Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeTo understand economical structure of Cosmos we should look closely at the key principles of the ecosystem, basic incentives for all different participants and possible influence of these principles on their behavior. Overall network purpose (mission) is satisfying the needs of ecosystem users by giving them an opportunity to provide their services in a decentralized manner with the ability to interoperate without centralized entities.

Cosmos network consists of application-specific blockchains (Zones) which can be designed differently depending on the utility purpose. All blockchains are interoperable within a single ecosystem connected through intermediary blockchains (hubs) that in fact replace centralized organizations by set of validators. As a separate blockchain each zone can have its own token to govern the private or public network and have its own set of validators but governance can decide that validators of the Cosmos hub will be required to validate additional zones.

Cosmos ecosystem utilizes Tendermint - practical byzantine fault tolerance (PBFT) consensus mechanism. It means that finalizing blocks depends on 2/3 plus one quorum of all validators agreed on the current state of the network in order to reach the consensus. There are three key groups of participants in Cosmos ecosystem. Each group has its own incentives and impact on the state of ecosystem.

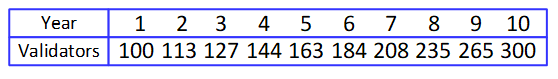

For Cosmos hub there are 100 possible validators, who are responsible for proposing new blocks and validating transactions. This number will rise by 13% a year until it reaches three hundred maximum possible validators. For other hubs and zones this number is not mandatory and will depend on the particular use case and required level of security. If there are more validators then the right to participate in consensus will have participants with the higher amount of ATOMs bonded.

Cosmos hub validators has the highest impact on network security and provide intercommunication between zones. They must actively participate in governance and are required to vote on every proposal otherwise their ATOMs are at the risk of being slashed (currently this feature is not active).

Tell me who are the validators and I will tell you if the network is safe

This group have enough knowledge and resources to maintain infrastructure and are interested in generating maximum long-term gains from ATOM inflation and transaction fees (about this later). That is why validators care about healthy and sustainable ecosystem development. They should act in interests of their delegators if they want to keep them loyal and increase the voting power in the long term.

This group consists of ATOM token holders who have not enough skills or resources to run and maintain the infrastructure but still want to increase the network security and earn a share of the transaction fees and inflationary reward by bonding tokens to the validators. It boosts the voting power of validator and frequency of being chosen as block proposer. In fact, by bonding ATOM to validator delegators choose one of the pillars of the ecosystem so their choice is very important and affects the level of decentralization.

Delegators are eligible for transaction fees and inflation reward as well but they have to pay commission, which vary within existing validators. There is no way for validators to steal bonded tokens but there are still other risks related with choosing the validator, which we will discuss later. Decisions based solely on a low commission rate is not always the best decision for delegators.

If we compare Cosmos network with the market, users are consumers and service providers. Developers, entrepreneurs and buyers who want to utilize the advantages of Cosmos ecosystem. Many different hubs can co-exist. To go further we can compare the network with a nation where there is a national hub with cities and zones each acting as smaller hubs within it and the possibility to join with the secure hub (Cosmos) if needed. Activity of this group measures the overall value of the network and can have a significant impact on demand for the token, transaction fees, workload and so on.

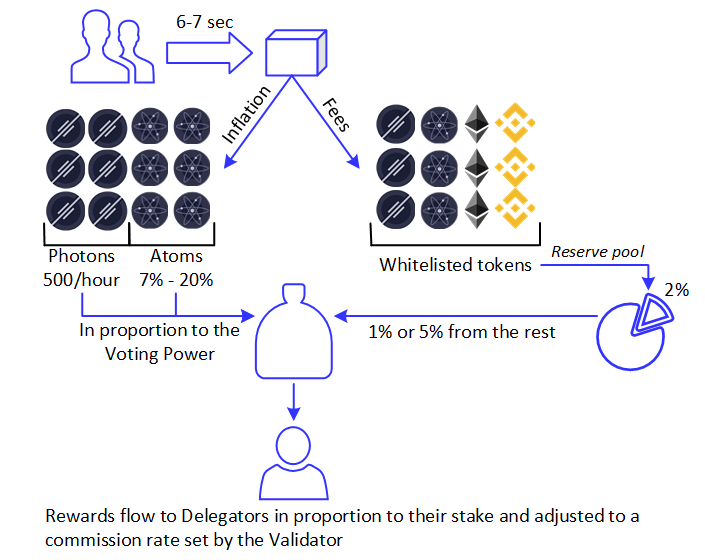

Cosmos hub economy relies on the inflationary approach. The target annual inflation rate represents the percentage from total supply that is changing each block. If the total bonded stake is less than 66% of the total ATOM supply, the inflation rate will slightly increase until it reaches a maximum of 20% or the total bonded stake climbs higher than 66%. In this case, the annual inflation will decrease to 7% depending on ATOMs participating in bonding. New tokens incentivize participants to secure the network. The more tokens locked via staking the higher the threshold for initiating a successful attack.

