Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeSecured around a PoS consensus mechanism, Vega is a novel project designed for developing and trading quality derivative products on a decentralised network.

Traditional centralised financial markets have left us paralysed. Traders and investors have no choice other than giving full trust to third parties who fix high costs and stifle innovation by controlling what markets and products can be traded.

The Vega network works to solve these shortcomings by improving access to a decentralised derivative trading network, cutting out the middleman and redistributing control back to the community. With Vega, anyone will be able to propose the markets they want to trade, and they will be approved for creation if they pass through governance. These markets will be:

Through the use of its permissionless and agnostic proof of stake network, VEGA is bringing efficient trading of derivative products (comparable to centralised exchanges) to the DeFi ecosystem.

VEGA raised ~$11 million from over 26 backers, including Arrington, Pantera, Cumberland, KR1, Hashed, and Coinbase Ventures.

Symbol: VEGA

Type: ERC20 token which interacts with the VEGA blockchain via a Ethereum-to-Vega bridge

Current Market Cap: ~$34,000,000

Current Circulating Token Supply: ~1,600,000 VEGA

Total Token Supply: 64,999,753 VEGA

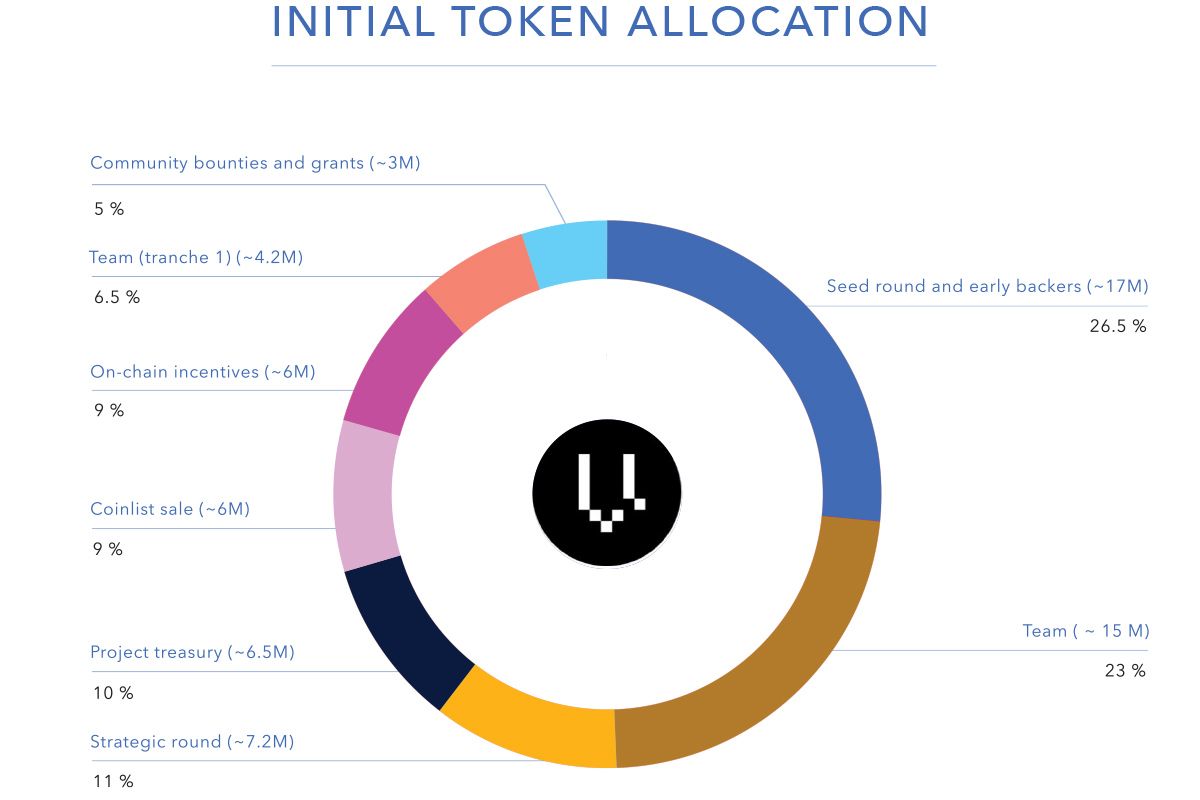

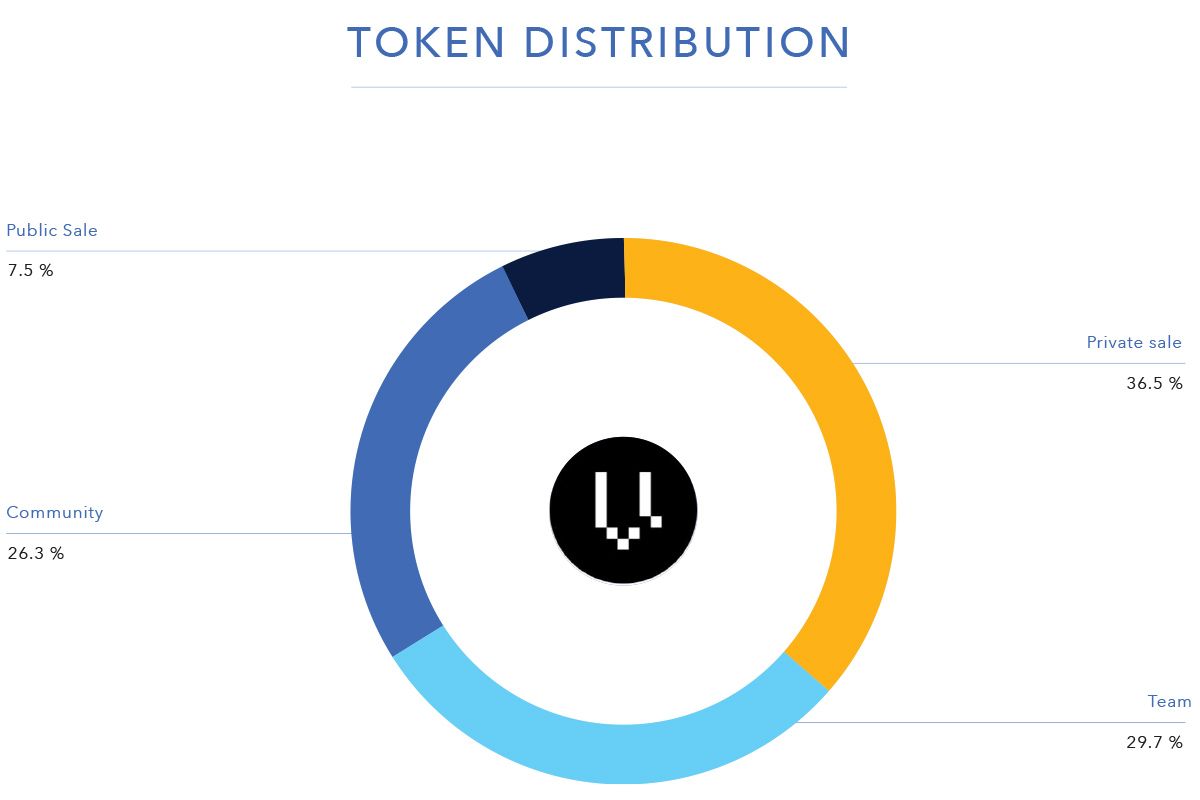

The initial token allocation and current token distribution looks as follows:

Each VEGA token will give rights to participate in governance and staking.

Governance

VEGA token holders will have the opportunity to propose and vote on 1) new markets on the VEGA protocol and 2) governance changes on rewards distribution policies, review fee prices, and the behaviour of the network.

Staking

Staking is the mechanism used to secure the network. It is the process of holding coins/tokens (stake) in order to earn rights to participate in the "validation" of new blocks, and in doing so "delegators" are compensated with rewards. Token holders can “delegate” their VEGA tokens rights to Validators. The more stake one has, the more influence they hold. Delegators are therefore incentivised to delegate to a Validator that acts according to the best interests of the network as a whole.

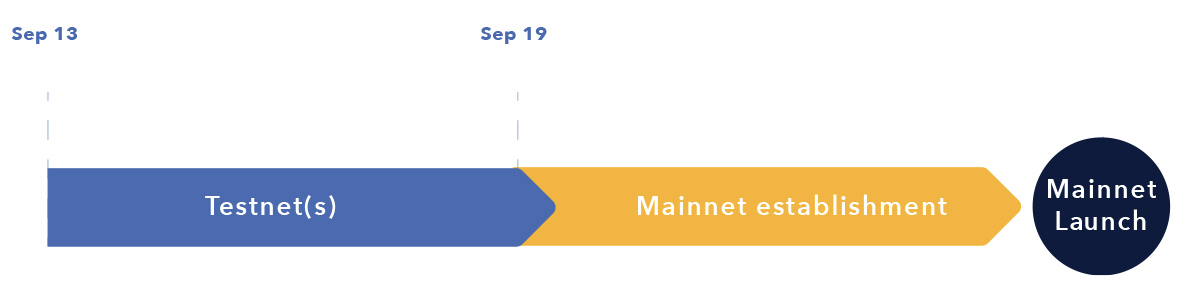

Vega started in 2018 and will be launching their Restricted Mainnet soon - enabling governance and staking of both unlocked and locked VEGA tokens. The core functionality of Vega will be introduced by a governance vote once the network is running smoothly and the functionality to enable trading is well-tested.

