Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

Treasury managers face a paradox that costs billions annually.

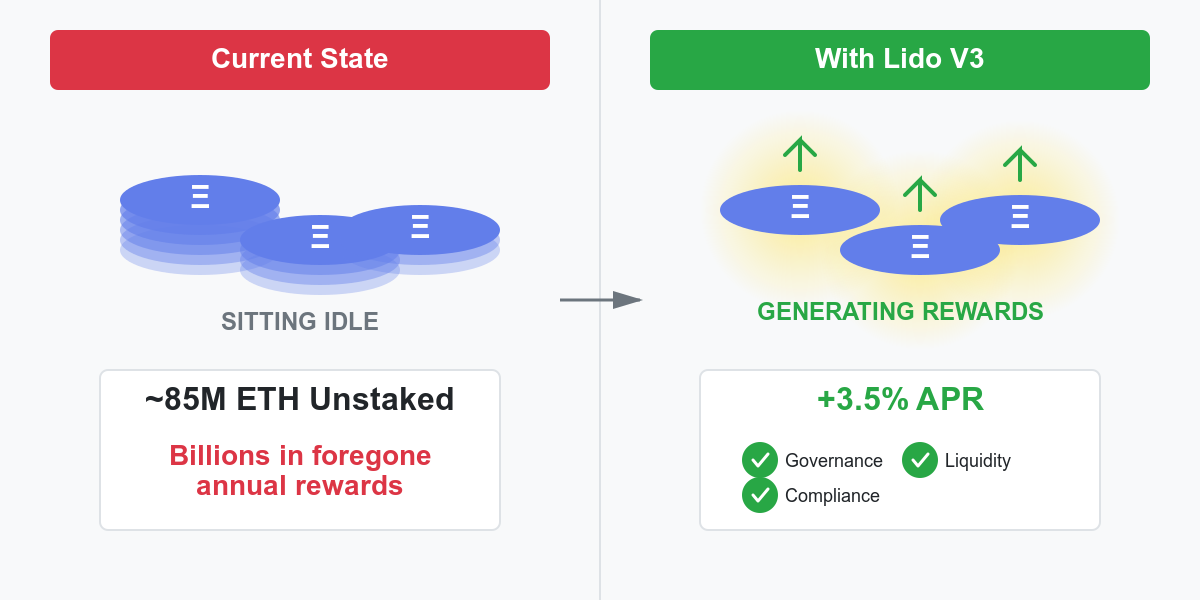

On one side: approximately 85 million ETH sitting unstaked — representing substantial institutional holdings sitting idle. On the other: staking rewards averaging 3-4% APR with institutional-grade security now available. In the middle: a gap where traditional staking solutions simply don't meet institutional requirements.

At P2P.org, we've meticulously built institutional staking infrastructure across 40+ networks, managing over $10B in staked assets. In strategy sessions with CFOs and treasury managers, we hear consistent themes: concerns about customization, compliance frameworks, operational control, and vendor risk management. These aren't theoretical obstacles — they're why institutional ETH remains largely unstaked while retail adoption flourished years ago.

Lido V3, expected to launch on mainnet in December 2025, will fundamentally change this equation. For the first time, institutions will be able to access customizable, compliant, and capital-efficient Ethereum staking without sacrificing the control and reporting capabilities their boards demand.

While mainnet launch is scheduled for December, aspects of the protocol are already live on the Holesky testnet, allowing institutional infrastructure providers like P2P.org to prepare implementation frameworks and conduct integration testing ahead of launch.

Let’s look at why Lido V3 represents a watershed moment for institutional staking, what specific capabilities matter most to treasury decision-makers, and how organizations can prepare for rapid deployment when V3 goes live.

Before Lido V3, institutional treasury managers faced an unappealing set of tradeoffs.

Solo staking offered maximum control but came with prohibitive operational complexity. Running your own validators means hiring specialized DevOps teams, maintaining 24/7 monitoring infrastructure, managing slashing risks, and dealing with the technical burden of Ethereum client updates. For a $100 million ETH position, the operational overhead typically exceeds $500K annually — assuming you can even recruit the specialized talent required.

