Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeThe Graph is a decentralised protocol for querying and indexing data from blockchains. It is the backbone of major crypto projects like Uniswap, Lido, Livepeer and Decentraland. Basically, any dApp in order to be truly decentralised has to store its data on a distributed database. And The Graph is where dApps can store and collect information in a familiar Web 2.0 fashion but with Web3 security and reliability.

You can capitalise on major Web3 projects’ successes and failures and earn fees on The Graph platform. The Graph supplies the databases and computing powers to support these projects and this work is done by the indexers. This work is backed by delegators that stake GRT by delegating it to them. Anyone can become a delegator and get between 9% and 15% APY on their GRT tokens.

Those looking for a higher yield and comfortable with higher risks can consider becoming a curator.

A Curators’ job is to identify the most prosperous Web3 projects that use The Graph as their database and buy their shares. When a curator holds these shares they get a part of the query fees served by indexers with some of them returning up to 30% APY.

With the new dashboard made by P2P for curators, it has become easier than ever to make data-driven decisions.

https://reports.p2p.org/superset/dashboard/graph_curation

The first tab (subgraphs) is designed to give you data on where the upcoming query fees are going to be higher.

The creators’ share column would help you identify how many other curators may leave and thus lower your share price, as it is unlikely (but still possible!) for subgraph creators to abandon their own subgraph.

Query fees (QF) probability is calculated based on the past 30 days. If there were no queries in the last month, the probability of new queries is close to 0. The percentage takes into account all closed allocations, their size, and duration and estimates the probability of the next query.

QF APR is estimated based on the annualised Price per Share changes in the last 30 days based on indexers' allocation collect events.

QF APR If You Signal N GRT is calculated considering current signals & query fees collected in the last 30 days.

Everything starts with indexers allocating their GRT to subgraphs. They would allocate their tokens proportionally to the number of signals on the subgraphs.

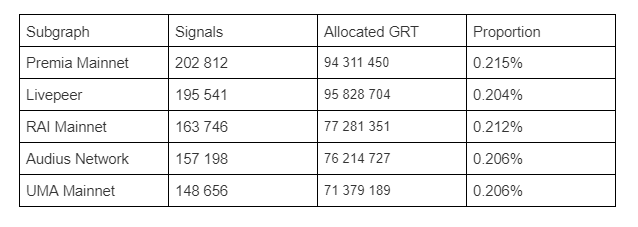

In the table below Proportion = Signals / Allocated GRT

If for example, curators added signals to the UMA subgraph, this would in theory lead to more indexers allocating GRT there. An allocation generates rewards for a period of 28 epochs only (approx. 28 days). After that, the allocation stops generating rewards and indexers have an incentive to close them. They may also close their allocation earlier if the signals on the subgraphs change. You can observe indexers' behaviour towards particular subgraphs in the Selected Subgraphs’ Current Indexers’ Allocations table.

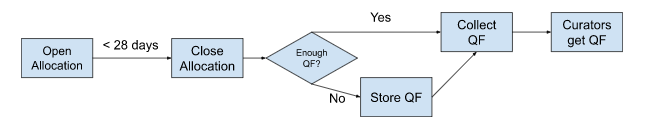

Here's how the allocation lifecycle plays out:

Because Indexers have to pay gas for every action sometimes they choose not to collect query fees if the reward doesn't outweigh the cost. They can store those query fees and accumulate them until it is economically viable to claim them. To help you predict whether an indexer will claim query fees, we provide you with the stats for previous allocations. Curators only get their share of query fees after the indexers claim them.

Query fees are not the primary source of income for curators. Most of the tokens earned come from the shares' price changes.

The share price is not tied to the project’s token price. For example, changes in the Uniswap token price, UNI, do not correlate with changes in price for its subgraph shares. Some of the projects with a subgraph do not have a token at all, for example, Connext has not released its token yet. You also need to pay attention to the subgraph publisher. For example, Messari has published subgraphs for Uniswap, Lido and other projects, but those subgraphs are not used by Uniswap or Lido, but by Messari.

With the help of our new tools, you can take a look at how other curators earn GRT on the share price changes. You can try to figure out the tactics that others use to become more profitable by taking a look at their portfolio and the actions they took.

