Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeBabylon is a revolutionary staking protocol that allows Bitcoin holders to provide their BTC assets to secure PoS systems and receive a yield on their assets.

The idea of BTC staking is relatively new and needs further explanation. When discussing BTC staking, many people associate it with locking BTC in some multisig account, bridging BTC to other chains, and minting new synthetic tokens. The addition of third parties always reduces security. However, that's not the case with Babylon.

To avoid misunderstandings, let’s clarify that Babylon is a Bitcoin Staking Protocol that provides shared security for PoS systems and allows Bitcoin holders to delegate their BTC to Finality Providers, who can then provide Bitcoin security to a consumer PoS chain or DA layer. On the other hand, there is also the Babylon chain, built on Cosmos SDK, which receives security from the Babylon Bitcoin Staking Protocol and acts as the first chain that Finality Providers can support. However, Babylon plans to support different PoS systems from various blockchain ecosystems and provide them access to shared security collateral with BTC.

In this article, we’ll focus on the Babylon Bitcoin Staking Protocol. We’ll show you how the staking flow works, how Babylon applies non-custodial features, and why the process is secure.

The Babylon Bitcoin Staking Protocol consists of two key protocols designed to enhance security in decentralized systems. These protocols leverage the robust features of both Bitcoin and Babylon:

These protocols form a solid foundation for Babylon, providing the ability to stake BTC and exchange data between Bitcoin and chains that use BTC as security collateral.

Before describing the entire flow, let’s briefly talk about the staking process's cornerstones: the Finality Providers' role, a time lock, and an EOTS signature.

Babylon introduces an additional layer of finality that can be added on top of CometBFT or other consensus protocols. Finality Providers are responsible for voting in a finality round on top of these consensus protocols.

Finality Providers can receive voting power delegations from BTC stakers and earn commissions from the staking rewards denominated in the tokens of the networks they support.

If a Cosmos chain decides to integrate with the Babylon Bitcoin Staking Protocol, they need to onboard Finality Providers in addition to their existing set of validators. Additionally, they must incentivize Finality Providers to secure the network by providing additional rewards.

This dual-layer security system creates a strong shared security that can be used by various PoS systems. By combining the efforts of current validators and Finality Providers, Babylon offers a solid foundation that PoS systems can use to boost their own security. This shared security strengthens the Babylon network and provides a reliable security setup for other networks and applications that connect with Babylon.

