Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

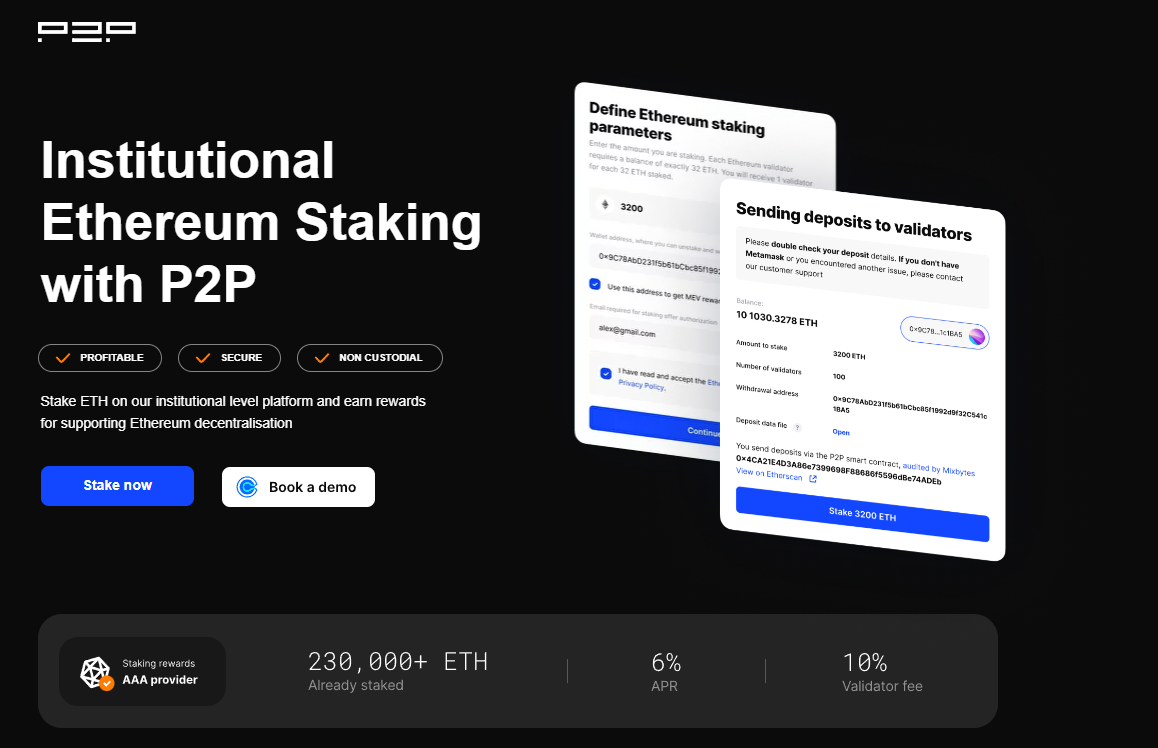

SubscribeWhen staking Ethereum (ETH) we are supporting the network with the additional benefit of earning additional ETH! Ethereum uses “Proof-of-stake” (PoS) as a consensus mechanism, where validators are responsible for reaching a consensus on adding new transaction blocks to the blockchain.

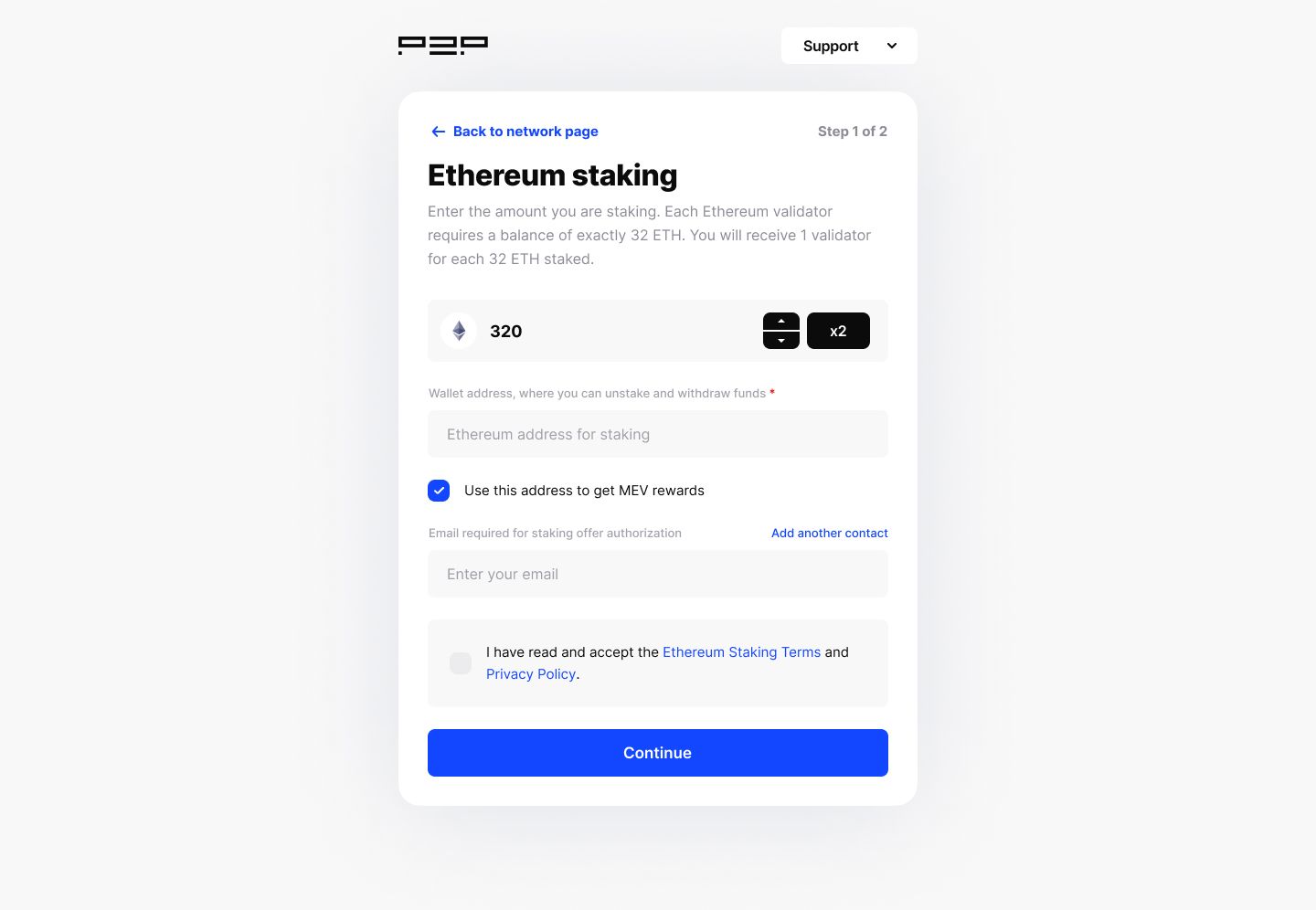

To stake Ethereum we need a minimum of 32 ETH. This is because each validator requires 32 ETH to set up and for this same reason staking can only be done in increments of 32 ETH. For example, someone holding 320 ETH will have to set up 10 different validators. Anyone can take part in this consensus mechanism, all we have to do is run a validator (or ask to run it staking-as-a-service provider like P2P.org) and deposit 32 ETH to a special smart contract to activate a validator. This act is called staking.

P2P has been running Ethereum validators since the launch of the Beacon Chain, in December 2020 as part of Lido Validator set. We take care of all the server maintenance and set-up.

P2P's Ethereum staking solution is completely non-custodial and each validator is personally set up so there is never any comingling of customer's funds throughout the process.

Those that choose to stake with P2P can also benefit from our insurance coverage against slashing events.

