Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeP2P.org recently launched a public pool on Aptos, and we are currently working towards accumulating a stake of 1 million to activate our node. If you’re interested in partnering with us, please feel free to reach out by contacting [email protected] or reaching us on Telegram at @P2P_staking.

Aptos is a Layer 1 blockchain heavily backed by an impressive group of VC funds, a16z, Tiger Global, Katie Haun, Multicoin Capital, Coinbase Ventures, Binance Labs and PayPal Ventures. With its own programming language called Move, strong partnerships, and a focus on technology, this blockchain holds great potential for real-world applications based on interest from various tech giants. On April 20th, delegated staking was launched, and P2P.org aims to provide you with all the information you need before starting your Aptos staking journey. Additionally, we conducted analytical research comparing the pace of staking adoption to a similar Layer 1 competitor.

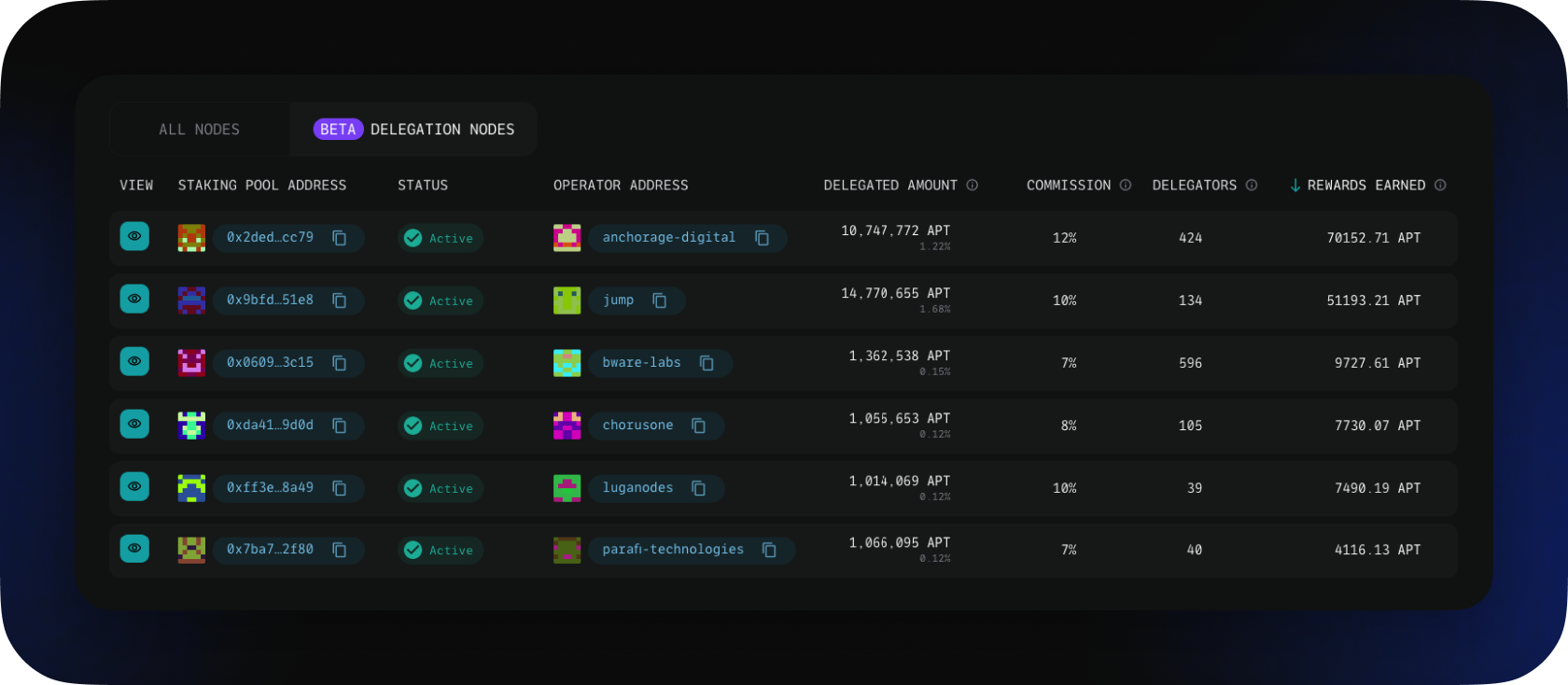

Currently, six node providers are available for staking, most of whom are well-known players in the crypto world. For example, Jump-Crypto has built a wormhole bridge connecting over 20 networks, and B-Ware labs led the development of delegated staking on Aptos. The network security is robust, backed by over 100 validators from around the globe using a different private staking mechanism. There is also a liquid staking opportunity called Tortuga Finance.

Node providers start generating rewards only after the total stake reaches over one million APT, approximately $9 million (as of 24.05.23). Currently, over ten inactive validators are still seeking enough stake to become active.

The Annual Percentage Rate (APR) on Aptos is 7% and depends on a validator's uptime and commission. So far, all validators have been performing well, and there haven't been any significant downtime periods. There is no slashing, and the minimum commission is 7%, resulting in a final yield increase of approximately 6.5%.

The validator unlock period varies from a few hours to 30 days, depending on when you unstake your APT. For example, if you stake 10 days into the cycle, you must wait 20 days to unlock your tokens. Once the unlock date has passed, you can withdraw your tokens.

The minimum stake required is 11 APT, and there is also a staked fee. You may notice that the amount you have staked is less than the total stake you added. This is because you start earning rewards when the next epoch begins. However, this fee is then returned at the end of the current epoch.

Staking can be done directly from the main Aptos Explorer page. All you need to do is connect one of the supported wallets (Petra, Pontem, Martian, Blocto, to name a few), choose a validator, and click the "stake" button. Our pool is called p2p-org.

