Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeBitcoin has long been recognized as a secure and valuable asset, primarily used for holding, payments, and collateral. However, with Babylon Bitcoin Staking, a new era of Bitcoin utility emerged, introducing staking and restaking opportunities that attracted significant TVL and facilitated the rise of Bitcoin-based Liquid Staking Tokens (LSTs).

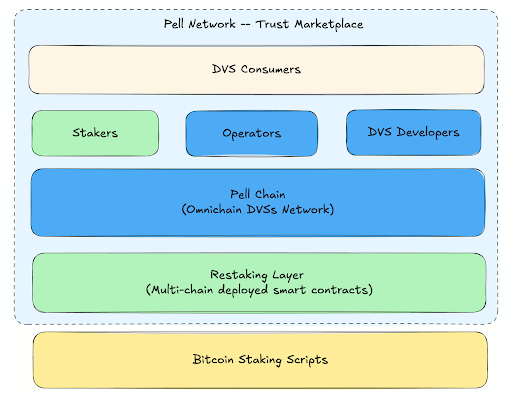

Pell Network aims to extend BTCFi to the cryptoeconomic security domain, fully unlocking the value and maximizing the utility of BTC with its innovative staking mechanism. BTC holders can now generate additional yields by providing cryptoeconomic security to Decentralized Validated Services (DVS) at Pell Network.

Pell Network is now extending its mission from an omnichain BTC restaking network to a DeFAI infrastructure platform. By applying to Pell’s shared security and omnichain capabilities to the domain of DeFAI, it contributes to creating a more efficient and secure environment for AI Agents.

Pell.Network repurposes LSTs and Bitcoin derivatives to extend Bitcoin’s security across decentralized applications through Decentralized Validated Services (DVSs). Users can allocate assets to these services and opt into additional slashing conditions to ensure network integrity.

Unlike traditional models, Pell.Network operates as a marketplace for developers, allowing them to attract validators using non-inflationary incentives instead of issuing new tokens. This significantly reduces the cost and complexity of securing decentralized applications.

Key Components of Pell.Network

By standardizing capital requirements across networks, Pell.Network simplifies Bitcoin restaking and expands its use as a security layer for decentralized applications.

Pell.Network employs a layered modular architecture to provide omnichain shared security across ecosystems like EVM, SVM, MoveVM, Cosmos SDK, and TVM. This structure reduces integration complexity for developers and enhances security for stakers.

The Restaking Layer consists of:

With Pell Chain’s interoperability, Operators and DVSs can manage services on a single platform, simplifying multi-chain development, lowering costs, and improving efficiency.

Restaking optimizes staked assets by allowing them to secure multiple networks simultaneously. Instead of being locked into one chain, BTC and its derivatives can back additional services like oracles, bridges, and data availability layers, strengthening security without requiring new capital.

For stakers, this means earning additional rewards on the same assets, while developers can secure applications without relying on inflationary token incentives.

The result: lower costs, better capital efficiency, and stronger security across blockchain ecosystems.

Pell.Network has secured $6.5 million in funding to develop its Bitcoin restaking infrastructure:

Currently live on testnet, Pell.Network allows users to stake BTC and participate in restaking. The upcoming mainnet launch will unlock full BTC restaking functionality, bringing decentralized operators and DVSs into production.

Future developments include:

As Pell.Network scales will establish Bitcoin as a foundational security layer for decentralized services, maximizing BTC’s utility in the evolving blockchain landscape.

P2P Validator is a world-leading non-custodial staking provider, securing over $7 billion from over 10,000 delegators/nominators across 40+ high-class networks. We have actively participated in the Babylon Chain activities since the beginning. In Phase 1 of Babylon Bitcoin Staking, we were the Top 1 Verified Staking Provider in the entire ecosystem, attracting the largest amount of BTC in delegation.

For further insights into BTC staking, Babylon, and the evolution of decentralized security, explore these articles from our blog:

Do not hesitate to ask questions in our Telegram chat. We are always open to communication.

