Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeIn this post, we will take a deep dive into the Ethereum network during the month of March 2023. Our goal is to provide a comprehensive analysis of the network and its various components. Here are the topics we explore:

All the data was sourced from our own validators, beaconcha.in and rated.network. We considered only staking providers whose information is publicly available, meaning this list isn’t a complete picture of the Ethereum staking ecosystem.

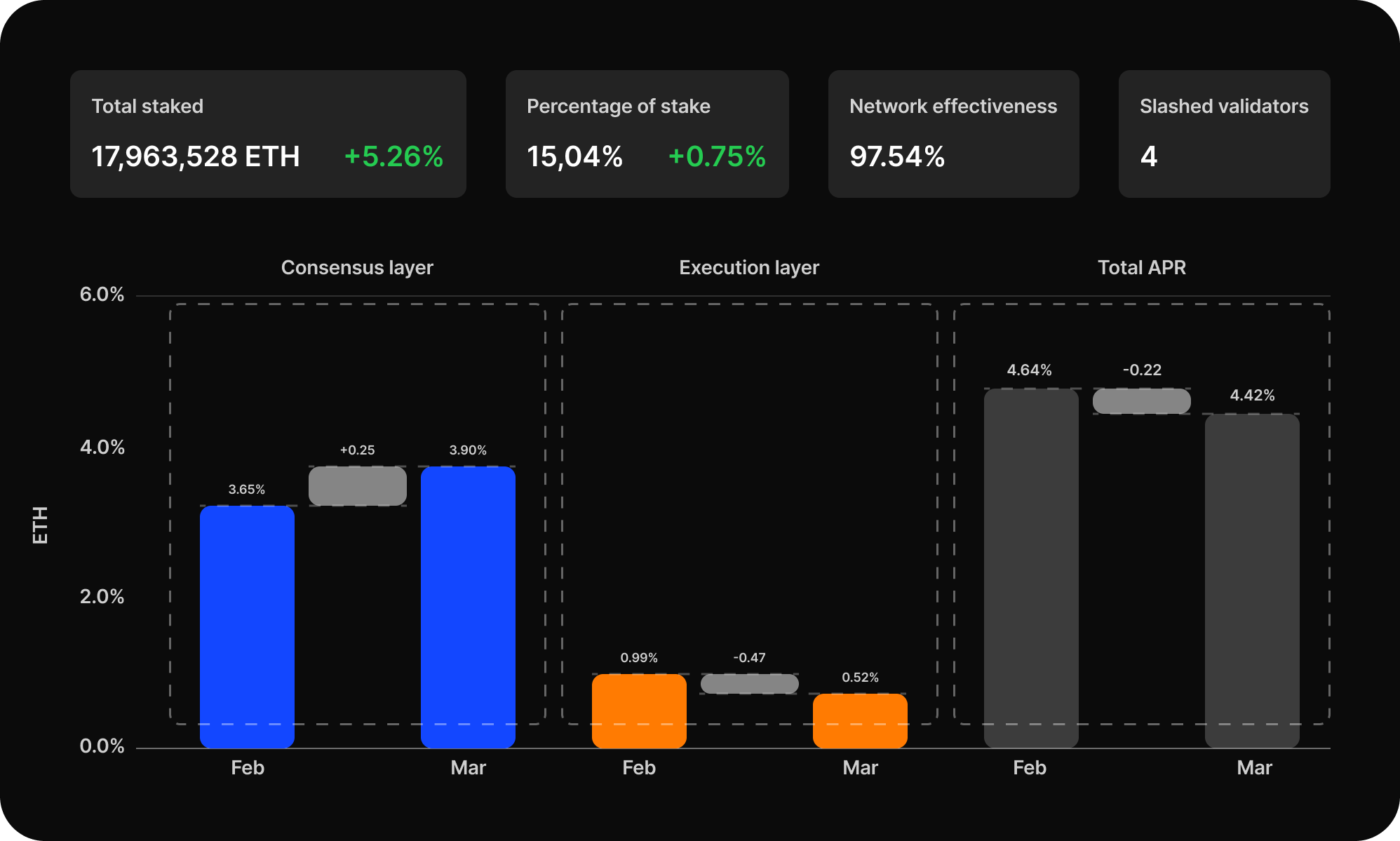

As of March 2023, the total amount of Ethereum staked has reached 17,963,528 ETH, which is 5.26% higher than the previous month's total stake. This is a significant increase, demonstrating the growing interest in Ethereum staking. The amount staked now represents approximately 15.04% of the total circulating supply of Ethereum, which is a strong indication of the confidence that investors have in the platform. It is worth noting that this is a considerable increase from just a few months ago, demonstrating the rapid growth of the Ethereum ecosystem.