In short, the benefits are:

To set up a validator we first need the following information:

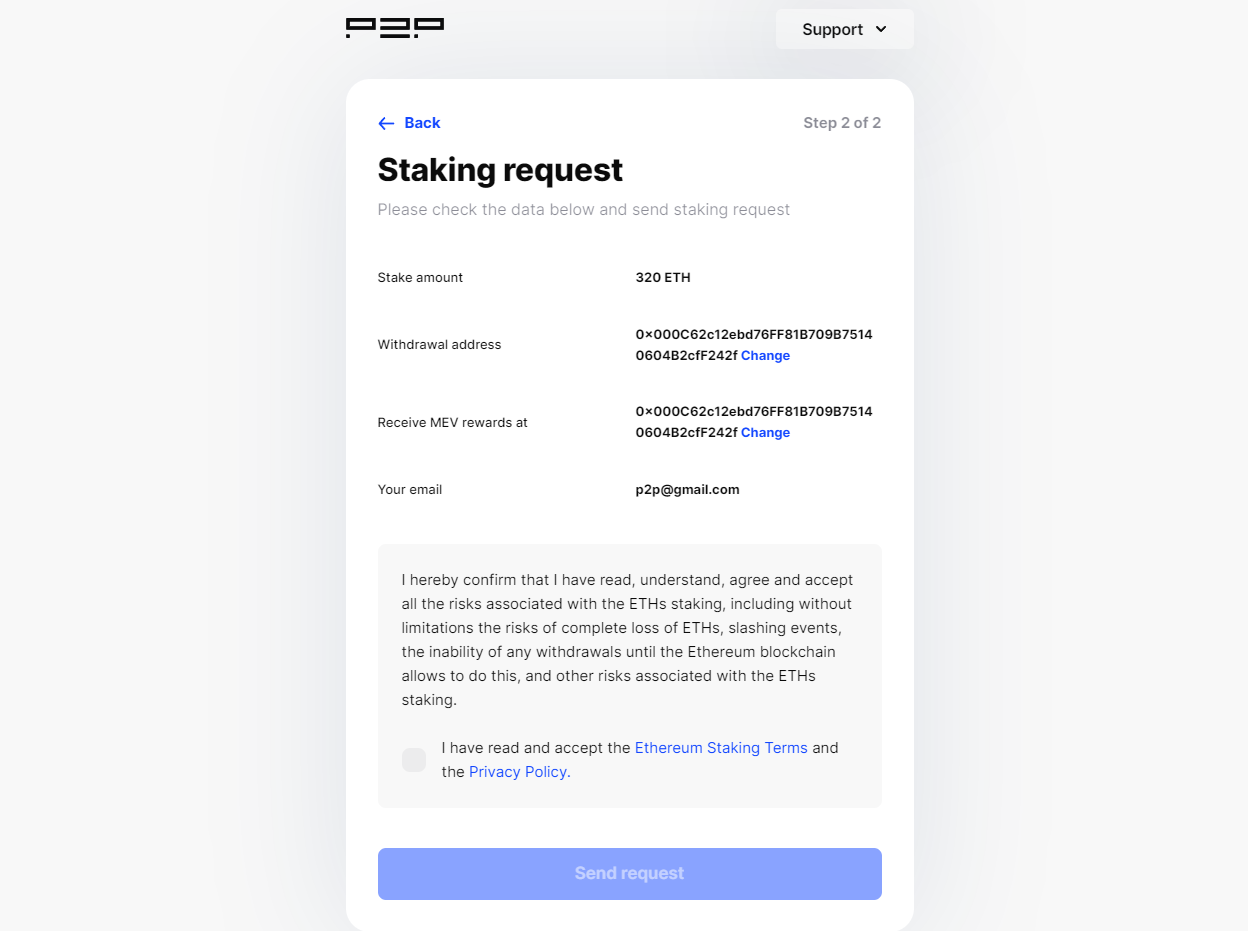

Please note that once set, the withdrawal address cannot be changed. A different address can also be specified to receive rewards.

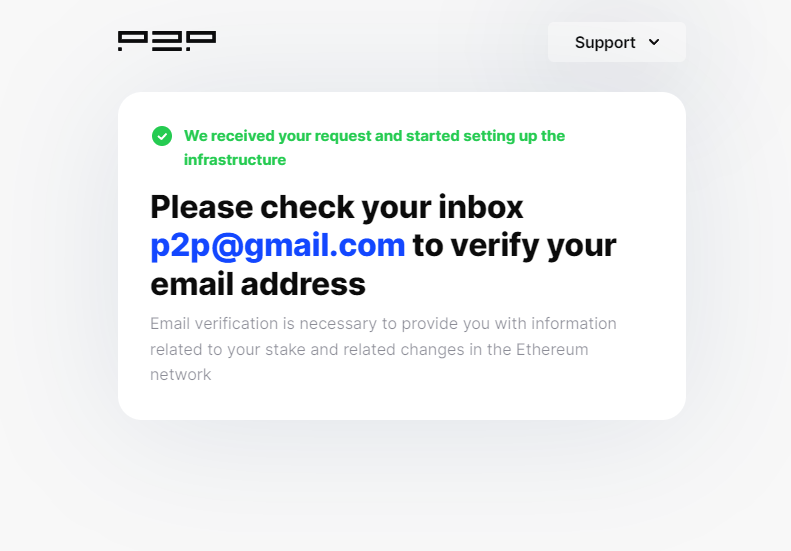

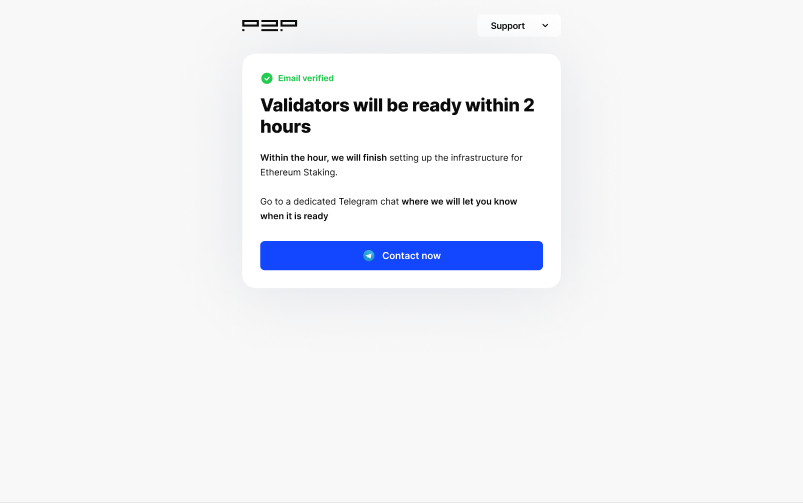

Following the reception of this information, the validators are set up and a link to the deposit page will be sent out. This process can take up to 24 hours.

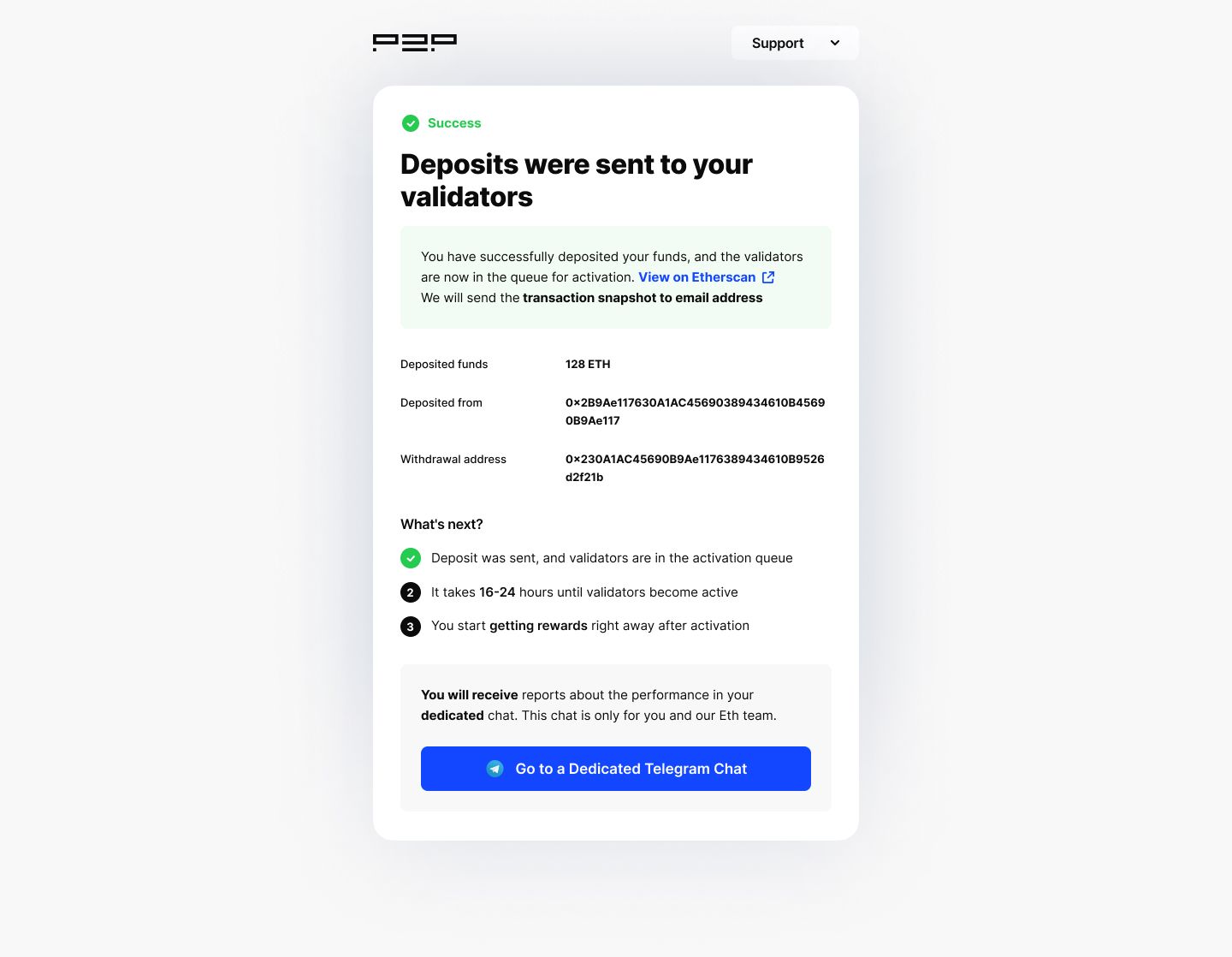

Once the staking deposit is sent, the validator will be created via our audited immutable smart contract. After a period of 16 to 24 hours, the validators will become active and start earning rewards.