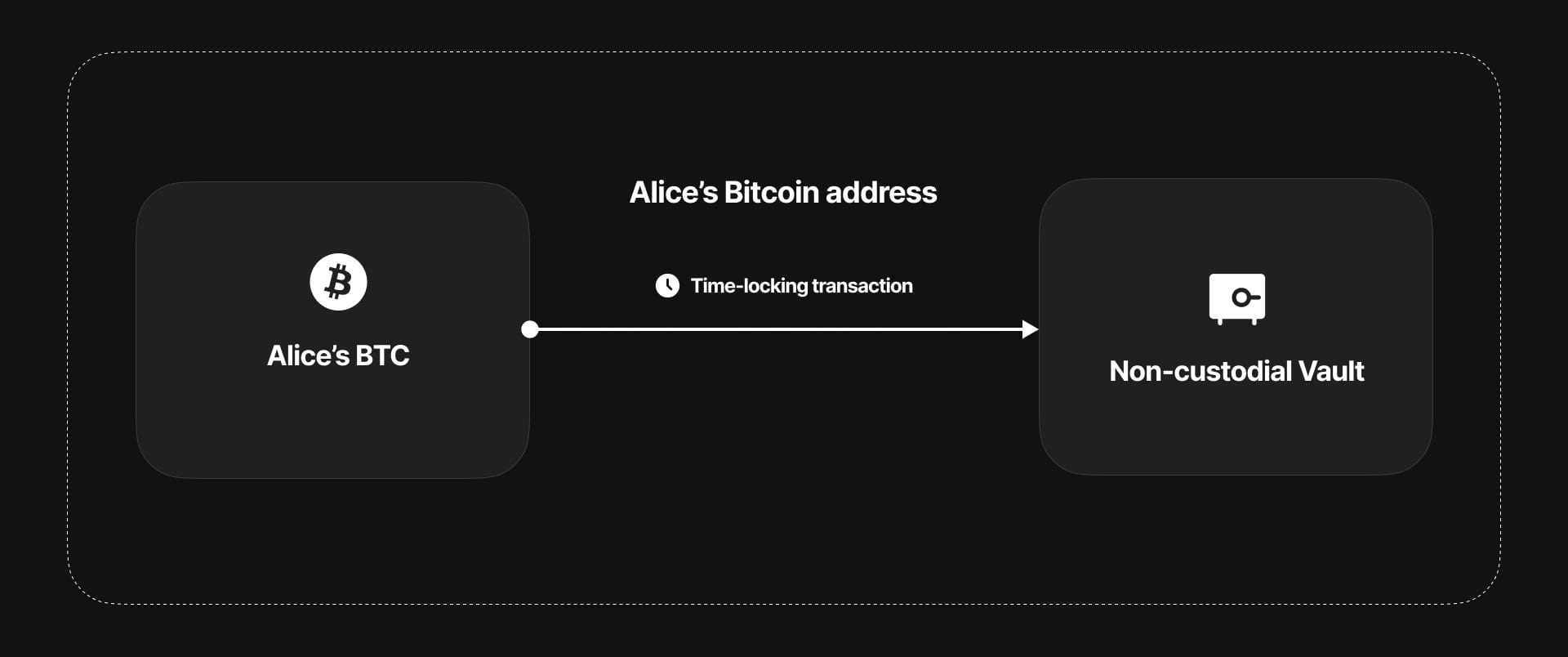

A UTXO time lock is a feature of the Bitcoin blockchain that ensures certain coins can't be used until a specific time or block height is reached. Since Bitcoin doesn't have smart contract functionality, developers use UTXO scripts to create these time locks. To set up a time lock on a UTXO, users need to utilize Bitcoin's script language. Bitcoin scripts define the conditions under which a transaction output can be spent. In the case of a time lock, the script includes specific opcodes (operations) that enforce the time-based restriction.

Using time locks, Babylon can maintain a secure and trustless staking environment, giving users confidence that their staked assets remain controlled until the time lock conditions are met. This approach not only secures the funds but also enhances the overall integrity of the staking process.