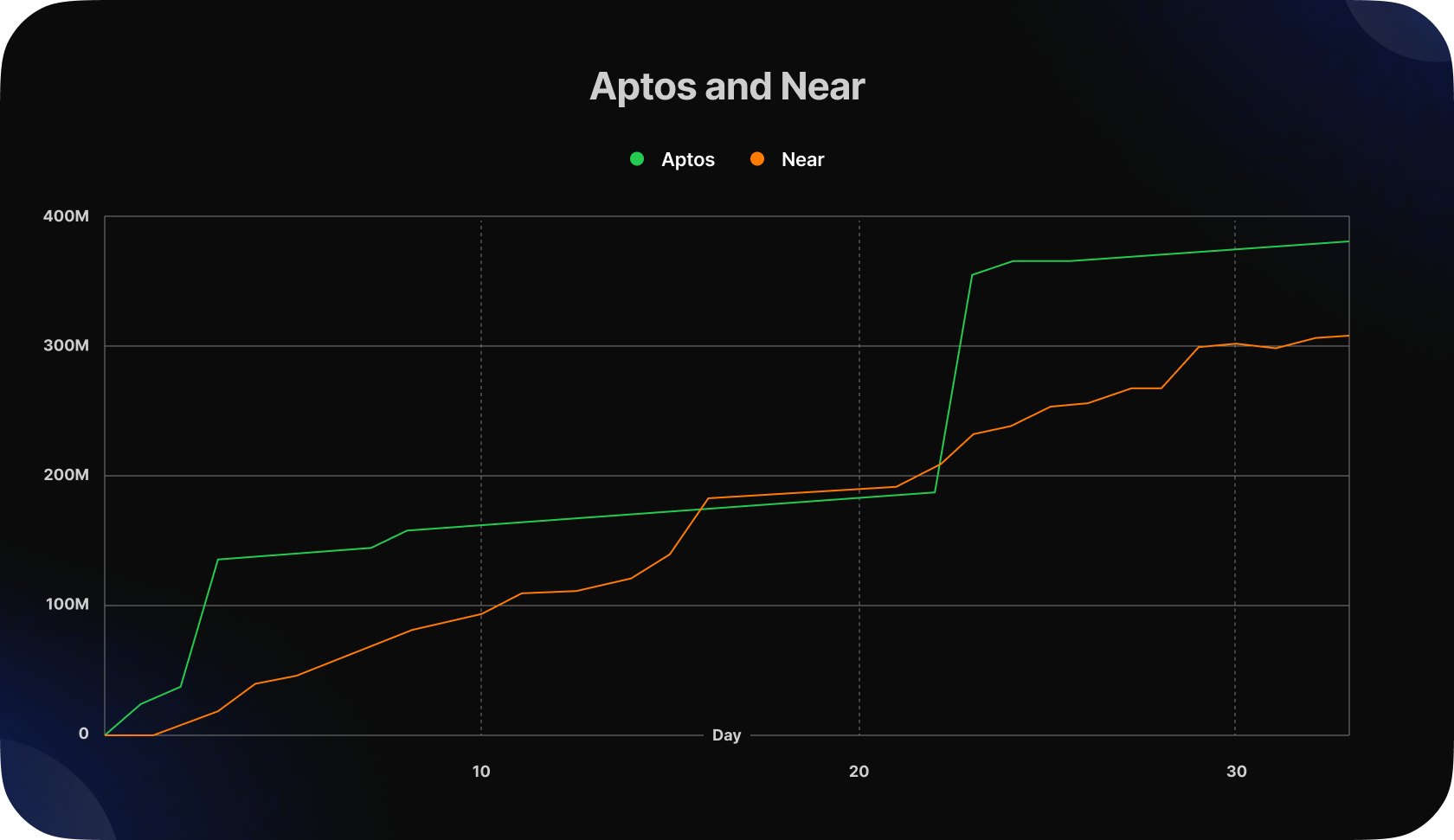

How quickly does the staking amount grow? Is the pace fast enough to instil confidence in token holders regarding Aptos as a long-term investment? How many institutions and whales are involved in staking? To answer these questions, let's compare Aptos to a similar Layer 1 blockchain, Near. For a fair comparison, let's return to October 2020, during the early stages of staking on Near.

As we can see, the lines are quite uniform, except for the significant spikes that occurred on Aptos on days 3 and 23. These spikes result from the requirement of reaching a threshold of 1 million APT for a public node to become active. On those days, several large public pools joined the validation set, particularly on day 23 when a pool with over 14 million APT entered. In Near, at that time, the total of 100 biggest validators was required, so the minimum stake needed was not predetermined, resulting in a smoother line.