Traditional liquid staking (including Lido V2) solved operational burden but introduced new institutional problems. The "one-size-fits-all" validator set meant no ability to customize for regulatory requirements. Treasury teams couldn't select validators based on jurisdiction, compliance certifications, or institutional relationships.Perhaps most critically, boards and compliance teams struggled with the lack of granular control and audit capabilities. The result? Billions in opportunity cost as institutional ETH remained unstaked.

1. Compliance Inflexibility

Standard liquid staking used democratically-selected validator sets. This works for retail but creates complexity for institutions under regulatory oversight. How does a Singapore-based fund ensure its validator set complies with MAS guidelines? For compliance teams, the answer was often: "We can't approve this structure."

2. Integration Friction

Enterprise treasury systems required substantial custom development to integrate with liquid staking protocols — 6-12 month implementation timelines and costs that rivaled first-year rewards benefits. CFOs reviewing proposals saw marginal business cases once implementation costs were factored in.

3. Control & Visibility Gaps

Boards expect detailed reporting and risk management capabilities. Previous solutions offered limited visibility into validator performance, no ability to customize fee structures, and minimal control over risk parameters. Treasury managers faced an impossible choice: full control with a massive operational burden, or operational simplicity with unacceptable control limitations.

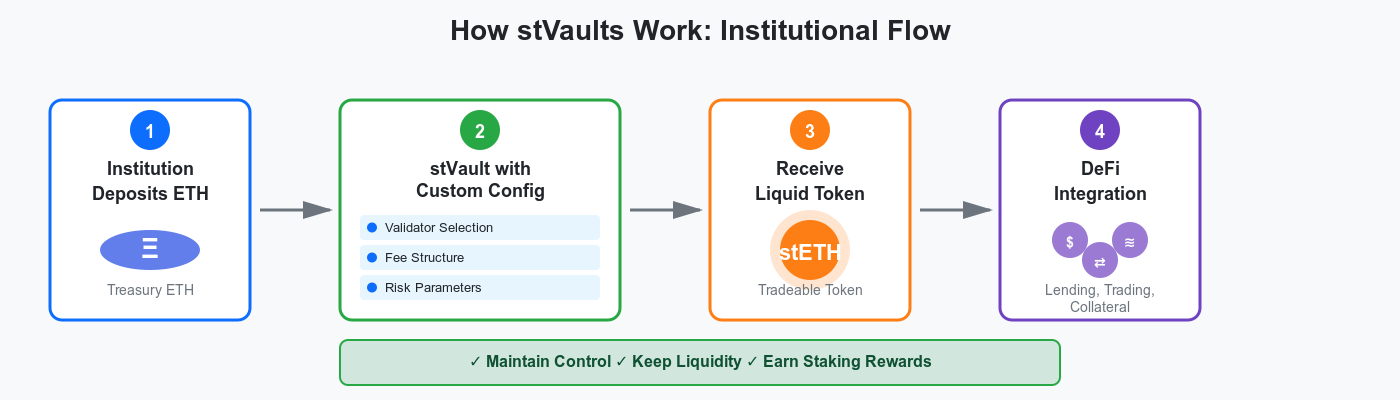

Lido V3 introduces stVaults — customizable staking vaults that bridge institutional requirements with liquid staking efficiency.

Think of stVaults as individually tailored staking configurations within the broader Lido protocol. Each stVault has its own validator set, fee structure, risk parameters, and integration specifications. Critically, stVault tokens remain liquid and can be used across DeFi, maintaining capital efficiency.

For institutional decision-makers, customization translates to four specific capabilities that traditional pooled staking cannot provide:

Validator Curation: Select from Lido's vetted operator set based on your criteria — jurisdiction, compliance certifications, institutional relationships, or performance history. A Singapore fund can build a vault exclusively with Asia-Pacific operators holding relevant certifications. A US institution can require validators with US presence and SOC2 compliance.

Risk Parameters: Set custom performance thresholds, diversification requirements, and operator limits aligned with your risk framework. Define maximum allocation per operator, minimum uptime requirements, or geographic diversification mandates — all enforced automatically via smart contracts.

Integration Specifications: Configure API access, reporting formats, and treasury system connections matching your existing infrastructure. Your custody platform, treasury management system, and reporting dashboards integrate via standardized endpoints rather than requiring protocol-specific custom development.

Governance Rights: Participate in vault-specific decisions independently from broader Lido governance. Your compliance requirements drive your vault's configuration, not protocol-wide governance votes that may not align with institutional needs.