Ethereum staking rewards are divided into 2 parts. Around 30% of the rewards can be withdrawn and are paid on a monthly basis while the rest is locked and can only be withdrawn after the Shanghai upgrade coming in 2023. Please note that this lock on rewards is not imposed by P2P but is a current feature of the Ethereum network.

Once the validators are up and running P2P will set up and email each staker a personalized dashboard that can be used to track rewards and validator metrics.

A new window will pop up and we can set how much ETH we want to stake and optionally a different withdrawal address. It's important to keep in mind that once the withdrawal address is set it can't be changed.

Here we can also set up an alternative wallet to receive MEV rewards. MEV rewards constitute around 30% of the APR and are paid on a monthly basis.

Once everything is set up, we can press continue and we will be taken to a confirmation screen. Here we have one last chance to change the withdrawal and the MEV reward address.

After reading and accepting the Ethereum Staking Terms and the Privacy policy we can continue.

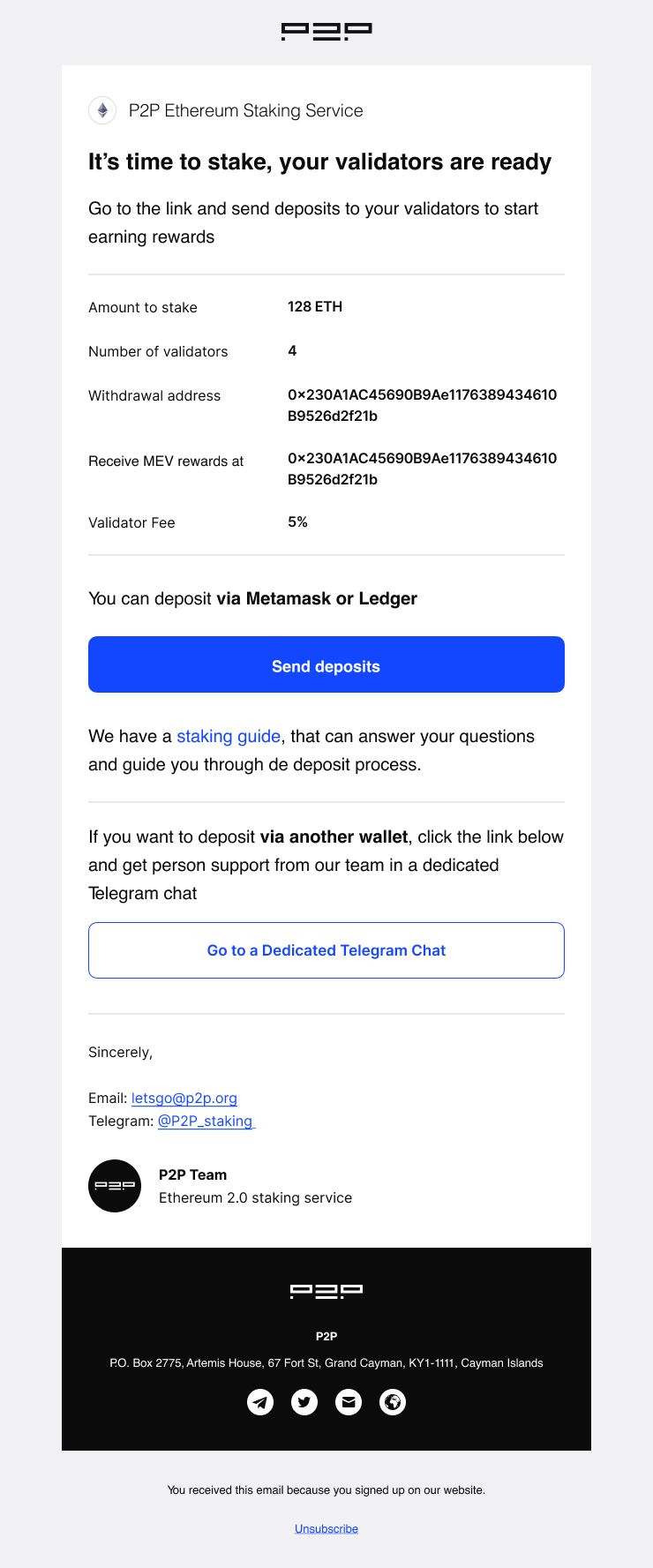

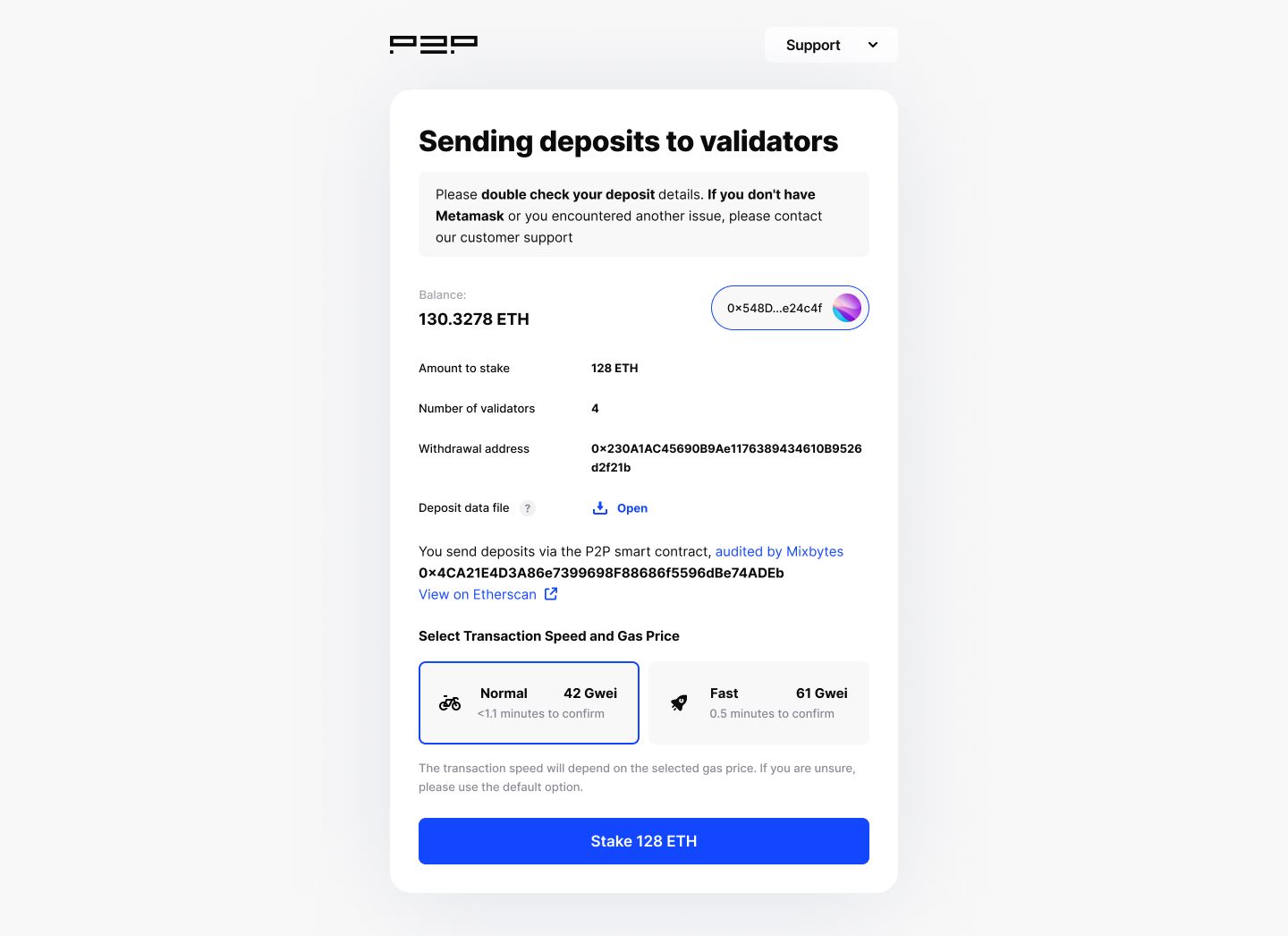

After the validators are set we will receive a link to resume the staking process (this email should come from a @p2p.org domain). The next and final step is to deposit the ETH into the validators. To proceed click "Send deposits".