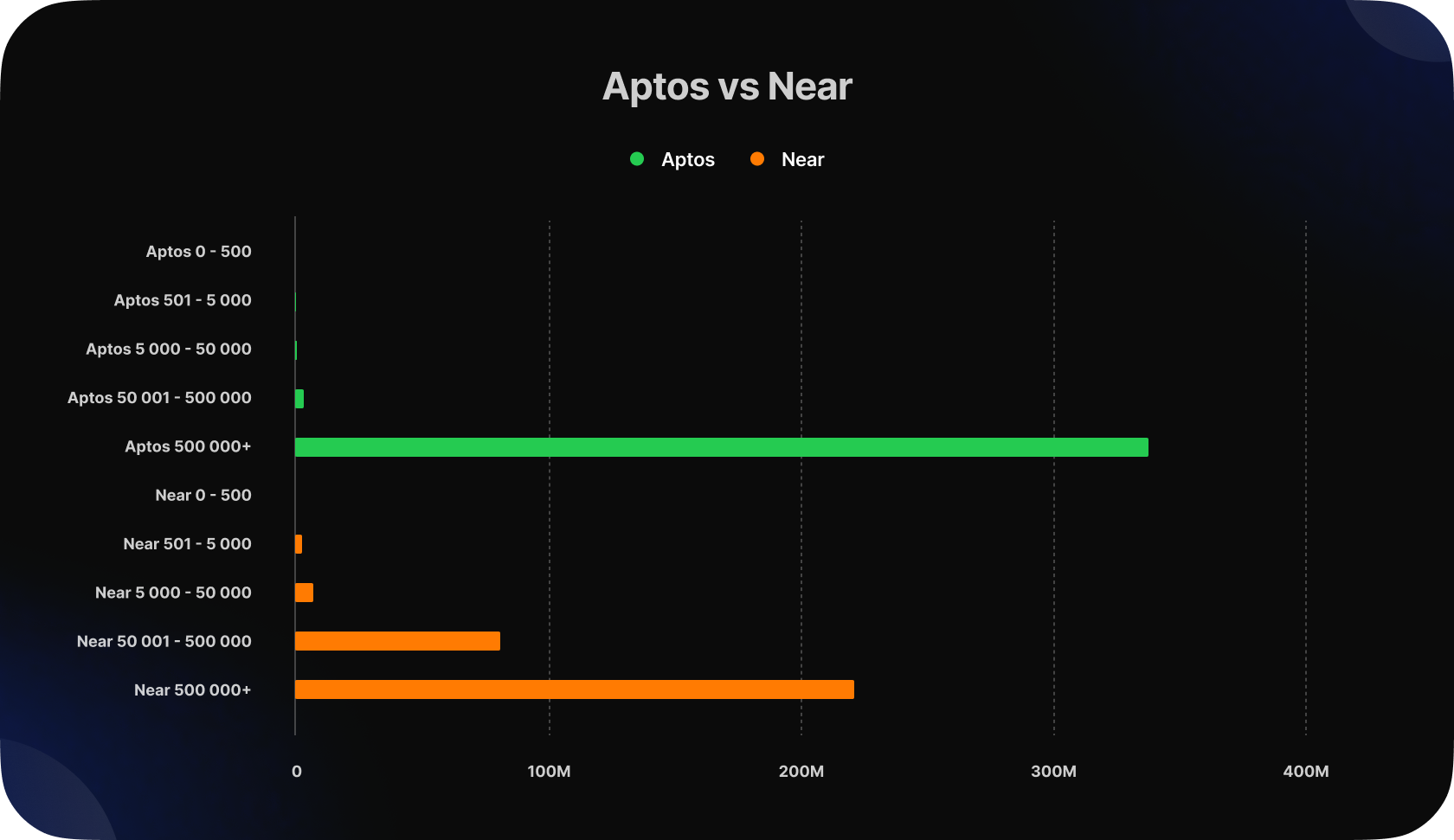

Now let's examine who delegates on Aptos.

As we can see from the table, the majority of the stake is held by a few large institutions on both networks. However, this distinction is more significant on Aptos. You cannot start a pool and wait for small delegators to collectively generate 1M APT. They are more likely to stake with active pools to generate rewards. Therefore, you must find a large partner who can stake 1M APT at once.

The table shows that only 15 delegators own 98.7% of the total stake. Most of them staked their tokens before the pools became active. Their total Total Value Locked (TVL) in USD is nearly $290,000,000, accounting for 85% of all delegated stake. However, this comparison is uneven because, at this stage, the Aptos foundation hadn't yet bootstrapped the validators, and there are only 6 mainnet participants who essentially stake their own money through the mechanism. This distribution will normalise when over 100 private validators join public staking.

Aptos delegated staking represents a significant milestone in the network's roadmap, although it is still in the early stages of development, with only a few participants currently involved. Despite this, there is noticeable interest in staking within the community, with a sufficient number of small and medium-sized delegators. However, the majority of stakers are still large investors. In contrast to Near, Aptos has gained support from major VC funds and global tech giants. This offers the potential for significant collaboration projects (e.g. Google Cloud partnership). According to Aptos, this is expected to accelerate the adoption of web3 and lead to numerous real-world applications of crypto solutions.

