Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

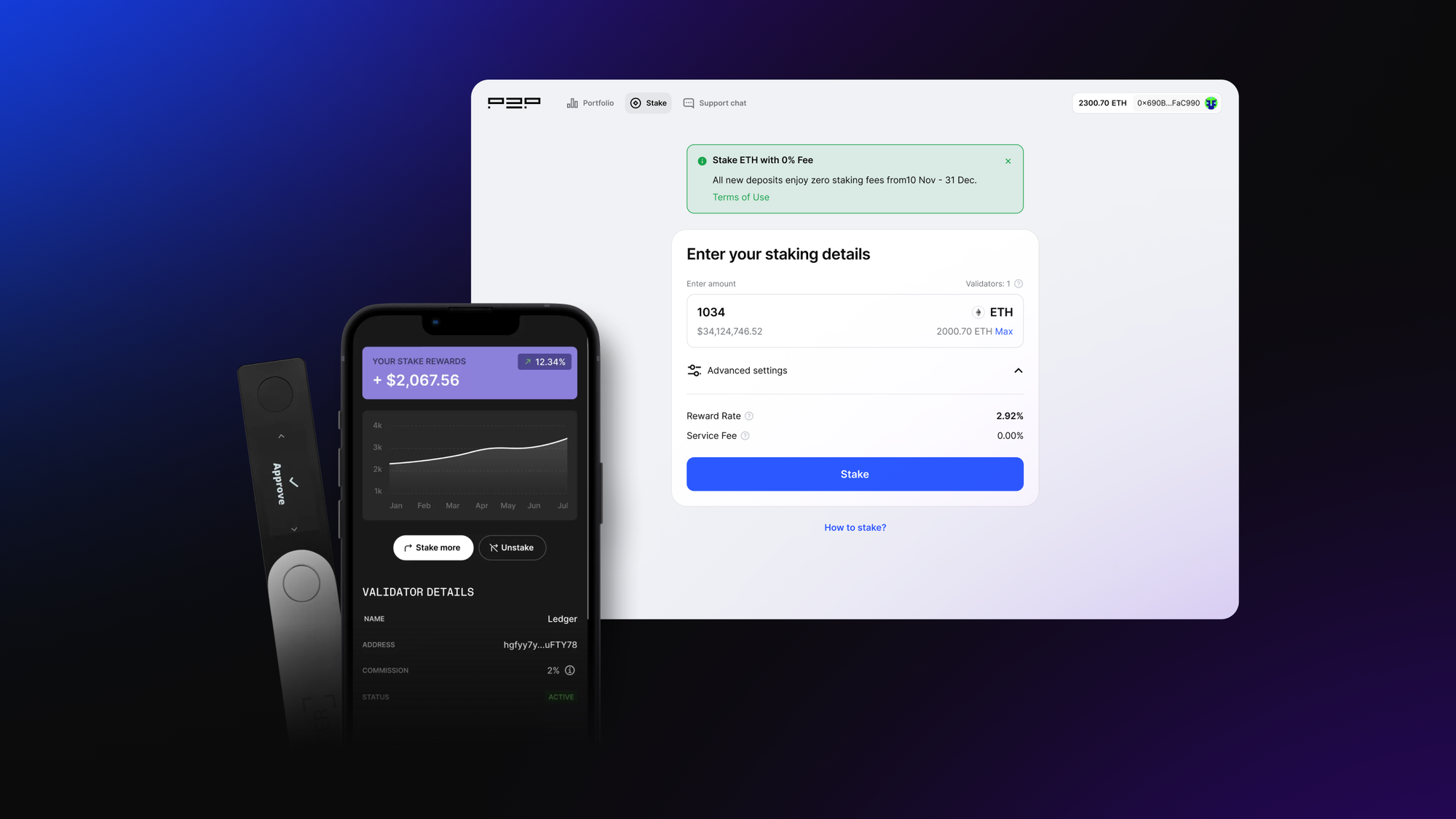

P2P.org brings Ethereum Pectra Staking to Ledger Wallet - powering 7 million users with the latest Ethereum upgrade.This means Ledger users can finally:

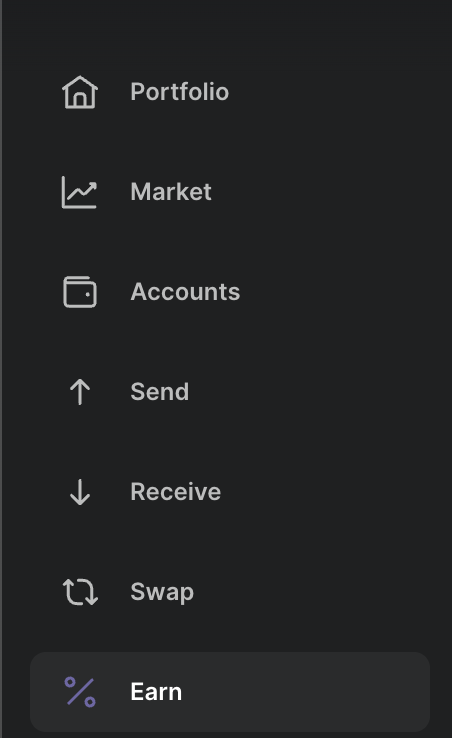

From the main sidebar in Ledger Wallet, select Earn.

(You’ll see this in the left navigation below Portfolio, Market, Accounts, Send, Receive, Swap.)

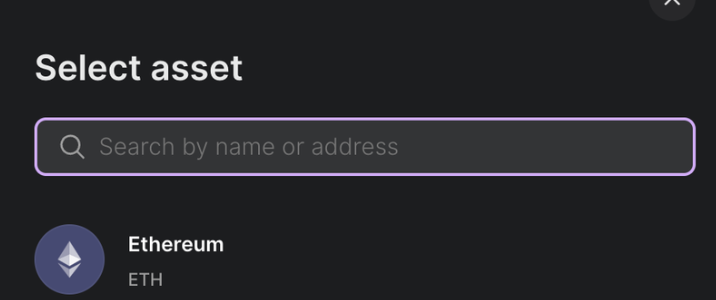

In the asset selector, pick Ethereum (ETH).

This takes you to the staking flow.

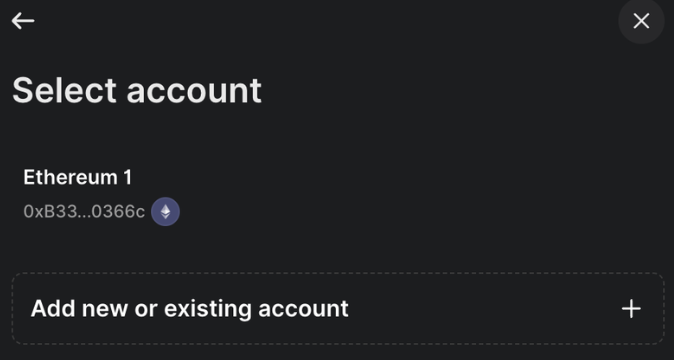

Ledger will show all your ETH accounts.Choose the account holding the ETH you want to stake.

If you need a new account, tap Add new or existing account.

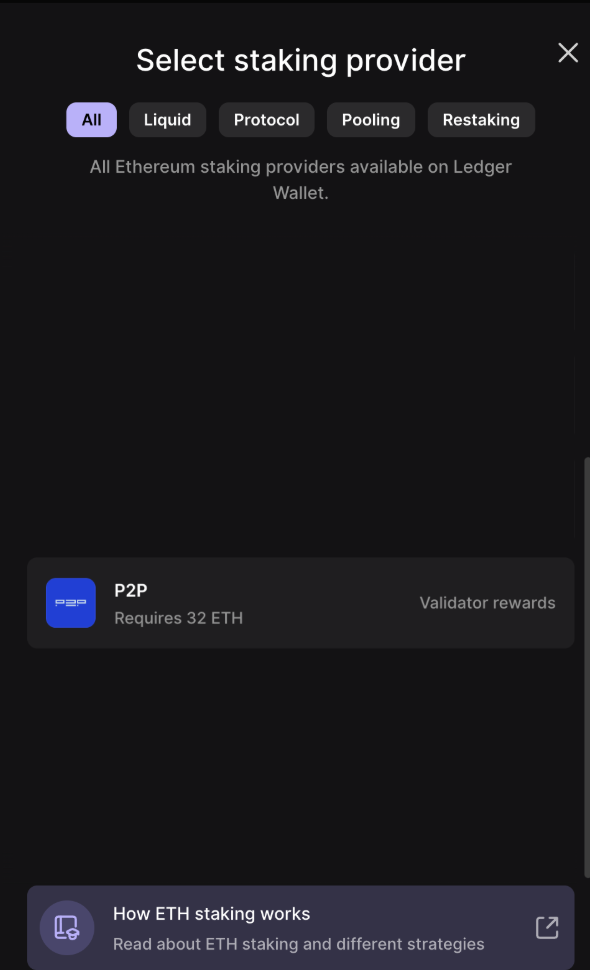

In the provider list, select P2P.

