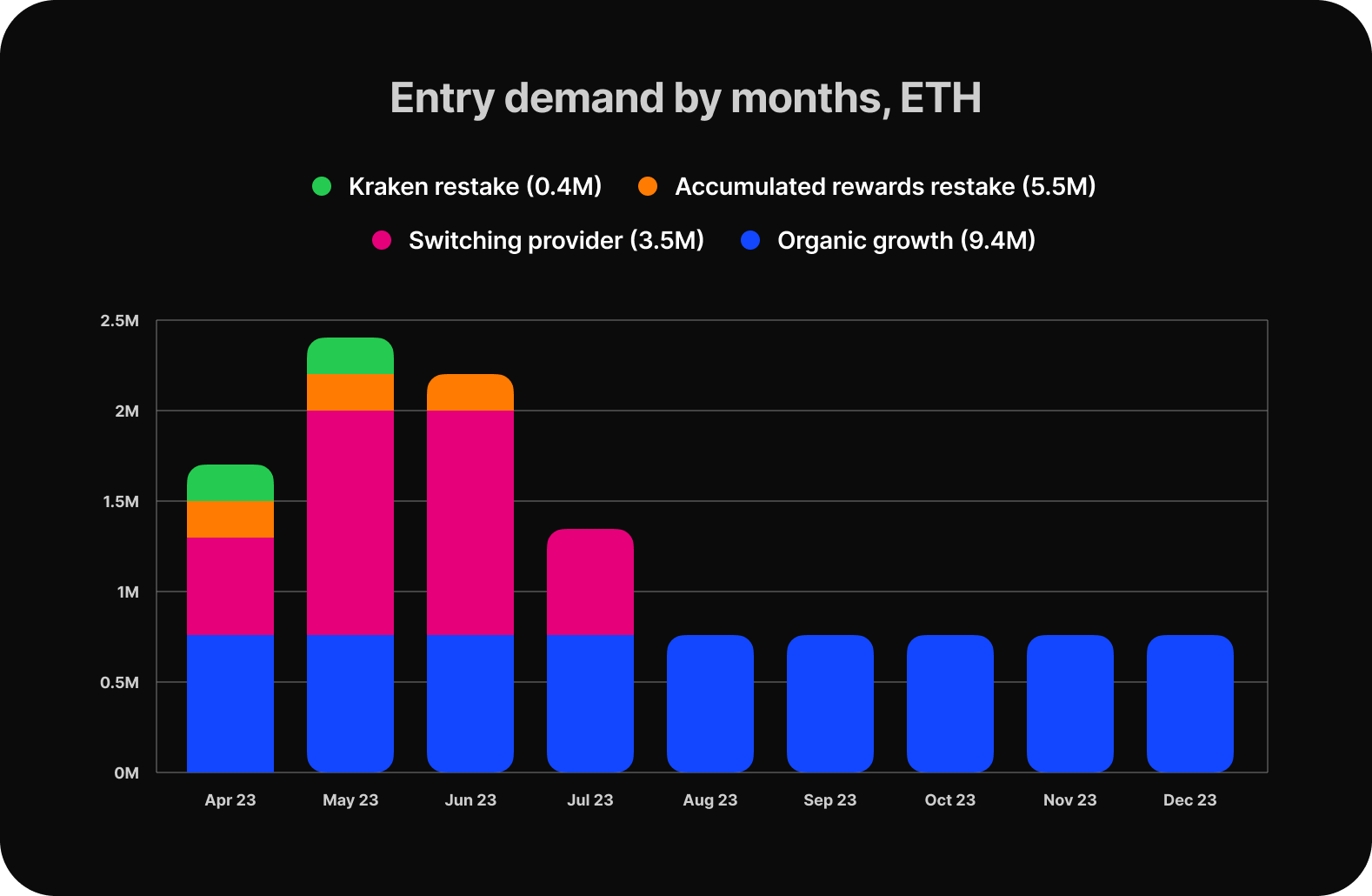

Until now, staked ETH has increased fairly linearly over time: +6 pp. to the staking ratio yearly (or around 220k new validators per year). But we believe that the Shapella update is a game-changer, and we will see accelerated organic growth (up to 440k new validators or 14M ETH per year).