Product Manager at p2p.org

<p><strong>Introduction:</strong></p><p>Our team has been hard at work, and we're pleased to say that the new direct ETH staking app is now live in the Safe Apps Ecosystem. This blog post will guide you through how to use the P2P.org Non-Custodial direct ETH Staking App on Safe. Discover how to set up your wallet integration, find additional support from us, and seize the opportunity to stake your ETH effortlessly.</p><p></p><p><strong>The P2P.org App with Safe</strong></p><p>Safe is one of the most trusted decentralized custody protocols and collective asset management platforms on Ethereum. Holding and safeguarding billions of dollars in assets, Safe provides secure and <a href="https://www.google.com/url?q=https://docs.safe.global/learn/security/security-audits&sa=D&source=docs&ust=1686751866991915&usg=AOvVaw0Vm0CRfgmqRZjLRGu-89ff">audited</a> smart contract accounts for individuals and organizations.</p><p>The first-of-its-kind app on the Safe Apps Ecosystem allows users to quickly and easily direct stake ETH with just a few clicks while maintaining full custody of their assets.</p><p>Additionally, it will enable clients to avoid smart contract risks associated with liquid staking protocols. At the time of this article being created, Safe currently stores $39B+ in digital assets for its users. <br></p><p>The P2P.org Safe App integration is another step towards our vision to support non-custodial staking services to a growing DeFi community whilst allowing full ownership over your digital assets. Additionally, Safe users will still benefit from P2P.org's slashing protection guarantee when they direct stake their ETH through the app.</p><figure class="kg-card kg-video-card"><div class="kg-video-container"><video src="https://p2p.org/economy/content/media/2023/06/Safe-New.mp4" poster="https://img.spacergif.org/v1/1920x1080/0a/spacer.png" width="1920" height="1080" playsinline preload="metadata" style="background: transparent url('https://p2p.org/economy/content/images/2023/06/media-thumbnail-ember210.jpg') 50% 50% / cover no-repeat;"></video><div class="kg-video-overlay"><button class="kg-video-large-play-icon"><svg xmlns="http://www.w3.org/2000/svg" viewbox="0 0 24 24"><path d="M23.14 10.608 2.253.164A1.559 1.559 0 0 0 0 1.557v20.887a1.558 1.558 0 0 0 2.253 1.392L23.14 13.393a1.557 1.557 0 0 0 0-2.785Z"/></svg></button></div><div class="kg-video-player-container"><div class="kg-video-player"><button class="kg-video-play-icon"><svg xmlns="http://www.w3.org/2000/svg" viewbox="0 0 24 24"><path d="M23.14 10.608 2.253.164A1.559 1.559 0 0 0 0 1.557v20.887a1.558 1.558 0 0 0 2.253 1.392L23.14 13.393a1.557 1.557 0 0 0 0-2.785Z"/></svg></button><button class="kg-video-pause-icon kg-video-hide"><svg xmlns="http://www.w3.org/2000/svg" viewbox="0 0 24 24"><rect x="3" y="1" width="7" height="22" rx="1.5" ry="1.5"/><rect x="14" y="1" width="7" height="22" rx="1.5" ry="1.5"/></svg></button><span class="kg-video-current-time">0:00</span><div class="kg-video-time">/<span