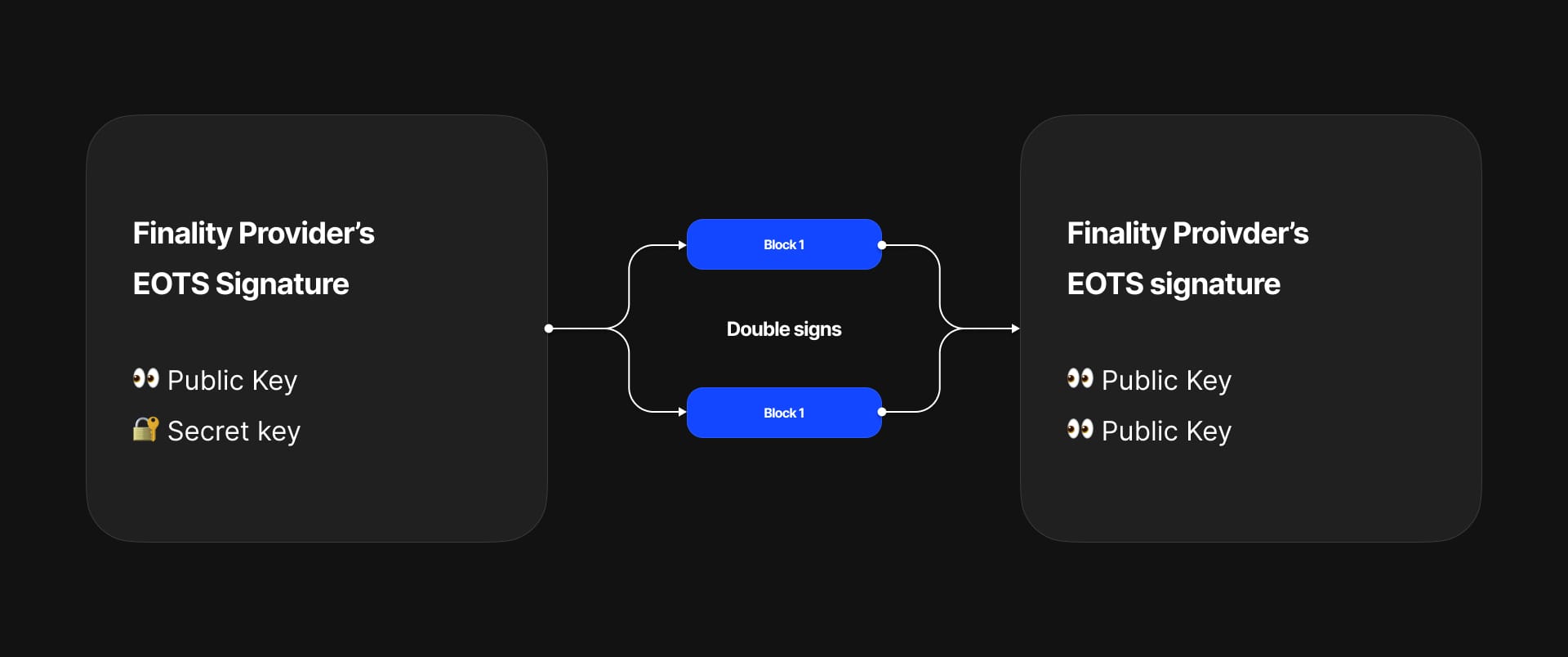

An EOTS (Extractable One-Time Signature) is a cryptographic feature used by Babylon to enhance the security and integrity of its staking process. EOTS signatures are built using Schnorr signatures, which prevent finality providers from double-signing. In the context of Babylon, an EOTS signature ensures that if a finality provider attempts to sign two conflicting blocks, their secret key is revealed. This exposed secret key can then be used to penalize the malicious actor by triggering a slashing mechanism.

Babylon employs EOTS signatures to ensure that Finality Providers validate blocks correctly and honestly. When a user like Alice stakes her Bitcoin, she relies on a Finality Provider to validate blocks using her staked BTC as collateral. If the Finality Provider behaves maliciously, for example, by signing the same block twice, the EOTS signature mechanism kicks in. Observers can detect the double-signing, reveal the provider’s EOTS secret key, and use this information to initiate a slashing transaction.

Here’s how the EOTS signature is involved in the staking process:

Using EOTS signatures, Babylon adds an extra layer of security to its staking process. This mechanism guarantees that any attempt by a finality provider to act dishonestly is met with immediate consequences, such as slashing the staked BTC. This approach protects Alice's funds and maintains the integrity and trustworthiness of the entire Babylon staking system.

