Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

We’re thrilled to announce our collaboration with SSV Network, marking the inception of our DVT Staking API, the first of its kind in the industry.

This initiative seeks to amplify our institutional staking offering further, ensuring seamless integration for custodians, wallets, and cryptocurrency exchanges.

Since 2018, our mission has been to create a secure and efficient platform to onboard institutions for non-custodial staking solutions, particularly within the Ethereum ecosystem. Fast forward to 2023, our operations now extend over 50 networks, managing staked assets close to $2B with over 60,000 delegators. The unveiling of the DVT Staking API is another significant milestone in our ongoing journey, embodying our commitment to foster non-custodial staking at the institutional level.

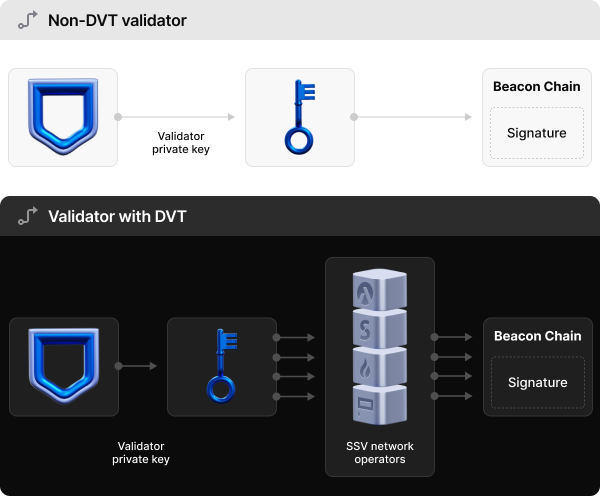

Distributed Validator Technologies (DVT) is pivotal in mitigating staking risks, offering a robust framework for managing digital assets and staking strategies. The resonance of DVT among institutions is profound, given its prowess in addressing key concerns such as counterparty and slashing risks, which are crucial in ETH Staking.

For an in-depth understanding and integration guide, we direct you to our staking API developer guides. The DVT Staking API is engineered for simplicity, offering a streamlined workflow to accommodate the diverse needs of custodians, wallets, and neo-banks. Our API acts as a bridge, simplifying the navigation of DVT staking and ensuring a seamless transition into decentralized staking. Our mission is to facilitate integration and offer cost-saving benefits to users who integrate with us.

The integration of DVT with our platform paves the way for a new era of Ethereum staking. Our platform provides a unique opportunity to stake directly with multiple institutional node operators, such as Allnodes, Stakely, and HTX, offering their own nodes operating on DVT. This initiative enables institutions to harness the full potential of decentralized staking through various experienced operators, each bringing a wealth of experience working with institutional entities, high-performance nodes, and best-in-class security practices to ensure node liveness. Our coordinated effort ensures a geographically distributed node operation with one node in the US, two in the EU, and one in APAC, significantly mitigating the risks associated with downtime due to country-specific incidents. Moreover, by supporting a broad spectrum of execution and consensus clients, we foster Ethereum client diversity, further eliminating reliance on the point of failure. This well-rounded approach significantly elevates the robustness and reliability of the P2Porg staking platform. It underscores our position as a leader in advancing the staking paradigm alongside industry leaders who share our vision.

Allnodes Founder & CEO Konstantin Boyko-Romanovsky told P2P.org, "Allnodes is dedicated to advancing the staking ecosystem, and our partnership with P2P.org through their DVT Staking API aligns with our commitment. We believe DVT represents a significant step forward in mitigating inherent staking risks like slashing and counterparty exposure - paramount concerns for ETH staking. The DVT framework complements our mission to deliver secure and efficient staking to institutions. By collaborating with P2P.org, we can integrate their healthy platform and progressive technology to benefit clients through a decentralized, resilient staking infrastructure. Our partnership is about more than enhancing our services; it's about shaping the future of institutional staking and contributing to a more secure, decentralized blockchain ecosystem."

Stakely Co-founder Ignacio Iglesias said, "Stakely's collaboration with P2P.org, employing Distributed Validator Technology (DVT) in the Ethereum staking ecosystem, marks a pivotal advancement towards a more secure and decentralized staking infrastructure, specially tailored for institutional clients. DVT aligns with our commitment to providing robust, non-custodial staking services for institutions by mitigating risks such as slashing and single-point failures through distributed key management. This approach ensures security and reliability and fosters decentralization by utilizing diverse Ethereum clients and operating across various geographical regions, further strengthening the resilience and integrity of the Ethereum network."