Web: https://p2p.org

Twitter: @p2pvalidator

Telegram: https://t.me/P2Pstaking

Bitcoin Staking dApp: btc.p2p.org

Babylon Staking Dashboard: https://btcstaking.babylonlabs.io/?ref=p2p.org

<p>This blog was written based on Pavel Iashin's <a href="https://purple-sea-cb0.notion.site/Max-Effective-Balance-Increase-Slashing-Risks-in-Pectra-14df8e6f8ab580e4a484d7da4b56dfd1?ref=p2p.org"><u>research on MEB and slashing risks in Pectra</u></a>.</p><h2 id="tldr"><strong>TLDR</strong></h2><ul><li><em>The Pectra upgrade reduces Ethereum slashing penalties for single validators by up to 128x, making staking a safer and more attractive option for all stakers. </em></li><li><em>P2P.org offers a range of variable risk/reward staking solutions, offering strategies based on your unique risk tolerance</em></li><li><em>With advanced slashing protection and professional management, P2P.org ensures Ethereum staking is secure and optimized for the best possible returns.</em></li></ul><p>Ethereum staking will change drastically with the upcoming Pectra upgrade, which is expected to go live in April 2025. The upgrade offers a significant opportunity for stakers, introducing more flexibility in balancing risk and reward. For the first time, stakers can dramatically reduce their exposure to penalties while maintaining attractive yields. At P2P.org, we're ready to help you understand and utilize these changes with <strong>personally tailored staking solutions</strong> designed around your individual risk tolerance.</p><p>This new era of Ethereum staking combines security with improved returns – a combination that was previously impossible to achieve. Whether you're a conservative staker seeking maximum protection or a growth-oriented staker looking to optimize, the Pectra upgrade opens up new possibilities for customizing your staking strategy.</p><h3 id="eip-7251-in-a-nutshell"><strong>EIP-7251 in a nutshell</strong></h3><p><a href="https://eips.ethereum.org/EIPS/eip-7251?ref=p2p.org"><u>Ethereum Improvement Proposal #7251</u></a>, also known as the Maximum Effective Balance (MEB) Increase, will address the inefficiencies of the current Ethereum staking design. This update will enable allocating up to 2048 ETH for a single validator alongside other important improvements and changes, such as auto-compounding and validator consolidations. We have shared more information about the upcoming changes in validator economics in our <a href="https://p2p.org/economy/ethereum-pectra-upgrade-a-shift-in-staking-mechanics/"><u>recent blog post</u></a> about the upgrade.</p><figure class="kg-card kg-image-card"><img src="https://lh7-rt.googleusercontent.com/docsz/AD_4nXej2CRaaVhdnN3nzl0Ybcy86XlgGHRk-qT40cdnf-QXcmmTqeS5rzwPdGRoV1IsKMS1Nk343WCQfhHALbpMn-daV2Yr2stb8fOrxgYsU65nhsbcJKLd5yIinjgwM2M1QV_MkTlxOg?key=Z5eK-GkRd-O7PM9Klu8-_q4d" class="kg-image" alt="" loading="lazy" width="1218" height="964"></figure><p><em>Img: Increased validator balance of up to 2048 ETH</em></p><h2 id="understanding-slashing-what-you-need-to-know"><strong>Understanding Slashing: What You Need to Know</strong></h2><p>Think of slashing as Ethereum's security system – it's a protective measure that helps maintain the network's integrity by penalizing validators who break the rules, whether intentionally or due to technical issues. Under the current system, these penalties can be significant, but the Pectra update is about to change that in your favor.</p><h3 id="why-does-slashing-happen"><strong>Why Does Slashing Happen?</strong></h3><p>Slashing occurs in three specific situations, and understanding them helps explain why professional management is crucial:</p><p><strong>Double Proposals</strong> (Proposing two different blocks for the same slot)</p><ol><ul><li>Think of this as sending two different versions of the same email. This usually happens due to technical issues with the validator setup such as using the same keys in multiple setups.</li><li>Professional operators like P2P.org have sophisticated systems to prevent this.</li></ul></ol><p><strong>Double Voting</strong> (Two different votes in the same slot)</p><ol><ul><li>Similar to marking two different answers on a test. This is the most common cause of slashing.</li><li>This usually also occurs when the same keys are used in multiple setups or the validator software has database issues.</li></ul></ol><p>Instead of handling raw keys (which creates risk), we implement Threshold Signature Schemes (TSS), which split one validator key into<strong> three separate shards</strong>, requiring any two shards to create a valid signature. <br><br>This 2-of-3 approach provides:</p><ol><ul><ol><li>Enhanced security: No single point stores the complete key</li><li>Operational flexibility: Enables node maintenance without missing attestations</li><li>Failover protection: The system remains operational even if one shard is compromised.