This level of customization was previously available only through solo staking, at 10x the operational cost and complexity.

1: Compliance-Ready Architecture

The regulatory landscape for institutional crypto staking remains complex and jurisdiction-dependent. Lido V3's customization transforms this from a barrier into a manageable process.

With stVaults, a Singapore-based institution can create a validator set exclusively featuring operators in Singapore or Switzerland, maintaining MAS compliance while accessing liquid staking benefits. Need SOC 2 certifications from all operators? Want insurance coverage? These requirements encode directly into validator selection criteria.

stVaults provide vault-specific reporting that isolates your institution's activity from the broader protocol, simplifying audits and regulatory reporting. Rather than explaining how the entire Lido protocol works to auditors, you provide clear documentation of your specific vault configuration and performance history.

2: Treasury Integration Simplicity

Integration complexity has historically been one of the biggest barriers. Lido V3 addresses this through API-first design that meets treasury teams where they are.

stVaults provide standardized API endpoints that integrate with platforms like Fireblocks, Copper, or Anchorage Digital without protocol-specific custom development. Implementation timelines measure in weeks, not quarters.

At P2P.org, we've pre-built integrations with major custody platforms, reducing implementation from 6-12 months to 2-4 weeks. Your CFO's dashboard shows staking positions alongside traditional treasury positions with consistent formatting—no separate systems, no manual reconciliation.

3: Granular Risk Management

Sophisticated institutional investors require granular risk management capabilities and the ability to adjust strategies as conditions evolve.

stVaults allow institutions to set specific risk controls: maximum percentage per operator (e.g., no more than 10% with one validator), minimum performance thresholds (e.g., 99% uptime requirement), and automatic rebalancing triggers. These parameters execute automatically via smart contracts.

Unlike opaque staking solutions, stVaults provide granular performance data at the operator level. At P2P.org, our institutional clients receive quarterly performance reviews comparing each operator against network medians, enabling evidence-based strategy adjustments.

4: Transparent Cost Optimization

Unlike solo staking's hidden costs (infrastructure, personnel, software, monitoring tools), stVault fees are explicit and predictable. For a $100M position earning 3.5% APR ($3.5M annually), total fees might be $350K — far below the $500K+ required for solo staking infrastructure.

Beyond direct costs, capital efficiency advantages include: no 32 ETH validator minimums (deploy capital at any increment), immediate liquidity through stVault tokens versus withdrawal delays, no specialized hiring requirements, and eliminated single-point-of-failure risks from in-house infrastructure.

5: Institutional-Grade Infrastructure

stVaults only deliver value if built on a reliable infrastructure. Validator downtime directly impacts returns — for a $100M position, each percentage point of uptime below 99% costs approximately $35K annually in lost rewards.

At P2P.org, we operate institutional-grade validation infrastructure, managing $10B+ in staked assets across 40+ networks. Our institutional Lido V3 implementations leverage:

We've successfully onboarded institutional clients ranging from corporate treasuries to hedge funds, with positions from $10M to $500M+. Our integration team has pre-built connections to major custody platforms, reducing implementation timelines from months to weeks.

Market conditions have aligned to create an unprecedented opportunity for institutional Ethereum staking.