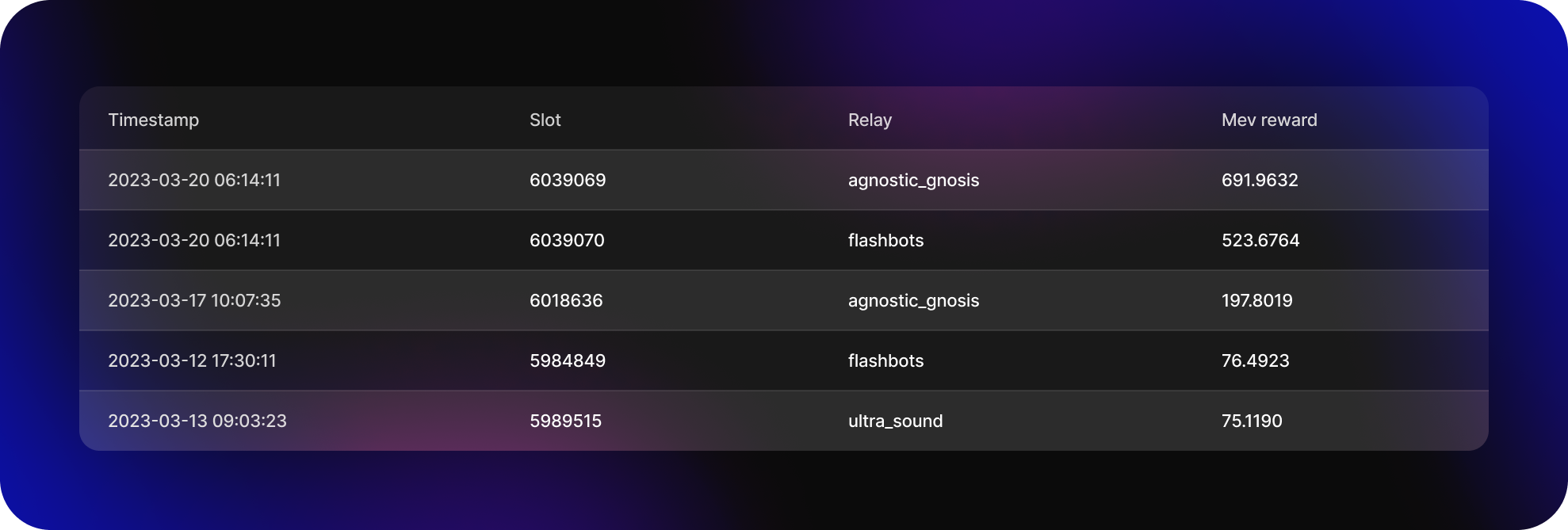

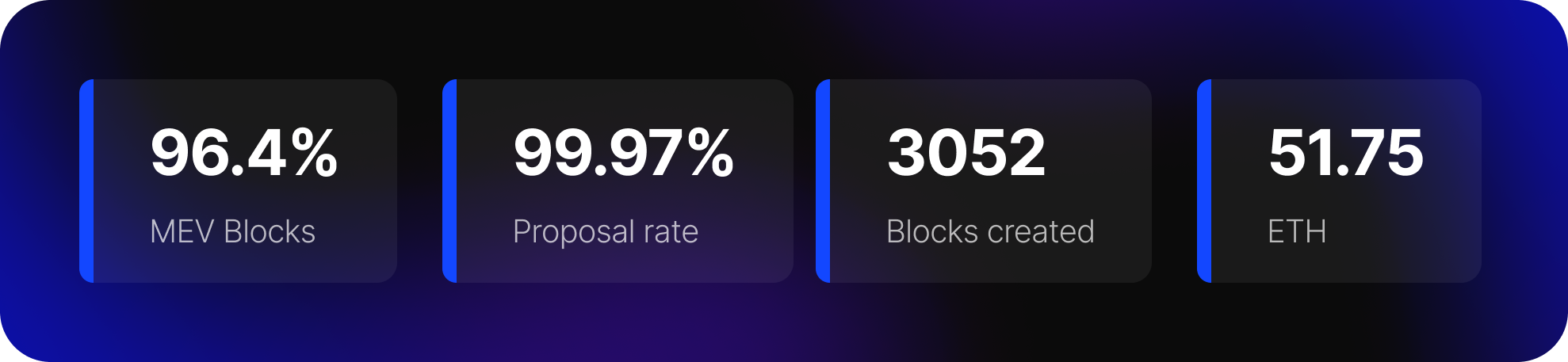

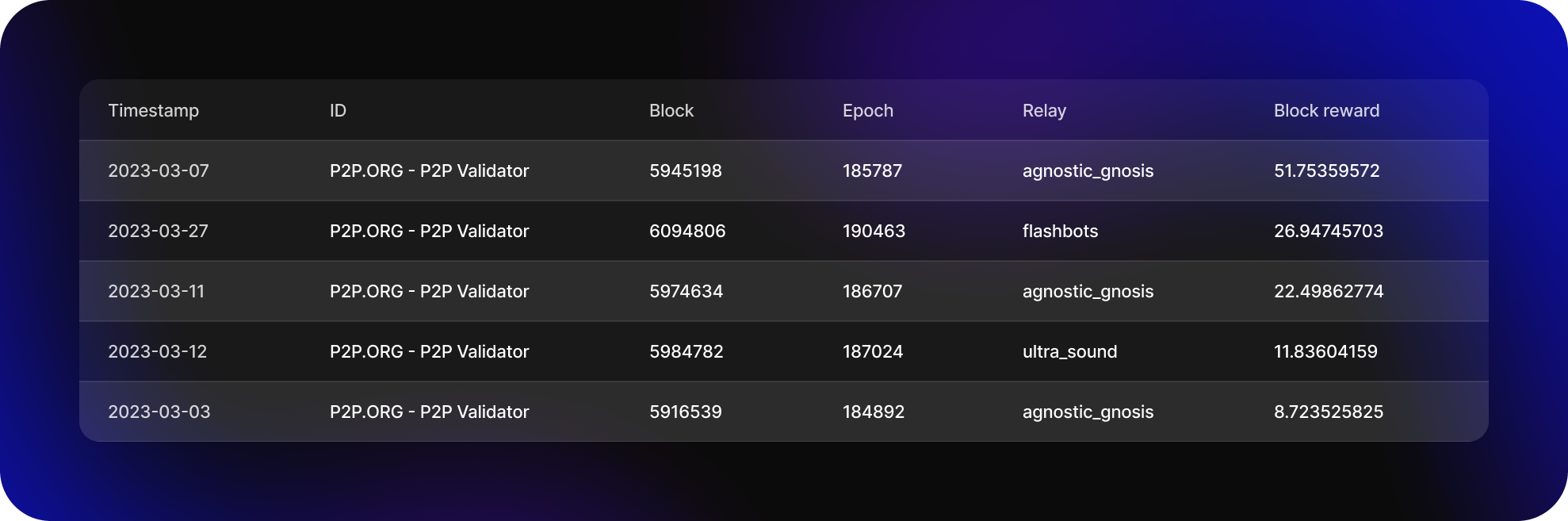

Despite the increase in the total amount of Ethereum staked, the current network-wide average annual percentage rate (APR) for Ethereum staking is around 4.1**%**, which is a 0.0738 percentage point increase from the previous month. The consensus rewards have increased by 0.2518 points, but the execution rewards have decreased by 0.178 points due to the increase in the number of validators in the network. The table below shows the top 5 block MEV rewards.

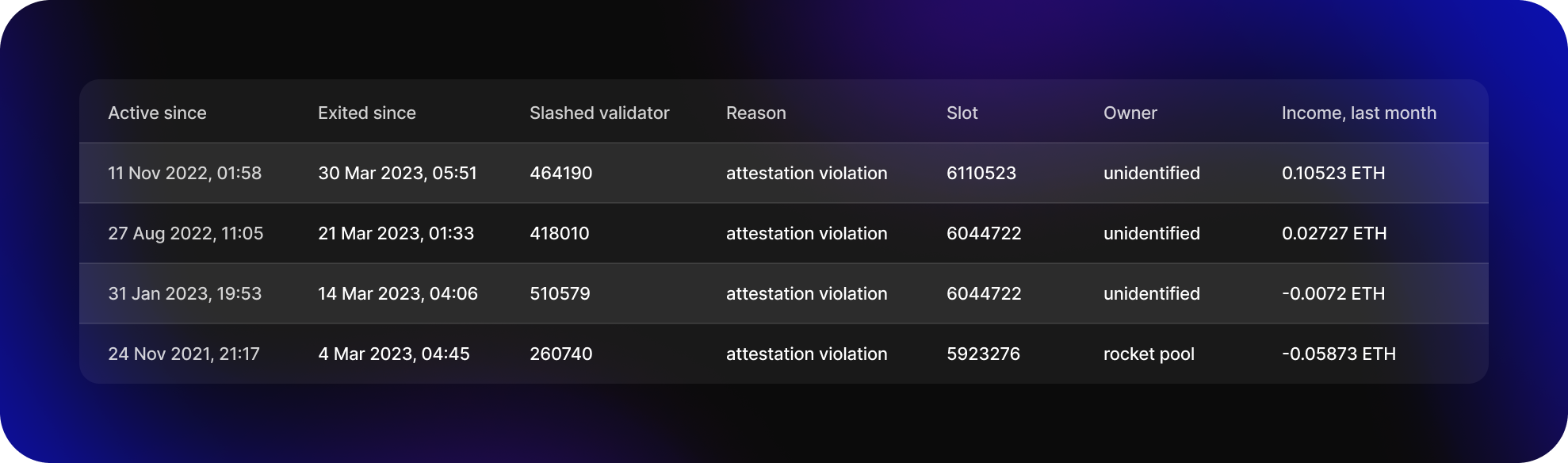

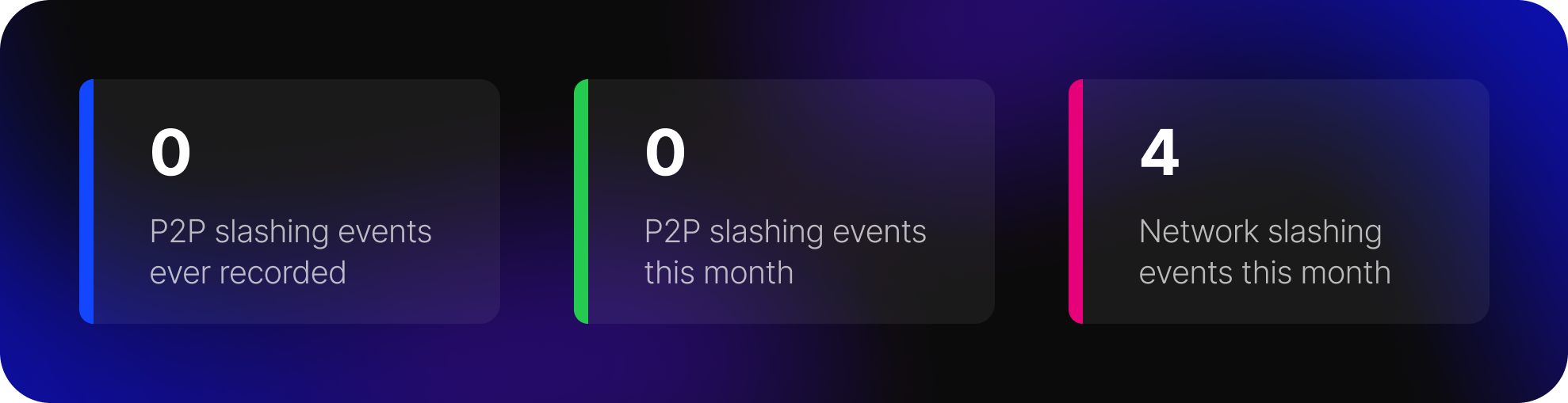

For investors interested in Ethereum staking, it is important to be aware and understand the risks involved. Additionally, during March, 4 validators from the network were slashed, one of which belongs to Rocket Pool

This highlights the risks involved in Ethereum staking and the importance of carefully selecting validators to stake with.