Other factors affect the activation queue

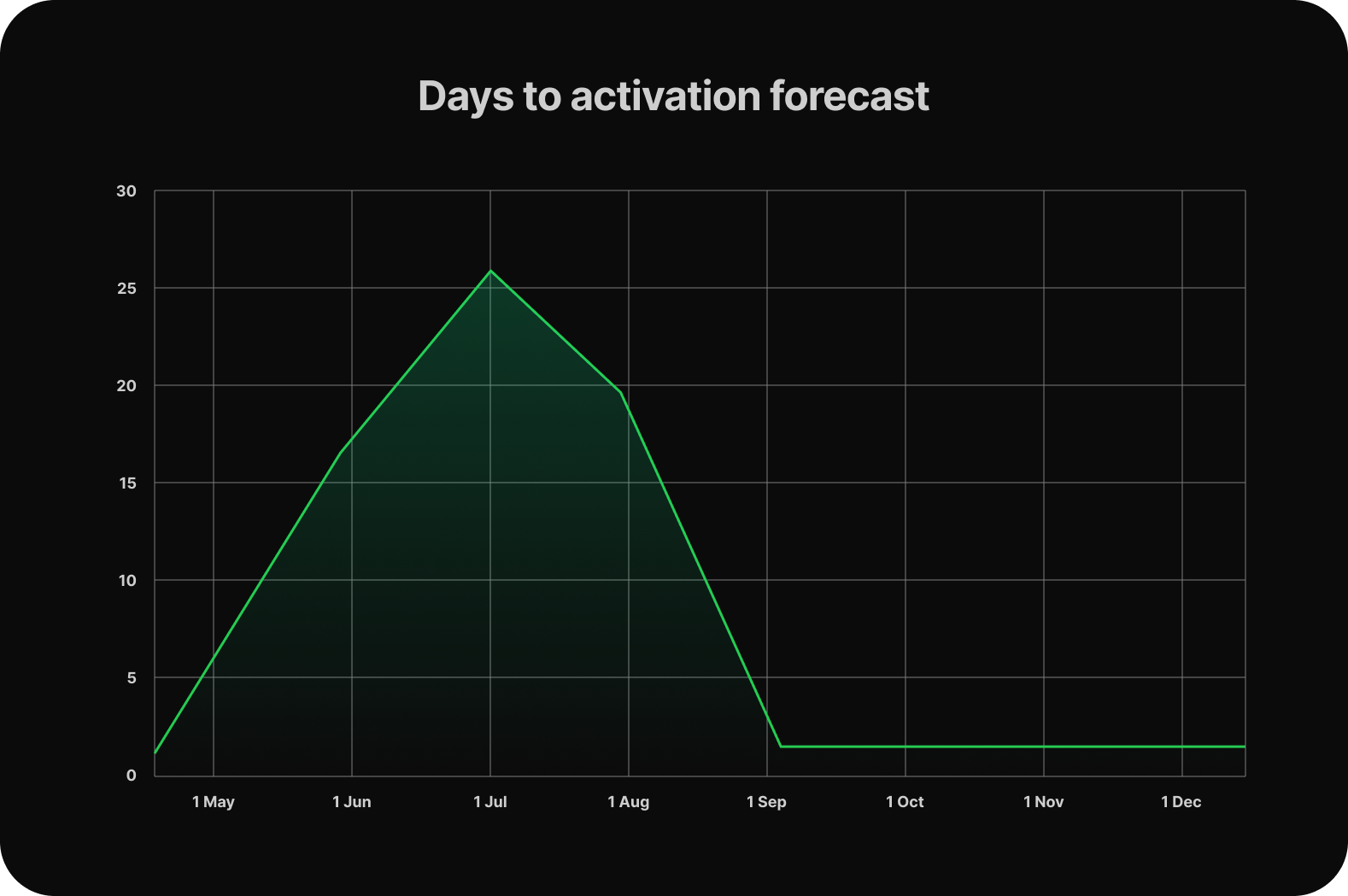

Applying these assumptions to activation queue bandwidth (57.6k ETH daily), we are getting the following activation queue projections:

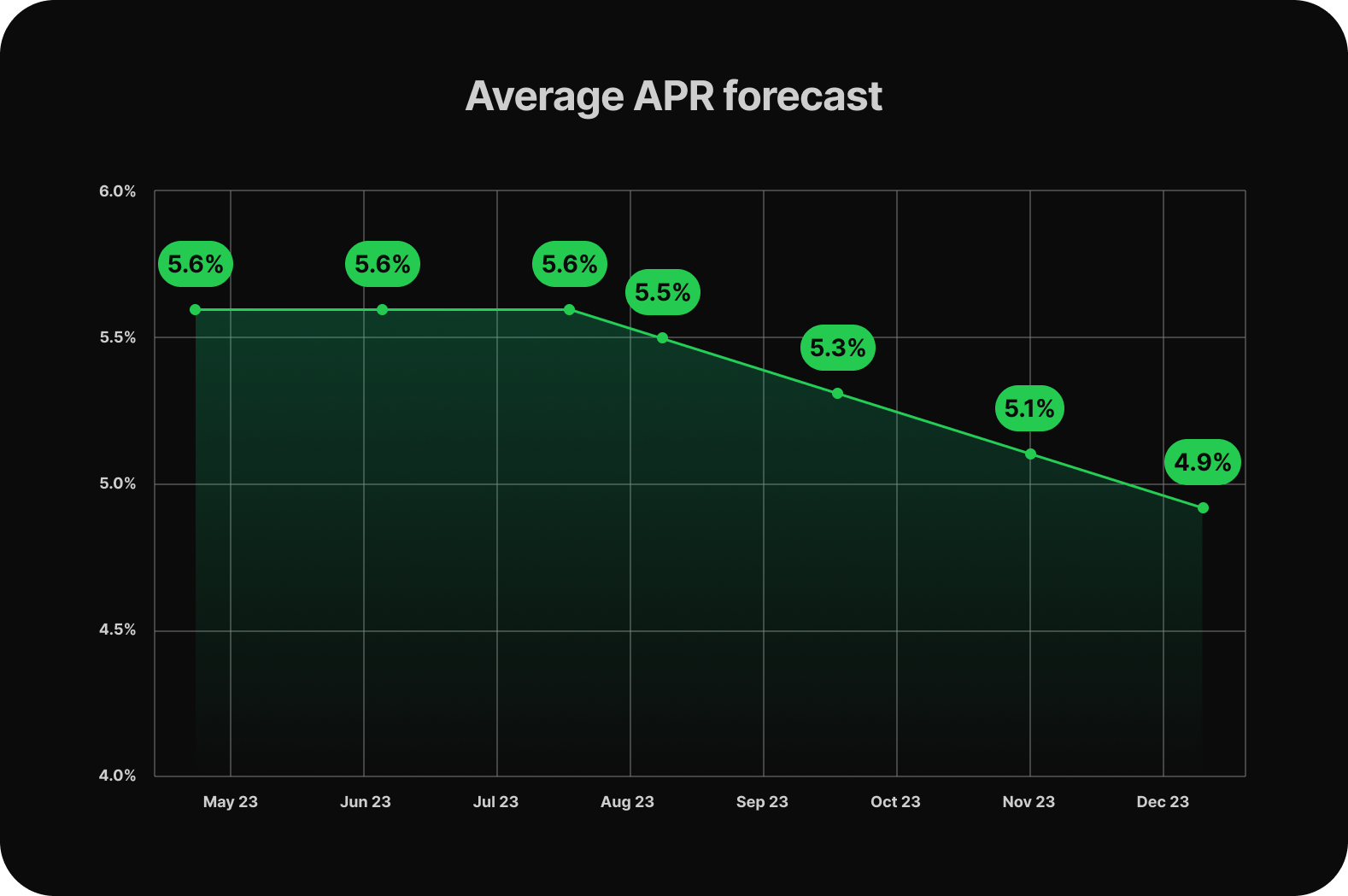

Since the activation and exit queues have similar bandwidth, and based on the assumptions mentioned above, during the first 3 months after Shapella, we can expect to see a stable number of active validators (57.6k ETH activations / 57.6k ETH exits daily). This leads to a consistent APR, as the number of active validators is one of the main factors influencing rewards. The more validators there are, the fewer rewards each of them receives.

Below is the APR baseline forecast that takes into account a limited number of factors. It may not be entirely accurate, as many other factors can significantly impact rewards. Nevertheless, it is interesting to consider the trends as a baseline scenario.