class="kg-video-duration"></span></div><input type="range" class="kg-video-seek-slider" max="100" value="0"><button class="kg-video-playback-rate">1×</button><button class="kg-video-unmute-icon"><svg xmlns="http://www.w3.org/2000/svg" viewbox="0 0 24 24"><path d="M15.189 2.021a9.728 9.728 0 0 0-7.924 4.85.249.249 0 0 1-.221.133H5.25a3 3 0 0 0-3 3v2a3 3 0 0 0 3 3h1.794a.249.249 0 0 1 .221.133 9.73 9.73 0 0 0 7.924 4.85h.06a1 1 0 0 0 1-1V3.02a1 1 0 0 0-1.06-.998Z"/></svg></button><button class="kg-video-mute-icon kg-video-hide"><svg xmlns="http://www.w3.org/2000/svg" viewbox="0 0 24 24"><path d="M16.177 4.3a.248.248 0 0 0 .073-.176v-1.1a1 1 0 0 0-1.061-1 9.728 9.728 0 0 0-7.924 4.85.249.249 0 0 1-.221.133H5.25a3 3 0 0 0-3 3v2a3 3 0 0 0 3 3h.114a.251.251 0 0 0 .177-.073ZM23.707 1.706A1 1 0 0 0 22.293.292l-22 22a1 1 0 0 0 0 1.414l.009.009a1 1 0 0 0 1.405-.009l6.63-6.631A.251.251 0 0 1 8.515 17a.245.245 0 0 1 .177.075 10.081 10.081 0 0 0 6.5 2.92 1 1 0 0 0 1.061-1V9.266a.247.247 0 0 1 .073-.176Z"/></svg></button><input type="range" class="kg-video-volume-slider" max="100" value="100"></div></div></div></figure><p><strong>How to Set Up Your P2P.org Safe Wallet Integration:</strong></p><ul><li>Visit the Safe website: <a href="https://safe.global/?ref=p2p.org">https://safe.global/</a>.</li><li>Click on "Launch Wallet" to access your dashboard.</li><li>On the left-hand side, locate and click on "Apps" to enter the apps ecosystem.</li><li>Search for "P2P" or "P2P.org" to find the P2P.org app.</li><li>Select the app and click on "Open Safe App."</li><li>Read the Disclaimer and press "Continue."</li><li>Next, review the User Terms, tick the box to accept, and click "Accept."</li><li>Enter the amount of ETH you wish to stake (remember, the minimum requirement is 32 ETH), and click "Continue." This will set up the validator and infrastructure, which may take up to one minute.</li><li>Confirm the staking details on the screen, then click "Stake ETH" and confirm the transaction in your wallet.</li><li>Once the transaction is indexed, you can view it in the pending queue. Feel free to click the "Chat with us" button to connect with our customer support via the Telegram group <a href="https://t.me/P2Pstaking?ref=p2p.org">@P2Pstaking</a>.</li><li>Head back to your dashboard to access the details of your staked ETH and monitor the status of your transaction.</li><li>If you encounter any questions or need further assistance, our dedicated support team is here to help. Join our Telegram group @P2Pstaking to connect with our knowledgeable staff and engage with the P2P.org community.</li></ul><p>You should now all be set up and ready to embark on your staking journey with P2P.org's direct ETH Staking App on Safe. Enjoy the benefits of secure and hassle-free staking while maintaining complete control and ownership of your assets. <br></p><div class="kg-card kg-button-card kg-align-center"><a href="https://app.safe.global/share/safe-app?appUrl=https%3A%2F%2Feth.p2p.org&chain=eth&ref=p2p.org" class="kg-btn kg-btn-accent">Stake with safe</a></div><p></p>