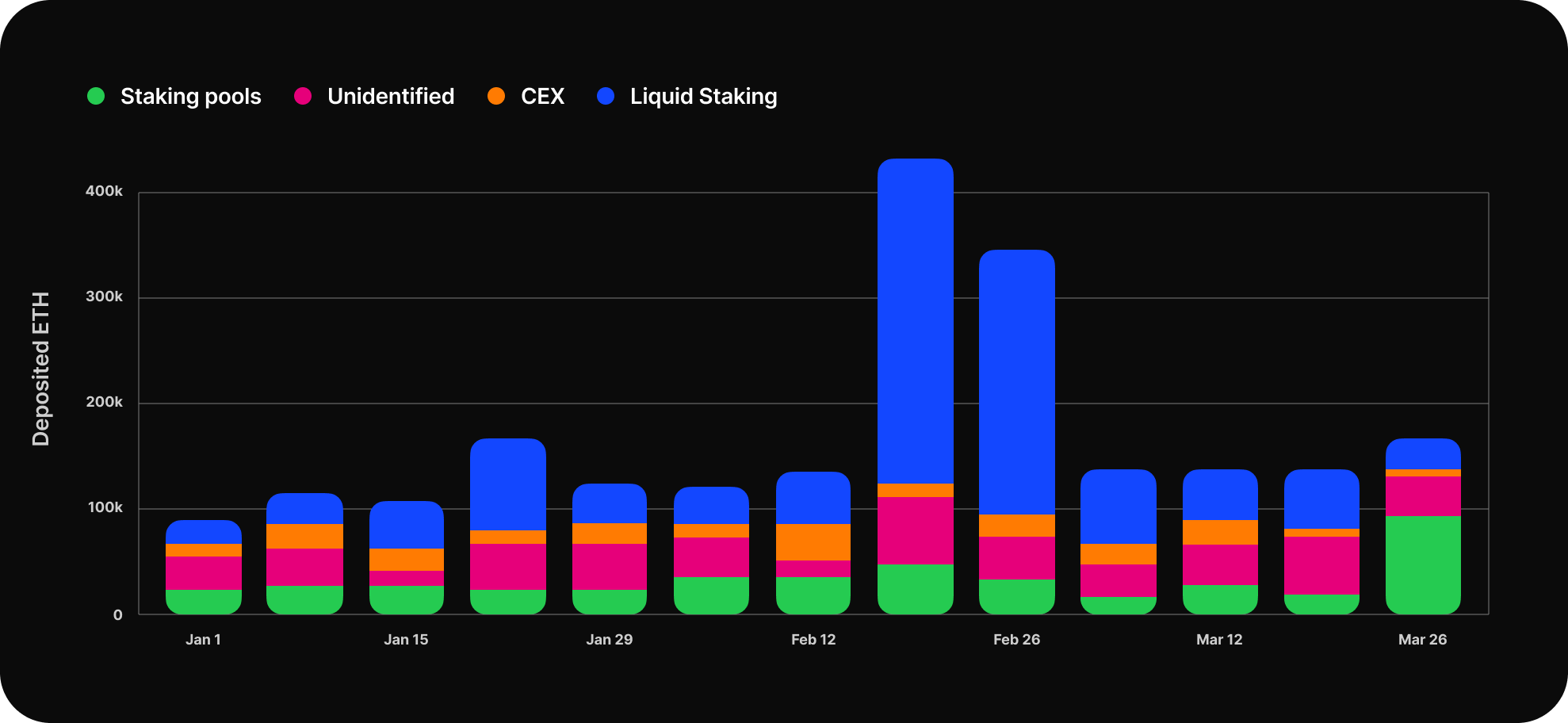

The upcoming Shanghai update for Ethereum, scheduled for April 12, has holders of liquid staking tokens eagerly anticipating how the event will impact their holdings. Prior to the update, any ETH deposits into these protocols could not be withdrawn from Ethereum's deposit-only Proof-of-Stake (PoS) system. After the Shanghai event, users will be able to unstake their ETH, sell their stakes, or migrate to a different staking service.

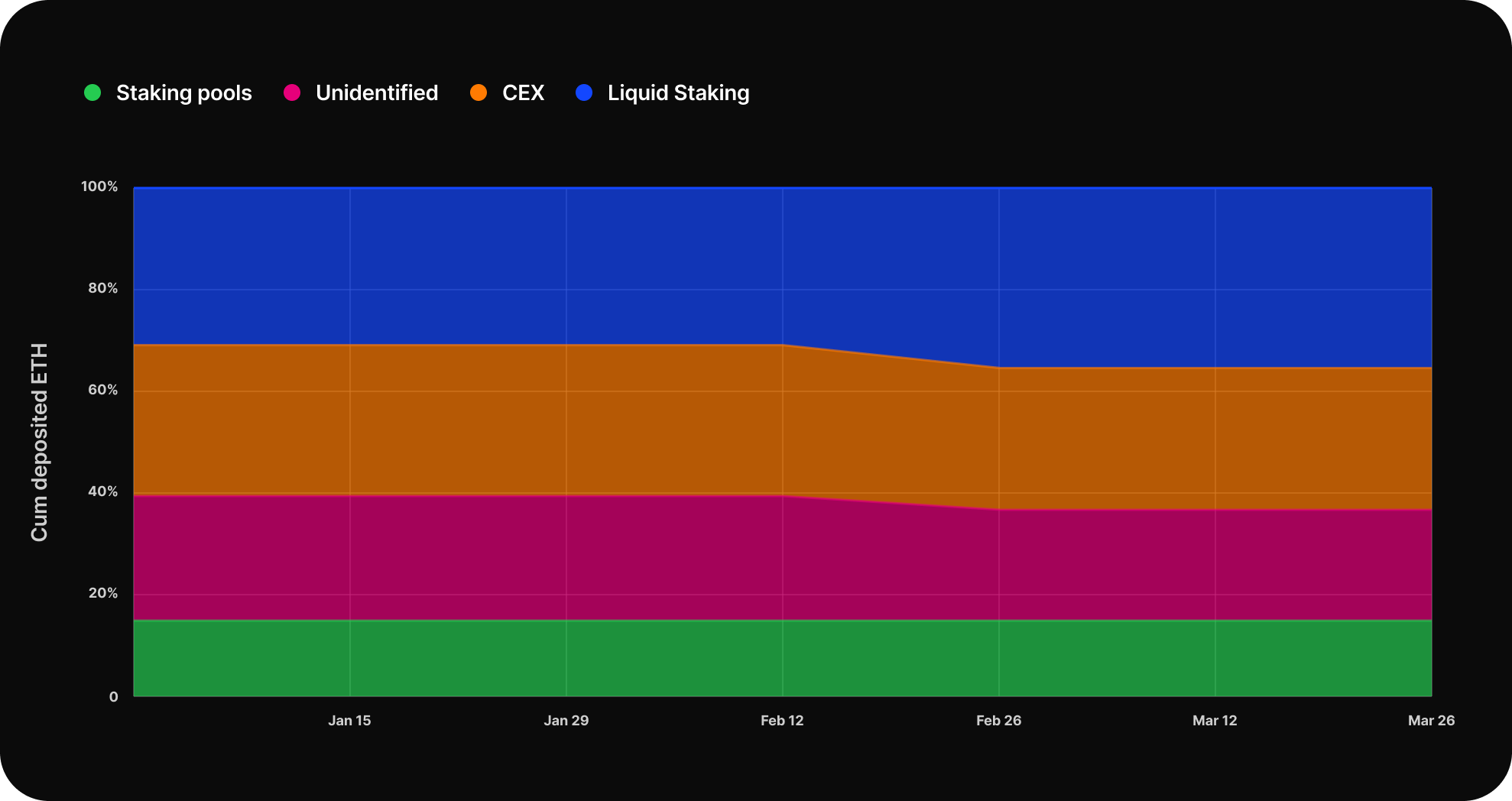

For the current period, liquid staking increased to a total of 33.33%. This value is 2.38 points higher than at the beginning of the year. Conversely, CEX stacking has decreased to 27.27%, which is 2.31 points lower than at the beginning of the year. Staking pools and unidentified validators have remained almost unchanged, at 16.97% and 22.43% respectively. As we can see, at the end of February there was a big amount of ETH deposited, one of them is the largest single daily inflow ever on the Lido platform in the amount of 150,000 ETH.

Lido is the largest liquid staking platform, which currently has over 31% of all staked ETH. Lido's popularity can be attributed to its ease of use and its ability to provide users with a flexible and secure way to stake their ETH. It is challenging to de-anonymize all validators, including their owners and whether they belong to centralized exchanges, staking pools or e.t.c. However, with Lido, all the information about the validators is public.