There are two fundamental streams of revenue for validators:

500 tokens per hour. Currently Photons are not available but could be activated with specific implementation and distribution method by the community via governance.1% or 5% depending on the number of precommits included. The frequency of proposing blocks is proportional to the voting power of a validator. Before fees distribution, 2% goes to a reserve pool. These funds can be spent on network development or other activities by voting.In some circumstances occurs slashing of bonded ATOMs. Penalties should increase the responsibility level of participants who are directly involved in decisions associated with network security. Validators have no control over delegator’s stake but if such an event happens both parties lose a percentage of their tokens. This is in order to prevent misbehavior and negligence from validators and bring incentives to delegators to diversify amongst them, perform proper due diligence and choose wisely.

5% and the validator who is responsible for that drops out of validators set. All ATOMs enter an unbonding (process of undelegating ATOMs from validator) period that lasts for 21 days and within this period the stake will not earn provisions and transaction fees.95% blocks in a row of 10000 due to inactivity, 0.01% of the bonded ATOMs will be lost and the validator will be jailed for 10 minutes without allowance to participate in consensus and be eligible for rewards.If slashing happens, it decreases stake and leads to fewer ATOMs paid as a reward.

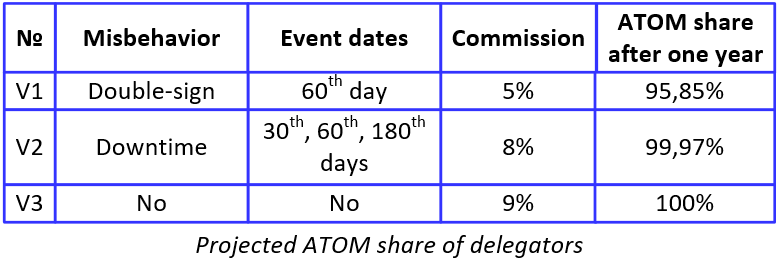

Let’s compare three imaginary validators. Assume that delegator bonded equal amount of ATOM to each. Slashing decreases the amount of stake thus meaning a proportional decrease in ATOM provisions since the event has taken place.

For example, validator 1 V1 was caught on a double sign and slashing occurred on the 60th day. After unbonding, the rest was staked with the same conditions to another one. Validator 2 V2 had three liveness slashes on the 30th day with a 2-day recovery period and an inability to fix the issue, on the 60th and 180th days being offline for one day each. Validator 3 V3 had no such events in place.

Overall results show that validator with a higher commission and honest behavior performed better than validators with stated slashing events. In this example we have not taken compounding into consideration. Every slashing event may decrease the confidence of delegators and may lead to immediate re-delegation to another validator. That will cause fewer commission rewards in ATOM for validator and can lead to inability to maintain secure infrastructure in future.

Every delegator is self-responsible for the financial decisions made. To choose the proper validator and understand misbehavior risks it is important to read the full conditions of the delegator agreement and find out the validator’s policy on this topic.

Do not forget to re-delegate your ATOM rewards in order to maximize profits and take advantage of the compounding.

P2P Validator offers high-quality staking facilities and provides up to date information for educational purposes. Stay tuned for updates and new blog posts.

Web: https://p2p.org

Stake ATOMs with us: https://p2p.org/cosmos

Twitter: @p2pvalidator

Telegram: https://t.me/p2pvalidator

Research & Analytics at p2p.org.