Vega uses a Delegated Proof of Stake BFT-style consensus protocol. Token holders can “delegate” their VEGA tokens to the validators they wish. Validators will validate blocks of transactions on their behalf, earn rewards proportionally to the represented stake, and the network will redistribute it to their delegators after deducting a fee for the service they provide. There are two variables that define the staking rewards APR: the amount of tokens in the network assigned for rewards (AKA the reward pool), and how many VEGA tokens are currently staked. The estimated APR will be released shortly after the network launches when these variables will be known.

These rewards will derive from two different places:

1) A percentage of the infrastructure fee - fees that are charged on trades executed on the platform.

2) From the on-chain treasury.

The amount of rewards received will be voted by the community where an equilibrium between desiring high fees and lowering fees to attract demand should be reached.

Initially, 13 validators (P2P Validator being one of them) will be in charge of the validation of new blocks. To promote decentralisation, Vega have implemented a non-whaling scheme. Rewards will not grow further beyond a maximum stake that will be imposed on validators. Delegators therefore have an incentive to delegate to validators with a stake below this threshold as doing so will lead to higher rewards per token.

Users that want to contribute to the stability and security of the Vega Network without the complexities associated with the management of being a validator can delegate stake and earn staking rewards.

Vega does not plan to implement slashing. However, validators will not receive rewards if they do not validate the blocks assigned to them and the community will punish validators who misbehave by undelegating their stake. Further punishments could be implemented if needed, such as retaining rewards generated. If it turns out to be insufficient, the community can always vote to implement further measures.

P2P Validator is a world-leading non-custodial staking provider with the best industry practices and proven expertise. We provide comprehensive due-diligence of digital assets and offer only high class staking opportunities securing more than 4 billion of USD value.

At the time of the latest update, P2P Validator is trusted by over 10,000 delegators across 25+ networks. We are a major player in all networks we support because of our experience, commitments and our reputation. We pay special attention to the process of governance.

Want to stake VEGA with us? Visit https://p2p.org/vega to find out more about Vega staking and our special offer.

If you have any questions, feel free to join our Telegram chat, we are always open for communication.