from p2p validator

<p>If you hold SUI tokens, you can help secure the network by delegating to validators on the mainnet. This way, proof of stake delegators can keep or grow their percentage of the total supply over time.</p><h3 id="why-delegate-sui">Why delegate Sui?</h3><p>Sui network rewards participants with extra subsidies from 10% of the total supply, on top of gas fee rewards. Delegation is non-custodial, so validators cannot access or take your tokens. Sui does not slash your initial delegation, but your staking rewards may be lost if validators perform poorly. So choose your validators carefully.</p><p>P2P.org is a trusted SUI validator that participated in all pre-mainnet tests, including the validator game. We have over six years of experience validating 40+ proof of stake networks with top ratings. Our support team is available 24/7 to assist you or answer your questions. You can join our <a href="https://t.me/P2Pstaking?ref=p2p.org">telegram</a> channel or visit https://p2p.org/ website for more information.</p><h3 id="step-by-step-staking-instruction">Step-by-step staking instruction</h3><p>To start, you need to download <a href="https://chrome.google.com/webstore/detail/sui-wallet/opcgpfmipidbgpenhmajoajpbobppdil?ref=p2p.org">Sui wallet browser extension</a> for Chrome</p><ul><li>Register in Sui wallet. You might lose control over your funds if you lose access to your seed phrase. Save it in a safe place. You can unlock Sui wallet from your device using the password.</li></ul><figure class="kg-card kg-image-card"></figure>

from p2p validator