<h2 id="step-1-download-imtoken-wallet"><strong>Step 1. Download imToken wallet</strong></h2><p>Download imToken wallet for <a href="https://itunes.apple.com/us/app/imtoken2/id1384798940?ref=p2p.org">iOS</a> or <a href="https://play.google.com/store/apps/details?id=im.token.app&ref=p2p.org">Android</a>, securely save mnemonic phrase and password</p><h2 id="step-2-select-cosmos-and-transfer-your-atoms"><strong>Step 2. Select Cosmos and transfer your Atoms</strong></h2><ul><li>Select Cosmos from the list & copy your address</li><li>Transfer your Atoms to imToken wallet</li></ul><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/47861351251_5ecee94080_o.png" class="kg-image" alt loading="lazy" width="2000" height="1665" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/47861351251_5ecee94080_o.png 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/47861351251_5ecee94080_o.png 1000w, https://p2p.org/economy/content/images/size/w1600/2020/09/47861351251_5ecee94080_o.png 1600w, https://p2p.org/economy/content/images/size/w2400/2020/09/47861351251_5ecee94080_o.png 2400w" sizes="(min-width: 720px) 720px"></figure><h2 id="step-3-stake-your-atoms-and-get-rewards"><strong>Step 3. Stake your Atoms and get rewards</strong></h2><ul><li>Select “Staking” button to start delegating</li><li>Select “Validators” tab</li><li>Choose P2P Validator from the validator list</li><li>Enter the amount and press the “delegate” button.</li><li>Enter your password to confirm the delegation</li></ul><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/40894825453_44d5b3b78e_o.png" class="kg-image" alt loading="lazy" width="2000" height="644" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/40894825453_44d5b3b78e_o.png 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/40894825453_44d5b3b78e_o.png 1000w, https://p2p.org/economy/content/images/size/w1600/2020/09/40894825453_44d5b3b78e_o.png 1600w, https://p2p.org/economy/content/images/size/w2400/2020/09/40894825453_44d5b3b78e_o.png 2400w" sizes="(min-width: 720px) 720px"></figure><h1 id="congratulations-now-you-can-sit-back-and-watch-your-rewards-grow-"><strong>Congratulations! Now you can sit back and watch your rewards grow.</strong></h1><p>If after following this guide you still have questions, issues or other concerns please follow us on <a href="https://twitter.com/p2pvalidator?ref=p2p.org">Twitter</a>. We will provide a personal consultation and guide you through the following process.</p><p>Whether you chose to delegate your digital assets to P2P Validator or not, we welcome you to join our social channels, educational hub and use our DApps, all of which will be open-source.</p><p><strong><strong>Public website:</strong></strong> <a href="https://p2p.org/?utm_source=lunie_post&utm_medium=creds_link&utm_campaign=blog">p2p.org</a></p><p><strong><strong>Medium:</strong></strong> <a href="http://medium.com/p2peconomy?ref=p2p.org">medium.com/p2peconomy</a></p><p><strong><strong>Twitter:</strong></strong> <a href="http://twitter.com/p2pvalidator?ref=p2p.org">twitter.com/p2pvalidator</a></p><p><strong><strong>Telegram:</strong></strong> <a href="http://t.me/p2porg?ref=p2p.org">t.me/p2porg</a></p>