You’ll see it under the “All” tab with the label Validator rewards and a requirement of 32 ETH.

This begins the validator-staking flow.

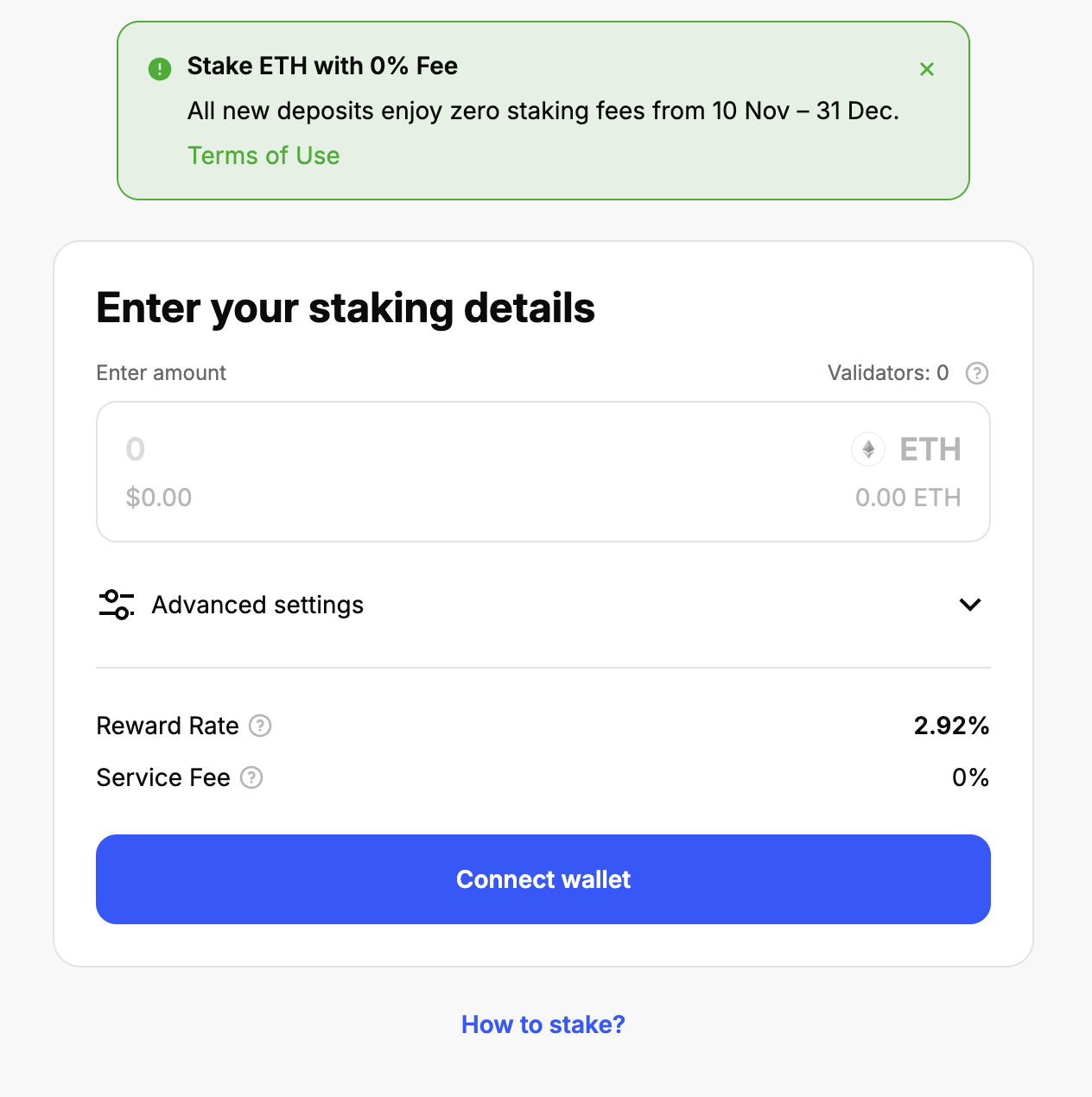

You’ll now land on the deposit page.

Enter the amount you want to stake.Minimum: 32 ETHNo requirement for 32-ETH multiples — Pectra removes that barrier.