<p><br>We have created a step-by-step guide to help you stake your Vega tokens (VEGA) using a Mac. If you are using a Windows instead you can find a guide <a href="https://p2p.org/economy/vega-vega-staking-guide-using-windows/">here</a>. </p><p>For those of you who have their tokens locked on Coinlist: <em>Coinlist will support staking</em>. More information will have to come from them about how they will manage it. To redeem unlocked VEGA tokens from Coinlist, you can do so <a href="https://p2p.org/economy/vega-vega-staking-guide-using-macs/token.vega.xyz">here</a>.<br><br>You will have to go through the following steps to successfully stake your VEGA:</p><p>I. Create your Vega Wallet <em>(If you have already done so skip to the next step)</em><br>II. Connect to a network<br>III. Stake your VEGA</p><p>Before we start, make sure you have VEGA in a Metamask wallet (token contract can be found <a href="https://token.vega.xyz/?ref=p2p.org">here</a>) as well as ETH to pay for transaction fees. The gas fees are variable and Vega has no control over it. </p><p> </p><h3 id="i-create-your-vega-wallet-if-you-have-already-done-so-skip-to-the-next-step-">I. <u>Create your Vega Wallet </u><em><u>(If you have already done so skip to the next step)</u></em></h3><p> <br>1. First you will need to download the right zip file of the releases from the<a href="https://github.com/vegaprotocol/vegawallet/releases/?ref=p2p.org" rel="nofollow noopener noreferrer"> Vega Wallet GitHub rep</a>.</p><p>For Mac download: vegawallet-darwin-amd64.zip</p><p>For Macs with an M1 processor (released in November 2020 or later): vegawallet-darwin-arm64.zip.</p><p>To check whether your Mac has a M1 processor select the apple logo in the top left and then "about this mac".</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281081/bdd48535a618879fb6a3c366/428DZD2WPHRatFAC4ImEeDgwR9tnPoclLfZa6RNYPhZjizQmGlj7gkRJHs_QXCRnqYLLn1-fOdySmgTQl_F48v512FLxPDdPHqx7Br6nntNRXOdfy69qMtLndb1i54bifApzJqpv" class="kg-image" alt loading="lazy"></figure><p>Create a folder to place your downloaded zip file in and make sure you remember where to find it as you will need to know it for the steps ahead. (to make following this guide easier, create a folder called "Vegawallet" in your "Downloads" folder and save it there so the below examples can be copy/pasted).</p><p>2. Once downloaded and saved, the next step is to open it. When attempting to do so, you may get a message saying “vegawallet cannot be opened because it is from an unidentified developer."</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281085/9125302e137a37962c8890d3/_ngOOm0r1hve_OVHVbIjlJ2oO0E2cJ53fOlVxedhIFie_3PI_buZ0cZLCGS1m6FwmN_ZdEe8m0CQpH0d5bc87IS7dqlnlJrsdVm6vN0zIM5-xkCHgKwbG7MOrGmZoGF8FB6ydJhs" class="kg-image" alt loading="lazy"></figure><p>To open it you will have to go to your system preferences, select "Security & Privacy". You will then find a section mentioning that "vegawallet" was blocked. To override the security measure, select "Open Anyway".</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281089/bc455a511d44b39969ae78ce/rlo3N1r9crPjpTSmqmo0tkNW8Cmvww5pEaQnKn1Iepq6mGd1aYdxhpFtTkNnnmh9UPkaRZJOvw8DQgJjqfHJxCYjf8DAFUB0_cRpyJw1wVYqVhQjCyuvoOi_N1QuD6O3NOm4CGWy" class="kg-image" alt loading="lazy"></figure><p>3. Once you have opened the file, you will need to initialise the wallet and create a new key pair. Open a new terminal page and indicate where the commands will run (where you have saved the vegawallet file). For example, I have saved my file in the following folder: Downloads → Vegawallet. To indicate where the commands will run you can use the command "cd" then the path. Below I wrote "cd Downloads/Vegawallet" to indicate that my file is in the Vegawallet folder which is in my Downloads folder.</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281094/095053c4ebed924c6ae0f5ff/aa2ZvrSxy8SgQP6EV3mLRqtYW0TBt0hL26QLlluUSD2j9mA4O0ruxJbLCioh1PcjYowEquON0V535amy2bfJJPmMpUeCeHHukJrQBBJuEyBsJzLyMDhgi8_im6ZudI9xCac2Yf0P" class="kg-image" alt loading="lazy"></figure><p>4. Once you have specified the folder to run the command from, you will need to initialise the wallet. This creates the folder, the configuration files, and default networks needed by the wallet to operate. Use the following command "./vegawallet init". Example below:</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2021/11/image-46.png" class="kg-image" alt loading="lazy" width="856" height="33" srcset="https://p2p.org/economy/content/images/size/w600/2021/11/image-46.png 600w, https://p2p.org/economy/content/images/2021/11/image-46.png 856w" sizes="(min-width: 720px) 720px"></figure><p>If you are experiencing any issues with this step, you can try to do the following command instead: "./vegawallet init --force".