When signalling onto the subgraph a curator buys shares. The price of a share is pre-determined by the bonding curve and each subsequent share is more expensive. The same logic applies in the opposite direction. If someone sells a share, the share price of each curator on that subgraph drops as the price goes down the bonding curve. This process is well documented in The Graph's official documentation. The primary way to earn rewards in curation is by being among the first to notice the true potential of a subgraph.

There are a few tactics that can be applied to be successful in this way of earning rewards. One that is very frowned upon by the community is the use of front-running bots that signal on a subgraph as soon as it appears in the network. There are different proposals on how to decrease their impact on the industry. These bots are not as aggressive as in other parts of the crypto ecosystem, so they still leave an opportunity for common investors to earn rewards in the curation market.

Projects with big names, such as Lido, Messari, and Curve get their signals very quickly as it is assumed that they will generate both hype and query fees that would generate rewards. But keep in mind that anyone can create a subgraph with any name, so it is better to make sure that the subgraph you plan to signal on is the official one. In all the cases mentioned above, a good place to discuss any Curation related questions is the official discord channel.

We hope our new tool helps you in your curation process decision-making, or if it is the case, it helps you get started. We are always happy to hear your feedback on the work we are doing, so do not hesitate to reach out, and make suggestions on how we can make The Graph even better.

Check out the tool below.

P2P Validator is a world-leading non-custodial staking provider with the best industry practices and proven expertise. At the time of publishing, P2P Validator is trusted with over $1B in staked assets by over 30,000 delegators across 40+ networks.