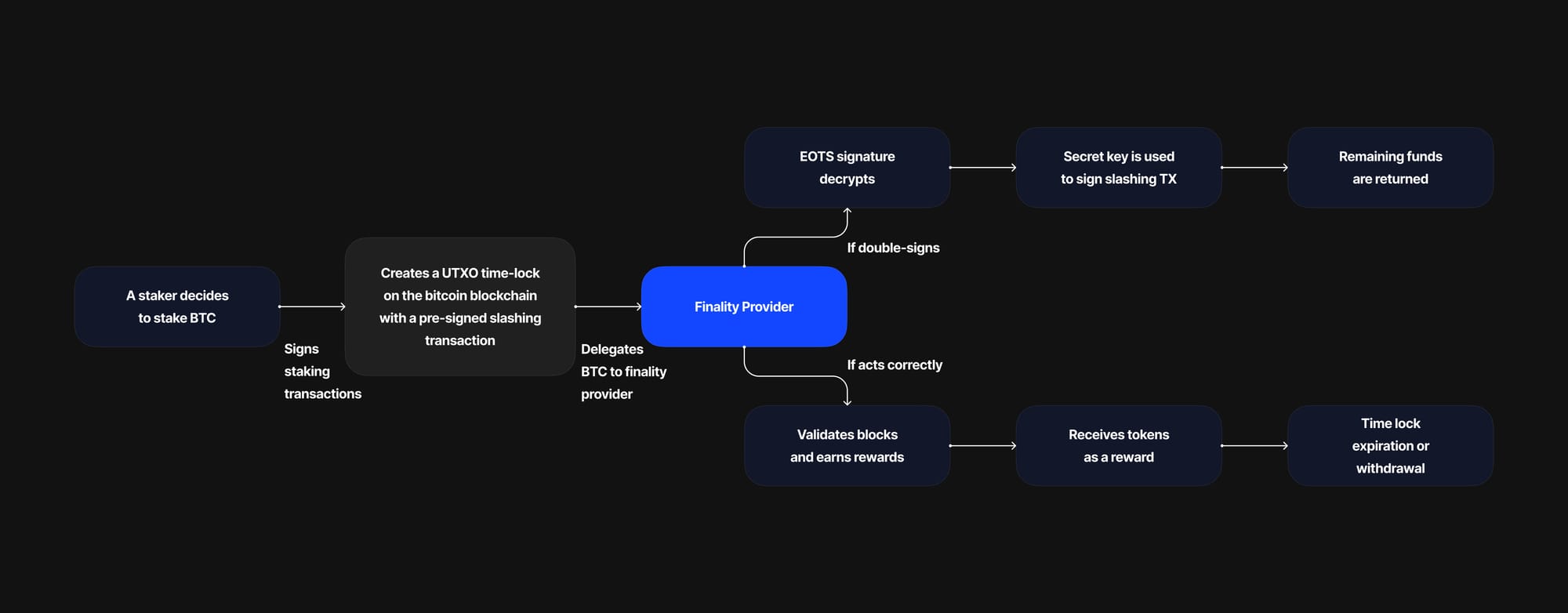

Let's imagine that Alice decides to stake her coins. What steps should she take?

When signing the transaction, Alice makes four essential steps:

After staking BTC, the Finality Provider starts validating blocks to secure the PoS systems using the BTC delegated by Alice. There are two main scenarios for the finality provider:

Because of Babylon's approach's beauty, BTC is always held in Alice's account. If slashing occurs, her Bitcoin can only be withdrawn or sent to a burn address. The EOTS secret key is required to slash Alice's transaction, which can only be revealed if the validator acts maliciously. This architectural approach provides confidence that the whole process is secure and trustless, ensuring that Alice maintains control over her assets at all times.

Alice's most important decision is choosing a provider with enough experience in the validating industry to secure her BTC without the risk of slashing it.

BTC holders can find different BTC staking solutions on the market. The most popular ones are Bitcoin L2s. If users want to stake their Bitcoins, they typically need to bridge Bitcoin using bridges, mint BTC derivatives on the receiving network, and find a protocol that allows them to stake their coins.

Most Bitcoin Layer 2 solutions don't use BTC as collateral for supporting PoS chains. Instead, they provide yield to BTC holders through additional emission, liquidity provision, or lending mechanisms.

Babylon's approach is more secure because it doesn't involve bridging or minting synthetic BTC. The source of yield is always clear, as it comes from supporting PoS networks, which reward validators with their coins.

We believe in the Bitcoin staking narrative and are committed to helping the Babylon Foundation use idle Bitcoin capital to fortify PoS systems. We will continue sharing content about this. Stay tuned for updates!