</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2021/11/image-80.png" class="kg-image" alt loading="lazy" width="984" height="34" srcset="https://p2p.org/economy/content/images/size/w600/2021/11/image-80.png 600w, https://p2p.org/economy/content/images/2021/11/image-80.png 984w" sizes="(min-width: 720px) 720px"></figure><p>5. The next step will be to create your username for the wallet. Use the following command: “./vegawallet key generate --wallet "your_username".” <em>Make sure there are no spaces in your username</em>. Example below:</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281105/90a3e69d6efc74584323c2a8/A40YAOsu9gT6ExhUGe7Mzgyj9GzTUU6uC7rYLXYdJtSpqiHXl2WPkYW5VWfCnQT1dEzz-4vT4dcbdf3wjC8G-Mr5oHqxJ-4fXbo0ZKsyFkQaHUawqfZuoM-Mc6ORPVGjNu7WSVy_" class="kg-image" alt loading="lazy"></figure><p>6. You then have to create a password. Note that when typing you will not see what is being typed, this is intended and it will be recorded. Select enter once you have written it. Example below:</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281112/2d5443df047ddaa6b3182ebc/jo9n1iwMFhLzxgiwzfzFyY1VPhdOJi5t-W3YFQVzeSnzJ0LRHVKsA6-0-MmK65psbkjZpwxvIpTlTPjbv-9QNIb5ZjUwuEH8nJ9CxeQTr3cO1ydDYPydWfLXisG_wUb4AF8Yi45U" class="kg-image" alt loading="lazy"></figure><p>7. Once you confirm your password, the wallet will be created! You will then be given your mnemonic passphrase. This passphrase can be used to restore your wallet in case something happens. It is very important, so make sure you write it down and keep it somewhere safe (offline), where no one will ever see it! It will never be displayed again so be sure to write it down accurately. You should also make a note of your username and public key, and remember your password in order to login to your account in future.</p><h3 id="ii-connect-to-a-network"><br>II. <u>Connect to a network</u><br> </h3><p>1. Once you have created and initialised the wallet, you are now ready to run the service. If you are starting with a new terminal page, make sure that you indicate where the commands will run again (where you have saved the vegawallet file). For example, I have saved my file in the following folder: Downloads → Vegawallet. To indicate where the commands will run you can use the command "cd" then the path. Below I wrote "cd Downloads/Vegawallet" to indicate that my file is in the Vegawallet folder which is in my Downloads folder.</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281115/b67208b7285f1306a3adae88/aa2ZvrSxy8SgQP6EV3mLRqtYW0TBt0hL26QLlluUSD2j9mA4O0ruxJbLCioh1PcjYowEquON0V535amy2bfJJPmMpUeCeHHukJrQBBJuEyBsJzLyMDhgi8_im6ZudI9xCac2Yf0P" class="kg-image" alt loading="lazy"></figure><p>You need to select and connect to a network. To find the list of networks use the following command: "./vegawallet network list". Example below:</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281116/2224f9b240b36a4fbdab8c15/NRzxPZBgAkW-k9IBN6VAvrGp1JkBZRagB5U9Zkn7m8dkFfQKPXNlNpJjan4154-59tgjGRFcAYF1yEYlLC8wMUuz9v571egpqBsP8u5COTQevTl1W7TvHHPfNJInW0WjBcHsa604" class="kg-image" alt loading="lazy"></figure><p>If you do not see the network "mainnet1", run the following command: "./vegawallet network import --from-url="<a href="https://raw.githubusercontent.com/vegaprotocol/networks/master/mainnet1/mainnet1.toml?ref=p2p.org" rel="noopener noreferrer">https://raw.githubusercontent.com/vegaprotocol/networks/master/mainnet1/mainnet1.toml</a>"</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2021/11/image-56.png" class="kg-image" alt loading="lazy" width="1138" height="361" srcset="https://p2p.org/economy/content/images/size/w600/2021/11/image-56.png 600w, https://p2p.org/economy/content/images/size/w1000/2021/11/image-56.png 1000w, https://p2p.org/economy/content/images/2021/11/image-56.png 1138w" sizes="(min-width: 720px) 720px"></figure><p>If you are experiencing issues importing the mainnet network, another way to do this is to download the file “mainnet1.toml” from here: <a href="https://raw.githubusercontent.com/vegaprotocol/networks/master/mainnet1/mainnet1.toml?ref=p2p.org" rel="noopener noreferrer">https://raw.githubusercontent.com/vegaprotocol/networks/master/mainnet1/mainnet1.toml</a>. To download it, open the page and press "Apple" - S and save it into the same folder where your “Vegawallet” file is. Then run the following command in the terminal: "./vegawallet network import --force --from-file ./mainnet1.toml.txt"</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2021/11/image-57.png" class="kg-image" alt loading="lazy" width="1138" height="283" srcset="https://p2p.org/economy/content/images/size/w600/2021/11/image-57.png 600w, https://p2p.org/economy/content/images/size/w1000/2021/11/image-57.png 1000w, https://p2p.org/economy/content/images/2021/11/image-57.png 1138w" sizes="(min-width: 720px) 720px"></figure><p>2. If properly inputed, the next step is to connect to the mainnet network. Use the following command: "./vegawallet service run --network mainnet1". </p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2021/11/image-48.png" class="kg-image" alt loading="lazy" width="1214" height="31" srcset="https://p2p.org/economy/content/images/size/w600/2021/11/image-48.png 600w, https://p2p.org/economy/content/images/size/w1000/2021/11/image-48.png 1000w, https://p2p.org/economy/content/images/2021/11/image-48.png 1214w" sizes="(min-width: 720px) 720px"></figure><p>Now that you have successfully created your wallet and connected to the network, you are ready to stake your VEGA! Make sure you keep the terminal open to stake in the next stage. </p><h3 id="iii-stake-your-vega"><br>III. <u>Stake your