</li></ol></ul></ol><p><strong>Surround Voting</strong> (Making conflicting votes about the chain's history)</p><ol><ul><li>This is like giving contradictory testimonies about the same event.</li><li>This can happen if a validator either has a database problem, uses multiple keys, is affected by a bug, or is involved in malicious activity.</li><li>Professional management ensures proper synchronization at all times.</li></ul></ol><p><strong><em>The good news?</em></strong> When it comes to slashing incidents, the data is reassuring: 90% are caused by double voting, 10% by double proposals, and none by surround voting. These incidents are extremely rare and typically occur when validator keys are mistakenly used across multiple validators. Working with professional operators who follow strict security protocols virtually eliminates these risks. </p><p><strong>At P2P.org, we have:</strong></p><ul><li>Advanced slashing protection systems</li><li>Real-time 24/7 monitoring of validator performance</li><li>Immediate response protocols for any anomalies</li><li>Regular system audits and updates</li></ul><div class="kg-card kg-button-card kg-align-center"><a href="https://www.p2p.org/networks/ethereum?ref=p2p.org#form" class="kg-btn kg-btn-accent">Start Staking with P2P.org</a></div><h3 id="how-slashing-works"><strong>How Slashing Works</strong></h3><p>Slashing is Ethereum's security mechanism that penalizes validators who break protocol rules. When a violation occurs, three distinct penalties come into play:</p><ol><li>The <strong>Initial Penalty</strong> is applied immediately when a violation is detected. Currently, it's set at 1 ETH for every 32 ETH staked. This acts as the immediate consequence for breaking protocol rules.</li><li>The <strong>Inactivity Penalty</strong> accumulates during the withdrawal period because the validator can no longer perform their duties. For a 32 ETH validator, this is currently around 0.057 ETH (as of February 2025), though the exact amount depends on the total effective balance of all validators in the network.</li><li>The <strong>Correlation Penalty</strong> increases if other validators are slashed within an 18-day window before or after the incident. This design protects against coordinated attacks by making group slashing events exponentially more expensive than isolated incidents.</li></ol><p>When a validator commits a violation, another validator must spot it and submit proof. Once the network confirms the violation, the initial penalty is applied immediately, and the forced withdrawal period begins. During this time, the blockchain monitors for other slashing events that might trigger correlation penalties. This creates a balanced approach where technical issues face lighter penalties, while coordinated misbehavior receives harsher treatment.</p><h3 id="what-changes-with-pectra"><strong>What Changes with Pectra?</strong></h3><p>With the Pectra upgrade, we will experience a shift in how Ethereum handles slashing penalties, making staking significantly safer for participants:</p><h3 id="understanding-the-components"><strong>Understanding the Components </strong></h3><p>With the upcoming Pectra upgrade, all three components of slashing are going to change:</p><p>The <strong>Initial Penalty</strong> will be reduced from 1 ETH to 0.0078125 ETH per 32 ETH validator. This means that small technical mistakes or isolated incidents become far less costly. For a validator with 2048 ETH (the new maximum), the initial penalty would be 0.5 ETH - still significant but much smaller than under the current system.</p><p>The <strong>Inactivity Penalty</strong> remains proportional to the validator's effective balance and continues through the 36-day withdrawal period. For context, with approximately 33.3M ETH staked (as of February 2025), a 32 ETH validator would face approximately 0.057096 ETH in inactivity penalties, while a 2048 ETH validator would see about 3.654152 ETH. These numbers vary based on changes in the total amount of ETH staked and base reward parameters.</p><p>The <strong>Correlation Penalty</strong> is where Pectra introduces improvements to maintain network security while being fairer to validators. The current system's correlation penalty can be uneven due to integer division effects, but Pectra implements a new formula that ensures proportional penalties regardless of validator size. This means a single 2048 ETH validator will face the same correlation penalty as sixty-four 32 ETH validators if the same total stake is affected.