For clarification, the ETH is being deposited to the validators via a smart contract. This is the Ethereum equivalent of staking and is necessary to activate the validators.

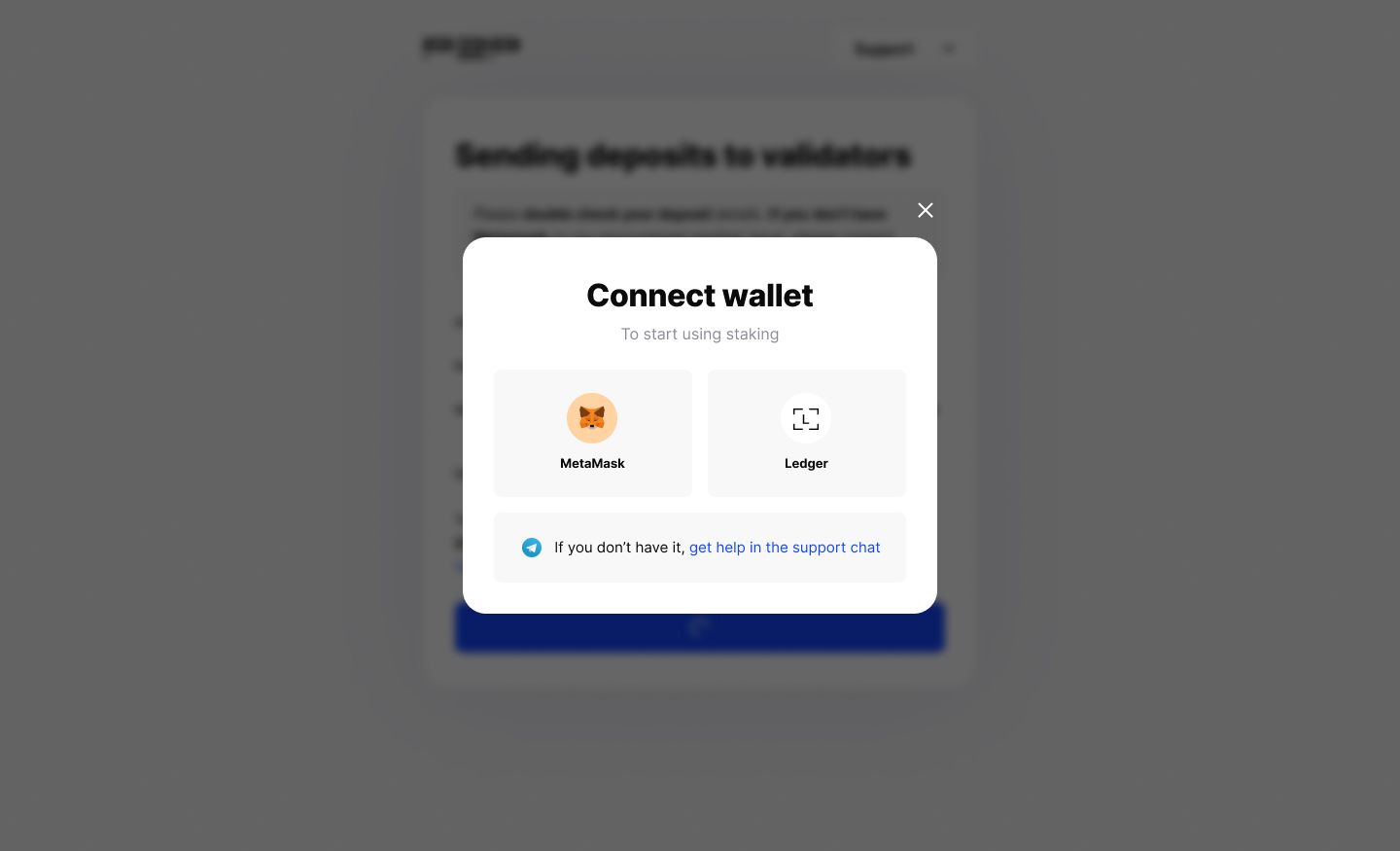

Next, we need to connect our Ethereum wallet.

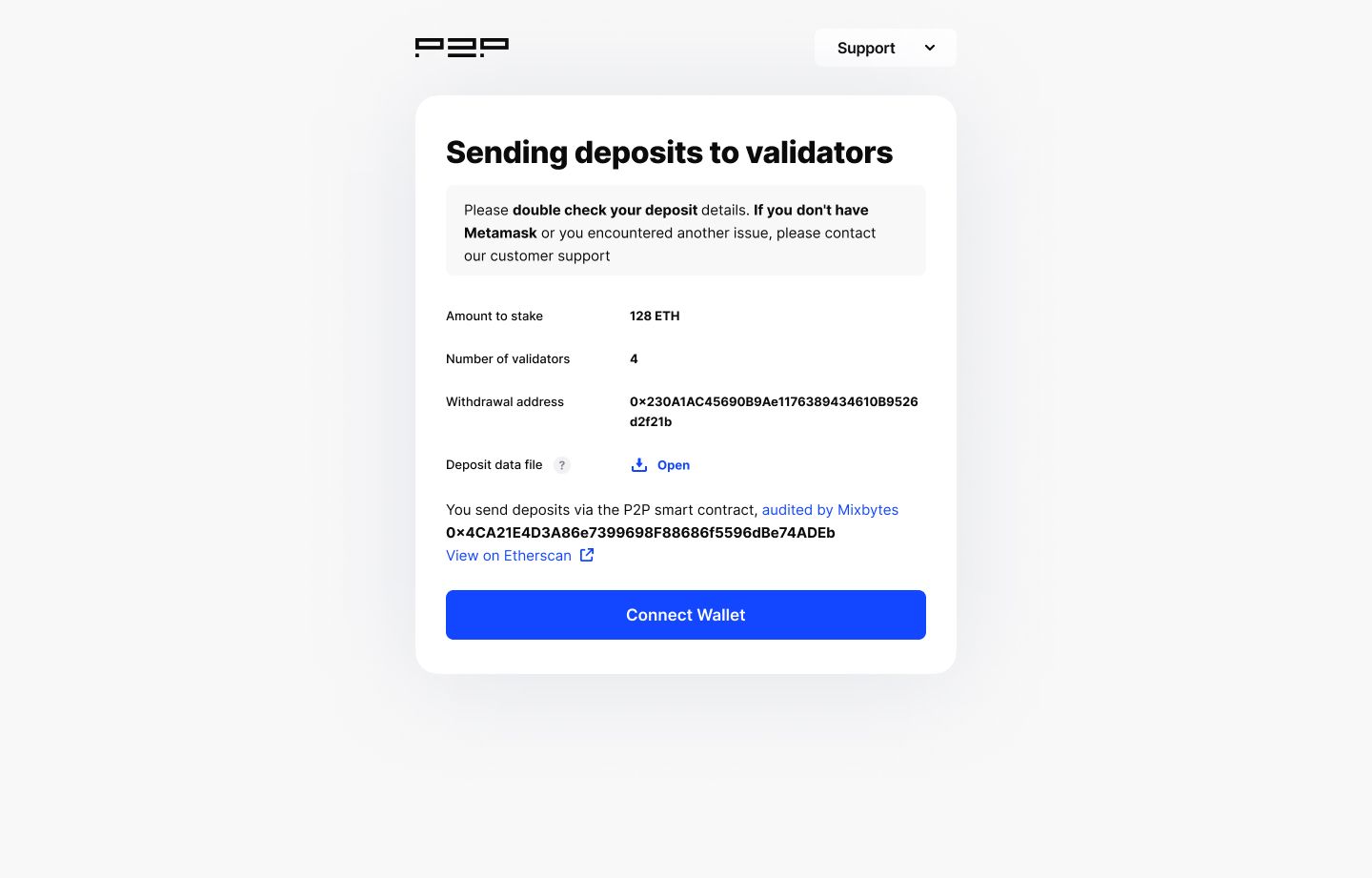

This will be our personal staking page with a prepared staking transaction. What does it mean?

P2P has set up the validators

P2P has prepared a special deposit data file that contains information about the validators' addresses where the ETH will be deposited and the withdrawal address we have set up previously, to unstake in the future.

All of this information is available in the Deposit data file.

We can stake with a Metamask or a Ledger wallet. There is currently no direct support for Trezor devices. We can stake with a Trezor wallet by first connecting it to a Metamask wallet.