Regarding the other factors not accounted for in the baseline scenario:

Factors that may increase rewards:

Factors that may decrease rewards:

The Shapella upgrade presents both challenges and opportunities for validators. To maximize benefits, validators should ensure they possess the necessary 0x01 withdrawal credentials, plan their withdrawal strategies, and be prepared for potential market fluctuations. By understanding the withdrawal process and adapting to the changing landscape, validators can ensure a successful experience with the Shapella upgrade.

Ethereum Product Manager at P2P.org

<h1 id="introduction"><strong>Introduction</strong></h1><p>In this post, we will take a deep dive into the Ethereum network during the month of March 2023. Our goal is to provide a comprehensive analysis of the network and its various components. Here are the topics we explore:</p><ul><li><a href="https://p2p.org/economy/ethereum-staking/#:~:text=Ethereum%20staking%20ecosystem.-,Network%20Overview,-As%20of%20March">Network Overview</a></li><li><a href="https://p2p.org/economy/ethereum-staking/#:~:text=Staking%20review%20by%20segment">Review by staking segments</a></li><li><a href="https://p2p.org/economy/ethereum-staking/#:~:text=validators%20is%20public.-,Lido%20operators,-When%20staking%20involves">Lido operators performance</a></li><li><a href="https://p2p.org/economy/ethereum-staking/#:~:text=block%2016867030.-,P2P.org%20overview,-The%20top%203">P2P.org overview</a></li><li><a href="https://p2p.org/economy/ethereum-staking/#:~:text=Tweets%20and%20articles%20of%20the%20month">Best tweets and articles</a></li></ul><p>All the data was sourced from our own validators, <a href="http://beaconcha.in/?ref=p2p.org">beaconcha.in</a> and <a href="https://www.rated.network/?ref=p2p.org">rated.network</a>. We considered only staking providers whose information is publicly available, meaning this list isn’t a complete picture of the Ethereum staking ecosystem.</p><h1 id="network-overview">Network Overview</h1><p>As of March 2023, the total amount of Ethereum staked has reached <strong>17,963,528 ETH</strong>, which is <strong>5.26%</strong> higher than the previous month's total stake. This is a significant increase, demonstrating the growing interest in Ethereum staking. The amount staked now represents approximately <strong>15.04%</strong> of the total circulating supply of Ethereum, which is a strong indication of the confidence that investors have in the platform. It is worth noting that this is a considerable increase from just a few months ago, demonstrating the rapid growth of the Ethereum ecosystem.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/01-Network-Overview-1.png" class="kg-image" alt loading="lazy" width="1996" height="1199" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/01-Network-Overview-1.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/01-Network-Overview-1.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/01-Network-Overview-1.png 1600w, https://p2p.org/economy/content/images/2023/04/01-Network-Overview-1.png 1996w" sizes="(min-width: 720px) 720px"></figure><p>Despite the increase in the total amount of Ethereum staked, the current network-wide average annual percentage rate (APR) for Ethereum staking is around 4.1**%**, which is a 0.0738 percentage point increase from the previous month. The consensus rewards have increased by 0.2518 points, but the execution rewards have decreased by 0.178 points due to the increase in the number of validators in the network. The table below shows the top 5 block MEV rewards.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/02-Network-Overview-2.png" class="kg-image" alt loading="lazy" width="1978" height="669" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/02-Network-Overview-2.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/02-Network-Overview-2.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/02-Network-Overview-2.png 1600w, https://p2p.org/economy/content/images/2023/04/02-Network-Overview-2.png 1978w" sizes="(min-width: 720px) 720px"></figure><p>For investors interested in Ethereum staking, it is important to be aware and understand the risks involved. Additionally, during March, 4 <strong>validators</strong> from the network were slashed, one of which belongs to Rocket Pool</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/03-Network-Overview-3.png" class="kg-image" alt loading="lazy" width="1978" height="584" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/03-Network-Overview-3.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/03-Network-Overview-3.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/03-Network-Overview-3.png 1600w, https://p2p.org/economy/content/images/2023/04/03-Network-Overview-3.png 1978w" sizes="(min-width: 720px) 720px"></figure><p>This highlights the risks involved in Ethereum staking and the importance of carefully selecting validators to stake with.</p><h1 id="staking-review-by-segment">Staking review by segment</h1><p>The upcoming Shanghai update for Ethereum, scheduled for April 12, has holders of liquid staking tokens eagerly anticipating how the event will impact their holdings. Prior to the update, any ETH deposits into these protocols could not be withdrawn from Ethereum's deposit-only Proof-of-Stake (PoS) system. After the Shanghai event, users will be able to unstake their ETH, sell their stakes, or migrate to a different staking service.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/04-Staking-review-by-segment-1.png" class="kg-image" alt loading="lazy" width="1978" height="912" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/04-Staking-review-by-segment-1.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/04-Staking-review-by-segment-1.