</p><h3 id="real-world-impact"><strong>Real-World Impact</strong></h3><p>Current System:</p><ul><li>A slashing incident affecting 32 ETH results in approximately 1.05 ETH in total penalties</li><li>This represents about 3.28% of the staked amount</li></ul><p>After Pectra:</p><ul><li>The same incident would result in only about 0.06 ETH in penalties</li><li>This represents just 0.19% of the staked amount</li></ul><p>This reduction in penalties won’t compromise network security because the correlation penalty still provides adequate protection against large-scale attacks. If a significant portion of validators (approaching 1/3 of total stake) are slashed simultaneously, the penalties can still result in complete stake loss, effectively deterring coordinated malicious behavior.</p><p>This is a risk reduction that makes staking significantly safer for conservative investors. When combined with P2P.org's professional management and customized risk assessment, <strong>you get a sophisticated level of protection for your stake.</strong></p><figure class="kg-card kg-image-card"><img src="https://lh7-rt.googleusercontent.com/docsz/AD_4nXf5ZLIFO15ECwt9FVGVzP_8QdR2KMdp5meyM2c1MYDvrtnQuzMNo6F9KEpq0HbHLb-etLppP7r96_uF_2NcJE7gNYJH6qCDZbjNv5ctr_JCI-Ktw0N-rcExXzneLB9StmHu-q91ow?key=Z5eK-GkRd-O7PM9Klu8-_q4d" class="kg-image" alt="" loading="lazy" width="1600" height="788"></figure><p><em>Img:</em> <em>Comparison of Pre-Pectra and Post-Pectra penalties</em></p><h2 id="why-professional-management-matters"><strong>Why Professional Management Matters</strong></h2><p>The importance of professional validator management becomes clear when we examine the data on slashing incidents. According to our models, the time taken to respond to an incident significantly impacts the amount of stake affected. For a 4096 ETH cluster, <strong>a 25-minute response time results in about 0.02% of stake being affected</strong>, while a slower <strong>3-hour response increases this to around 0.1%</strong> - a fivefold increase in impact.</p><p>This difference becomes even more striking when we look at pre-Pectra penalties. The same scenarios under current rules would result in penalties of 12 ETH for quick responses versus 52 ETH for slower responses, with a significant portion coming from the initial penalty. Even though Pectra reduces the initial slashing penalty dramatically (from 1 ETH to 0.0078125 ETH for 32 ETH validators), the speed of response remains crucial.</p><p>Professional management makes a substantial difference in minimizing these risks. Automation tools can reduce response time to a single slot, significantly decreasing the potential for subsequent slashing events. This is particularly important because slashing incidents typically begin with an "alerting event" followed by potential "subsequent slashing events" that continue until the issue is resolved.</p><p>The data shows that professional management with rapid response capabilities is crucial in reducing their impact when they occur. This becomes even more important in Pectra's environment of consolidated validators, where a single incident could affect larger amounts of stake.</p><p>After all, prevention is still the best strategy. That's why P2P.org:</p><ul><li>Uses battle-tested validator software</li><li>Maintains separate databases for each validator group</li><li>Provides 24/7 technical monitoring</li><li>Offers rapid response to any potential issues</li></ul><h2 id="risk-management-with-p2porg"><strong>Risk Management with P2P.org</strong></h2><p>At P2P.org, we understand that every staker has unique needs and concerns. That's why we:</p><ul><li>Conduct detailed risk assessment consultations with each client</li><li>Design personalized staking strategies based on your specific risk tolerance</li><li>Provide ongoing risk monitoring tailored to your comfort level</li><li>Adjust strategies as your risk tolerance evolves</li></ul><div class="kg-card kg-button-card kg-align-center"><a href="https://www.p2p.org/networks/ethereum?ref=p2p.org#form" class="kg-btn kg-btn-accent">Start Staking with P2P.org</a></div><h2 id="your-next-steps"><strong>Your Next Steps</strong></h2><p>If you've been waiting for the right time to stake your ETH, the Pectra update provides the security and peace of mind you've been looking for. P2P.org's personalized approach ensures you get a staking solution that perfectly matches your risk tolerance.</p><p>Ready to start staking with peace of mind? Contact P2P.org's team to schedule your personal risk assessment consultation and learn how you can adjust your staking strategy specifically to your needs.</p>