If you're interested in participating in the launch of Babylon, we recommend two main directions for involvement:

The Babylon Testnet-4 has already been launched, and the mainnet launch is anticipated by the end of the first half of the year. This new testnet focuses on the security of staked Bitcoins by testing user interactions with the BTC Signet test network. The Babylon team is actively monitoring updates and feedback from the community to ensure the network's robustness and security before the mainnet launch.

P2P Validator is a world-leading non-custodial staking provider, securing over $7 billion from over 10,000 delegators/nominators across 40+ high-class networks. We have actively participated in the Babylon Chain activities since the beginning.

Do not hesitate to ask questions in our Telegram chat.

Web: https://p2p.org

Twitter: @p2pvalidator

Telegram: https://t.me/P2Pstaking

<p>We are excited to announce a <strong>significant update to our Polkadot Staking API</strong>, which was made possible by the dedicated efforts of our Staking API team.<br><br>In the rapidly evolving world of Web3, <strong>intermediaries like custodians, exchanges, wallets, and institutional investors are constantly seeking ways to optimize their services and provide superior value to their clients.</strong></p><div class="kg-card kg-callout-card kg-callout-card-blue"><div class="kg-callout-text">At P2P.org, we understand the critical role these intermediaries (for example, custodians, wallets, exchanges, and institutional investors) play in the ecosystem, and we are committed to offering solutions that enhance their operational efficiency and client offerings.</div></div><p>Our Staking API enables seamless integration and management of staking operations for Polkadot.</p><h3 id="why-choose-p2porgs-polkadot-staking-api"><strong>Why Choose P2P.org's Polkadot Staking API?</strong></h3><p>Our Staking API is tailored for businesses leveraging Polkadot's staking capabilities to enhance their service portfolio.<br><br>Here's how it can benefit your organization:</p><ol><li><strong>Streamlined Integration</strong>: Easily integrate staking functionalities into your existing systems with minimal effort, ensuring a smooth user experience for your clients. This saves you time and resources. It also enables you to integrate other networks to offer your clients various products effortlessly.</li><li><strong>Enhanced Security</strong>: Benefit from robust security features that protect your assets and ensure compliance with industry standards.</li><li><strong>Scalability</strong>: Our API supports high volumes of transactions, making it ideal for large-scale operations.</li><li><strong>Expert Support</strong>: Access our dedicated support team, which is ready to assist you with any technical challenges and ensure your integration is successful.</li><li><strong>Revenue Sharing</strong>: Benefit from a revenue-sharing model that aligns with your business goals, ensuring a mutually beneficial partnership.</li></ol><p>On top of that, our new Polkadot Staking API enhancements significantly increase the network rewards with P2P.org compared to the industry average. You can see it from this chart (check the <a href="https://dune.com/substrate/polkadot-staking?ref=p2p.org" rel="noreferrer">Dune Staking Dashboard for Polkadot and look for pools ID: 189 and 238</a>):</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2024/06/high-reward-polka-GRAPH-1.jpg" class="kg-image" alt="" loading="lazy" width="1978" height="1225" srcset="https://p2p.org/economy/content/images/size/w600/2024/06/high-reward-polka-GRAPH-1.jpg 600w, https://p2p.org/economy/content/images/size/w1000/2024/06/high-reward-polka-GRAPH-1.jpg 1000w, https://p2p.org/economy/content/images/size/w1600/2024/06/high-reward-polka-GRAPH-1.jpg 1600w, https://p2p.org/economy/content/images/2024/06/high-reward-polka-GRAPH-1.jpg 1978w" sizes="(min-width: 720px) 720px"></figure><p><strong>By enabling Nomination Pools staking via Staking API</strong>,<strong> we lowered the entry barrier for your Clients: Staking is</strong> <strong>now available starting from just 1 DOT</strong>. Before, the previous requirement was to stake at least 100K. This makes it accessible to a broader range of users.