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/04-Staking-review-by-segment-1.png 1600w, https://p2p.org/economy/content/images/2023/04/04-Staking-review-by-segment-1.png 1978w" sizes="(min-width: 720px) 720px"></figure><p>For the current period, liquid staking increased to a total of 33.33%. This value is 2.38 points higher than at the beginning of the year. Conversely, CEX stacking has decreased to 27.27%, which is 2.31 points lower than at the beginning of the year. Staking pools and unidentified validators have remained almost unchanged, at 16.97% and 22.43% respectively. As we can see, at the end of February there was a big amount of ETH deposited, one of them is the largest single daily inflow ever on the Lido platform in the amount of 150,000 ETH.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/05-Staking-review-by-segment-2.png" class="kg-image" alt loading="lazy" width="1978" height="1048" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/05-Staking-review-by-segment-2.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/05-Staking-review-by-segment-2.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/05-Staking-review-by-segment-2.png 1600w, https://p2p.org/economy/content/images/2023/04/05-Staking-review-by-segment-2.png 1978w" sizes="(min-width: 720px) 720px"></figure><p>Lido is the largest liquid staking platform, which currently has over 31% of all staked ETH. Lido's popularity can be attributed to its ease of use and its ability to provide users with a flexible and secure way to stake their ETH. It is challenging to de-anonymize all validators, including their owners and whether they belong to centralized exchanges, staking pools or e.t.c. However, with Lido, all the information about the validators is public.</p><h2 id="lido-operators">Lido operators</h2><p>When it comes to ETH staking we should not only consider the APR as an important metric but also take into account validator effectiveness, which can be an even more accurate metric. Validator effectiveness indicates how much of your validator balance is being used for attestations, and is calculated as the effective balance as a fraction of the total balance. <a href="https://p2p.org/?ref=p2p.org">P2P.org</a> published an article explaining why validator effectiveness is a better metric than APR, and providing tips on how to choose the best staking operator.</p><p>In this regard, two of the highest-performing validators in the market are Allnodes and Attestant. These validators have an effectiveness rating of 97.25%, which means they are highly efficient in terms of attestation.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/06-Lido-operators.png" class="kg-image" alt loading="lazy" width="1978" height="1044" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/06-Lido-operators.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/06-Lido-operators.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/06-Lido-operators.png 1600w, https://p2p.org/economy/content/images/2023/04/06-Lido-operators.png 1978w" sizes="(min-width: 720px) 720px"></figure><p>The top 3 by validator effectiveness is <strong><a href="https://p2p.org/?ref=p2p.org">P2P.org</a></strong> with the highest APR in the top 5 effectiveness rating over the last 30 days. We will explore this in more detail in the next section.</p><p>We would also like to note that Staking Facilities and Everstake had the highest APR in March. Staking Facilities has an APR of 9.96%, with an execution APR of 6.07%. This value is approximately 50% higher than their average APR, due to a very large MEV block reward of around 692 ETH for block <a href="https://beaconcha.in/block/16867030?ref=p2p.org">16867030</a>.</p><h1 id="p2porg-overview">P2P.org overview</h1><p>The top 3 by validator effectiveness is <strong><a href="https://p2p.org/?ref=p2p.org">P2P.org</a></strong> with the highest APR in the top 5 effectiveness rating over the last 30 days.</p><h2 id="rewards">Rewards</h2><p>For March, all active validators on the network generated a mean rewards rate of 0.1345 ETH. The average reward of P2P’s validators was 0.1386 ETH, around 3% higher than the mean performance of all the active validators on the network</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/07-AVG-validator-rewards.png" class="kg-image" alt loading="lazy" width="1978" height="649" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/07-AVG-validator-rewards.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/07-AVG-validator-rewards.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/07-AVG-validator-rewards.png 1600w, https://p2p.org/economy/content/images/2023/04/07-AVG-validator-rewards.png 1978w" sizes="(min-width: 720px) 720px"></figure><p>This is mostly due to P2P's enterprise-grade infrastructure, which maximizes node uptime and rewards, while also utilizing MEV-Boost to extract additional value during block production.</p><h2 id="consensus-performance">Consensus performance</h2><p>The primary metric commonly used when choosing a staking provider is APR. However, due to Ethereum’s complex rewards structure, it’s better to compare staking providers by their validator’s effectiveness rather than APR. We conducted extensive research on the topic, and you can read about it <a href="https://www.stakingrewards.com/journal/choosing-the-best-using-metrics-and-data-to-choose-the-right-ethereum-validator/?ref=p2p.org">here.</a></p><h3 id="earned">Earned</h3><p>Validators may receive fewer consensus rewards due to missed attestations and errors that result in penalties. Here, we compare the average share of rewards of the network and <a href="https://p2p.org/?ref=p2p.org">P2P.org</a>.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/08Earned.png" class="kg-image" alt loading="lazy" width="1978" height="1225" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/08Earned.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/08Earned.