from p2p validator

<h2 id="story-network-intellectual-property-handled-on-the-blockchain"><strong>Story Network: Intellectual Property Handled on the Blockchain</strong></h2><p>Imagine a world where creators can share, remix, and monetize their intellectual property without getting held up in complex legal agreements or losing track of rights and royalties.<strong> </strong><a href="https://www.story.foundation/?ref=p2p.org" rel="noreferrer"><strong>Story Network</strong></a><strong> - the first blockchain explicitly built for IP - </strong><a href="https://www.story.foundation/blog/story-mainnet?ref=p2p.org" rel="noreferrer"><strong>has just gone live</strong></a>, and it's a game-changer for creators, developers, and investors.</p><p>Managing intellectual property is like tracking a spider's web during a windstorm in the current digital landscape. Rights get tangled, ownership becomes unclear, and tracking who owes what to whom quickly becomes a nightmare. Traditional blockchains, while revolutionary in many ways, weren't built to handle these types of relationships. Their foundation just wasn’t purpose-built for the task.</p><p>This is where Story Network comes in. It's <strong>a new Layer 1 blockchain</strong> specifically engineered to handle the complexities of intellectual property in the digital age. <br><br>But what makes it so unique?</p><h2 id="a-purpose-built-solution-for-a-complex-problem"><strong>A Purpose-Built Solution for a Complex Problem</strong></h2><p>Unlike general-purpose blockchains that try to be everything to everyone, Story Network has taken a different approach.</p><p>Storys' strength lies in its graph-like data structure, which is built right into its core. Think of it as a sophisticated family tree for intellectual property, where each creation can have multiple parents, children, and relatives, all interconnected in complex ways. This structure allows Story Network to track and manage these relationships efficiently, making it possible to:</p><ul><li>Instantly verify ownership and rights</li><li>Automate royalty payments</li><li>Enable permissionless licensing</li><li>Support creative remixing while maintaining proper attribution</li></ul><figure class="kg-card kg-image-card kg-card-hascaption"><img src="https://lh7-rt.googleusercontent.com/docsz/AD_4nXceEzYkvGEQ-JeoPOsndyN8UyNvKjrRqlxjNhRaXoBR-CPhieoIgDVKwOcgi_bvrwJbjtTdQfAOSwVRNxOoDa5alWjJQR0aYnP8Pb-5r8uYhP55emwK8r_pQAuczsIjHlmtbeOu?key=xbLMGoANrXRMdnJo95mTRTbD" class="kg-image" alt="" loading="lazy" width="1200" height="675"><figcaption><i><em class="italic" style="white-space: pre-wrap;">The components of the Story Network</em></i></figcaption></figure><h2 id="securing-the-network-with-industry-leading-infrastructure"><br><br><strong>Securing the Network with Industry-Leading Infrastructure</strong></h2><p>As <a href="https://rewards.story.foundation/?ref=p2p.org" rel="noreferrer">Story Network prepares for its token generation event</a>, the importance of choosing the right staking partner cannot be overstated. P2P.org is an industry leader, securing over $8B in staked assets across more than 40 PoS networks. What makes P2P.org particularly valuable for Story Network participants is its unique double-node support system:</p><ul><li><strong>Flexible Token Management</strong>: P2P.org operates two types of validator nodes - one for locked tokens and another for unlocked tokens. This dual-node system allows you to optimize your staking rewards by:<ul><li>Keeping locked tokens with the lock-up validator</li><li>Transferring unlocked tokens and staking rewards to the full-reward validator for higher returns</li></ul></li><li><strong>Institutional-Grade Security</strong>: With 99.8% uptime and comprehensive slashing protection, P2P.org offers institutional clients coverage for up to 12 months of staking revenue, ensuring your assets remain secure.