Regulatory Clarity Is Emerging

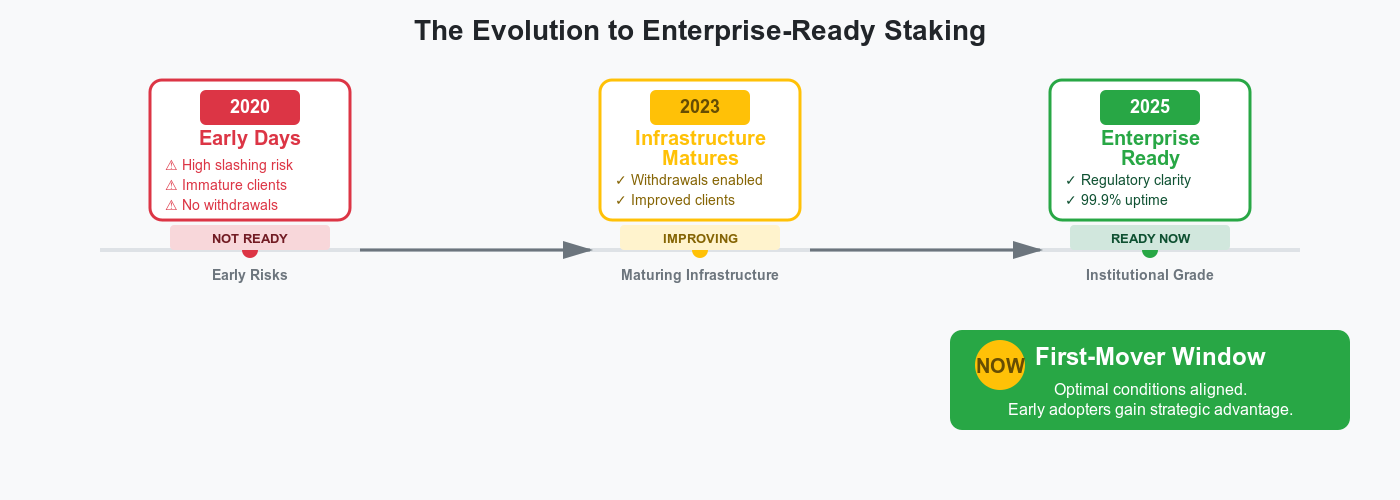

After years of uncertainty, regulatory frameworks for institutional crypto staking are solidifying. This regulatory maturation removes the primary barrier that kept institutional capital on the sidelines. Boards that previously couldn't approve staking due to regulatory uncertainty now have frameworks for compliant participation.

Infrastructure Has Reached Enterprise Standards

The early days of Ethereum staking featured high slashing rates and operational complexity that made institutional participation impractical. The infrastructure landscape has transformed — client software is mature and battle-tested, professional operators deliver 99.9%+ uptime as standard, sophisticated monitoring prevents incidents, and withdrawal capabilities (enabled in 2023) eliminate forced illiquidity.

First-Mover Advantages Matter

Institutions deploying capital into staking today gain strategic advantages, including optimal fee negotiations with operators eager to win large, stable deposits, operational learning curves that enable faster scaling, and strategic relationships with leading infrastructure providers that develop over time.

The institutional staking landscape has fundamentally transformed. Where treasury managers once faced impossible tradeoffs between control and operational efficiency, Lido V3 provides a clear path forward: customizable, compliant, capital-efficient staking that meets institutional requirements without sacrificing the benefits that make liquid staking attractive.

Are you a treasury team ready to explore the opportunities that Lido V3 opens?

Contact us to book a 45-minute strategy session with our institutional team. We'll review your specific requirements, answer technical and compliance questions, and outline a realistic implementation timeline tailored to your organization.