<h3 id="intro">Intro</h3><p>Everyone is always looking for ways to improve their finances and we often hear that staking in crypto can't be profitable and stable during the bear market. At P2P we think that it depends on how effectively your staking provider uses the infrastructure.</p><p>Today we want to share the story of how we became a successful Node operator (NOP) on Chainlink by continuously improving our performance metrics. We will also talk about Chainlink’s oracle network, its current state and how NOPs can get a stable revenue even during a bear market.</p><h3 id="what-is-chainlink-oracle-network">What is Chainlink oracle network?</h3><p>Chainlink is the market-leading decentralised oracle network providing real-world data to smart contracts on any blockchain. Currently, Chainlink supplies data for DeFi consumers across 14 networks:</p><ol><li>Ethereum: Mainnet, Goerli, Kovan, Rinkeby, Ropsten</li><li>Avalanche</li><li>Binance SM</li><li>Optimism</li><li>Arbitrum</li><li>Fantom</li><li>Harmony</li><li>Moonriver</li><li>Moonbeam</li><li>Metis</li><li>Heco</li><li>Polygon</li><li>xDai</li><li>Solana</li></ol><p>Ethereum registered the highest number of working oracles during 2022.</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/ko4Q_PCIn7OB4WTIL_bSQUuTWml5S6uWUMEHHijYiDy1_dbXi3DoPdJVMkniYsriQkhfi1q0yMXC8thIjeyzN65kJNdpAiYg6pYSD-J3gWQ4jXaXwbsQQkGmRCBK9--8P5bep1glXSRkXTebpjAvkOi8GbUphwfEi5NbSyYhMzTXyE03q4G4tfHlU5EqNA" class="kg-image" alt loading="lazy" width="602" height="215"></figure><p>Within each network, oracles can provide different types of data:</p><ul><li>price rates between two tokens, NFTs, etc. (data about the price relation between 2 tokens is called data feeds);</li><li>automation services;</li><li>direct requests from consumers (when somebody directly requests data from Chainlink protocol);</li><li>A verifiable source of randomness for smart contract developers (VFR).</li></ul><p>P2P currently provides more than 2000 unique data feeds on different chains. While most of these data feeds are shared across multiple chains, some of them are unique to a specific chain, for example, the METIS-USD data feed is present only in the Metis network. Here’s the distribution of data feeds per network:</p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/PoRy4aBEV2Y-nutW0NLkgLF6UdD4HxMGBCuoutrrYMIdt9D4NwKX45YCzCbcf1M7jceBnnyZOsYGDmftMiFcas8jNjbd6wJVzrXeHb33RqCKXnHbC0flxRZca43_La6oR07sUNTkfROSm0yuEFQ7GRzZnZilZQeJRtpLxBO-kmALFji7vdI2qanxcyQVjw" class="kg-image" alt loading="lazy" width="602" height="216"></figure><p>These data feeds are distributed between node operators in every blockchain. This is the first side of Chainlink’s decentralisation.</p><p>A few technical details:</p><p><em>Oracles generate reports for data feeds continuously by sending requests to data providers (APIs) and aggregating them (median). Every time consumers need data, Chainlink asks one of the oracles, that is assigned to that data feed, to write that data to the blockchain. The session data recording is called the Round and the chosen oracle is called the Leader of the Round. The Leader gets data from other oracles (who are also assigned to this data feed), calculates the median value and writes it to the blockchain. If for any reason the Leader couldn’t do it - the next oracle becomes the Leader and has to do it.</em></p><p><br>It is not enough to just attract a large number of oracles, it is also important to ensure that the oracle’s data is decentralised. This is achieved by using different data sources for different oracles.</p><p>For example, the price feed for ETH-USD in Fantom is distributed between oracles and data sources (APIs) as follows:</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/n5ZNZNryhyK1tldaIwlR_iMB7yL8nm-g7hifNVL9uHp2r1DYPanLa2RrQnP4ESaFGmoelpxr_7KAOEjq8qsh5AgpD7w5mo70xFRBEY_LYP712JBbyXetp02hrTDVzfP9gtLdCzKPL1_Y6qC8KocEspigEkxMwlZSGfGbi4oGnuwMmkSuLWKmvZClfHfZag" class="kg-image" alt loading="lazy" width="581" height="503"></figure><p><em>Note: A 1 means that an oracle gets the data from the API, 0 means that the oracle doesn’t get it from that source</em></p><p>The degree of decentralisation can vary as it depends on the number of data sources that provide the price data and the number of oracles. We only need the fact that different oracles send requests to different API services to proceed with the data when Chainlink needs it for understanding Chainlink’s decentralisation.