from p2p validator

<p>Lunie (previous name “Voyager”) is an official audited web wallet and UI for interacting with the Cosmos Hub. The process of sending, staking and redelegating atoms could be done in a simple and secure way. Lunie will not ask for your private keys or seed phrases. To interact with it you need to have Ledger device. Following this two-step guide will not take more than 5-10 minutes.</p><blockquote><em><em><strong><strong>Note:</strong></strong> If you participated in the fundraiser, you should be in possession of a 12-word mnemonic. When setting up a Ledger wallet, enter the seed phrase to access your digital assets obtained through an ICO. We advise you to connect a new Ledger device, in case of replacing the seed phrase on the working device, all data will be overwritten.</em></em></blockquote><h2 id="step-1-set-up-your-ledger"><strong>Step 1. Set up your Ledger</strong></h2><p>Download <a href="https://shop.ledger.com/pages/ledger-live?ref=p2p.org">Ledger Live</a> to update your Ledger device to the latest version (1.5.5) Press the “Settings” button in the top right corner</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/1-2.jpg" class="kg-image" alt loading="lazy" width="1599" height="210" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/1-2.jpg 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/1-2.jpg 1000w, https://p2p.org/economy/content/images/2020/09/1-2.jpg 1599w" sizes="(min-width: 720px) 720px"></figure><p>Turn on Developer mode</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/2-19.png" class="kg-image" alt loading="lazy" width="2000" height="1326" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/2-19.png 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/2-19.png 1000w, https://p2p.org/economy/content/images/size/w1600/2020/09/2-19.png 1600w, https://p2p.org/economy/content/images/size/w2400/2020/09/2-19.png 2400w" sizes="(min-width: 720px) 720px"></figure><p>Go to the Ledger Live App Store and download the Cosmos application</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/3-3.jpg" class="kg-image" alt loading="lazy" width="1598" height="439" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/3-3.jpg 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/3-3.jpg 1000w, https://p2p.org/economy/content/images/2020/09/3-3.jpg 1598w" sizes="(min-width: 720px) 720px"></figure><p>You will see a dialog window while the installation is processing, it can take a while</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/4-3.jpg" class="kg-image" alt loading="lazy" width="1023" height="542" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/4-3.jpg 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/4-3.jpg 1000w, https://p2p.org/economy/content/images/2020/09/4-3.jpg 1023w" sizes="(min-width: 720px) 720px"></figure><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/5-1.jpg" class="kg-image" alt loading="lazy" width="1599" height="759" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/5-1.jpg 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/5-1.jpg 1000w, https://p2p.org/economy/content/images/2020/09/5-1.jpg 1599w" sizes="(min-width: 720px) 720px"></figure><p>At the same time it will install on your Ledger</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/6-1.jpg" class="kg-image" alt loading="lazy" width="1024" height="768" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/6-1.jpg 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/6-1.jpg 1000w, https://p2p.org/economy/content/images/2020/09/6-1.jpg 1024w" sizes="(min-width: 720px) 720px"></figure><p>After successful finish, check that the Cosmos application appears on your Ledger</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/7-1.jpg" class="kg-image" alt loading="lazy" width="1024" height="768" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/7-1.jpg 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/7-1.jpg 1000w, https://p2p.org/economy/content/images/2020/09/7-1.jpg 1024w" sizes="(min-width: 720px) 720px"></figure><h2 id="step-2-connect-ledger-with-lunie-on-your-pc"><strong>Step 2. Connect Ledger with Lunie on your PC</strong></h2><ul><li>Go to the <a href="https://lunie.io/?ref=p2p.org">Lunie website</a></li><li>Choose “Staking” and find there P2P Validator</li></ul><p>Press “Sign in” in the top right corner</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/8-1.jpg" class="kg-image" alt loading="lazy" width="1599" height="849" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/8-1.jpg 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/8-1.jpg 1000w, https://p2p.org/economy/content/images/2020/09/8-1.jpg 1599w" sizes="(min-width: 720px) 720px"></figure><p>You will see a dialog window like in the picture - press “Sign in”</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/9.jpg" class="kg-image" alt loading="lazy" width="640" height="369" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/9.jpg 600w, https://p2p.org/economy/content/images/2020/09/9.jpg 640w"></figure><p>Lunie will connect to your Ledger and you will see Tendermint Cosmos appear on it</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/10.jpg" class="kg-image" alt loading="lazy" width="640" height="480" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/10.jpg 600w, https://p2p.org/economy/content/images/2020/09/10.jpg 640w"></figure><p>After that you can press “Delegate”. Your address can be found in the top left corner</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/11.jpg" class="kg-image" alt loading="lazy" width="639" height="290" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/11.jpg 600w, https://p2p.org/economy/content/images/2020/09/11.jpg 639w"></figure><p>Now you will be able to enter the amount of Atoms and finish the process by pressing “Next” and confirm the delegation.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/12.jpg" class="kg-image" alt loading="lazy" width="640" height="294" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/12.jpg 600w, https://p2p.org/economy/content/images/2020/09/12.jpg 640w"></figure><h2 id="congratulations-now-you-can-grow-your-holdings-and-earn-rewards-with-p2p-validator-hooray-"><strong>Congratulations! Now you can grow your holdings and earn rewards with P2P Validator, Hooray!</strong></h2><p>If after following this guide you still have questions, issues or other concerns please follow us on <a href="https://twitter.com/p2pvalidator?ref=p2p.org">Twitter</a>. We will provide a personal consultation and guide you through the following process.</p><p>Whether you chose to delegate your digital assets to P2P Validator or not, we welcome you to join our social channels, educational hub and use our DApps, all of which will be open-source.</p><p><strong><strong>Public website:</strong></strong> <a href="https://p2p.org/?utm_source=lunie_post&utm_medium=creds_link&utm_campaign=blog">p2p.org</a></p><p><strong><strong>Medium:</strong></strong> <a href="http://medium.com/p2peconomy?ref=p2p.org">medium.com/p2peconomy</a></p><p><strong><strong>Twitter:</strong></strong> <a href="http://twitter.com/p2pvalidator?ref=p2p.org">twitter.com/p2pvalidator</a></p><p><strong><strong>Telegram:</strong></strong> <a href="http://t.me/p2porg?ref=p2p.org">t.me/p2porg</a></p>

from p2p validator