Other wallets are also available but the process is more complicated. To use a different wallet please contact P2P via Telegram.

After connecting the wallet we can set the gas price for our ETH transaction. When staking conventionally each validator would require an individual transaction but with a smart contract, we can stake up to 100 validators with a single transaction. This greatly reduces the cost of staking and the chance of human error.

Before signing the transaction we should once again check:

Those that stake Ethereum with P2P are encouraged to join a personal Telegram chat with some members of our team.

To note that while MEV rewards are paid on a monthly basis, 1 Validator only produces on average one block every 62 days. Those staking with only 1 validator should expect their first reward after 2 months. The more validators are staked, the sooner it will happen.

No, when working with P2P, there is no need to go through KYC because staked assets never touch our account and are sent directly to the Ethereum network.

No Ethereum is necessary to run a node. However, it is necessary to stake 32 ETH x [amount of validators] to activate the validators and start getting rewards.

The withdrawal address is the Ethereum address used to unstake and receive rewards. This address is specified once and it can't be changed after the staking deposit is sent, because the network cements the association of a particular validator and withdrawal address. Access to the private key for this withdrawal address is required to unstake (seed phrase). It is also important to note that P2P is not a custodian and has no exposure to the client’s withdrawal private key. P2P will never ask, under any circumstance, at any time for access to the withdrawal key.

A validator key is a private key for maintaining the validator’s work (setting up validators, updating software etc.). P2P owns the validator keys and guarantees the highest standards for protecting these keys from being compromised, breached, or otherwise misused. This is accomplished through Threshold signatures, which are the gold standard for internal/external security threats. This solution is used by leading custodians, crypto banks, and Multi-Party Computation solutions.

By design, ETH staking requires one staking transaction per 32 ETH. By using smart contracts we significantly simplify staking, reduce the cost of staking and minimize the risk of any human error. Thanks to our audited smart contracts it is possible to activate up to 100 validators with a single transaction.

Yes, it is possible to stake ETH with a Ledger (via native connection) or a Trezor wallet (via Metamask).

Ethereum rewards are comprised of 2 parts associated with performing validation duties and block creation.

No, the staked ETH is locked in the Ethereum smart contract and cannot be used.

P2P takes its service fee from the execution layer rewards. By default, a special immutable smart contract is used to automatically split rewards between the user and P2P by the previously agreed rules. Other invoicing strategies can be employed by prior agreement.

Unstaking will be available after the Shanghai upgrade, which is planned for March 2023. The ustaking time is projected to be 2-3 days depending on the number of validators that want to exit. This process consists of four steps:

Slashing punishes validators for actions that are very difficult to do accidentally, and it’s very likely a sign of malicious intent. It’s a really rare event: there's only been 5 slashed validators within the whole network over the last month (or 0.001%). beaconcha.in/validators/slashings

What is “slashable” behaviour? In a nutshell, it’s a violation of consensus rules in the network. As of right now, it needs to meet three conditions: proposal of two conflicting blocks at the same time, double vote attestation and surround attestation. This can happen due to either an intentional malicious action or misconfiguration of the validator (the most often being, running two of the same validators in the network).

Slashing results in burning 1,0 ETH at once, and removing the validator from the network forever, which takes 36 days. During this time, the validator continues to work but can no longer participate in validation and block creation, getting a penalty of around 0.1 ETH in total.

For the most part that's the sum of the penalty incurred, but there is also an additional midpoint (Day 18) penalty that scales with the number of slashed validators. This is called "correlation penalty” and it's currently only theoretical and has never been encountered on the Ethereum mainnet. This mechanism is there to protect the network from large attacks. The math for calculation penalty is pretty complicated, but the summary is if there are only 1, 100, or even 1000 slashed validators within 36 days the penalty will equal zero ETH. However, if the number of slashed validators increases to roughly 1.1% of all validators (currently 5.1k), this penalty becomes 1 ETH and an additional 1 ETH for every additional 1.1% validator slashed. So if 1/3 of the network is slashed, the penalty will nullify the whole stake (32 ETH). This mechanism is in place to prevent an attack on the network and it should never be triggered by accident.

There are special mechanisms in place to prevent validators from meeting the slashing conditions called slashing protection. These mechanisms usually consist of a database with a signing history which the validator uses to check if the block can be signed (coupled with the default levels of monitoring and alerting protection). Additional protection levels will depend on the validator’s setup. P2P uses double-checking with a separate database at the key-manager stage and secures validators' key’s by Threshold, which means that no single person, even a P2P engineer, can run a second validator and a quorum is required for that. The final level of protection we have in place is an institutional grade slashing insurance.

Anyone who stakes with P2P gets access to a personal staking dashboard that can be used to track rewards and the validators' performance (APR, staking balance, % of blocks created with MEV, attestation rate, missed block, market comparisons, etc.)

P2P direct staking infrastructure is located in Europe and distributed among 5 separate physical locations for protection from downtime.

P2P validators have no single point of failure and are downtime resistant with back-ups of all critical infrastructure parts between 5 different physical locations, including:

Signing infrastructure - 3 location-independent key managers with 2-of-3 threshold quorum required for consensus;

Validators Nodes - we have a reserve in a secure region ready to be activated within a maximum of 1 minute in case of an outage;

Consensus layer nodes - our setup has top-3 consensus layer clients (Lighthouse, Prysm, Teku) simultaneously for diversity and preventing outrages related to soft bugs in one client. It also increases availability for validators.

<p></p><p>Remote procedure call (RPC) is one of the critical tools of the blockchain ecosystem. With the help of RPC, it is possible to implement almost any service based on blockchain data.</p><p>Decentralized applications (dApps), require access to a huge amount of information from the blockchain. This can be in the form of historical data, transaction history, node connections, block numbers, etc. and to access this data, it is necessary to query the blockchain.</p><p>There are several reasons why having a dedicated RPC node is a good idea:</p><ul><li>Control: Full control over the node and its data can be gained, which allows customization to suit specific needs such as configuring it to store more historical data than a typical node.</li><li>Security: As complete visibility and control over the node and its data is achieved, this translates to an increase in security. This can assist in preventing unauthorized access to the data and reducing the risk of data breaches.</li><li>Privacy: Complete privacy can be achieved since the data is not shared with third parties.</li><li>Independence: Dependency on a third party can be avoided, which can help ensure continuity of service, even in the event of third-party nodes going offline or becoming unavailable.</li><li>Performance: Improved performance can be achieved through direct control over the resources available to the node.</li><li>Compliance: Compliance with regulations or data privacy laws may require a dedicated node in some industries or regions.<br></li></ul><p>Overall, running your own RPC Ethereum node can provide greater control, security, privacy, independence, performance and compliance for your specific needs.</p><p>However, doing it yourself would require a lot of DevOps team resources. Not only for deploying the solution, but also for further maintenance. That's why it's often better to turn to professionals on this issue. P2P can help you maintain your own dedicated nodes with low latency, with servers in the US, EU and Asia Pacific. You get the benefits of a dedicated machine without the headache of having to manage it.</p><h3 id="the-main-use-cases-for-rpc-nodes">The main use cases for RPC Nodes</h3><p>There are several use cases for Remote Procedure Call (RPC) nodes in blockchain:<br></p><ul><li>Decentralized applications (dApps): dApps rely on the network to function, and they often use RPC nodes to communicate with the network and access the blockchain data they need.</li><li>Smart contract development: Developers use RPC nodes to test and deploy smart contracts on networks.</li><li>Wallet development: Wallet developers use RPC nodes to access blockchain data and perform transactions on behalf of users.</li><li>Token and cryptocurrency exchanges: Exchanges use RPC nodes to access blockchain data and perform transactions on behalf of users.</li><li>Blockchain analytics: Analysts and researchers use RPC nodes to access and analyse blockchain data.</li><li>Auditing: Auditing firms use RPC nodes to access blockchain data and perform audits on smart contracts, tokens and other assets.</li><li>Payment processing: Companies and organizations use RPC nodes to process payments and transactions on the Ethereum network.<br></li></ul><p>These are just a few examples of the many ways that RPC nodes can be used.</p><h3 id="what-is-an-rpc-endpoint">What is an RPC endpoint?</h3><p>Typically, an RPC endpoint is a point on the network where a program sends RPC requests to access server data. With an RPC endpoint, you can easily perform operations that use real-time blockchain data in your dApp.</p><p>The appropriate software needs to be installed on a node in order to respond to RPC requests. RPC endpoints run on nodes connected to the blockchain service through which your dApp receives information for its users. Therefore, all RPC endpoints run on RPC nodes, and all RPC nodes have RPC endpoints. </p><h3 id="full-node-and-archive-node">Full node and archive node</h3><p>Depending on your use case, the type of node you need will vary. RPC nodes can also be divided into two main types - full nodes and archive nodes. The difference is in the depth of history that the nodes keep.</p><p>A full node keeps the current state of the blockchain and contains all the data on the network except trace data for transactions beyond the most recent blocks. </p><p>An archive node is a type of node that stores the entire blockchain history. This allows the node to provide access to historical data and transactions, which can be useful for various purposes such as analyzing the blockchain's past performance or auditing the network's activity. These nodes typically require a large amount of storage and computational resources to run, as they must maintain a copy of the entire blockchain. They are also known as full archive nodes or simply archive nodes.</p><p>To sum up, an archive node is a full node that additionally maintains a database of historical blockchain states. Full nodes can calculate historical states, but archive nodes have the information readily available locally and have better performance for this type of request.</p><h3 id="the-standard-rpc-specification">The standard RPC specification</h3><p>Blockchains use the JSON-RPC standard for RPC. Data requests are received and processed quickly by this system. JSON-RPC is a stateless, lightweight protocol for remote procedure calls (RPCs). Several data structures are defined in this protocol, along with rules for their processing. It is transport agnostic in that the concepts can be used within the same process, over sockets, over HTTP, or in various message-passing environments.</p><p>P2P is happy to provide assistance in deploying or maintaining your Web3 infrastructure. We will help you find the best configuration for your RPC nodes and address any infrastructure needs you may have. You'll get the benefits of a dedicated node without the headache of managing your own machine. Ideal for Dex's Financial services and dApps.<br><br>Contact us at <a href="mailto:[email protected]" rel="noopener noreferrer">[email protected]</a><br></p>