</p><h3 id="p2p-chainlink">P2P & Chainlink</h3><p>P2P joined the Chainlink oracles network in 2018. We first started as a NOP in Ethereum on several data feeds and we haven't stopped growing since that time. Today we are present in 6 networks and we provide data for more than 150 feeds.</p><p>This level of growth was a serious challenge for us as a company. Looking back it seems that it would be impossible to become a successful Node operator without a data-driven approach. Luckily, in 2020 we had already understood that we needed to collect and analyse data about NOPs’ performance in Chainlink. In this article we will walk you through our path and go through it from the beginning.</p><p>We provide 4 steps for a successful data-driven approach to node management:</p><ol><li>Define key metrics. You can’t control anything without measuring it, but first, you need to understand what you want to measure.</li><li>Extract all the necessary data. It seems obvious but we had to work hard to collect all the data from different networks, make indexers and transform it so that they are usable for analytical purposes.</li><li>Determine who is a good node operator. When you’ve collected all the metrics you should understand what you can do with them: what is under your control and what is not. You need to also keep in mind Chainlink's main mission - to provide accurate off-chain data to the blockchains.</li><li>Decision making. Develop analytic tools to transform the data into knowledge that can be used in decision-making.<br></li></ol><p>Let's start with the first step.</p><h3 id="key-metrics">Key metrics</h3><p>The main purpose of the Chainlink protocol is to provide data for users. As we have previously mentioned, “Round” is the act of writing data to the blockchain by an Oracle.</p><p>Here are the number of rounds for the Ethereum mainnet in 2022.</p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/xapxQXV-nkH28gGuqnyC0DxlXRTfWntVZM5B92D8Jm7BX24Z9Cgsb1Kfw8uSVc5I_PBZjhN2dD9TUNSOWWmhYeWFi-A2_M4n5Xb_5ienucAcJVKrtfkk_HfxnDZsMc2cvpJCNDTL-WGU05i7HB43RIA3lQRK0kP3txlaF5MqLbh4K-j2DWs9lZbqQ1PlAQ" class="kg-image" alt loading="lazy" width="602" height="193"></figure><p>This is how we compare the consumption of Chainlink’s data by different chains (for example Avalanche, Fantom, Harmony, Moonriver and Ethereum). You can notice there is a peak in the number of rounds in May (Terra collapse), June (Celsius) and November (FTT/FTX collapse). This is true for every chain:</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/b9ZreTaBRX5kUef45SkDBOFsJrgXmwmKrFcwf_5CBdvwPxtMgHP2JieX4xHVAE3tQhSidDFG_FAMFptn2bRnkYHHCOs5VCGfQ6mdy3DRoKSksgKgYtRSW1IRFkZLr-tao1SwaHza-r--sieVqQlFjWZ1LaLPahSdolAlAqulYP7Hvj6fVrGqsTCWVsod7g" class="kg-image" alt loading="lazy" width="602" height="180"></figure><p>We can track the number of rounds to measure the consumption of data supported by Chainlink for any chain/feed/oracle. For example here is the number of rounds for ETH-USD (dark blue), FTT-USD (green) and ATOM-USD (bright blue) on Ethereum’s mainnet:</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/5vGOUEiQeURrCyua2Imyq5boZ6GjD4MAVmH_4eh_dDld3pY3IZOH2Y8jDWHKbMV8RX7gNCexad_poWtHYVGGTDwCW7VO-eSPJVBI142XoaF_MNzsrcxaxVo3ZL8iG2h_jVSfpq8RAvtOcG5QUkgPoLzb1dLm5GQO3KL8C_OFXHO5UkTEPr9LGJOPyaOLFQ" class="kg-image" alt loading="lazy" width="602" height="175"></figure><ul><li>There are a lot of spikes for the ETH-USD data feed. During our monitoring of Chainlink's activity, we see that every significant crypto event increases the demand for ETH data feeds. It is probably connected with the need to swap every token to Ethereum either because it seems like one of the most securable assets or because it has the best liquidity;</li><li>Cosmos ATOM saw a growing demand for price data in the middle of May (we link this with the Terra collapse) and not a so significant peak in November;</li><li>With FTT we see the opposite. The number of rounds was lower during May ‘22 and much bigger in November ‘22 during the FTX scandal.</li></ul><p>It is not enough to just provide data, our purpose in Chainlink as a NOP is to provide accurate data. For that, we need an estimation of the quality of the data that is calculated based on the oracles’ answers every round. We call this “Deviation”. It is calculated by comparing a particular oracle’s answer for that Round to the Round’s final value (the median of each oracle's answer). This way, we can track the variance of each oracle every Round. This can also be used to calculate the average value of each oracle’s deviation. Here is how we can compare the data quality for different chains:</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/GIGrmSCocpuw1HYcBG5nb325HI2kPQO1-BkkeSN2gjrleMZckC3fBt69FhJuy6HbxZS22QVeJ9DD-laJ35WcSKhDznJJIctF4_8ndu9QIaUBvkhHpWoyWaXiSBDknbLtym6aU7Zeb2F9tCBkA8dBcCRTYmjMCN1ani9Tt1Xx9FO31mTpgzZaPyLiXXVhNw" class="kg-image" alt loading="lazy" width="602" height="172"></figure><p>It is important to mention that the most popular deviation threshold for data feed defined by Chainlink is 0.5%. There are a lot of feeds with even a 5% deviation threshold.