<br><br>This update provides much-needed flexibility and opportunities for our partners and clients. We believe it will foster new partnerships and help our existing partners grow their staking activities quickly and efficiently.</p><h3 id="how-does-the-integration-work"><strong>How does the Integration Work?</strong></h3><p>Our Staking API is designed to be intuitive and easy to implement. Here's a brief overview of the process:</p><ol><li><strong>Integration</strong>: Use <a href="https://docs.p2p.org/docs/staking-polkadot-public?ref=p2p.org" rel="noreferrer">our step-by-step documentation</a> and support resources to integrate the API into your platform easily. Approximate ETA: 3 days!</li><li><strong>On-demand support</strong>: Our integration team is ready to support you with any questions and doubts to lead to a successful integration</li><li><strong>Staking</strong>: Get your first stake and enjoy!</li></ol><h3 id="case-study"><strong>Case Study</strong></h3><p>Consider a scenario in which the CEO of a financial services company is seeking new revenue streams and ways to enhance client satisfaction. By integrating P2P.org's Staking API directly into their platform, the company can achieve several key objectives:</p><ol><li><strong>Operational Efficiency</strong>: By integrating our Staking API, the company can streamline staking operations, reducing manual effort and increasing reliability.</li><li><strong>Competitive Advantage</strong>: Our API optimizes the staking process, resulting in higher protocol rewards than other solutions (see the chart above: Our integration has historically provided higher staking rewards over the same period than others.). This positions the company as a leader in the market, providing an unparalleled staking experience that attracts more clients.</li><li><strong>Client Satisfaction</strong>: Thanks to reliable performance, your client satisfaction improves significantly. Our service boasts a 99% uptime SLA, ensuring that clients can stake their assets with confidence and reliability. The seamless staking experience and the promise of higher staking rewards ensure clients are more engaged and satisfied with the services.</li></ol><p>Contact us today to learn more about how our API can benefit your organization.</p><h3 id="person-of-contact">Person of contact:</h3><p>Polkadot Staking: <a href="mailto:[email protected]" rel="noreferrer">Alexander Tishin </a><br>Staking API integration: <a href="mailto:[email protected]" rel="noreferrer">Alessandro Maci</a><br><br>Let's continue to innovate and achieve great things together!</p><h1 id="about-p2p-validator"><strong>About P2P Validator</strong></h1><p><a href="https://p2p.org/?ref=p2p.org">P2P Validator</a> is a world-leading non-custodial staking provider, securing over $7 billion from over 10,000 delegators/nominators across 40+ high-class networks. We have actively participated in the Polkadot/Kusama network since the beginning.</p><hr><p>Do not hesitate to ask questions in our <a href="https://t.me/P2Pstaking?ref=p2p.org">Telegram</a> chat or contact Alex via <a href="mailto:[email protected]">[email protected]</a>. We are always open to communication.</p><hr><p><strong>Web:</strong> <a href="https://p2p.org/?ref=p2p.org">https://p2p.org</a></p><p><strong>Stake DOT with us:</strong> <a href="https://p2p.org/polkadot?ref=p2p.org">https://p2p.org/polkadot</a></p><p><strong>Twitter:</strong> <a href="https://twitter.com/p2pvalidator?ref=p2p.org">@p2pvalidator</a></p><p><strong>Telegram:</strong> <a href="https://t.me/P2Pstaking?ref=p2p.org">https://t.me/P2Pstaking</a><br><br></p>