</li><li><strong>Enhanced Services</strong>:<ul><li>White Label Validator options for partners looking to create custom-branded nodes</li><li>24/7 dedicated support with custom SLAs for institutional clients</li></ul></li></ul><p>Read more about Story Network staking <a href="https://x.com/StoryProtocol/status/1889767559236383204?ref=p2p.org" rel="noreferrer">here</a>.</p><h2 id="deep-expertise-in-story-protocol"><strong>Deep Expertise in Story Protocol</strong></h2><p>P2P.org's commitment to Story Network runs deep. As one of the top validators in the Cosmos ecosystem, we bring extensive experience with the CometBFT consensus engine, which powers Story Network. Our active participation in both Iliad and Odyssey testnets, along with the Story Foundation's selection of us as an initial validator, demonstrates our technical expertise and dedication to the project's success.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://t.me/P2P_staking_support_bot?ref=p2p.org" class="kg-btn kg-btn-accent">Get in touch with us!</a></div><h2 id="why-this-matters-for-creators-and-developers"><br><br><strong>Why This Matters for Creators and Developers</strong></h2><p>The implications are enormous for anyone working with intellectual property. Imagine a musician who creates a beat that others can instantly license and remix, with automatic royalty payments flowing back to the original creator. Or picture a digital artist whose work can be securely tokenized and traded, with each transaction automatically respecting the original creator's rights.</p><p>For developers, Story Network offers the best of both worlds. It's <strong>EVM-equivalent</strong>, meaning you'll feel right at home if you're familiar with Ethereum development. However, it also provides specialized tools and optimizations that make handling complex IP relationships a breeze.</p><h2 id="the-future-of-intellectual-property"><strong>The Future of Intellectual Property</strong></h2><p>What makes Story Network particularly exciting is its potential to democratize IP management. Built on the robust CometBFT consensus engine, with support for both locked and unlocked token staking, Story Network provides the technical foundation needed for secure and efficient IP management at scale.</p><p>With features like single-slot finality (meaning transactions are processed instantly) and a developer-friendly environment, Story Network isn't just another theoretical construct but a practical solution to real-world problems that creators and businesses face every day.</p><h2 id="ready-for-the-big-bang"><strong>Ready for the big bang?</strong></h2><p>The countdown is on. <strong>Story Network's </strong><a href="https://www.story.foundation/blog/big-bang-block?ref=p2p.org" rel="noreferrer"><strong>Big Bang Block</strong></a><strong> lands at block 1,580,851 on March 4, 2025</strong>. This is when <a href="https://x.com/StoryProtocol/status/1889419995131871556?ref=p2p.org" rel="noreferrer">Story Network's token emissions begin</a>, starting a new chapter in IP management.</p><p>Are you looking for a trusted partner to navigate this launch? P2P.org brings serious credentials to the table. With $8B+ in staked assets and a rock-solid track record across 40+ networks, we are helping shape Story Network's future.</p><p>Whether you're a creator looking to protect and monetize your work, a developer building the next generation of IP-centric applications, or an investor interested in supporting this revolutionary platform through staking, Story Network provides the foundation for the future of intellectual property management.</p><p><strong>Ready to participate in this big bang? </strong><a href="https://t.me/P2P_staking_support_bot?ref=p2p.org" rel="noreferrer"><strong>Contact P2P.org</strong></a><strong> to learn more about maximizing your staking rewards</strong> while contributing to the security and success of the world's first purpose-built IP blockchain.<br><br>Read the Story Network whitepaper here: <a href="https://www.story.foundation/whitepaper.pdf?ref=p2p.org">https://www.story.foundation/whitepaper.pdf</a></p>

from p2p validator