</p><p>It is also interesting to compare the performance of different NOPs by their ability to write Chainlink data on-chain. We use the Transaction success rate (TSR) for this. This is the ratio of the number of successful transactions to the number of unsuccessful transactions.</p><p><strong>Data extraction</strong></p><p>This is not the main subject of the current article. We plan to talk about this a bit more in a future post. Today we will only mention the main architecture of the ETL (Extract, transform, load steps of data uploading pipeline) process:</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/k8IpSUldKoj2x3RDdjVRlY01TlVaKtvARTFciBmqkGLOwOMNo-CSVCyvdQimOTzaB0mhL_cFC7J_RQlpfVH-uWARBeUkrmIjg0xL9LxHj2_eHSesRQ_WnxwSgMYSBIwp_L9P6S0vL3UYZV1sYMyGHdjh0JMuwTJrnzmTMXG2jKX1ejnl8TLdegIMCMhVOw" class="kg-image" alt loading="lazy" width="602" height="189"></figure><p>The first 3 sources are:</p><ol><li>On-chain data</li><li>Chainlink <a href="https://github.com/smartcontractkit/reference-data-directory?ref=p2p.org">repo</a></li><li>TheGraph: our subgraphs are available here:</li></ol><ul><li><a href="https://thegraph.com/explorer/subgraphs/53PbnKoeHChwYvh7rKJES7sdRbwtutszWyTbrrSyib7Y?view=Overview&ref=p2p.org">Chainlink on Ethereum</a></li><li><a href="https://thegraph.com/hosted-service/subgraph/vkuzenkov/chainlink-fantom-mainnet?ref=p2p.org">Chainlink on Fantom</a></li></ul><p>Stay tuned if you want to know more about data and indexation in the future.</p><h3 id="who-is-a-good-node-operator">Who is a good node operator?</h3><p>Every NOP is a company first. The main target of every business is to be profitable. Let’s look deeper into Node operator economics.</p><p>Oracles get rewarded in LINK for every report to the blockchain, regardless of who was the Leader of the round. The Leader gets additional rewards for writing data to the blockchain.</p><p>The main expenses of an Oracle are gas costs, infrastructure costs and human resources. Oracles should pay the gas cost to write data to the blockchain when it was chosen as Leader of the Round.</p><p>We can track rewards and gas costs to estimate the revenue of the oracle's performance. Here is Chainlink on Ethereum financial metrics:</p><figure class="kg-card kg-image-card"><img src="https://lh5.googleusercontent.com/G-e8bKxh3uuB8r4xRLS8LBfnRh7EVqJFcSvpnsDm2nuoKSbnxBhrbhZyCZ5tvRYHQ26aoNgGkuHiNNgM-ky_mOqTIGTIiNknQfbEEbv5aOAxgw8WhRm5e3kKi2TcEBXrDm4f4jVK7MZRlhw53KwkDpMbV4rtLpahFZ-bURQ1CNs3zSKMswSftu4JBm9lig" class="kg-image" alt loading="lazy" width="602" height="265"></figure><p>So the total net revenue for all of the oracles in Ethereum is 37.3 mil $ during this year.</p><p>Now we know the Chainlink mechanics. We also know that a Bear market in Crypto leads to smaller amounts of revenue for every project. But 2022 has also brought us a lot of activity from scandals involving multiple projects: Terra, Celsius, FTT and so on. What if we want to understand how stable an oracle’s revenue can be during an unusual event ? We will definitely want to know what the gas spending value was and how many rewards the oracles got. It will also be great to see deviations to understand the consensus about price data between oracles.</p><p>Let’s see what was happening with an oracle's net revenue during 2022 across 6 networks: Ethereum, Solana, Fantom, Moonriver, Harmony and Avalanche:</p><figure class="kg-card kg-image-card"><img src="https://lh5.googleusercontent.com/lDoax59JiicEyvaBGsGERT7XT_v8qT8u1R5K7uHgIdIc7hdd6Y6ijI0j0Efe1om5UTsPyy0qYtVuO021MNS5OVtcjbUl7f4hl96QJcVTMaFnx7u05U2fORFe02Ds3H3PX8iXQ0fRHEm_LmGW0dCDf8Df8lAhIF2icWaQ-khXzAVGWc-7nxqK55XzgCUIgQ" class="kg-image" alt loading="lazy" width="602" height="176"></figure><p>Here's what was happening with revenue during April-may ‘22 to understand how the Terra event influenced Chainlink NOPs:</p><figure class="kg-card kg-gallery-card kg-width-wide"><div class="kg-gallery-container"><div class="kg-gallery-row"><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/1.png" width="516" height="518" loading="lazy" alt></div><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/2.png" width="686" height="598" loading="lazy" alt srcset="https://p2p.org/economy/content/images/size/w600/2022/12/2.png 600w, https://p2p.org/economy/content/images/2022/12/2.png 686w"></div></div></div></figure><p><br>We can see that everything went up: Costs, Rewards and Net Revenue. So during this commotion around Terra, we see a peak in the number of rounds as we mentioned earlier. It led to an increase in network utilisation and higher gas costs. But it also brought more rewards to node operators and higher Net Revenue as a result.