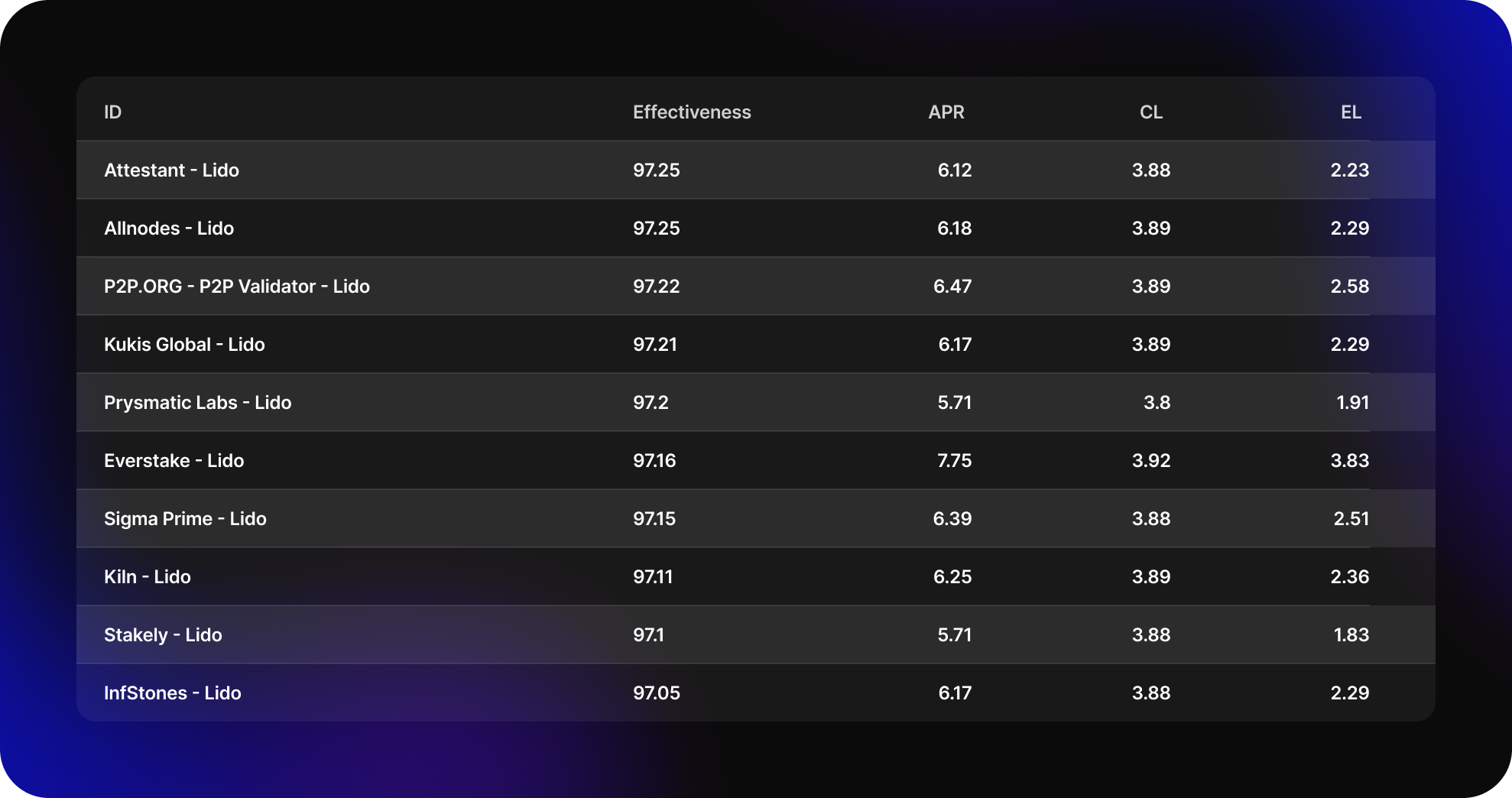

When it comes to ETH staking we should not only consider the APR as an important metric but also take into account validator effectiveness, which can be an even more accurate metric. Validator effectiveness indicates how much of your validator balance is being used for attestations, and is calculated as the effective balance as a fraction of the total balance. P2P.org published an article explaining why validator effectiveness is a better metric than APR, and providing tips on how to choose the best staking operator.

In this regard, two of the highest-performing validators in the market are Allnodes and Attestant. These validators have an effectiveness rating of 97.25%, which means they are highly efficient in terms of attestation.

The top 3 by validator effectiveness is P2P.org with the highest APR in the top 5 effectiveness rating over the last 30 days. We will explore this in more detail in the next section.

We would also like to note that Staking Facilities and Everstake had the highest APR in March. Staking Facilities has an APR of 9.96%, with an execution APR of 6.07%. This value is approximately 50% higher than their average APR, due to a very large MEV block reward of around 692 ETH for block 16867030.

The top 3 by validator effectiveness is P2P.org with the highest APR in the top 5 effectiveness rating over the last 30 days.

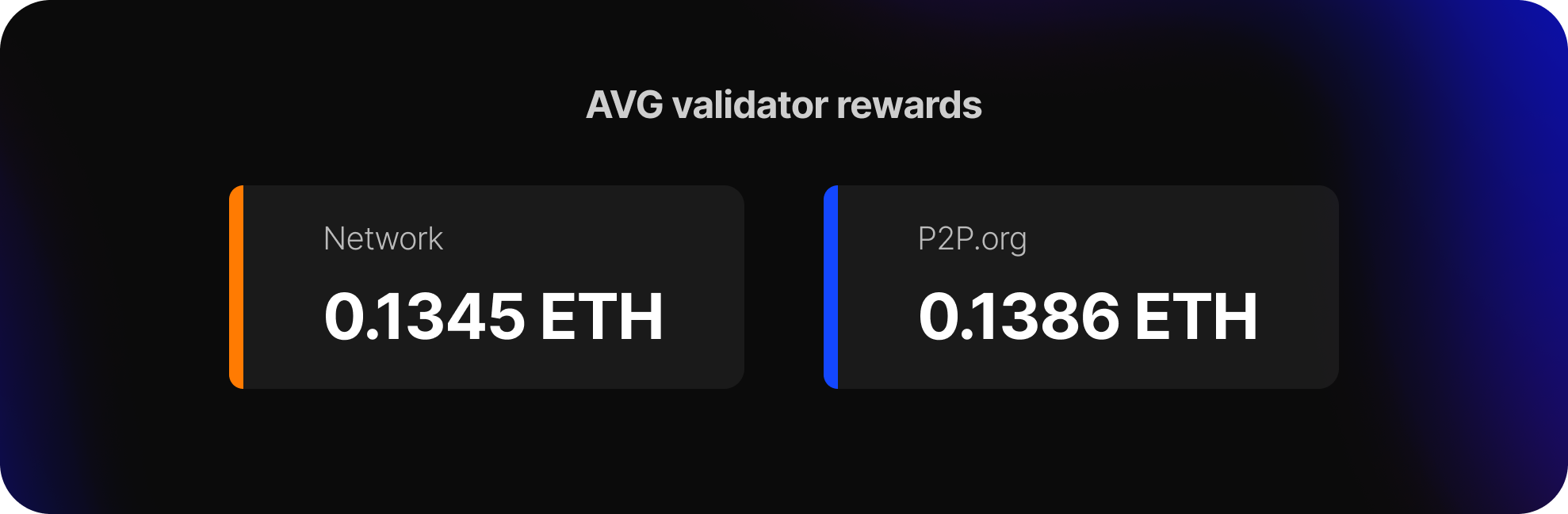

For March, all active validators on the network generated a mean rewards rate of 0.1345 ETH. The average reward of P2P’s validators was 0.1386 ETH, around 3% higher than the mean performance of all the active validators on the network

This is mostly due to P2P's enterprise-grade infrastructure, which maximizes node uptime and rewards, while also utilizing MEV-Boost to extract additional value during block production.

The primary metric commonly used when choosing a staking provider is APR. However, due to Ethereum’s complex rewards structure, it’s better to compare staking providers by their validator’s effectiveness rather than APR. We conducted extensive research on the topic, and you can read about it here.