<h3 id="at-a-glance">At a Glance:</h3><ul><li>Billions in crypto are sitting idle. Our latest research finds over $200B in stablecoins, ETH, and protocol rewards remain unproductive.</li><li>The opportunity cost is massive. Unstaked ETH alone misses out on <strong>3–5% annual rewards</strong>, and billions in unclaimed yields go unrecovered each year.</li><li>Account Abstraction (AA) could unlock this capital by automating staking, restaking, and reward compounding — turning wallets into self-managing financial engines.</li></ul><p><strong>Crypto has a hidden inefficiency. </strong>Despite maturing into a multi-trillion–dollar asset class, billions of dollars in stablecoins, ETH, and protocol rewards remain idle — sitting in wallets, exchanges, or unclaimed balances earning nothing.</p><p>Our latest research, <em>The Idle Assets Report</em>, quantifies the scale of this “dead money” and explains how Account Abstraction (AA) can turn it into productive capital.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://link.p2p.org/18ae4b?ref=p2p.org" class="kg-btn kg-btn-accent">Download the Idle Assets Report</a></div><h3 id="the-scale-of-the-problem"><strong>The Scale of the Problem</strong></h3><ul><li>Stablecoins: Over $300B in circulation, with the majority sitting idle and earning 0%</li><li>Ethereum: Only 28% of supply (~35M ETH) staked; 70% remains unstaked, missing 3–5% annual rewards </li><li>Restaking: Just 25–30% of stakers have adopted EigenLayer</li><li>Unclaimed rewards: Billions lost each year to friction, gas fees, and complexity.</li></ul><p>In total, more than $200B sits dormant—a massive pool of underutilized capital that weakens network security, liquidity, and reward generation.</p><h3 id="why-so-much-crypto-stays-idle"><strong>Why So Much Crypto Stays Idle</strong></h3><p>Earning yield in crypto still requires manual effort. Users must move assets across dApps, stake and restake, claim rewards, and manage gas. Institutions face similar friction — regulatory complexity, fragmented infrastructure, and risk concerns.</p><p>As a result, most assets stay where they are: static.</p><h3 id="account-abstraction-the-unlock"><strong>Account Abstraction: The Unlock</strong></h3><p>Account Abstraction (via ERC-4337 and EIP-7702) makes wallets programmable, enabling reward automation, restaking, and payments to run in the background.</p><ul><li>Stablecoins can earn network rewards by default.</li><li>ETH can be staked or restaked in one click.</li><li>Rewards can auto-compound.</li><li>Recurring payments can be funded from reward streams.</li></ul><p>This is how wallets evolve from storage to <em>self-managing financial engines</em> — and how billions in idle crypto can be reactivated.</p><h3 id="regional-dynamics"><strong>Regional Dynamics</strong></h3><ul><li>U.S.: Regulatory clarity (GENIUS Act, SEC guidance) is driving demand for compliant yield.</li><li>APAC: The fastest-growing crypto market, led by Hong Kong and Singapore’s stablecoin frameworks.</li><li>LATAM: Over 50% of crypto transactions in Argentina and Brazil involve stablecoins — mostly sitting idle.</li></ul><p>Every region faces the same problem: huge adoption, low activation.</p><h3 id="the-path-forward"><strong>The Path Forward</strong></h3><p>If just 25% of idle assets were mobilized, it would unlock $80–100B in active capital. A 50% activation scenario would exceed $150B — the next real growth phase for crypto.</p><h3 id="read-the-full-report"><strong>Read the Full Report</strong></h3><p>P2P.org’s <em>Idle Assets Report</em> explores these dynamics in detail — with market data, regional breakdowns, and more.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://link.p2p.org/18ae4b?ref=p2p.org" class="kg-btn kg-btn-accent">Download the Idle Assets Report</a></div>