</p><p>A slightly different situation was the FTT/FTX collapse. We’ve already seen that there were way more rounds for FTT data feeds. If we dig deeper we can also see that it happened to every asset associated with FTX such as Solana. But what about net revenue?</p><figure class="kg-card kg-gallery-card kg-width-wide"><div class="kg-gallery-container"><div class="kg-gallery-row"><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/3.png" width="694" height="654" loading="lazy" alt srcset="https://p2p.org/economy/content/images/size/w600/2022/12/3.png 600w, https://p2p.org/economy/content/images/2022/12/3.png 694w"></div><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/4.png" width="864" height="640" loading="lazy" alt srcset="https://p2p.org/economy/content/images/size/w600/2022/12/4.png 600w, https://p2p.org/economy/content/images/2022/12/4.png 864w" sizes="(min-width: 720px) 720px"></div><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/5.png" width="684" height="650" loading="lazy" alt srcset="https://p2p.org/economy/content/images/size/w600/2022/12/5.png 600w, https://p2p.org/economy/content/images/2022/12/5.png 684w"></div></div></div></figure><p><br>It was the same during September and October, with no significant differences. But what about P2P:</p><figure class="kg-card kg-gallery-card kg-width-wide"><div class="kg-gallery-container"><div class="kg-gallery-row"><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/6.png" width="584" height="612" loading="lazy" alt></div><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/7.png" width="614" height="626" loading="lazy" alt srcset="https://p2p.org/economy/content/images/size/w600/2022/12/7.png 600w, https://p2p.org/economy/content/images/2022/12/7.png 614w"></div><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/8.png" width="612" height="628" loading="lazy" alt srcset="https://p2p.org/economy/content/images/size/w600/2022/12/8.png 600w, https://p2p.org/economy/content/images/2022/12/8.png 612w"></div></div></div></figure><p>Our revenue hasn't changed much during the last 3 months.</p><p>Besides revenue, every NOP should care about its reputation in the Chainlink network. As we previously mentioned, we track reputation by 2 key metrics:</p><ol><li>Deviation</li><li>TSR</li></ol><p>Here’s the Deviation stat for 5 networks:</p><figure class="kg-card kg-image-card"><img src="https://lh5.googleusercontent.com/MFvB1wIPX31q-SczY1-ZRDov9wNrfniYHIBiSpqWMnJvsQJ8F5Hb4YMSHFxdNj9NmC4AAx1d4nR1UCfsvkewZYKSGSE6ICtKeCZZ4Jmms2D6mOvuL9JlZi1vqkA6qH7NqG-113OrPYXxoFiItbyeKfMAlGuoWWZMJ8ydT0AJF6pOK7xiBXI2-QvCaCVvXw" class="kg-image" alt loading="lazy" width="602" height="173"></figure><p>The two red vertical lines mark the Terra and FTT/FTX events.</p><p>It is expected that during a big market event, the consistency of oracles decreases. We can see the huge deviation in Avalanche and Moonriver during the Terra collapse.</p><p>During the FTX event we can observe a deviation, although much smaller when compared to the earlier one:</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/PF1e9w5FoYu1eUCBICXhEepDSJd01b9q-v_V9O7RGT51L1yI5yOCFe3awTjaBpiztMrBZFbLQMT7tyuVbq2lMbH-YClh4fVu42oYM_j_dgPuhYIbcSNM10EwYdPDhVs9FwMliPoEQE9XF4Zmc7IO-XJim4rfQKTkz2ThbBA30IcRAFM_m3PTeMdBTleMlQ" class="kg-image" alt loading="lazy" width="203" height="276"></figure><p>We can also compare oracles based on TSR to estimate how successful oracles are in writing data to the blockchain. For example, here is the TSR for Ethereum’s mainnet:</p><figure class="kg-card kg-image-card"><img src="https://lh5.googleusercontent.com/0AwgVfBVVPTzGOmoXWFbqxTtTYMHRlbKgvz_JkoJ83drgBcsidggKMCu6M2F9aJOZol0k7wBM-F_31iPjnRmHVQn1tip5a_Zu8l1652XFfwoAqhV8PvvF1UvcZACIU0OkxaKRkPoI-RHPRtBaarQEa3ruE_ODKGnz3kOpU3ODRIbmsX7nQq8muTMxBczcA" class="kg-image" alt loading="lazy" width="602" height="175"></figure><p>We can observe that during November and for most of 2022, P2P had a TSR ranging between 90-100% in every network except Fantom and Solana (and Moonriver in April). This is because those chains use a different transaction execution mechanism compared to most EVM chains. You can make sure that this is quite a good metric value by comparing us to others.