from p2p validator

<p></p><p><strong>Introduction</strong></p><p>Today (4th July 2024) marks a significant milestone for Web3 as <a href="https://twitter.com/lagrangedev?ref=p2p.org" rel="noreferrer">Lagrange</a> Labs launches its Prover Network on the <a href="https://twitter.com/eigenlayer?ref=p2p.org" rel="noreferrer">EigenLayer</a> mainnet.<br><br>At P2P.org, <strong>we are thrilled to participate in this development, collaborating with top-tier institutional operators to bring the first decentralized zero-knowledge (ZK) prover network into production.</strong> <br><br>This launch represents a transformative step forward in adopting and implementing ZK technology, which promises to revolutionize how we approach scalability, privacy, and security in the blockchain space.</p><figure class="kg-card kg-embed-card"><blockquote class="twitter-tweet"><p lang="en" dir="ltr">Watch the video! Well-explained what the Zk (zero knowledge) technology is. 👌<br><br>We’re betting strongly on ZK proofs. Stay tuned to the upcoming launches of ZK networks.<br><br>Do you want to know what’s launching next?<br><br>⏩ Subscribe to the newsletter: <a href="https://t.co/QRWqmu2Rku?ref=p2p.org">https://t.co/QRWqmu2Rku</a> <a href="https://t.co/YhzTDULlzE?ref=p2p.org">https://t.co/YhzTDULlzE</a></p>— P2P.org (@P2Pvalidator) <a href="https://twitter.com/P2Pvalidator/status/1773629855860466007?ref_src=twsrc%5Etfw&ref=p2p.org">March 29, 2024</a></blockquote> <script async="" src="https://platform.twitter.com/widgets.js" charset="utf-8"></script></figure><p><br><br><strong>Our Role and Commitment</strong></p><p>As an operator within Lagrange's Prover Network, P2P.org is committed to contributing our expertise and infrastructure to ensure the network's success.<br><br>We are honored to join forces with esteemed partners such as Coinbase, Kraken's Staked, OKX, Ankr, Nethermind, and many more. Our collaboration underscores the collective effort to bring ZK technology to the forefront of the blockchain industry.</p><p>We have always been dedicated to supporting innovative technologies and enhancing the performance and reliability of decentralized networks. The launch of Lagrange's Prover Network aligns perfectly with our mission to advance blockchain technology and foster a more secure, scalable, and decentralized future.</p><p><strong>Lagrange's Prover Network 101</strong></p><div class="kg-card kg-callout-card kg-callout-card-blue"><div class="kg-callout-emoji">💡</div><div class="kg-callout-text"><b><strong style="white-space: pre-wrap;">Lagrange’s Prover Network is the first production-ready decentralized ZK prover network designed to deliver high-liveness guarantees and cost-effective solutions </strong></b>for users and provers alike. </div></div><p></p><p>By leveraging EigenLayer's low-cost-of-capital environment and restaked ETH, the network ensures that users pay less for high availability while operators are incentivized to maintain optimal performance.</p><p>The Prover Network also introduces a novel architecture that enables a hyper-parallel ZK coprocessor. This allows <strong>developers to execute intensive off-chain computations and bring the results back on-chain with verifiable ZK proofs.</strong> This innovative approach significantly enhances the scalability and efficiency of ZK proofs, making them more accessible to developers and applications.<br><br>If you'd like to know more detailed information on Lagrange's ZK Prover, please read <a href="https://www.lagrange.dev/blog/lagrange-deploys-first-production-ready-zk-prover-network-powered-by-coinbase-kraken-and-okx?ref=p2p.org" rel="noreferrer">Lagrange's blog</a>.