from p2p validator

<h3 id="intro">Intro</h3><p>Everyone is always looking for ways to improve their finances and we often hear that staking in crypto can't be profitable and stable during the bear market. At P2P we think that it depends on how effectively your staking provider uses the infrastructure.</p><p>Today we want to share the story of how we became a successful Node operator (NOP) on Chainlink by continuously improving our performance metrics. We will also talk about Chainlink’s oracle network, its current state and how NOPs can get a stable revenue even during a bear market.</p><h3 id="what-is-chainlink-oracle-network">What is Chainlink oracle network?</h3><p>Chainlink is the market-leading decentralised oracle network providing real-world data to smart contracts on any blockchain. Currently, Chainlink supplies data for DeFi consumers across 14 networks:</p><ol><li>Ethereum: Mainnet, Goerli, Kovan, Rinkeby, Ropsten</li><li>Avalanche</li><li>Binance SM</li><li>Optimism</li><li>Arbitrum</li><li>Fantom</li><li>Harmony</li><li>Moonriver</li><li>Moonbeam</li><li>Metis</li><li>Heco</li><li>Polygon</li><li>xDai</li><li>Solana</li></ol><p>Ethereum registered the highest number of working oracles during 2022.</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/ko4Q_PCIn7OB4WTIL_bSQUuTWml5S6uWUMEHHijYiDy1_dbXi3DoPdJVMkniYsriQkhfi1q0yMXC8thIjeyzN65kJNdpAiYg6pYSD-J3gWQ4jXaXwbsQQkGmRCBK9--8P5bep1glXSRkXTebpjAvkOi8GbUphwfEi5NbSyYhMzTXyE03q4G4tfHlU5EqNA" class="kg-image" alt loading="lazy" width="602" height="215"></figure><p>Within each network, oracles can provide different types of data:</p><ul><li>price rates between two tokens, NFTs, etc. (data about the price relation between 2 tokens is called data feeds);</li><li>automation services;</li><li>direct requests from consumers (when somebody directly requests data from Chainlink protocol);</li><li>A verifiable source of randomness for smart contract developers (VFR).</li></ul><p>P2P currently provides more than 2000 unique data feeds on different chains. While most of these data feeds are shared across multiple chains, some of them are unique to a specific chain, for example, the METIS-USD data feed is present only in the Metis network. Here’s the distribution of data feeds per network:</p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/PoRy4aBEV2Y-nutW0NLkgLF6UdD4HxMGBCuoutrrYMIdt9D4NwKX45YCzCbcf1M7jceBnnyZOsYGDmftMiFcas8jNjbd6wJVzrXeHb33RqCKXnHbC0flxRZca43_La6oR07sUNTkfROSm0yuEFQ7GRzZnZilZQeJRtpLxBO-kmALFji7vdI2qanxcyQVjw" class="kg-image" alt loading="lazy" width="602" height="216"></figure><p>These data feeds are distributed between node operators in every blockchain. This is the first side of Chainlink’s decentralisation.</p><p>A few technical details:</p><p><em>Oracles generate reports for data feeds continuously by sending requests to data providers (APIs) and aggregating them (median). Every time consumers need data, Chainlink asks one of the oracles, that is assigned to that data feed, to write that data to the blockchain. The session data recording is called the Round and the chosen oracle is called the Leader of the Round. The Leader gets data from other oracles (who are also assigned to this data feed), calculates the median value and writes it to the blockchain. If for any reason the Leader couldn’t do it - the next oracle becomes the Leader and has to do it.</em></p><p><br>It is not enough to just attract a large number of oracles, it is also important to ensure that the oracle’s data is decentralised. This is achieved by using different data sources for different oracles.</p><p>For example, the price feed for ETH-USD in Fantom is distributed between oracles and data sources (APIs) as follows:</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/n5ZNZNryhyK1tldaIwlR_iMB7yL8nm-g7hifNVL9uHp2r1DYPanLa2RrQnP4ESaFGmoelpxr_7KAOEjq8qsh5AgpD7w5mo70xFRBEY_LYP712JBbyXetp02hrTDVzfP9gtLdCzKPL1_Y6qC8KocEspigEkxMwlZSGfGbi4oGnuwMmkSuLWKmvZClfHfZag" class="kg-image" alt loading="lazy" width="581" height="503"></figure><p><em>Note: A 1 means that an oracle gets the data from the API, 0 means that the oracle doesn’t get it from that source</em></p><p>The degree of decentralisation can vary as it depends on the number of data sources that provide the price data and the number of oracles. We only need the fact that different oracles send requests to different API services to proceed with the data when Chainlink needs it for understanding Chainlink’s decentralisation.</p><h3 id="p2p-chainlink">P2P & Chainlink</h3><p>P2P joined the Chainlink oracles network in 2018. We first started as a NOP in Ethereum on several data feeds and we haven't stopped growing since that time. Today we are present in 6 networks and we provide data for more than 150 feeds.</p><p>This level of growth was a serious challenge for us as a company. Looking back it seems that it would be impossible to become a successful Node operator without a data-driven approach. Luckily, in 2020 we had already understood that we needed to collect and analyse data about NOPs’ performance in Chainlink. In this article we will walk you through our path and go through it from the beginning.</p><p>We provide 4 steps for a successful data-driven approach to node management:</p><ol><li>Define key metrics. You can’t control anything without measuring it, but first, you need to understand what you want to measure.</li><li>Extract all the necessary data. It seems obvious but we had to work hard to collect all the data from different networks, make indexers and transform it so that they are usable for analytical purposes.</li><li>Determine who is a good node operator. When you’ve collected all the metrics you should understand what you can do with them: what is under your control and what is not. You need to also keep in mind Chainlink's main mission - to provide accurate off-chain data to the blockchains.</li><li>Decision making. Develop analytic tools to transform the data into knowledge that can be used in decision-making.<br></li></ol><p>Let's start with the first step.</p><h3 id="key-metrics">Key metrics</h3><p>The main purpose of the Chainlink protocol is to provide data for users. As we have previously mentioned, “Round” is the act of writing data to the blockchain by an Oracle.</p><p>Here are the number of rounds for the Ethereum mainnet in 2022.</p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/xapxQXV-nkH28gGuqnyC0DxlXRTfWntVZM5B92D8Jm7BX24Z9Cgsb1Kfw8uSVc5I_PBZjhN2dD9TUNSOWWmhYeWFi-A2_M4n5Xb_5ienucAcJVKrtfkk_HfxnDZsMc2cvpJCNDTL-WGU05i7HB43RIA3lQRK0kP3txlaF5MqLbh4K-j2DWs9lZbqQ1PlAQ" class="kg-image" alt loading="lazy" width="602" height="193"></figure><p>This is how we compare the consumption of Chainlink’s data by different chains (for example Avalanche, Fantom, Harmony, Moonriver and Ethereum). You can notice there is a peak in the number of rounds in May (Terra collapse), June (Celsius) and November (FTT/FTX collapse). This is true for every chain:</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/b9ZreTaBRX5kUef45SkDBOFsJrgXmwmKrFcwf_5CBdvwPxtMgHP2JieX4xHVAE3tQhSidDFG_FAMFptn2bRnkYHHCOs5VCGfQ6mdy3DRoKSksgKgYtRSW1IRFkZLr-tao1SwaHza-r--sieVqQlFjWZ1LaLPahSdolAlAqulYP7Hvj6fVrGqsTCWVsod7g" class="kg-image" alt loading="lazy" width="602" height="180"></figure><p>We can track the number of rounds to measure the consumption of data supported by Chainlink for any chain/feed/oracle. For example here is the number of rounds for ETH-USD (dark blue), FTT-USD (green) and ATOM-USD (bright blue) on Ethereum’s mainnet:</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/5vGOUEiQeURrCyua2Imyq5boZ6GjD4MAVmH_4eh_dDld3pY3IZOH2Y8jDWHKbMV8RX7gNCexad_poWtHYVGGTDwCW7VO-eSPJVBI142XoaF_MNzsrcxaxVo3ZL8iG2h_jVSfpq8RAvtOcG5QUkgPoLzb1dLm5GQO3KL8C_OFXHO5UkTEPr9LGJOPyaOLFQ" class="kg-image" alt loading="lazy" width="602" height="175"></figure><ul><li>There are a lot of spikes for the ETH-USD data feed. During our monitoring of Chainlink's activity, we see that every significant crypto event increases the demand for ETH data feeds. It is probably connected with the need to swap every token to Ethereum either because it seems like one of the most securable assets or because it has the best liquidity;</li><li>Cosmos ATOM saw a growing demand for price data in the middle of May (we link this with the Terra collapse) and not a so significant peak in November;</li><li>With FTT we see the opposite. The number of rounds was lower during May ‘22 and much bigger in November ‘22 during the FTX scandal.