</p><p>Here is the distribution of different NOPs TSR for the Fantom network:</p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/6nvlDCRGlu0CQezWXbVY_Hz9RSnlkKGTHUUVCDiIckYpfRtxrmr0Y0Rz7WoD5EyHXnHUTAVxctbssydK82O-htUsQ980nGcglNVN2Fu93nEDdrv8ZZbIKMkvExrlfLyd5QnfWK0OsimT9zAiBd_McY2VH7fY0GoQ2BhRyWy67_eCmjsnVQDT43ylX9S6Wg" class="kg-image" alt loading="lazy" width="602" height="329"></figure><p><br>We can observe that even at its lowest point P2P was among the top NOPs.</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/rq8zjGR9Gg1DnY7SI840HpM4Nl03jg54-7tr3z6YhJOOh2xXUl1A-qKX7l59hco13rNG8hE4jtCg1BA5-FBQIJC0L6JPbQaS26b5cwQy-55b-UdaOJFufVOkiBP8mNp0qC576tZW2vCPee7ShXW9yeK01QIL-R5qcGcDqFq4k6G6WUH55OLa952T3m4gTA" class="kg-image" alt loading="lazy" width="602" height="333"></figure><p>The median TSR or all Nops on Solana was 6.07% and the median TSR for P2P was 6% for the same period.</p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/2T9H6f4Ovl5_QpOcvm1G7wVaFomZuLOKC3NdWW6T6sUMW0nn8Rz0db0Y7NmXBvsjj-Ouuf3bLyYESj-JGhy8IeZ3U4418pX_CQHUWbm03_qDMnJGVPYcqD7TvRtDzjs0ZOT6vfj0dhh-J2Uej-nqhJpKtaA0TSfIV9wFdlCmxVegFjHz23as4BzCW36FDw" class="kg-image" alt loading="lazy" width="602" height="332"></figure><h3 id="decision-making">Decision making</h3><p>In this section, we will discuss how we solve business problems by using a data-driven approach.</p><p>On August 2021 Ethereum released EIP-1559. A significant aspect of this proposal was how it overhauled the transaction fee system. For P2P it meant that we could now use EIP-1559 to prioritize transactions. We weren’t sure how this would affect the transaction success rate, in other words, did miners have a preference for one type of transaction?</p><p>We’ve decided to run an A/B test. The design was to switch the priority fee algorithm from Standard to 1559 every 15 minutes and set the configuration of both algorithms. As a result, we’ve got the same transaction success rate and significantly different cap fees as can be seen in the picture below:<br></p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/cZyvehzptSVbQyPoD8YDWRJWCzQIE5XZ8cN-X6Sm2vBhqtmTKO9AQg5vyqkRp_MYm1e5Ldop_oqZRRdjRED7zeWDU-WrzBAJIR3kLAy6Ueo64cnnN6hYlS8nX7vnal2Yj0GG8DjXgzJoHTCSp5uftQWhy1tZsHOaZ_krVTE54Fqt2uluZzOXDU9Q0lW3GA" class="kg-image" alt loading="lazy" width="602" height="371"></figure><p><br>This is how data analysis and data-driven approaches are applied in decision-making.</p><h3 id="staking">Staking</h3><p>Chainlink Staking v.0.1 launched on December 6, 2022. During this first version there are two ways to stake Chainlink:</p><ol><li>Community staking: you need to satisfy three <a href="https://blog.chain.link/chainlink-staking-early-access-eligibility-app/?ref=p2p.org">criteria</a> and the APR is around <a href="https://blog.chain.link/chainlink-staking-launch-details/?ref=p2p.org">4.75%</a><br></li><li>Staking through a NOP: when a NOP stakes from 1000 to 50k LINKs as a self-stake. APR is 7%.</li></ol><p>If you want to see the details you can read <a href="https://p2p.org/economy/chainlink-staking">this post</a> in our blog or on Chainlink's official <a href="https://blog.chain.link/how-to-stake-chainlink-link/?ref=p2p.org">website</a>. But as you may see the community staking pool is already full and won’t be expended till v.1.0 (9-12 months):</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/EhIZFEBJ2vh9a7_V1SzfCJZF2-cWSKe12djGu_6WTb1vlaSwJ9Fi5GezBhCJnqoDf_TdoIPi1HVv5CzdIfuLmcg2a0qbI4Qv6tyuaWgdFZe2c_pYU1hyKUfK2X-bS1hnDsMjZPvbWQdpXaY3TO2vQMPNMfoDG9DBj3bo59575bJQvY9DaRUdeLDfLJDKwg" class="kg-image" alt loading="lazy" width="386" height="373"></figure><p><br>That is why we are glad to provide our clients with a custodial solution to get a higher APR through P2P with a 10% fee. Through P2P you need a minimum of 10k LINK and can stake up to 50k LINK.</p><hr><h3 id="about-p2p">About P2P</h3><p>P2P Validator is a world-leading staking provider with the best industry security practices and proven expertise. We provide comprehensive due diligence on digital assets and offer only top-notch staking opportunities. At the time of the latest update, more than 1,5 billion USD is staked with P2P Validator by over 25,000 delegators across 25+ networks.</p><p><br></p><p><br></p><p><br></p><p><br></p><p><br></p><p><br></p><p><br></p>