You’ll also see:

After choosing your amount:

You’ll see a prompt on your Ledger device:

Sign transaction on your Ledger DeviceConfirm the details (amount, network fee) and approve.

Once the transaction is signed and broadcast, your validator deposit is live.

Inside Ledger Wallet you can now:

Thanks to Pectra, you can add more ETH to an existing validator at any time.

This reduces fragmentation and makes your staked ETH more efficient.

You can begin staking directly in Ledger Wallet under Earn → Ethereum → P2P.org, or click the button below:

<p>At <a href="http://p2p.org/?ref=p2p.org" rel="noopener noreferrer nofollow">P2P.org</a>, we’ve supported Monad since Testnet-1. With over $10B secured across 40+ networks and zero slashing, we’re now bringing battle-tested infrastructure to MON.This guide shows you how to stake MON directly with <a href="http://p2p.org/?ref=p2p.org" rel="noopener noreferrer nofollow">P2P.org</a> in just a few clicks — using either <a href="https://monadvision.com/?ref=p2p.org" rel="noopener noreferrer nofollow"><strong>MonadVision</strong></a> or <a href="https://gmonads.com/?ref=p2p.org" rel="noopener noreferrer nofollow"><strong>Gmonads</strong></a>.<br><br></p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Screenshot-2025-11-24-at-15.45.39.png" class="kg-image" alt="" loading="lazy" width="2000" height="660" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Screenshot-2025-11-24-at-15.45.39.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/Screenshot-2025-11-24-at-15.45.39.png 1000w, https://p2p.org/economy/content/images/size/w1600/2025/11/Screenshot-2025-11-24-at-15.45.39.png 1600w, https://p2p.org/economy/content/images/size/w2400/2025/11/Screenshot-2025-11-24-at-15.45.39.png 2400w" sizes="(min-width: 720px) 720px"></figure><p><br><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993321631888928768?ref=p2p.org"></a>Whether you’re a first-time staker or adding Monad staking to your portfolio, this walkthrough covers everything you need to get started with confidence.</p><h2 id="stake-on-monadvision">Stake on MonadVision</h2><ol><li>Go to <a href="http://monadvision.com/?ref=p2p.org" rel="noopener noreferrer nofollow">monadvision.com</a></li></ol><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking1.png" class="kg-image" alt="" loading="lazy" width="1280" height="437" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking1.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/Monadstaking1.png 1000w, https://p2p.org/economy/content/images/2025/11/Monadstaking1.png 1280w" sizes="(min-width: 720px) 720px"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993321918607347712?ref=p2p.org"></a>2. Сonnect your wallet.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking2.png" class="kg-image" alt="" loading="lazy" width="618" height="946" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking2.png 600w, https://p2p.org/economy/content/images/2025/11/Monadstaking2.png 618w"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993322028917501952?ref=p2p.org"></a>3. Click this link to stake MON with <a href="http://p2p.org/?ref=p2p.org" rel="noopener noreferrer nofollow">P2P.org</a>, or find us in the validator list and press the “Stake” button: <a href="https://monadvision.com/validator/0x6bf8d5eE9d39Bc41b41578E722DE3950e15Bf128?ref=p2p.org" rel="noopener noreferrer nofollow">https://monadvision.com/validator/0x6bf8d5eE9d39Bc41b41578E722DE3950e15Bf128</a></p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking3.png" class="kg-image" alt="" loading="lazy" width="1280" height="503" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking3.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/Monadstaking3.png 1000w, https://p2p.org/economy/content/images/2025/11/Monadstaking3.png 1280w" sizes="(min-width: 720px) 720px"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993322175554600960?ref=p2p.org"></a>4. Enter the number of MON tokens you want to stake and click the “Stake” button.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking4.png" class="kg-image" alt="" loading="lazy" width="774" height="628" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking4.png 600w, https://p2p.org/economy/content/images/2025/11/Monadstaking4.png 774w" sizes="(min-width: 720px) 720px"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993322295473958912?ref=p2p.org"></a>5. Click the “confirm” button.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking5.png" class="kg-image" alt="" loading="lazy" width="1332" height="2024" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking5.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/Monadstaking5.png 1000w, https://p2p.org/economy/content/images/2025/11/Monadstaking5.png 1332w" sizes="(min-width: 720px) 720px"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993322428450148352?ref=p2p.org"></a>6. You’re all set! Enjoy your rewards!