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/08Earned.png 1600w, https://p2p.org/economy/content/images/2023/04/08Earned.png 1978w" sizes="(min-width: 720px) 720px"></figure><p>The network average share of consensus layer rewards was 98.29%, while that of <a href="https://p2p.org/?ref=p2p.org">P2P.org</a> is 99.18%, which is 0.89 percentage points above the network average</p><h3 id="attestation-rate-correctness">Attestation rate & correctness</h3><p>The attestation rate measures how often a validator successfully attests new proposed blocks to the rest of the network. If a validator is down or cannot attest blocks for other reasons, its attestation rate and, therefore, rewards will decrease. Attestation correctness is another essential metric to consider, as it measures the accuracy of a validator's attestation. Validators must attest to the correct block or face penalties, including potential slashing. Accurate attestations are crucial for maintaining the integrity and security of the Ethereum network, making attestation correctness an essential metric to consider.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/09-Attestation-rate.png" class="kg-image" alt loading="lazy" width="1978" height="1074" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/09-Attestation-rate.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/09-Attestation-rate.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/09-Attestation-rate.png 1600w, https://p2p.org/economy/content/images/2023/04/09-Attestation-rate.png 1978w" sizes="(min-width: 720px) 720px"></figure><p>In March, the network's average attestation rate was approximately 99.6%, while P2P's attestation rate was 99.98%, which is 0.38% higher than the network average. The network's average attestation correctness was approximately 98.91%. Meanwhile, P2P's attestation rate was 99.36%, which is 0.45% higher than the network average.</p><h2 id="execution-performance">Execution performance</h2><p>The execution layer is the layer on the Ethereum blockchain that provides the environment for applications and smart contracts to operate and process transactions within and between applications. In general, there are two types of execution layer rewards: transaction priority tips and MEV tips.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/10-Execution-performance.png" class="kg-image" alt loading="lazy" width="1978" height="457" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/10-Execution-performance.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/10-Execution-performance.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/10-Execution-performance.png 1600w, https://p2p.org/economy/content/images/2023/04/10-Execution-performance.png 1978w" sizes="(min-width: 720px) 720px"></figure><p>There is a high risk of missing a block when the MEV relay proposes it for an extended period of time. Therefore, we create the block ourselves, which is why we haven't achieved 100% success rate. In March 2023, <a href="https://p2p.org/?ref=p2p.org">P2P.org</a> had 96.4% of the MEV blocks, with 3052 proposed blocks and a proposal rate of 99.97%. Here are the top 5 blocks with the highest MEV rewards:</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/11-to-5-mev.png" class="kg-image" alt loading="lazy" width="1978" height="657" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/11-to-5-mev.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/11-to-5-mev.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/11-to-5-mev.png 1600w, https://p2p.org/economy/content/images/2023/04/11-to-5-mev.png 1978w" sizes="(min-width: 720px) 720px"></figure><h3 id="slashing">Slashing</h3><p>A slashing event occurs when a validator misbehaves on the network. This is the most severe penalty a validator can suffer, and it results in the loss of a portion of their staked tokens.</p><p>During March, P2P had no slashing occurrences. We are proud to maintain a flawless record of zero slashing events throughout our time running Ethereum validators.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/12-Execution-performance--1-.png" class="kg-image" alt loading="lazy" width="1978" height="509" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/12-Execution-performance--1-.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/12-Execution-performance--1-.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/12-Execution-performance--1-.png 1600w, https://p2p.org/economy/content/images/2023/04/12-Execution-performance--1-.png 1978w" sizes="(min-width: 720px) 720px"></figure><p>P2P operates validator infrastructure securely, to minimize the risk of being slashed, and provides coverage to mitigate any losses in the event of a slashing incident.</p><h1 id="tweets-and-articles-of-the-month">Tweets and articles of the month</h1><p><br>Check out P2P.org best tweets and articles for March 2023</p><ol><li> <strong>A deep dive into withdrawals</strong>. What will the post-Shapella market look like? We researched the market landscape and withdrawal documentation comprehensively to highlight the pitfalls and insights about the upcoming changes. <a href="https://twitter.com/P2Pvalidator/status/1643974124145102849?ref=p2p.org">Read the Twitter thread and check the full post here</a></li><li><strong>Choosing the best validator</strong>. Dive into our ultimate guide on choosing the best Ethereum validator for the Shanghai update Metrics, slashing insurance, SLA & more. <a href="https://www.stakingrewards.com/journal/choosing-the-best-using-metrics-and-data-to-choose-the-right-ethereum-validator/?ref=p2p.org">Read article</a></li><li><strong>Calculate possible APR</strong>. Ethereum APR is highly influenced by random factors like the number of blocks created or MEV. But how do you know if your APR is good or not? We've developed an advanced APR simulator, that calculates the average expected APR and possible deviations. <a href="https://p2p.org/networks/ethereum/apr-simulator?ref=p2p.org">Try it out</a></li></ol>