from p2p validator

<p>Liquid staking became one of the key elements of modern DeFi. It gives higher flexibility for end users and allows them to capitalize on illiquid staking positions based on their risk appetite. <strong>Liquid staking can improve decentralization and censorship resistance for the underlying proof-of-stake network</strong>. Quicksilver is a sovereign protocol that aims to bring liquid staking to the broad Cosmos ecosystem.</p><p>Most TVL in Cosmos is locked in staking making users decide between DeFi and participation in network security. <strong>Quicksilver will utilize the liquidity staking module (LSM) that allows delegators to avoid unstaking their assets and make deposits into the protocol without losing rewards during the unbonding period</strong>. It also helps to maintain better security of the underlying chain. In the long term, it will seamlessly boost DeFi within the Cosmos ecosystem involving a portion of assets that are locked in staking and not transferable.</p><p>Quicksilver Protocol will be able to query the number of qAssets of a user and provide the ability to participate in governance according to the voting power, without the need to return qAssets. Through its concept of proxy governance, users will be able to vote on proposals directly through Quicksilver.</p><p><em>We are thrilled to announce that<a href="https://p2p.org/?ref=p2p.org"> P2P.ORG</a> joins Quicksilver as a genesis validator. It aligns with our intention to improve security, censorship resistance, and support better decentralization.</em></p><p>P2P has broad expertise in operating Cosmos SDK chains. We participated in the launch of Cosmos Hub mainnet and more than 10 other networks. P2P participated in the Quicksilver testnets to get familiar with operation specifics and prepare for mainnet launch. Our team provides 24/7 technical support and maintenance using best security practices.</p><h1 id="about-quicksilver"><strong>About Quicksilver</strong></h1><p>Quicksilver is a liquid staking protocol that will bring liquidity to staked assets within Cosmos ecosystem. The team consists of former engineers from Chorus One. Quicksilver funding was received from investors like Strangelove Ventures, Interop Ventures, Iqlusion, Ki Foundation, Cerulean Ventures, and validators aligned with the ecosystem's values. More than 50% of QCK supply is expected to be airdropped to the users.</p><p>Learn more by visiting the<a href="https://quicksilver.zone/?ref=p2p.org"> official website</a> and<a href="https://twitter.com/quicksilverzone?ref=p2p.org"> Twitter</a>. If you are a developer, explore Quicksilver in more detail on<a href="https://discord.com/invite/xrSmYMDVrQ?ref=p2p.org"> Discord</a>.</p><h1 id="about-p2p-validator"><strong>About P2P Validator</strong></h1><p><a href="https://p2p.org/?ref=p2p.org">P2P Validator</a> is a world-leading staking provider with the best industry security practices<a href="https://www.stakingrewards.com/savings/p2p-validator/?ref=p2p.org"> AAA SR-rating</a> and proven expertise. We provide comprehensive due diligence on digital assets and offer only top-notch staking opportunities. At the time of the latest update, more than 750 million USD value is staked with P2P Validator by over 35,000 delegators across 40+ networks. We have successfully participated in Quicksilver testnets willing to provide long-term strategic support to the project.</p>

from p2p validator