The Head of HTX Web3 Technology, Token Xi, stated: "HTX staking is committed to advancing the overall ETH stake ecosystem towards greater security and decentralization. Our collaboration with P2P.org in developing DVT StakeAPI aligns with our expectations for the positive growth of the entire industry ecosystem. As a deep partner of the official SSV, HTX has long supported the development of SSV, from testnet to mainnet, as a core validator node operator. Through the SSV network, we have reduced the risk of single points of failure, thereby better securing our users' assets. Additionally, the decentralized nature of SSV allows our users to enjoy the safety benefits of decentralization while promoting the decentralization of the entire ETH ecosystem."

Our collaboration with the ssv network has been long-running; as one of their Mainnet Verified Operators, we've been working closely with the ssv network to redefine Ethereum staking with the integration of DVT into the P2P.org platform via our new Staking API thanks to a grant awarded to us. The ssv network grant has been instrumental in developing and launching the DVT Staking API to advance institutional staking solutions at P2P.org. This integration propels our value proposition to institutional investors, framing us as the go-to platform for a diverse suite of staking services. You can learn more about our work as a Mainnet Verified Operator with an ssv network here!

The ease of integration and cost-efficiency is at the core of our DVT Staking API. It is not merely about staking; it's about creating an ecosystem that is accessible, secure, and beneficial to all stakeholders involved. Our API is designed to save substantial time and resources, accelerate your product offerings, and propel your business toward its staking goals. Our customer-centric dashboard allows you to effortlessly retrieve all the necessary information, consolidated within a user-friendly interface and real-time reporting.

If you'd like to discover more about the ease of integration for our DVT Staking API, you can find more in our documentation portal, here!

You can also contact a team member via our official Telegram account or book a demo and learn more about the DVT Staking API here!

The DVT Staking API is a testament to our relentless pursuit of innovation, redefining the contours of institutional staking. We welcome all institutions and businesses to leverage this novel Staking API to meet the demands of your current staking strategy and be well-prepared for tomorrow's decentralized landscape.

For further inquiries and discussions, feel free to reach out to us. Our team at P2P.org is here to assist you in every step of your staking journey.

Official P2P.org Telegram Channel: https://t.me/P2Pstaking

<p>We are excited to unveil an exciting <strong>new partnership between P2P.org and Matrixport, strategically designed to supercharge the growth of staking opportunities for institutional investors to engage in ETH staking.</strong> This collaboration seamlessly aligns with P2P.org's core mission of delivering secure and user-centric staking solutions. Moreover, it underscores our unwavering commitment to accelerating institutional adoption.</p><h3 id="whos-matrixport">Who's Matrixport?</h3><p>Matrixport is one of Asia's fastest-growing digital asset platforms that offers a comprehensive suite of crypto investment products and financial services. Its service includes tokenized real-world assets, prime brokerage, custody, spot OTC, fixed income, investment products, lending, and asset management. </p><p><strong>P2P.org’s infrastructure and platform now power Matrixport’s groundbreaking and hassle-free staking product.</strong> Clients' deposited ETH will be 100% staked through P2P.org. </p><p>Our mutual aspiration is to actively propel the adoption of institutional staking and move the ecosystem forward, ensuring its continuous growth and evolution. The shared vision revolves around simplifying user access to diverse financial products via decentralized technology. </p><h3 id="enhanced-staking-and-security-with-p2porg">Enhanced Staking and Security with P2P.org</h3><p>Your security is our top priority. At P2P.org, we take a dual-layered approach to protect a client's digital assets. We also have stringent security measures, such as cutting-edge encryption protocols and multi-signature wallets.</p><p>Our commitment to protecting your stake, even in worst-case scenarios, sets us apart. Our fail-safe mechanisms, like smart contracts, ensure you can permanently unlock and access your assets.</p><p>Together with Matrixport, we are committed to delivering a seamless, secure, and efficient path for institutional Ethereum staking opportunities.</p><h3 id="contact-us">Contact us</h3><p>For in-depth insights into staking with Matrixport and leveraging P2P.org's robust security features, contact <a href="https://www.matrixport.com/institutions/get-in-touch?ref=p2p.org">Matrixport</a> or connect with our customer service teams on Telegram at <a href="https://t.me/P2Pstaking?ref=p2p.org">https://t.me/P2Pstaking</a>.</p>