VEGA</u><br> </h3><p>1. Go to the Vega staking website (<a href="https://token.vega.xyz/?ref=p2p.org" rel="nofollow noopener noreferrer">https://token.vega.xyz</a>), it is best to use <em>Google Chrome</em>. Make sure to disable brave shield if you are going to use the <em>Brave</em> browser. </p><p>To disable brave shield select the lion in the url as shown in the image below. </p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2021/11/image-21.png" class="kg-image" alt loading="lazy" width="1632" height="70" srcset="https://p2p.org/economy/content/images/size/w600/2021/11/image-21.png 600w, https://p2p.org/economy/content/images/size/w1000/2021/11/image-21.png 1000w, https://p2p.org/economy/content/images/size/w1600/2021/11/image-21.png 1600w, https://p2p.org/economy/content/images/2021/11/image-21.png 1632w" sizes="(min-width: 720px) 720px"></figure><p>You can then disable the shield by clicking on the toggle. </p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2021/11/image-27.png" class="kg-image" alt loading="lazy" width="722" height="642" srcset="https://p2p.org/economy/content/images/size/w600/2021/11/image-27.png 600w, https://p2p.org/economy/content/images/2021/11/image-27.png 722w" sizes="(min-width: 720px) 720px"></figure><p>2. At the top of the page you will find the staking section. Select "Staking”. </p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281124/6fb380adab9f5b989dfdd460/RLBrrgu1kgIfnyxGukw9idqS870iuZ6B3dtH9Us48Wqwsvq_l5RgaC-P8jyYdK_rR2f0U3dYtaXSIOfG66y8ydY0E2rVev2qgyMQdc31KG1_eK7crcb4OpzHc2G5jRpsCH0dpnUD" class="kg-image" alt loading="lazy"></figure><p>3. The first step is to connect your Ethereum and Vega wallet. To connect your Ethereum wallet select "Connect to an Ethereum wallet". Here you will be prompted by Metamask to connect your wallet.</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281130/4022268cc4dd287f1d10cffa/g4C7h2QpVVzUN35pzGVbKhnW0NNbybR6cEw8jD_CKra5JB0_-3mZpezvN-0sBDdTHjnfIjHRauyPFtYfNKkuMqAGaXGqnnr7CnEYqld_9u1ZBRfIHSkWPc9odQ8uRIPFGJiXC7yQ" class="kg-image" alt loading="lazy"></figure><p>Next, to connect your Vega Wallet, select "Connect to see your VEGA balance".</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281138/e1be38b405b90d966eac045f/n0POHur9Rbz13N3t8yWrMGoesCqN6fGGEktmFvzfW9MYQMGYD_F883De6rK1mxARygm6aYTWy5QS9jjdR8294ducuT_koQUxHaFsK3008rjDmd2DrND1HBM1OloipRieIhf1n2IP" class="kg-image" alt loading="lazy"></figure><p>You must enter your username and passphrase that you chose when the wallet was created.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2021/11/Screenshot-2021-11-17-at-17.24.25-1.png" class="kg-image" alt loading="lazy" width="1312" height="806" srcset="https://p2p.org/economy/content/images/size/w600/2021/11/Screenshot-2021-11-17-at-17.24.25-1.png 600w, https://p2p.org/economy/content/images/size/w1000/2021/11/Screenshot-2021-11-17-at-17.24.25-1.png 1000w, https://p2p.org/economy/content/images/2021/11/Screenshot-2021-11-17-at-17.24.25-1.png 1312w" sizes="(min-width: 720px) 720px"></figure><p>4. The next step is to associate tokens with your VEGA wallet. Select "Associate tokens with a VEGA wallet".</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281154/013632bb6c1a03f7752cd4a6/rt_cA0_JPwF4Fp_VgqbvvdsLvHmCafykZ4BVpkmTM9Cm18szjAqvrfiGsD_eUtQIS8E8XyUAPbRb59ohph2SFojw6ciu6fnPa_gFFOYnmJMx1ymPfi7JxwzVJwyk3nd1pWwshn-p" class="kg-image" alt loading="lazy"></figure><p>5. Here you need to (a) select "Wallet", (b) verify that this is your public key, and (c) select the amount that you would like to stake. To move to the next step select "Approve VEGA tokens for staking on Vega".</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281164/f63133029050714649bb87af/yvRXUnrC72GaH2l6VcpfiZxYu08oeHLlMh3j73elyAEiTrSqO1MBmLsCpThrmdL7MgFVYUz7VfSYIoLw2NtdlzSn5o4Jhw3wMyo1scPYK1K9_Lg_MtdhmTFkPmmYvaDPOpZztoTL" class="kg-image" alt loading="lazy"></figure><p>You will be prompted by Metamask, where you must confirm the transaction.</p><p>6. Once approved, you can associate your VEGA tokens with your key. Select "Associate VEGA Tokens with key".</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281170/214829ff1be9b604b53752fb/gA18urvfpVnUITulNgHmoD3Ld-We45lyaOFK2gj6n9VaeRQ-6F_f4wQChREmQM4hq_MJdiSP0DCFvAC6vMIgVbMZbQRph2FB5qqcE5_-FJl5Q0Pa3dMpDVzOdwEK6VNx6mHhICPK" class="kg-image" alt loading="lazy"></figure><p>You will be prompted by Metamask again, where you can confirm the transaction. You will have to wait for a sufficient amount of block confirmations on the Ethereum network.</p><p>7. Once approved, you can select "Nominate Stake to Validator Node" to nominate a validator.</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281176/452cecf6c36565a940b1568e/iMbCC3eDY3q1XyewdssBgMzQS3tc0dHoDzmvnbz2QWGfk5OYe7NYvydXxRcwEzEItd3c32BohYUeZ3qqGbUMCpiUw64MQyH-HVE6SuEy3wcPE3b2_Szt9ujYc_OOUc9nR-8gKaV_" class="kg-image" alt loading="lazy"></figure><p>8. You will now be asked which validator you wish to select. It's important to select a validator that you trust. You can find our validator addresses as well as more information about us on our<a href="https://p2p.org/vega?ref=p2p.org" rel="nofollow noopener noreferrer"> VEGA page</a>.