from p2p validator

<p>We are excited to announce that the Tezos Mumbai upgrade has successfully passed and is now fully operational on Mainnet.</p><p>The Tezos Mumbai upgrade brings with it a host of new features and improvements, including:</p><ul><li>Epoxy - Tezos Validity Rollup (aka ZK-rollup) solution, allowing for instant finality due to SNARK’s proof-of-validity.</li><li>Reduced block time to 15 seconds, thanks to improved pipelining.</li><li>Ticket transfers between accounts, including implicit accounts.</li><li>New RPCs for ticket balances, improving ticket ownership visibility.</li><li>New Michelson operations, allowing for logical operations on bytes.</li></ul><p>The Mumbai upgrade also includes the activation of <strong>Smart Rollups on Mainnet, a powerful scaling solution</strong> that allows anyone to deploy decentralized WebAssembly applications with dedicated computational and networking resources. Furthermore, the <strong>upgrade disables Transaction Optimistic Rollups on Mainnet</strong>, as these can now be easily implemented through Smart Rollups.</p><p>In addition to the successful upgrade of the Tezos network, we are pleased to announce that our <strong>baker infrastructure has been upgraded as well</strong>. Our bakers have completed the necessary upgrades to ensure that they are able to continue providing secure and reliable services to XTZ stakers.</p><p>To learn more about the Tezos Mumbai update, check out the full preview post on the<a href="https://research-development.nomadic-labs.com/mumbai-preview.html?ref=p2p.org"> Tezos website</a>. The<a href="https://tezos.gitlab.io/protocols/016_mumbai.html?ref=p2p.org"> changelog</a> provides a detailed list of changes, and a general technical overview of Mumbai can be found in the protocol proposal’s<a href="https://tezos.gitlab.io/mumbai/protocol.html?ref=p2p.org"> technical documentation</a>.</p><p><em>This is a joint post from Nomadic Labs, Marigold, TriliTech, Oxhead Alpha, Tarides, DaiLambda & Functori.</em></p><h1 id="about-p2p"><strong>About P2P</strong></h1><p>P2P Validator began in 2018 with a mission to positively influence the development of POS technologies. At the time of the latest update, more than 750 million USD value is staked with P2P Validator by over 35,000 delegators across 40+ networks. We work closely with each network we support to push the developments of each project to new limits.</p>

from p2p validator