from p2p validator

<p>Having all MEV relays connected to the validator is already a widespread industry practice. Every operator utilizes it to collect more bids and extract more MEV rewards. But is it maximum?</p><p>The team at <a href="http://p2p.org/?ref=p2p.org">P2P.org</a> constantly explores new opportunities and technologies to increase staking yield. We are thrilled to announce that we have made a step forward to MEV maximization, <strong>allowing our clients to extract an additional 10% more from block rewards*.</strong></p><p>Let’s dive into how our team has been able to achieve this as one of the first staking validators in the industry.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://p2p.org/start?utm_source=blog&utm_medium=article_mev&utm_campaign=brewards" class="kg-btn kg-btn-accent">Get special offer for ETH staking!</a></div><h3 id="exploring-opportunities">Exploring opportunities</h3><p>The validator has four seconds from the beginning of its slot to create, sign, and propagate the block to the network. By default at 0.0 sec validator requests bids from connected MEV relays, waiting some time for response, chooses the most profitable one and sign it. </p><p>But what if some builder finds a new MEV opportunity with a higher bid a little later than the start of the slot? Likely, validator will lose this opportunity.</p><p>We observe numerous examples when bids increased drastically during the first seconds of the slot. There are cases when the bid has risen from 0.05 to 300 ETH. Charts below demonstrate it.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/11/Untitled-9.png" class="kg-image" alt loading="lazy" width="1658" height="720" srcset="https://p2p.org/economy/content/images/size/w600/2023/11/Untitled-9.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/11/Untitled-9.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/11/Untitled-9.png 1600w, https://p2p.org/economy/content/images/2023/11/Untitled-9.png 1658w" sizes="(min-width: 720px) 720px"></figure><div class="kg-card kg-callout-card kg-callout-card-red"><div class="kg-callout-emoji">🧐</div><div class="kg-callout-text">Every 4th block, reward increases more than 10% during the 1st second</div></div><h3 id="why-do-builders-increase-their-bids-over-time">Why do builders increase their bids over time?</h3><p>Let's delve a bit deeper to understand why builders increase their bids over time. The general reasons are as follows:</p><ul><li>Builders strive for inclusion and need to raise their stakes to outperform competitors in a dynamic block auction occurring on relays.</li><li>The market landscape updates more frequently than the Ethereum block time, causing the potential extracted value to fluctuate as time passes and more information/order flow becomes available.</li></ul><p>Several examples illustrate these points:</p><ul><li>A new DEX swap in the mempool creates a new MEV opportunity.</li><li>Changes in the USDC/ETH price on some centralized exchanges (CEX) just after the slot starts can lead to arbitrage opportunities on decentralized exchanges (DEX) before they disappear in the next slot.</li></ul><h3 id="looking-for-the-golden-mean-in-delaying-mev-request">Looking for the golden mean in delaying MEV request</h3><p>Historical data shows that waiting more time before requesting MEV may increase block rewards up to 15% on average. </p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/11/Untitled--1-.png" class="kg-image" alt loading="lazy" width="1868" height="998" srcset="https://p2p.org/economy/content/images/size/w600/2023/11/Untitled--1-.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/11/Untitled--1-.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/11/Untitled--1-.png 1600w, https://p2p.org/economy/content/images/2023/11/Untitled--1-.png 1868w" sizes="(min-width: 720px) 720px"></figure><p>However we can’t delay the MEV request too much for two reasons:</p><ol><li>The validator has 4 seconds to request/receive bids, sign the block, and send it to the MEV relay, leaving enough time for block propagation within the network. High delay in MEV request shifts block propagation and can lead to block misses.</li><li>Late blocks due to high delay will lead to an increased number of forks and reorgs since some nodes won’t receive new blocks timely.</li></ol><p>Speaking about the second point, the plot below shows that 95% of blocks utilize bids submitted before 1.1 sec. Having that, we have about <a href="https://reorg.pics/?ref=p2p.org">0.1% reorgs currently</a>. Increasing MEV requesting delay too much may increase the number of reorgs drastically.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/11/Untitled--2-.png" class="kg-image" alt loading="lazy" width="1968" height="994" srcset="https://p2p.org/economy/content/images/size/w600/2023/11/Untitled--2-.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/11/Untitled--2-.