</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281182/536394cca705f86bdf9c7bcf/R-Q1Yq2apFwRvxnhXIueOQqj6BOe8MJJEleHAQF45ihw5TO-XyTyqbteoW1-5JkaDf-A6-TCEsCcPbGUy3YOemNl6z5M2mLWaKiHpKjqMhP7O2r7gOgQRvi43L9m01rI7tZVdkqg" class="kg-image" alt loading="lazy"></figure><p>9. After selecting which validator you wish to stake with, go to the bottom of the page and find "Manage your stake". Select "Add" and input how much you would like to stake with this Validator.</p><figure class="kg-card kg-image-card"><img src="https://p2p-validator-fa82109e4cef.intercom-attachments-7.com/i/o/420281192/7b5a4ea46e0dd82c7be58dc7/4EPJG3IDMWhPI4pC2vZ0-9l5MfyLSwfda7Al9oLZse2PDTM6lCoch-JKvd6WasjHBFawdzPMTdrZ9PT5oGANBp8sjo6tk7bdCvNw35jWjegVjsZ51xXawQ08EADYCeoerhKYedmN" class="kg-image" alt loading="lazy"></figure><p>That's it! You have successfully created a nomination transaction to the validator of your choice. If you see that your stake in the next epoch has increased by the amount you submitted, you can close the website and terminal - it has been registered. </p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2021/11/image-55.png" class="kg-image" alt loading="lazy" width="1338" height="808" srcset="https://p2p.org/economy/content/images/size/w600/2021/11/image-55.png 600w, https://p2p.org/economy/content/images/size/w1000/2021/11/image-55.png 1000w, https://p2p.org/economy/content/images/2021/11/image-55.png 1338w" sizes="(min-width: 720px) 720px"></figure><p>Your stake will be active at the beginning of the next epoch. One epoch on the Vega network is currently configured to be 24 hours. An epoch is the period of time the network uses to manage the list of registered validator nodes and staking rewards payouts.<br><br>The APR for staking VEGA is variable and will depend on the % of the total VEGA supply that is staked. As with most staking services, the earlier phases provide the highest rewards. Vega are placing a fixed amount of VEGA into a treasury for staking rewards that will be distributed among the staked VEGA. Less staked VEGA to distribute it to, the higher the rewards per VEGA staked. The APR will become more stable once more VEGA is staked.</p><p>Thank you for using our guide! If you have any questions, need further help, or any feedback please reach out to us on<a href="https://t.me/P2Pstaking?ref=p2p.org" rel="nofollow noopener noreferrer"> Telegram.</a></p><hr><h3 id="useful-vega-resources"><strong><u>Useful VEGA resources</u></strong></h3><ul><li><strong><strong>Website:</strong></strong> <a href="https://vega.xyz/?ref=p2p.org">vega.xyz</a></li><li><strong>Token console: </strong><a href="https://token.vega.xyz/?ref=p2p.org" rel="noopener noreferrer">https://token.vega.xyz</a></li><li><strong>Trading Console:</strong> <a href="https://console.fairground.wtf/?ref=p2p.org" rel="noopener noreferrer">https://console.fairground.wtf/</a></li><li><strong>Network Overview<strong>: </strong></strong><a href="https://p2p.org/economy/vega-network-overview/">https://economy.p2p.org/vega-network-overview/</a></li><li><strong><strong>Whitepaper:</strong></strong> <a href="https://vega.xyz/papers/vega-protocol-whitepaper.pdf?ref=p2p.org">vega.xyz/papers/vega-protocol-whitepaper.pdf</a></li><li><strong><strong>Github:</strong></strong> <a href="https://github.com/vegaprotocol/?ref=p2p.org">github.com/vegaprotocol/</a></li><li><strong><strong>Twitter:</strong></strong> <a href="https://twitter.com/vegaprotocol?ref=p2p.org">twitter.com/vegaprotocol</a></li><li><strong><strong>Discord</strong>: </strong><a href="https://discord.com/invite/3hQyGgZ?ref=p2p.org">https://discord.com/invite/3hQyGgZ</a></li><li><strong><strong>Blog</strong></strong>: <a href="https://blog.vega.xyz/?ref=p2p.org">blog.vega.xyz/</a></li><li><strong><strong>Community:</strong></strong> <a href="https://community.vega.xyz/?ref=p2p.org">community.vega.xyz/</a></li></ul><hr><h3 id="about-p2p-validator"><strong><u>About P2P Validator</u></strong></h3><p><a href="https://p2p.org/?ref=p2p.org"><em><em>P2P Validator</em></em></a><em><em> is a world-leading <strong><strong>non-custodial staking provider</strong></strong> with the best industry practices and proven expertise. We provide comprehensive due-diligence of digital assets and offer only high class staking opportunities securing more than </em>4<em><strong><strong> billion of USD</strong></strong> value</em> a<em>t the time of the latest update</em>.</em><br><br><em><em>P2P Validator is <strong><strong>trusted by over </strong></strong></em><strong>24</strong><em><strong><strong>,000 delegators</strong></strong> across 25+ networks. We are a major player in all networks we support because of our experience, commitments and our <strong><strong>reputation</strong></strong>. We pay special attention to the process of <strong><strong>governance</strong></strong>.</em></em></p><hr><p><em><em>Want to stake VEGA with us? Visit </em></em><a href="https://p2p.org/vega?ref=p2p.org">https://p2p.org/vega</a><em><em> to find out more about Vega staking and our special offer.</em></em><br><br><em><em>If you have any questions, feel free to join our</em></em><a href="https://t.me/P2Pstaking?ref=p2p.org"><em><em> Telegram chat</em></em></a><em><em>, we are always open for communication.</em></em></p>