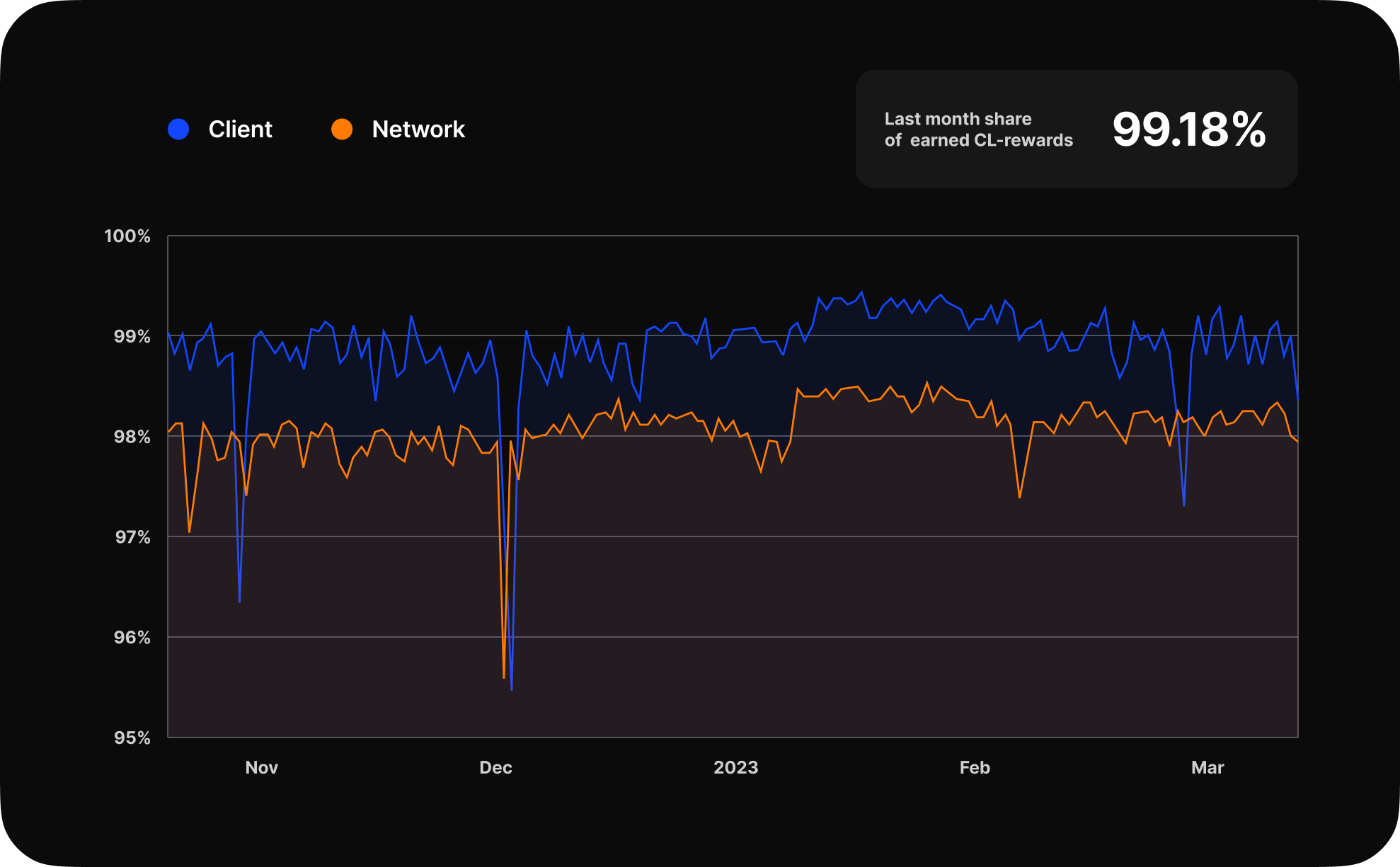

Validators may receive fewer consensus rewards due to missed attestations and errors that result in penalties. Here, we compare the average share of rewards of the network and P2P.org.

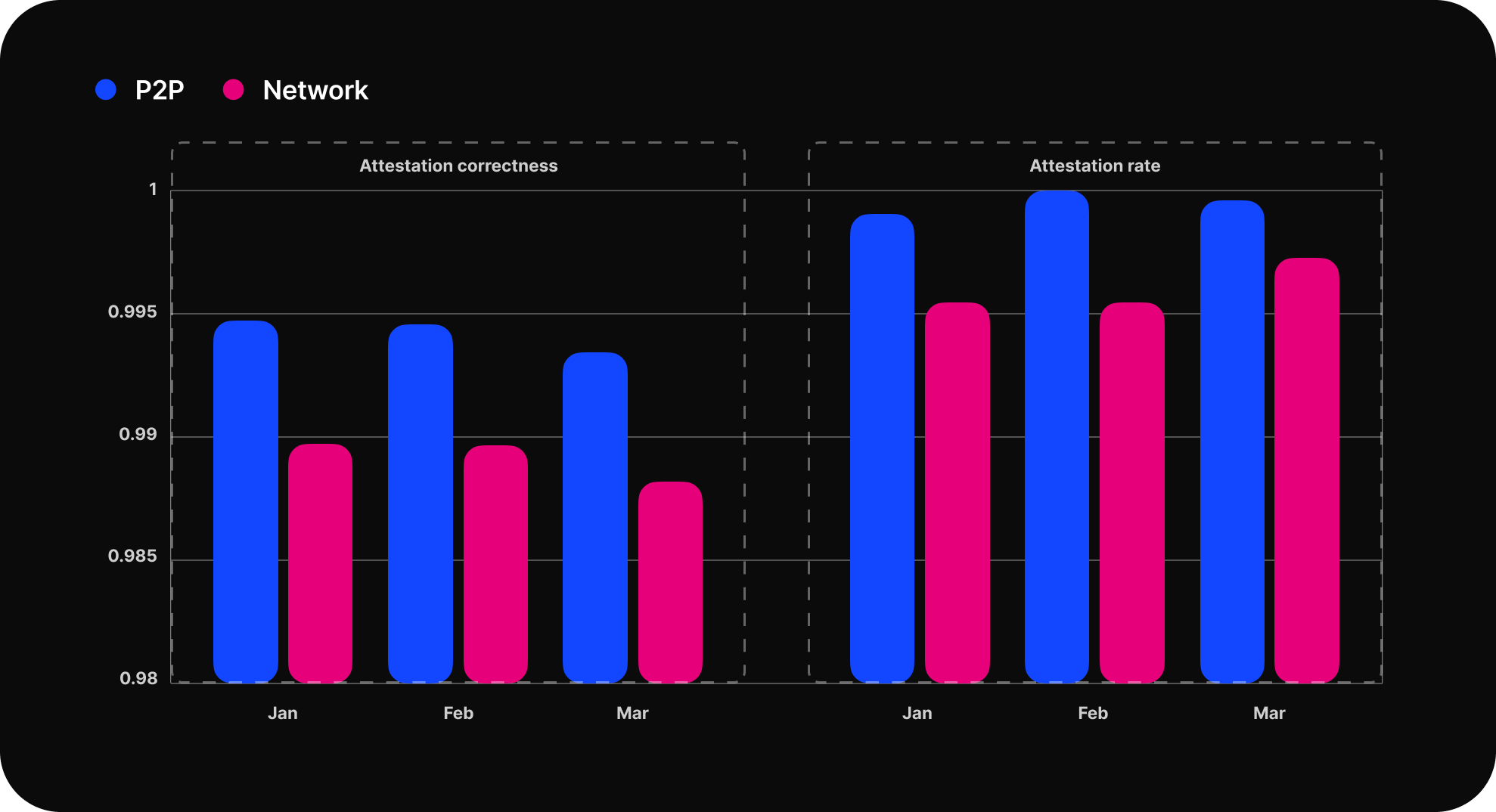

The network average share of consensus layer rewards was 98.29%, while that of P2P.org is 99.18%, which is 0.89 percentage points above the network average

The attestation rate measures how often a validator successfully attests new proposed blocks to the rest of the network. If a validator is down or cannot attest blocks for other reasons, its attestation rate and, therefore, rewards will decrease. Attestation correctness is another essential metric to consider, as it measures the accuracy of a validator's attestation. Validators must attest to the correct block or face penalties, including potential slashing. Accurate attestations are crucial for maintaining the integrity and security of the Ethereum network, making attestation correctness an essential metric to consider.

In March, the network's average attestation rate was approximately 99.6%, while P2P's attestation rate was 99.98%, which is 0.38% higher than the network average. The network's average attestation correctness was approximately 98.91%. Meanwhile, P2P's attestation rate was 99.36%, which is 0.45% higher than the network average.

The execution layer is the layer on the Ethereum blockchain that provides the environment for applications and smart contracts to operate and process transactions within and between applications. In general, there are two types of execution layer rewards: transaction priority tips and MEV tips.

There is a high risk of missing a block when the MEV relay proposes it for an extended period of time. Therefore, we create the block ourselves, which is why we haven't achieved 100% success rate. In March 2023, P2P.org had 96.4% of the MEV blocks, with 3052 proposed blocks and a proposal rate of 99.97%. Here are the top 5 blocks with the highest MEV rewards:

A slashing event occurs when a validator misbehaves on the network. This is the most severe penalty a validator can suffer, and it results in the loss of a portion of their staked tokens.

During March, P2P had no slashing occurrences. We are proud to maintain a flawless record of zero slashing events throughout our time running Ethereum validators.

P2P operates validator infrastructure securely, to minimize the risk of being slashed, and provides coverage to mitigate any losses in the event of a slashing incident.