</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking6.png" class="kg-image" alt="" loading="lazy" width="1198" height="928" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking6.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/Monadstaking6.png 1000w, https://p2p.org/economy/content/images/2025/11/Monadstaking6.png 1198w" sizes="(min-width: 720px) 720px"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993322509408612352?ref=p2p.org"></a></p><h2 id="stake-on-gmonads">Stake on Gmonads</h2><ol><li>Go to <a href="http://gmonads.com/?ref=p2p.org" rel="noopener noreferrer nofollow">gmonads.com</a></li></ol><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking7.png" class="kg-image" alt="" loading="lazy" width="1280" height="726" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking7.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/Monadstaking7.png 1000w, https://p2p.org/economy/content/images/2025/11/Monadstaking7.png 1280w" sizes="(min-width: 720px) 720px"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993323009398960128?ref=p2p.org"></a>2. Go to staking page.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking8.png" class="kg-image" alt="" loading="lazy" width="1280" height="484" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking8.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/Monadstaking8.png 1000w, https://p2p.org/economy/content/images/2025/11/Monadstaking8.png 1280w" sizes="(min-width: 720px) 720px"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993323074763014144?ref=p2p.org"></a>3. Connect your wallet.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking9.png" class="kg-image" alt="" loading="lazy" width="718" height="1130" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking9.png 600w, https://p2p.org/economy/content/images/2025/11/Monadstaking9.png 718w"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993323166471503872?ref=p2p.org"></a>4. Enter the number of MON tokens you want to stake and click the “Continue” button.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking10.png" class="kg-image" alt="" loading="lazy" width="1280" height="487" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking10.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/Monadstaking10.png 1000w, https://p2p.org/economy/content/images/2025/11/Monadstaking10.png 1280w" sizes="(min-width: 720px) 720px"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993323256468668416?ref=p2p.org"></a>5. Choose the <a href="http://p2p.org/?ref=p2p.org" rel="noopener noreferrer nofollow">P2P.org</a> validator from the list or use our validator ID — 123.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking11.png" class="kg-image" alt="" loading="lazy" width="1280" height="1147" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking11.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/Monadstaking11.png 1000w, https://p2p.org/economy/content/images/2025/11/Monadstaking11.png 1280w" sizes="(min-width: 720px) 720px"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993323351880728576?ref=p2p.org"></a>6. Verify the transaction and confirm if everything is correct.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking12.png" class="kg-image" alt="" loading="lazy" width="1280" height="1146" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking12.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/Monadstaking12.png 1000w, https://p2p.org/economy/content/images/2025/11/Monadstaking12.png 1280w" sizes="(min-width: 720px) 720px"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993323636845875200?ref=p2p.org"></a>7. Confirm.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking13.png" class="kg-image" alt="" loading="lazy" width="772" height="1158" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking13.png 600w, https://p2p.org/economy/content/images/2025/11/Monadstaking13.png 772w" sizes="(min-width: 720px) 720px"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993323724154527744?ref=p2p.org"></a>8. You’re all set! Enjoy your rewards!</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/Monadstaking14.png" class="kg-image" alt="" loading="lazy" width="1200" height="1088" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/Monadstaking14.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/Monadstaking14.png 1000w, https://p2p.org/economy/content/images/2025/11/Monadstaking14.png 1200w" sizes="(min-width: 720px) 720px"></figure><p><a href="https://x.com/P2Pvalidator/article/1993325158040285350/media/1993323806086008832?ref=p2p.org"></a>Curious how we’re performing so far? Check out our live Monad validator stats here: <a href="https://www.gmonads.com/validators?ref=p2p.org" rel="noopener noreferrer nofollow">https://www.gmonads.com/validators</a>.<br><br>Get all the details of our full Monad offering here: <a href="https://www.p2p.org/networks/monad?ref=p2p.org" rel="noopener noreferrer nofollow">https://www.p2p.org/networks/monad</a></p>