</p><figure class="kg-card kg-bookmark-card"><a class="kg-bookmark-container" href="https://www.lagrange.dev/blog/lagrange-deploys-first-production-ready-zk-prover-network-powered-by-coinbase-kraken-and-okx?ref=p2p.org"><div class="kg-bookmark-content"><div class="kg-bookmark-title">Lagrange: Lagrange Deploys First Production-Ready ZK Prover Network Powered by Coinbase, Kraken and OKX</div><div class="kg-bookmark-description"></div><div class="kg-bookmark-metadata"><img class="kg-bookmark-icon" src="https://cdn.prod.website-files.com/6626eae60883543ea2814ed0/663aa051201b1281c91efeff_32.png" alt=""></div></div><div class="kg-bookmark-thumbnail"><img src="https://cdn.prod.website-files.com/6626eae60883543ea2814ed0/6628fa04f7855cecec18d64e_R.webp" alt=""></div></a></figure><p></p><p><strong>Our Continued Support for Lagrange</strong></p><p>In our previous blog post, <a href="https://p2p.org/economy/know-your-avs/" rel="noreferrer">Know Your AVS</a>, we highlighted the potential of advanced verification systems and our enthusiasm for partnering with trailblazers like Lagrange. Today, as we celebrate the launch of their Prover Network, we reaffirm our commitment to supporting Lagrange's vision and contributing to the broader adoption of ZK technology.</p><figure class="kg-card kg-bookmark-card"><a class="kg-bookmark-container" href="https://p2p.org/economy/know-your-avs/"><div class="kg-bookmark-content"><div class="kg-bookmark-title">Know Your AVS!</div><div class="kg-bookmark-description">Restaking with P2P.org: Know Your AVS The latest development in the EigenLayer protocol has culminated with the launch of the EigenLayer Stage 2 mainnet. This phase marks the introduction of Operators, who assume responsibility for performing validation tasks for Actively Validated Services (AVS) built on the EigenLayer protocol. This</div><div class="kg-bookmark-metadata"><img class="kg-bookmark-icon" src="https://p2p.org/economy/content/images/2020/09/favicon.ico" alt=""><span class="kg-bookmark-author">P2P.org Blog: Insights, Guides, and News</span><span class="kg-bookmark-publisher">Kamil Jakub Natil</span></div></div><div class="kg-bookmark-thumbnail"><img src="https://p2p.org/economy/content/images/2024/04/Know-Your-AVS.jpg" alt=""></div></a></figure><p></p><p><strong>Looking Ahead</strong></p><p>The launch of Lagrange's Prover Network on EigenLayer is just the beginning. P2P.org will continue to play an active role in the network, helping to scale its operations and ensure its robustness. We are excited about the opportunities for this collaboration and look forward to further innovations that will emerge from the Prover Network.</p><p>To stay updated on our progress and the latest developments within the Lagrange Prover Network, follow us on <a href="https://twitter.com/P2Pvalidator?ref=p2p.org" rel="noreferrer">social media</a> and <a href="https://t.me/P2Pstaking?ref=p2p.org" rel="noreferrer">join our community discussions</a>. Together, we can drive the future of decentralized technology and unlock the full potential of zero-knowledge proofs.</p><p><strong>Conclusion</strong></p><p>The successful deployment of Lagrange's Prover Network marks a pivotal moment in the evolution of blockchain technology. At P2P.org, we are proud to be part of this historic launch and work alongside industry leaders to mainstream ZK technology. It's our commitment to advance the decentralized ecosystem and build a more secure, scalable, and efficient blockchain infrastructure for all.</p><h2 id="contact-us">Contact Us:</h2><p><em>Do not hesitate to ask questions in our </em><a href="https://t.me/P2Pstaking?ref=p2p.org"><em>Telegram chat</em></a><em> <br>We are always open for communication.</em><br><br>We encourage you to check our website and start our staking journey together!</p><div class="kg-card kg-button-card kg-align-center"><a href="https://p2p.org/ethereum?ref=p2p.org" class="kg-btn kg-btn-accent">Stake with us!</a></div><hr><p><strong>Web:</strong> <a href="https://p2p.org/?ref=p2p.org">https://p2p.org</a><br><strong>Blog:</strong> <a href="https://p2p.org/economy/">https://p2p.org/economy</a><br><strong>Twitter:</strong> <a href="https://twitter.com/p2pvalidator?ref=p2p.org">@p2pvalidator</a><br><strong>Telegram:</strong> <a href="https://t.me/P2Pstaking?ref=p2p.org">https://t.me/P2Pstaking</a></p><h1 id="about-p2p-validator"><br><strong>About P2P Validator</strong></h1><p><a href="https://p2p.org/?ref=p2p.org">P2P Validator</a> is a world-leading non-custodial staking provider, securing over $7 billion from over 10,000 delegators/nominators across 40+ high-class networks.</p><p>Do not hesitate to ask questions in our <a href="https://t.me/P2Pstaking?ref=p2p.org">Telegram</a> chat or contact our team directly on X or LinkedIn. We are always open to communication.</p>

from p2p validator