Check out P2P.org best tweets and articles for March 2023

Ethereum Product Manager at P2P.org

<h3 id="introducing-our-ethereum-staking-dapp-empowering-users-with-complete-privacy-unmatched-simplicity-ultimate-security-and-zero-fees">Introducing our Ethereum Staking dApp, empowering users with complete privacy, unmatched simplicity, ultimate security and zero fees</h3><p></p><p>We are thrilled to announce the launch of our Ethereum Staking dApp, which is designed to give you the ultimate control over your crypto assets while ensuring complete privacy, autonomy, and security. We have been working diligently behind the scenes to bring you a solution that simplifies the staking process without compromising your privacy.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/image-12.png" class="kg-image" alt loading="lazy" width="670" height="724" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/image-12.png 600w, https://p2p.org/economy/content/images/2023/04/image-12.png 670w"></figure><h1 id="staking-dapp-key-features"><strong>Staking dApp Key Features</strong></h1><ol><li><strong>Bunker Security Staking & 100% Slashing Protection</strong>: We understand the importance of security for our users, so we have built an infrastructure with no single point of failure. Our geographically distributed data centres with hot reserves in different countries ensure that your validators will keep working even in worst-case scenarios such as a data centre burning down. Moreover, we have implemented threshold cryptography (similar to multisig) to secure your validator keys. This advanced technology ensures that nobody, not even our P2P engineers, can access your validator keys, thereby adding additional protection against slashing incidents. Furthermore, our Staking dApp offers 100% slashing protection options for a truly worry-free staking experience.</li><li><strong>Stake with just a few clicks</strong>: Really, no human input is needed! Our Staking dApp automates the entire staking process, eliminating the need for human intervention. Our dApp is built on smart contracts, offering a transparent, trustless, and tamper-proof solution for staking your Ethereum assets. Additionally, our Staking dApp allows clients to stake directly from our website with just a few clicks, ensuring an effortless experience without the need for any technical know-how.</li><li><strong>No KYC</strong>: Our dApp ensures that you can stake your Ethereum assets without having to go through the cumbersome KYC (Know Your Customer) process. We respect your right to privacy and offer a seamless user experience without any unnecessary roadblocks.</li><li><strong>No Email Registration</strong>: With our Staking dApp, you no longer need to share your email address to stake your crypto. Just access the dApp through your preferred web3-enabled wallet, and you are ready to stake.</li><li><strong>No AML Risks</strong>: We have designed our Staking dApp to comply with all relevant regulations, mitigating any AML (Anti-Money Laundering) risks while ensuring that your Ethereum staking experience is secure and reliable.</li></ol><h2 id="how-does-it-work">How does it work?</h2><p>By automating the staking process, we have created a permissionless dApp that is both user-friendly and highly secure.</p><p>If you have ever tried to delegate your stake to a staking provider, you are already familiar with the multi-step flow of selecting the amount to stake, setting your withdrawal address, entering an email address, and then… receiving an email from a sales representative for an intro call.</p><p>While we understand the reasoning behind it (we have used a similar flow till now), the improvement opportunities in terms of user experience are massive.</p><p>That’s why, when you stake with our staking dashboard, you can expect to complete the request in just a few clicks:</p><ul><li>Enter the amount to stake and the withdrawable address</li><li>Check your staking details and stake the requested amount</li></ul><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/image-13.png" class="kg-image" alt loading="lazy" width="670" height="785" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/image-13.png 600w, https://p2p.org/economy/content/images/2023/04/image-13.png 670w"></figure><ul><li>Sign a transaction with your favourite wallet provider</li><li>Wait for the transaction to be broadcasted to the Ethereum network</li></ul><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/image-14.png" class="kg-image" alt loading="lazy" width="670" height="868" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/image-14.png 600w, https://p2p.org/economy/content/images/2023/04/image-14.png 670w"></figure><ul><li>The request is successfully sent!</li></ul><p>After receiving the request, your validators will be added to the Ethereum entry queue before becoming active (the amount of time depends on the network congestion).<br><br>For those of you that have a Safe wallet, we prepared a guide on how to use it with the dApp.</p><figure class="kg-card kg-video-card"><div class="kg-video-container"><video src="https://p2p.org/economy/content/media/2023/04/howto-eth-p2p-stake-1.mp4" poster="https://img.spacergif.org/v1/1920x1080/0a/spacer.png" width="1920" height="1080" playsinline preload="metadata" style="background: transparent url('https://p2p.org/economy/content/images/2023/04/media-thumbnail-ember272.jpg') 50% 50% / cover no-repeat;" /></video><div class="kg-video-overlay"><button class="kg-video-large-play-icon"><svg xmlns="http://www.w3.org/2000/svg" viewBox="0 0 24 24"><path d="M23.14 10.608 2.253.164A1.559 1.559 0 0 0 0 1.557v20.887a1.558 1.558 0 0 0 2.253 1.392L23.14 13.393a1.557 1.557 0 0 0 0-2.785Z"/></svg></button></div><div class="kg-video-player-container"><div class="kg-video-player"><button class="kg-video-play-icon"><svg xmlns="http://www.w3.org/2000/svg" viewBox="0 0 24 24"><path d="M23.14 10.608 2.253.164A1.559 1.559 0 0 0 0 1.557v20.887a1.558 1.558 0 0 0 2.253 1.392L23.14 13.393a1.557 1.557 0 0 0 0-2.785Z"/></svg></button><button class="kg-video-pause-icon kg-video-hide"><svg xmlns="http://www.w3.org/2000/svg" viewBox="0 0 24 24"><rect x="3" y="1" width="7" height="22" rx="1.5" ry="1.5"/><rect x="14" y="1" width="7" height="22" rx="1.5" ry="1.5"/></svg></button><span class="kg-video-current-time">0:00</span><div class="kg-video-time">/<span class="kg-video-duration"></span></div><input type="range" class="kg-video-seek-slider" max="100" value="0"><button class="kg-video-playback-rate">1×</button><button class="kg-video-unmute-icon"><svg xmlns="http://www.w3.org/2000/svg" viewBox="0 0 24 24"><path d="M15.189 2.021a9.728 9.728 0 0 0-7.924 4.85.249.249 0 0 1-.221.133H5.25a3 3 0 0 0-3 3v2a3 3 0 0 0 3 3h1.794a.249.249 0 0 1 .221.133 9.73 9.73 0 0 0 7.924 4.85h.06a1 1 0 0 0 1-1V3.02a1 1 0 0 0-1.06-.998Z"/></svg></button><button class="kg-video-mute-icon kg-video-hide"><svg xmlns="http://www.w3.org/2000/svg" viewBox="0 0 24 24"><path d="M16.177 4.3a.248.248 0 0 0 .073-.176v-1.1a1 1 0 0 0-1.061-1 9.728 9.728 0 0 0-7.924 4.85.249.249 0 0 1-.221.133H5.25a3 3 0 0 0-3 3v2a3 3 0 0 0 3 3h.114a.251.251 0 0 0 .177-.073ZM23.707 1.706A1 1 0 0 0 22.293.292l-22 22a1 1 0 0 0 0 1.414l.009.009a1 1 0 0 0 1.405-.009l6.63-6.631A.251.251 0 0 1 8.515 17a.245.245 0 0 1 .177.075 10.081 10.081 0 0 0 6.5 2.92 1 1 0 0 0 1.061-1V9.266a.247.247 0 0 1 .073-.176Z"/></svg></button><input type="range" class="kg-video-volume-slider" max="100" value="100"></div></div></div></figure><h2 id="free-test-drive-offer">Free Test-drive offer</h2><p>To celebrate the launch of our Staking dApp and the upcoming Shanghai upgrade, we are offering a limited-time promotional period with 0% validator fees until August 1, 2023. This means you can enjoy maximum returns on your staked Ethereum with absolutely no fees.</p><p>And there's more! We have not forgotten our loyal existing clients. If you are a current client and decide to add additional stakes to your account, you will also benefit from the 0% fee promotion. This is our way of thanking you for your continued support and trust in our platform.</p><p>In conclusion, our Ethereum Staking dApp is here to revolutionize the staking experience for Ethereum users. Our commitment to privacy, autonomy, security, and innovation is at the core of our product. We invite you to try out our Staking dApp and join us in this exciting journey towards a decentralized and empowered future.</p><p>If you have any questions or need assistance, please reach out to our BD team! Happy staking, and welcome to the future of Ethereum staking!</p><div class="kg-card kg-button-card kg-align-center"><a href="https://ethereum-staking.p2p.org/?ref=p2p.org" class="kg-btn kg-btn-accent">Stake now</a></div>