from p2p validator

<h3 id="at-a-glance"><strong>At a Glance:</strong></h3><ul><li>Over $5B in Canadian staked digital assets are held with U.S. custodians, outside our jurisdiction.</li><li>Canadian solutions are expensive and introduce regulatory complexity.</li><li>The Balance and P2P.org integration offers a pathway for Canadian institutions to stake Ethereum while maintaining their assets in Canada, with full legal title and control throughout.</li></ul><p></p><p>For years, Canadian institutions wanting to stake digital assets at scale faced a complex trilemma: use Canadian platforms and lose legal asset title, move assets out of Canadian custody and into U.S.-controlled platforms, or miss out on staking rewards entirely.</p><p>In time, over $5 billion of staked Canadian digital assets ended up sitting with U.S. custodians. Starting today, they can come home and enjoy consensus rewards without sacrificing security or sovereignty.</p><p>Balance and P2P.org have integrated their platforms to enable institutions to stake within a Canadian custody framework, with Ethereum as the choice asset to start and more to follow. This brings together Balance's world-class safekeeping technology with P2P.org's $10+ billion staking infrastructure.</p><p>Through this integration, Balance’s clients can stake ETH securely from their existing offline or warm custody wallets via P2P.org, without taking needless operational risk or compromising on compliance.</p><h2 id="the-northern-gateway-why-canadian-institutions-are-switching">The Northern Gateway: Why Canadian Institutions Are Switching</h2><p> While Canadian institutions hold billions in crypto, the reliance on U.S. custodians for getting access to a diverse array of staking providers results in high fees, increased regulatory complexity, and brings about concerns around sovereignty. Balance changes this equation.</p><p> As a qualified Canadian custodian with a fully proprietary technology stack, Balance offers what U.S. and even some local custodians can't: true safekeeping of staked assets on Canadian soil and under exclusive Canadian jurisdiction.</p><p><strong>P2P.org brings the performance:</strong></p><ul><li>99.9% uptime across 90,000+ validators</li><li>Zero slashing events recorded so far. </li><li>Currently securing $10+ billion across 40+ blockchain networks.</li><li>Constant top 3 efficiency on Rated.network's RAVER metric — ahead of 98% of global validators.</li></ul><p>Balance has been a pioneer in Canada’s digital asset space since its inception, setting the standard for security, regulatory compliance, and institutional trust. As staking is an essential part of Ethereum, Canadian institutions need a tried and tested, compliant way to secure its consensus and earn rewards.</p><p>P2P.org operates one of the highest-performing Ethereum validator infrastructures globally, consistently ranking in the top 5 on <a href="https://rated.network/?ref=p2p.org"><u>Rated.network’s</u></a> RAVER efficiency metric. Our platform is non-custodial by design, meaning validator nodes cannot access client funds, mitigating operational and security risks.</p><p>Together, Balance and P2P.org are unlocking ETH staking at true institutional scale.</p><h2 id="stake-eth-without-leaving-secure-custody"><strong>Stake ETH Without Leaving Secure Custody</strong></h2><p>For many institutions, secure custody is the cornerstone of their journey in digital assets. Moving assets outside of custody to participate in staking often introduces unacceptable operational and compliance risks.</p><p>This integration changes that.</p><ul><li><strong>No asset movement:</strong> Stake directly from your Balance offline or warm wallets.</li><li><strong>Retain control and title:</strong> Assets remain in direct client control, with their full legal title at all times.</li><li><strong>Battle-tested infrastructure:</strong> P2P.org’s validators secure billions in ETH and are trusted by funds, DAOs, and treasuries worldwide.</li></ul><h2 id="built-for-institutional-performance"><strong>Built for Institutional Performance</strong></h2><p>This is more than just staking access. It’s <strong>staking at the highest performance levels</strong>:</p><ul><li>Consistent top 5 efficiency among Ethereum validators (Rated.network)</li><li>Geographically distributed infrastructure to reduce correlated downtime risk</li><li>Active participation in Ethereum protocol upgrades to stay ahead of operational best practices</li></ul><h2 id="the-leadership-viewpoint"><strong>The Leadership Viewpoint </strong></h2><p>"Canadian institutions have long faced trade-offs between maintaining domestic custody and participating in protocol-level staking. Through this integration with P2P.org, our clients can now initiate ETH staking from within a Canadian-first custody framework, aligning operational security with jurisdictional clarity. This represents a meaningful step forward in building digital asset infrastructure rooted in true institutional sovereignty."<br>— <strong>George Bordianu, co-founder and CEO - Balance</strong></p><p>”Balance didn't just want another staking integration, but to redefine what's possible for Canadian institutions. Their proprietary stack combined with our validator performance creates something unique: institutional-grade staking that's genuinely Canadian-controlled. When a large portion of institutional ETH holders globally are staking, Canadian institutions should have equal opportunities.”<br>— <strong>Artemiy Parshakov, VP of Institutions - </strong><a href="http://p2p.org/?ref=p2p.org"><strong><u>P2P.org</u></strong></a><strong> </strong></p><h3 id="get-started"><strong>Get Started</strong></h3><p>The integration is live. No waiting list. No complex onboarding.</p><p><strong>Balance’s clients can stake in as little as 1-2-3</strong>:</p><ol><li>Enable P2P.org as an Ethereum staking provider through your account manager.</li><li>Initiate staking directly from your Balance wallets.</li><li>Drag a slider to select your staking amount (minimum 32 ETH as per the protocol rules).</li></ol><h2 id="about-balance-custody"><strong>About Balance Custody</strong></h2><p><a href="http://www.balance.ca/?ref=p2p.org"><u>Balance</u></a> connects its clients to top-tier providers such as Attestant, BlockFills, DARMA and P2P.org through its digital asset rails, enabling them to stake, lend, and liquidate billions of dollars’ worth of assets directly from the comfort of Balance Trust Company, its qualified custodian. <a href="http://www.balance.ca/disclaimer?ref=p2p.org"><u>www.balance.ca/disclaimer</u></a></p><h2 id="about-p2porg"><strong>About P2P.org</strong></h2><p>P2P.org is one of the world’s leading staking infrastructure providers, operating validators across more than 50 networks with a focus on performance, security, and decentralization. We are trusted by top funds, DAOs, and treasuries to provide non-custodial, institutional-grade staking solutions.</p>

from p2p validator