from p2p validator

<p><a href="https://p2p.org/?ref=p2p.org">P2P Validator</a> is excited to announce our upcoming launch of Vega staking. P2P will be joining the Vega Mainnet as node operators to increase network decentralization and support the security of the first network. </p><p><a href="https://vega.xyz/?ref=p2p.org">Vega</a> is a financial infrastructure protocol designed for developing and trading novel margin products on a decentralized network. Secured with PoS, Vega facilitates automated margin trading of complex products, allowing anyone to design and launch their own financial products.</p><p>By staking Vega with P2P Validator, users can earn rewards on their VEGA through our non-custodial staking infrastructure. There are two variables that define the staking rewards APR: the number of tokens in the network assigned for rewards, and how many VEGA will be locked up to secure the network. These factors are likely to be variable upon network launch and better defined APR estimates will be available shortly after staking begins. Rewards are paid every epoch (daily) to the separate, non-staking account. P2P has been selected as one of the first 13 validators and we are successfully running on testnet, to be one of the first validators to launch on the Vega mainnet.<br><br>For more information on how P2P can assist you with your Vega, please visit <a href="https://p2p.org/vega?ref=p2p.org">p2p.org/vega</a>.<br></p><!--kg-card-begin: markdown--><p> </p> <!--kg-card-end: markdown--><h3 id="about-p2p-validator">About P2P Validator</h3><p>The P2P team has extensive experience in setting up secure infrastructure. P2P Validator maintains high-availability nodes and provides secure staking services for the most groundbreaking projects in the blockchain space. The node infrastructure is under advanced monitoring with 24/7 technical support, backups and alerts. P2P currently supports more than $4 billion in staked value across more than 10,000 individual stakers and 25+ key PoS networks.</p>

from p2p validator