</li></ul><p>It is not enough to just provide data, our purpose in Chainlink as a NOP is to provide accurate data. For that, we need an estimation of the quality of the data that is calculated based on the oracles’ answers every round. We call this “Deviation”. It is calculated by comparing a particular oracle’s answer for that Round to the Round’s final value (the median of each oracle's answer). This way, we can track the variance of each oracle every Round. This can also be used to calculate the average value of each oracle’s deviation. Here is how we can compare the data quality for different chains:</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/GIGrmSCocpuw1HYcBG5nb325HI2kPQO1-BkkeSN2gjrleMZckC3fBt69FhJuy6HbxZS22QVeJ9DD-laJ35WcSKhDznJJIctF4_8ndu9QIaUBvkhHpWoyWaXiSBDknbLtym6aU7Zeb2F9tCBkA8dBcCRTYmjMCN1ani9Tt1Xx9FO31mTpgzZaPyLiXXVhNw" class="kg-image" alt loading="lazy" width="602" height="172"></figure><p>It is important to mention that the most popular deviation threshold for data feed defined by Chainlink is 0.5%. There are a lot of feeds with even a 5% deviation threshold.</p><p>It is also interesting to compare the performance of different NOPs by their ability to write Chainlink data on-chain. We use the Transaction success rate (TSR) for this. This is the ratio of the number of successful transactions to the number of unsuccessful transactions.</p><p><strong>Data extraction</strong></p><p>This is not the main subject of the current article. We plan to talk about this a bit more in a future post. Today we will only mention the main architecture of the ETL (Extract, transform, load steps of data uploading pipeline) process:</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/k8IpSUldKoj2x3RDdjVRlY01TlVaKtvARTFciBmqkGLOwOMNo-CSVCyvdQimOTzaB0mhL_cFC7J_RQlpfVH-uWARBeUkrmIjg0xL9LxHj2_eHSesRQ_WnxwSgMYSBIwp_L9P6S0vL3UYZV1sYMyGHdjh0JMuwTJrnzmTMXG2jKX1ejnl8TLdegIMCMhVOw" class="kg-image" alt loading="lazy" width="602" height="189"></figure><p>The first 3 sources are:</p><ol><li>On-chain data</li><li>Chainlink <a href="https://github.com/smartcontractkit/reference-data-directory?ref=p2p.org">repo</a></li><li>TheGraph: our subgraphs are available here:</li></ol><ul><li><a href="https://thegraph.com/explorer/subgraphs/53PbnKoeHChwYvh7rKJES7sdRbwtutszWyTbrrSyib7Y?view=Overview&ref=p2p.org">Chainlink on Ethereum</a></li><li><a href="https://thegraph.com/hosted-service/subgraph/vkuzenkov/chainlink-fantom-mainnet?ref=p2p.org">Chainlink on Fantom</a></li></ul><p>Stay tuned if you want to know more about data and indexation in the future.</p><h3 id="who-is-a-good-node-operator">Who is a good node operator?</h3><p>Every NOP is a company first. The main target of every business is to be profitable. Let’s look deeper into Node operator economics.</p><p>Oracles get rewarded in LINK for every report to the blockchain, regardless of who was the Leader of the round. The Leader gets additional rewards for writing data to the blockchain.</p><p>The main expenses of an Oracle are gas costs, infrastructure costs and human resources. Oracles should pay the gas cost to write data to the blockchain when it was chosen as Leader of the Round.</p><p>We can track rewards and gas costs to estimate the revenue of the oracle's performance. Here is Chainlink on Ethereum financial metrics:</p><figure class="kg-card kg-image-card"><img src="https://lh5.googleusercontent.com/G-e8bKxh3uuB8r4xRLS8LBfnRh7EVqJFcSvpnsDm2nuoKSbnxBhrbhZyCZ5tvRYHQ26aoNgGkuHiNNgM-ky_mOqTIGTIiNknQfbEEbv5aOAxgw8WhRm5e3kKi2TcEBXrDm4f4jVK7MZRlhw53KwkDpMbV4rtLpahFZ-bURQ1CNs3zSKMswSftu4JBm9lig" class="kg-image" alt loading="lazy" width="602" height="265"></figure><p>So the total net revenue for all of the oracles in Ethereum is 37.3 mil $ during this year.</p><p>Now we know the Chainlink mechanics. We also know that a Bear market in Crypto leads to smaller amounts of revenue for every project. But 2022 has also brought us a lot of activity from scandals involving multiple projects: Terra, Celsius, FTT and so on. What if we want to understand how stable an oracle’s revenue can be during an unusual event ? We will definitely want to know what the gas spending value was and how many rewards the oracles got. It will also be great to see deviations to understand the consensus about price data between oracles.</p><p>Let’s see what was happening with an oracle's net revenue during 2022 across 6 networks: Ethereum, Solana, Fantom, Moonriver, Harmony and Avalanche:</p><figure class="kg-card kg-image-card"><img src="https://lh5.googleusercontent.com/lDoax59JiicEyvaBGsGERT7XT_v8qT8u1R5K7uHgIdIc7hdd6Y6ijI0j0Efe1om5UTsPyy0qYtVuO021MNS5OVtcjbUl7f4hl96QJcVTMaFnx7u05U2fORFe02Ds3H3PX8iXQ0fRHEm_LmGW0dCDf8Df8lAhIF2icWaQ-khXzAVGWc-7nxqK55XzgCUIgQ" class="kg-image" alt loading="lazy" width="602" height="176"></figure><p>Here's what was happening with revenue during April-may ‘22 to understand how the Terra event influenced Chainlink NOPs:</p><figure class="kg-card kg-gallery-card kg-width-wide"><div class="kg-gallery-container"><div class="kg-gallery-row"><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/1.png" width="516" height="518" loading="lazy" alt></div><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/2.png" width="686" height="598" loading="lazy" alt srcset="https://p2p.org/economy/content/images/size/w600/2022/12/2.png 600w, https://p2p.org/economy/content/images/2022/12/2.png 686w"></div></div></div></figure><p><br>We can see that everything went up: Costs, Rewards and Net Revenue. So during this commotion around Terra, we see a peak in the number of rounds as we mentioned earlier. It led to an increase in network utilisation and higher gas costs. But it also brought more rewards to node operators and higher Net Revenue as a result.</p><p>A slightly different situation was the FTT/FTX collapse. We’ve already seen that there were way more rounds for FTT data feeds. If we dig deeper we can also see that it happened to every asset associated with FTX such as Solana. But what about net revenue?