from p2p validator

<h3 id="what%E2%80%99s-this-article-about">What’s this article about?</h3><p>The Shapella upgrade brings significant changes to the Ethereum network, introducing new withdrawal options for validators in the form of full withdrawals and partial withdrawals. This article delves into the details of withdrawal eligibility, the step-by-step process for withdrawals, and what to expect in the immediate, mid-term, and long-term future. We also explore the potential impact on the activation queue, withdrawal queue, and APR dynamics, as well as the various factors that may influence these aspects of the Ethereum ecosystem.</p><h3 id="table-of-contents">Table of contents</h3><ul><li><a href="https://p2p.org/economy/the-shapella-upgrade-a-deep-dive-into-withdrawals/#T2:~:text=Influence%20Your%20Return-,Uncovering%20Withdrawals%3A%20Key%20Information%20You%20Should%20Know,-The%20Shapella%20upgrade">Uncovering Withdrawals: Key Information You Should Know</a></li><li><a href="https://p2p.org/economy/the-shapella-upgrade-a-deep-dive-into-withdrawals/#T2:~:text=the%20exit%20queue.-,The%20Withdrawal%20Process%20Step%2Dby%2DStep,-Active%20validators%20can">The Withdrawal Process Step-by-Step</a></li><li><a href="https://p2p.org/economy/the-shapella-upgrade-a-deep-dive-into-withdrawals/#T2:~:text=More%20about%20the%20withdrawal%20eligibility">Is Your Validator Ready for Withdrawals? </a></li><li><a href="https://p2p.org/economy/the-shapella-upgrade-a-deep-dive-into-withdrawals/#T2:~:text=eligible%20for%20withdrawals.-,Navigating%20the%20Post%2DShapella%20Market,-Immediately%20(first%20days">Navigating the Post-Shapella Market: A Comprehensive Overview</a></li><li><a href="https://p2p.org/economy/the-shapella-upgrade-a-deep-dive-into-withdrawals/#T2:~:text=after%20the%20Shapella.-,Anticipating%20the%20Withdrawal%20Queue%3A%20What%20to%20Expect,-Various%20factors%20affect">Anticipating the Withdrawal Queue: What to Expect</a></li><li><a href="https://p2p.org/economy/the-shapella-upgrade-a-deep-dive-into-withdrawals/#T2:~:text=end%20of%20July.-,Forecasting%20the%20Activation%20Queue%3A%20Preparing%20for%20the%20Future,-The%20current%20percentage">Forecasting the Activation Queue: Preparing for the Future</a></li><li><a href="https://p2p.org/economy/the-shapella-upgrade-a-deep-dive-into-withdrawals/#T2:~:text=beginning%20of%20July.-,Post%2DShapella%20APR%3A%20Factors%20That%20Will%20Influence%20Your%20Return,-Since%20the%20activation">Post-Shapella APR: Factors That Will Influence Your Return</a></li></ul><h3 id="uncovering-withdrawals-key-information-you-should-know">Uncovering Withdrawals: Key Information You Should Know</h3><p>The Shapella upgrade introduces two types of withdrawals: full withdrawals (also known as exits) and partial withdrawals (staking reward collection).</p><p>Core withdrawal concepts</p><ol><li>Withdrawal eligibility. Not every validator can withdraw immediately after the Shapella upgrade, as only validators with 0x01 format withdrawal addresses are eligible. Validators with old 0x00 format addresses (58% of the total) need to switch to the new format, a process that will take approximately three days. So if you have 0x01 format, you have an advantage over other validators to exit with a minimal queue.</li><li>Full withdrawals involve validators withdrawing their entire stake after passing through an exit queue (dependent on the number of validators wishing to exit) and a withdrawal period (1-5 days). This process prevents sudden changes in validator numbers, ensuring network security.</li><li>Partial withdrawals automatically withdraw accumulated staking rewards (balances over 32 ETH) if validators possess the required withdrawal credentials. Right after the Shapella update, this process will take around 2 days since some validators are not eligible for withdrawals. But this is temporary, and in the near future partial withdrawals should be expected every 5 days.</li><li>You will continue to earn staking rewards while you wait in the exit queue.</li></ol><h3 id="the-withdrawal-process-step-by-step">The Withdrawal Process Step-by-Step</h3><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/01.png" class="kg-image" alt loading="lazy" width="1578" height="988" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/01.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/01.png 1000w, https://p2p.org/economy/content/images/2023/04/01.png 1578w" sizes="(min-width: 720px) 720px"></figure><ol><li>Active validators can earn rewards and perform partial withdrawals.</li><li>To perform a full withdrawal, validators initiate a voluntary exit and enter the exit queue. The exit queue works on a first-in, first-out (FIFO) basis and limits the number of validators that can withdraw every epoch to a dynamic churn limit. The minimum churn limit is set to four. Currently, for 560k validators, it’s 8 validators per epoch (or 1800 validators / 57.6k ETH daily)</li><li>Validators enter a waiting period to ensure no malicious activity. This is approximately 27 hours if not slashed, and 36 days if slashed. After the waiting period, the stake becomes withdrawable.</li><li>All withdrawals, both full and partial, are processed sequentially at a rate of 16 validator addresses per block, amounting to 115k validators daily. Each validator has a designated position in this withdrawal queue. The queue operates in a loop, starting from the beginning after each cycle. It takes 5 days to complete one rotation. Consequently, the maximum waiting time for this withdrawal step is 5 days, while the minimum waiting time can be just a few minutes if the validator completes step 3 (waiting 27 hours) right before their turn for withdrawal.</li></ol><div class="kg-card kg-callout-card kg-callout-card-green"><div class="kg-callout-text">P2P.org is fully prepared for the Shapella update, and once it occurs, the platform will enable you to initiate a full withdrawal with just two clicks.</div></div><h3 id="more-about-the-withdrawal-eligibility">More about the withdrawal eligibility</h3><p>Validators must use withdrawal credentials with the 0x01 format, introduced in March 2021, to be eligible for withdrawals. Validators with the older 0x00 format will be able to switch to the 0x01 format after the Shanghai upgrade, limited to 16 switches per block. It may take two days for every validator to switch their credentials and another two to three days for most staking rewards to be withdrawn.</p><div class="kg-card kg-callout-card kg-callout-card-green"><div class="kg-callout-text"><a href="https://p2p.org/?ref=p2p.org">P2P.org</a> has 0x01 format by default, so if you stake with us, you are already eligible for withdrawals.</div></div><h3 id="navigating-the-post-shapella-market">Navigating the Post-Shapella Market</h3><ul><li><strong>Immediately (first days)</strong> after the Shapella upgrade, we expect only a limited number of validators to exit, as 58% of the total will lack the necessary withdrawal credentials. Substantial partial withdrawals should occur in the following days. We assume that half of the partial withdrawals (550k ETH) will be restaked in order to get more rewards, remaining 550k ETH will likely be sold to pay taxes, which may temporarily cause price pressure.</li><li><strong>Mid-term (around 3 months)</strong>, there will be large stake movements with the maximum possible full withdrawal limit reached and new validators (with long queues). The main factors will be a regulatory crackdown on CEX staking, switching staking providers, complete withdrawals, and staking of accumulated rewards. While waiting in the long activation queue (up to 20 days), validators don't receive any rewards. This is likely to lead to higher demand for liquid staking. It generates yield immediately after staking, distributing rewards among all staking derivatives holders. However, the downside of this feature is a reduced average APR for all liquid stakers (even for those who staked before the Shapella update). As a result, direct staking will generate a higher yield in the upcoming months.</li><li><strong>Long-term (several years)</strong>, we expect that the reduced risk associated with the enabling of withdrawals will bring more adoption but a corresponding drop in APR, which will conversely slow the adoption rate. The two factors balance each other out. Nevertheless, we estimate that 30% of ETH will be staked by the end of 2024 and 50% within 5 years (more on this below)</li></ul><div class="kg-card kg-callout-card kg-callout-card-green"><div class="kg-callout-text">There will be significant increased activation and withdrawal queues first 3 month after the Shapella.</div></div><h3 id="anticipating-the-withdrawal-queue-what-to-expect">Anticipating the Withdrawal Queue: What to Expect</h3><p>Various factors affect the demand for staking withdrawals. We have selected the most important ones, in our opinion, and tried to evaluate their effect on the market:</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/02.png" class="kg-image" alt loading="lazy" width="1578" height="1030" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/02.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/02.png 1000w, https://p2p.org/economy/content/images/2023/04/02.png 1578w" sizes="(min-width: 720px) 720px"></figure><p>Below we have analyzed our assumptions in detail:</p><ol><li><strong>Regulatory crackdown on CEX staking</strong>: Kraken's recent fine by the SEC has led to the exchange winding down its US staking operations. We already know that Kraken will withdraw US investors' staked ETH shortly after Shapella, which represents approximately 400k ETH (2% of total staked ETH). Other CEXs may be more likely to withdraw a significant part of their staked ETH as well. However, this stake will likely be quickly restaked.