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/11/Untitled--2-.png 1600w, https://p2p.org/economy/content/images/2023/11/Untitled--2-.png 1968w" sizes="(min-width: 720px) 720px"></figure><p>P2P.org team has conducted enhanced experiments and infra optimisations to find a golden mean between maximizing block rewards and staying healthy for the network (not producing missed or late blocks). </p><p>This allowed us to roll out the MEV Maximizer feature for our clients, the first of its kind in the industry.</p><h3 id="maximizing-rewards">Maximizing rewards</h3><p>MEV Maximizer feature allows validators to catch larger MEV rewards. Chart below demonstrates a few examples of the block rewards increase for the particular slots:</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/11/image-11.png" class="kg-image" alt loading="lazy" width="1942" height="978" srcset="https://p2p.org/economy/content/images/size/w600/2023/11/image-11.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/11/image-11.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/11/image-11.png 1600w, https://p2p.org/economy/content/images/2023/11/image-11.png 1942w" sizes="(min-width: 720px) 720px"></figure><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/11/image-9.png" class="kg-image" alt loading="lazy" width="1960" height="1020" srcset="https://p2p.org/economy/content/images/size/w600/2023/11/image-9.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/11/image-9.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/11/image-9.png 1600w, https://p2p.org/economy/content/images/2023/11/image-9.png 1960w" sizes="(min-width: 720px) 720px"></figure><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/11/image-10.png" class="kg-image" alt loading="lazy" width="1960" height="1020" srcset="https://p2p.org/economy/content/images/size/w600/2023/11/image-10.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/11/image-10.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/11/image-10.png 1600w, https://p2p.org/economy/content/images/2023/11/image-10.png 1960w" sizes="(min-width: 720px) 720px"></figure><div class="kg-card kg-callout-card kg-callout-card-red"><div class="kg-callout-emoji">🔥</div><div class="kg-callout-text"><strong>10% more block rewards</strong> - that is what our clients already get*</div></div><p>It's fair to mention that not every block shows such a significant increase in rewards, and the 10% block rewards increase was gotten for randomized sample of 4000 blocks comparing value of maximum bids change over time for discovered slots and initial bids at 0.0 slot time. A client with only a few validators due to a low number of proposed blocks may be unlucky and receive zero increase, or conversely, they may receive an extra-large MEV of 10 ETH or more.</p><p>Speaking about yield, block rewards (or execution rewards) account for 30% of total rewards, increasing APR by <code>10% x 30% = 3%</code> from 4.20% to 4.33% currently. So, if you have 250 validators, you can expect to receive an additional ±10 ETH in rewards per year, the calculations are the following <code>250 validators x 32 ETH x 0.13 % extra APR</code> .</p><p>Stake with <a href="http://p2p.org/?ref=p2p.org">P2P.org</a> to get early access to the newest technologies & unique perks, increasing your revenue.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://eth.p2p.org/auth?utm_source=blog&utm_medium=article_mev&utm_campaign=hrewards" class="kg-btn kg-btn-accent">Stake ETH with P2P.org in 1 click</a></div><h3 id="other-exclusive-p2porg-perks">Other exclusive P2P.org perks</h3><ol><li><a href="https://p2p.org/economy/eigen-layer-restaking-with-p2p-org-guide/">Restaking with Eigen Layer</a>. 0.5%-5pp. APR increase expected after Eigen Layer rewardslaunch in Q3 2024. Stake with Eigen Layer now to book this opportunity <code>already available</code></li><li><a href="https://p2p.org/networks/ethereum?ref=p2p.org">Opt-in MEV relays</a>. Configure your validator to remain regulatory-compliant or support decentralization <code>already available</code></li><li><a href="https://p2p.org/economy/a-step-by-step-guide-using-the-p2p-org-eth-staking-app-on-safe/">Stake ETH with Safe</a>. The first-of-its-kind app on the Safe Apps Ecosystem allows users to quickly and easily direct stake ETH with just a few clicks while maintaining full custody of their assets. <code>already available</code></li><li>Distributed validator staking powered by SSV. Don’t trust <a href="http://p2p.org/?ref=p2p.org">P2P.org</a>, set up in 1 click a decentralized validator backed by the best operators: Allnodes, Stakely, Huobi and <a href="http://p2p.org/?ref=p2p.org">P2P.org</a>. <code>coming soon</code></li></ol><p>*The calculation is based solely on the methods shown above. Results calculated using other methods may differ, including on the low side. IN ANY CASE THERE ARE NO GUARANTEED EARNINGS.</p>

from p2p validator