</p><figure class="kg-card kg-gallery-card kg-width-wide"><div class="kg-gallery-container"><div class="kg-gallery-row"><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/3.png" width="694" height="654" loading="lazy" alt srcset="https://p2p.org/economy/content/images/size/w600/2022/12/3.png 600w, https://p2p.org/economy/content/images/2022/12/3.png 694w"></div><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/4.png" width="864" height="640" loading="lazy" alt srcset="https://p2p.org/economy/content/images/size/w600/2022/12/4.png 600w, https://p2p.org/economy/content/images/2022/12/4.png 864w" sizes="(min-width: 720px) 720px"></div><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/5.png" width="684" height="650" loading="lazy" alt srcset="https://p2p.org/economy/content/images/size/w600/2022/12/5.png 600w, https://p2p.org/economy/content/images/2022/12/5.png 684w"></div></div></div></figure><p><br>It was the same during September and October, with no significant differences. But what about P2P:</p><figure class="kg-card kg-gallery-card kg-width-wide"><div class="kg-gallery-container"><div class="kg-gallery-row"><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/6.png" width="584" height="612" loading="lazy" alt></div><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/7.png" width="614" height="626" loading="lazy" alt srcset="https://p2p.org/economy/content/images/size/w600/2022/12/7.png 600w, https://p2p.org/economy/content/images/2022/12/7.png 614w"></div><div class="kg-gallery-image"><img src="https://p2p.org/economy/content/images/2022/12/8.png" width="612" height="628" loading="lazy" alt srcset="https://p2p.org/economy/content/images/size/w600/2022/12/8.png 600w, https://p2p.org/economy/content/images/2022/12/8.png 612w"></div></div></div></figure><p>Our revenue hasn't changed much during the last 3 months.</p><p>Besides revenue, every NOP should care about its reputation in the Chainlink network. As we previously mentioned, we track reputation by 2 key metrics:</p><ol><li>Deviation</li><li>TSR</li></ol><p>Here’s the Deviation stat for 5 networks:</p><figure class="kg-card kg-image-card"><img src="https://lh5.googleusercontent.com/MFvB1wIPX31q-SczY1-ZRDov9wNrfniYHIBiSpqWMnJvsQJ8F5Hb4YMSHFxdNj9NmC4AAx1d4nR1UCfsvkewZYKSGSE6ICtKeCZZ4Jmms2D6mOvuL9JlZi1vqkA6qH7NqG-113OrPYXxoFiItbyeKfMAlGuoWWZMJ8ydT0AJF6pOK7xiBXI2-QvCaCVvXw" class="kg-image" alt loading="lazy" width="602" height="173"></figure><p>The two red vertical lines mark the Terra and FTT/FTX events.</p><p>It is expected that during a big market event, the consistency of oracles decreases. We can see the huge deviation in Avalanche and Moonriver during the Terra collapse.</p><p>During the FTX event we can observe a deviation, although much smaller when compared to the earlier one:</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/PF1e9w5FoYu1eUCBICXhEepDSJd01b9q-v_V9O7RGT51L1yI5yOCFe3awTjaBpiztMrBZFbLQMT7tyuVbq2lMbH-YClh4fVu42oYM_j_dgPuhYIbcSNM10EwYdPDhVs9FwMliPoEQE9XF4Zmc7IO-XJim4rfQKTkz2ThbBA30IcRAFM_m3PTeMdBTleMlQ" class="kg-image" alt loading="lazy" width="203" height="276"></figure><p>We can also compare oracles based on TSR to estimate how successful oracles are in writing data to the blockchain. For example, here is the TSR for Ethereum’s mainnet:</p><figure class="kg-card kg-image-card"><img src="https://lh5.googleusercontent.com/0AwgVfBVVPTzGOmoXWFbqxTtTYMHRlbKgvz_JkoJ83drgBcsidggKMCu6M2F9aJOZol0k7wBM-F_31iPjnRmHVQn1tip5a_Zu8l1652XFfwoAqhV8PvvF1UvcZACIU0OkxaKRkPoI-RHPRtBaarQEa3ruE_ODKGnz3kOpU3ODRIbmsX7nQq8muTMxBczcA" class="kg-image" alt loading="lazy" width="602" height="175"></figure><p>We can observe that during November and for most of 2022, P2P had a TSR ranging between 90-100% in every network except Fantom and Solana (and Moonriver in April). This is because those chains use a different transaction execution mechanism compared to most EVM chains. You can make sure that this is quite a good metric value by comparing us to others.</p><p>Here is the distribution of different NOPs TSR for the Fantom network:</p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/6nvlDCRGlu0CQezWXbVY_Hz9RSnlkKGTHUUVCDiIckYpfRtxrmr0Y0Rz7WoD5EyHXnHUTAVxctbssydK82O-htUsQ980nGcglNVN2Fu93nEDdrv8ZZbIKMkvExrlfLyd5QnfWK0OsimT9zAiBd_McY2VH7fY0GoQ2BhRyWy67_eCmjsnVQDT43ylX9S6Wg" class="kg-image" alt loading="lazy" width="602" height="329"></figure><p><br>We can observe that even at its lowest point P2P was among the top NOPs.</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/rq8zjGR9Gg1DnY7SI840HpM4Nl03jg54-7tr3z6YhJOOh2xXUl1A-qKX7l59hco13rNG8hE4jtCg1BA5-FBQIJC0L6JPbQaS26b5cwQy-55b-UdaOJFufVOkiBP8mNp0qC576tZW2vCPee7ShXW9yeK01QIL-R5qcGcDqFq4k6G6WUH55OLa952T3m4gTA" class="kg-image" alt loading="lazy" width="602" height="333"></figure><p>The median TSR or all Nops on Solana was 6.07% and the median TSR for P2P was 6% for the same period.</p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/2T9H6f4Ovl5_QpOcvm1G7wVaFomZuLOKC3NdWW6T6sUMW0nn8Rz0db0Y7NmXBvsjj-Ouuf3bLyYESj-JGhy8IeZ3U4418pX_CQHUWbm03_qDMnJGVPYcqD7TvRtDzjs0ZOT6vfj0dhh-J2Uej-nqhJpKtaA0TSfIV9wFdlCmxVegFjHz23as4BzCW36FDw" class="kg-image" alt loading="lazy" width="602" height="332"></figure><h3 id="decision-making">Decision making</h3><p>In this section, we will discuss how we solve business problems by using a data-driven approach.</p><p>On August 2021 Ethereum released EIP-1559. A significant aspect of this proposal was how it overhauled the transaction fee system. For P2P it meant that we could now use EIP-1559 to prioritize transactions. We weren’t sure how this would affect the transaction success rate, in other words, did miners have a preference for one type of transaction?</p><p>We’ve decided to run an A/B test. The design was to switch the priority fee algorithm from Standard to 1559 every 15 minutes and set the configuration of both algorithms. As a result, we’ve got the same transaction success rate and significantly different cap fees as can be seen in the picture below:<br></p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/cZyvehzptSVbQyPoD8YDWRJWCzQIE5XZ8cN-X6Sm2vBhqtmTKO9AQg5vyqkRp_MYm1e5Ldop_oqZRRdjRED7zeWDU-WrzBAJIR3kLAy6Ueo64cnnN6hYlS8nX7vnal2Yj0GG8DjXgzJoHTCSp5uftQWhy1tZsHOaZ_krVTE54Fqt2uluZzOXDU9Q0lW3GA" class="kg-image" alt loading="lazy" width="602" height="371"></figure><p><br>This is how data analysis and data-driven approaches are applied in decision-making.</p><h3 id="staking">Staking</h3><p>Chainlink Staking v.0.1 launched on December 6, 2022. During this first version there are two ways to stake Chainlink:</p><ol><li>Community staking: you need to satisfy three <a href="https://blog.chain.link/chainlink-staking-early-access-eligibility-app/?ref=p2p.org">criteria</a> and the APR is around <a href="https://blog.chain.link/chainlink-staking-launch-details/?ref=p2p.org">4.75%</a><br></li><li>Staking through a NOP: when a NOP stakes from 1000 to 50k LINKs as a self-stake. APR is 7%.</li></ol><p>If you want to see the details you can read <a href="https://p2p.org/economy/chainlink-staking">this post</a> in our blog or on Chainlink's official <a href="https://blog.chain.link/how-to-stake-chainlink-link/?ref=p2p.org">website</a>. But as you may see the community staking pool is already full and won’t be expended till v.1.0 (9-12 months):</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/EhIZFEBJ2vh9a7_V1SzfCJZF2-cWSKe12djGu_6WTb1vlaSwJ9Fi5GezBhCJnqoDf_TdoIPi1HVv5CzdIfuLmcg2a0qbI4Qv6tyuaWgdFZe2c_pYU1hyKUfK2X-bS1hnDsMjZPvbWQdpXaY3TO2vQMPNMfoDG9DBj3bo59575bJQvY9DaRUdeLDfLJDKwg" class="kg-image" alt loading="lazy" width="386" height="373"></figure><p><br>That is why we are glad to provide our clients with a custodial solution to get a higher APR through P2P with a 10% fee. Through P2P you need a minimum of 10k LINK and can stake up to 50k LINK.</p><hr><h3 id="about-p2p">About P2P</h3><p>P2P Validator is a world-leading staking provider with the best industry security practices and proven expertise. We provide comprehensive due diligence on digital assets and offer only top-notch staking opportunities. At the time of the latest update, more than 1,5 billion USD is staked with P2P Validator by over 25,000 delegators across 25+ networks.</p><p><br></p><p><br></p><p><br></p><p><br></p><p><br></p><p><br></p><p><br></p>

from p2p validator