</li><li><strong>Withdrawals to switch staking providers</strong>. There are numerous reasons to change staking providers, and we assume that at least 20% of validators will do it shortly (first three month)<br><br>2.1. Disliking validator performance: For example, around 8% of validators have effectiveness <a href="https://www.rated.network/?network=mainnet&view=pool&timeWindow=30d&page=1&ref=p2p.org">significantly lower</a> than the network average. <a href="https://www.rated.network/relays?network=mainnet&timeWindow=30d&ref=p2p.org">Some providers</a> don't have MEV-boost at all (10%) or use a limited number of MEV relays (10%). Additionally, <a href="https://www.rated.network/?network=mainnet&view=pool&timeWindow=30d&page=1&ref=p2p.org">8% don’t have</a> client diversity. All of the above is not necessarily a bad thing. The validator may have a super secure setup that reduces performance or a principled position to censor/not censor transactions. Our point is that more than half of the validators have been staking for over a year (before the merge and the appearance of MEV, at least). Therefore, disagreement with the provider's approaches is quite possible. <br><br>2.2. CEXs risks: The recent <a href="https://www.investopedia.com/what-went-wrong-with-ftx-6828447?ref=p2p.org">FTX</a> collapse and <a href="https://blog.kraken.com/post/17619/settlement/?ref=p2p.org">Kraken</a> unstake of all U.S. client assets cases have reminded us of custody risks. Currently, 27.3% of ETH is <a href="https://dune.com/hildobby/eth2-staking?ref=p2p.org">staked by CEXs</a>, and some part of that will be restaked.<br><br>2.3. Solo stakers may exit and stake their ETH with Liquid-staking derivatives (LSDs), as it is a better deal for them. It's hard to estimate the number of solo stakers, but according to our research of ETH deposits, approximately 350k ETH came from separate different addresses in the last three months alone (32 ETH per address). So, solo stakers likely account for 5-10% of validators in total, at least.<br><br>2.4. Switching LSDs to direct staking in favour of diversification: Currently, Liquid staking accounts for 33% of the total stake and seems to be increasing its market share. Despite good diversification in the validator pool, Liquid staking carries additional smart contract risk. Since it will be possible to unstake ETH, a good strategy would be to diversify and restake some amount of ETH in non-custodial direct staking services.</li><li><strong>One-time withdrawal of ETH</strong>, reflecting the need that has accumulated over two years: Staked ETH has been locked for more than 2 years, a considerable period in the blockchain world, during which many circumstances could have changed. Bankruptcy, alterations in portfolio strategy, and other situations may necessitate the sale of ETH. Based on Polkadot and Solana's largest unstakes (10-15% of the total stake within a month), we believe it's fair to assume that at least 10% of the stake will be withdrawn as soon as such an opportunity becomes available.</li><li><strong>Regular organic withdrawals.</strong> According to the Polkadot benchmark, there is evidence of organic stake/unstake movements. Polkadot's historical median value of unstaking is 0.04% daily, which amounts to 15% yearly. We cannot directly apply this benchmark to Ethereum, as it differs in terms of its popular liquid staking option (those who do not want to hold a stake for an extended period can use liquid staking). However, we believe it's reasonable to assume an organic unstaking rate of around 10% per year for Ethereum.</li></ol><p>Considering the assumptions above and the fact that the maximum unstake bandwidth is 57.6k ETH daily, we’ve calculated the potential exit queue for the upcoming month.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/03.png" class="kg-image" alt loading="lazy" width="1578" height="1049" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/03.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/03.png 1000w, https://p2p.org/economy/content/images/2023/04/03.png 1578w" sizes="(min-width: 720px) 720px"></figure><div class="kg-card kg-callout-card kg-callout-card-green"><div class="kg-callout-text">By the beginning of May, total exit time probably will increase to 30 days and will remain at this level until the end of July.</div></div><h3 id="forecasting-the-activation-queue-preparing-for-the-future">Forecasting the Activation Queue: Preparing for the Future</h3><p>The current percentage of staked ETH is low (15%) compared to other chains like Solana (68%) and Polygon (43%). The Shanghai upgrade should unlock pent-up demand from investors who have been reluctant to lock their ETH. A larger proportion of staked ETH will provide greater network security over time.</p><p>Yields from staking are higher than those from the largest and safest DeFi protocols. After the Shanghai upgrade, the risk of locking funds through staking will decrease, making it more attractive to investors.</p><p>In addition, partial withdrawals allow validators to withdraw rewards regularly and restake them, utilizing compounding. Validators can restake these rewards promptly to maximize their returns.</p><p>Until now, staked ETH has increased fairly linearly over time: +6 pp. to the staking ratio yearly (or around 220k new validators per year). But we believe that the <strong>Shapella update is a game-changer, and we will see accelerated organic growth</strong> (up to 440k new validators or 14M ETH per year).</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/04.png" class="kg-image" alt loading="lazy" width="1578" height="1030" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/04.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/04.png 1000w, https://p2p.org/economy/content/images/2023/04/04.png 1578w" sizes="(min-width: 720px) 720px"></figure><p>Other factors affect the activation queue</p><ol><li><strong>Staking of accumulated rewards</strong>: after partial withdrawals, validators may choose to restake their rewards in new 32 ETH units to generate additional yield. Now there are approximately 1.1M ETH rewards locked, and these will be withdrawn within the first week following Shapella. Most likely half of them will go to taxes, half will be staked.</li><li><strong>ETH restaked from Kraken unstake</strong>. 400k ETH within 3 months.</li><li><strong>ETH restake from switching staking providers</strong>. 3.5M within 3 months.</li></ol><p>Applying these assumptions to activation queue bandwidth (57.6k ETH daily), we are getting the following activation queue projections:</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/05.png" class="kg-image" alt loading="lazy" width="1578" height="1049" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/05.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/05.png 1000w, https://p2p.org/economy/content/images/2023/04/05.png 1578w" sizes="(min-width: 720px) 720px"></figure><div class="kg-card kg-callout-card kg-callout-card-green"><div class="kg-callout-text">Total activation time is projected to increase steadily up to 10 days at the beginning of May and 25 days at the beginning of July.</div></div><h3 id="post-shapella-apr-factors-that-will-influence-your-return">Post-Shapella APR: Factors That Will Influence Your Return</h3><p>Since the activation and exit queues have similar bandwidth, and based on the assumptions mentioned above, during the first 3 months after Shapella, we can expect to see a stable number of active validators (57.6k ETH activations / 57.6k ETH exits daily). This leads to a consistent APR, as the number of active validators is one of the main factors influencing rewards. The more validators there are, the fewer rewards each of them receives.</p><p>Below is the APR baseline forecast that takes into account a limited number of factors. It may not be entirely accurate, as many other factors can significantly impact rewards. Nevertheless, it is interesting to consider the trends as a baseline scenario.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/06.png" class="kg-image" alt loading="lazy" width="1578" height="1049" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/06.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/06.png 1000w, https://p2p.org/economy/content/images/2023/04/06.png 1578w" sizes="(min-width: 720px) 720px"></figure><p>Regarding the other factors not accounted for in the baseline scenario:</p><p><strong>Factors that may increase rewards:</strong></p><ul><li>Increased DeFi activity after the update, potentially contributing to a period of higher execution rewards and APR immediately following Shapella.</li><li><a href="https://www.eigenlayer.xyz/?ref=p2p.org">Eigenlayer</a> mainnet release. Restaking will enable staked ETH to be used as cryptoeconomic security for protocols other than Ethereum, in exchange for protocol fees and rewards.</li></ul><p><strong>Factors that may decrease rewards:</strong></p><ul><li>A large influx of new validators may temporarily reduce the effectiveness of current validators due to increased attestation propagation time, affecting consensus rewards.</li><li>The average liquid staking APR for the first three months is likely to be lower than for those staked directly before Shapella (due to reward distribution among all pool members, even if their validators are not yet active).</li><li>The lengthy activation queue will implicitly impact those staked directly after Shapella, as validators do not receive any rewards while waiting for activation.</li><li>A shift of transactions from Ethereum to L2, leading to decreased priority fees & MEV rewards.</li></ul><h3 id="conclusion-navigating-the-shapella-upgrade"><strong>Conclusion: Navigating the Shapella Upgrade</strong></h3><p>The Shapella upgrade presents both challenges and opportunities for validators. To maximize benefits, validators should ensure they possess the necessary 0x01 withdrawal credentials, plan their withdrawal strategies, and be prepared for potential market fluctuations. By understanding the withdrawal process and adapting to the changing landscape, validators can ensure a successful experience with the Shapella upgrade.</p><hr><h3 id="more-about-ethereum">More about Ethereum</h3><ol><li><a href="https://www.stakingrewards.com/journal/choosing-the-best-using-metrics-and-data-to-choose-the-right-ethereum-validator/?ref=p2p.org">Choosing the Best</a>: Using Metrics and Data to Choose the Right Ethereum Validator.</li><li><a href="https://p2p.org/networks/ethereum/apr-simulator?ref=p2p.org">P2P.org APR simulator</a> that calculates the average expected APR and possible deviations.</li><li><a href="https://ethereum-staking.p2p.org/?ref=p2p.org">Institutional Ethereum Staking with P2P.org</a></li></ol>

from p2p validator