from p2p validator

<h3 id="at-a-glance"><strong>At a Glance:</strong></h3><ul><li><strong>AlphaTON Capital (Nasdaq: ATON)</strong> selected P2P.org as its institutional staking partner, deploying 4 million locked TON tokens through infrastructure that combines BitGo custody, P2P.org, and Ton Whales smart contracts. </li><li>The partnership validates infrastructure built through our Ton Whales collaboration: 10 TON minimums (down from 300,000), unlimited delegator capacity, and dual-audited smart contracts from Quantstamp and Trail of Bits. </li><li>This marks the first publicly-traded company implementing institutional TON staking — $71M treasury backed by $10B+ in P2P.org validator infrastructure and the security standards public companies require. </li><li>The same infrastructure powering AlphaTON's treasury is available now, whether you're staking 10 TON or 10 million.</li></ul><p>Today, AlphaTON Capital became the first Nasdaq-listed company to implement institutional TON staking, powered by P2P.org's infrastructure and Ton Whales' smart contract innovation.</p><h1 id="the-moment-ton-went-institutional"><strong>The Moment TON Went Institutional</strong></h1><p>When a Nasdaq-listed company commits its $71 million TON treasury to staking infrastructure — starting with 4 million locked TON tokens — that signals institutional validation. Public company governance requires due diligence that goes beyond typical crypto deployments.</p><p>The infrastructure came through our collaboration with Ton Whales, eliminating traditional limitations:</p><ul><li>Minimum stake: 10 TON (down from 300,000)</li><li>Delegator capacity: Unlimited (versus 40-user caps)</li><li>Auto-distribution: Automated network reward flows</li><li>Security: Dual audits from Quantstamp and Trail of Bits</li></ul><p>Combined with P2P.org's validator infrastructure and BitGo custody, AlphaTON gets institutional-grade staking without operational complexity or custody risk.</p><h1 id="the-technical-foundation"><strong>The Technical Foundation</strong></h1><p>Our Ton Whales collaboration rebuilt TON staking infrastructure for institutional scale:</p><p>Infrastructure that handles any deployment size above 10 TON with unlimited participants. Automated reward distribution with no manual claims or operational overhead. Dual audits from Quantstamp and Trail of Bits meeting institutional security requirements.</p><p>AlphaTON's 4 million locked token deployment validates an architecture that scales infinitely — whether they expand to 40 million tokens or beyond, the infrastructure handles it identically.</p><h2 id="why-this-stack-wins"><strong>Why This Stack Wins</strong></h2><h3 id="ton-whales-smart-contract-innovation"><strong>Ton Whales: Smart Contract Innovation</strong></h3><p>Ton Whales rebuilt TON staking from the ground up. Their FunC-optimized smart contracts handle any stake size above 10 TON with unlimited participants, eliminating the bottlenecks that plagued earlier implementations.</p><p>The auto-distribution mechanism means network rewards flow automatically to delegators. No manual claims. No operational overhead. Just transparent, auditable, continuous rewards.</p><p>Security? Quantstamp and Trail of Bits both verified the contracts — the same audit firms that institutional treasuries require.</p><h3 id="p2porg-infrastructure-excellence"><strong>P2P.org: Infrastructure Excellence</strong></h3><p>We bring what AlphaTON's due diligence demanded:</p><ul><li>$10+ billion in assets under management across 40+ networks</li><li>Zero slashing events </li><li>99.9% uptime maintained across all validator infrastructure</li><li>90,000+ delegators trusting our validators globally</li><li>SOC 2 certified infrastructure meeting institutional compliance standards</li></ul><p>When you're a public company answering to shareholders and regulators, "pretty good" doesn't cut it. AlphaTON needed provable excellence. We had the receipts.</p><h3 id="bitgo-custody-without-compromise"><strong>BitGo: Custody Without Compromise</strong></h3><p>Here's what makes this architecture powerful: AlphaTON's tokens never leave BitGo's custody environment.</p><p>P2P.org operates the validators. Ton Whales' smart contracts handle the staking logic. BitGo maintains custody control. The non-custodial design satisfies every public company requirement while delivering institutional-grade rewards.</p><p>API-based staking initiation. Automated reward distribution. Daily reconciliation. Complete audit trails.</p><h1 id="what-alphatons-leadership-says"><strong>What AlphaTON's Leadership Says</strong></h1><p>"Selecting P2P.org as our staking partner reflects our commitment to working with best-in-class infrastructure providers who share our standards for institutional excellence," said <strong>Yury Mitin, Chief Business Development Officer</strong> of AlphaTON Capital.</p><p><strong>Brittany Kaiser, CEO of AlphaTON Capital</strong>, added: "Their proven track record at scale, combined with seamless integration through BitGo, enables us to generate sustainable yields for our shareholders while contributing to the security and decentralization of the TON network. This partnership exemplifies how traditional capital markets can effectively engage with blockchain infrastructure through proper risk management and operational excellence."</p><h1 id="what-this-partnership-represents"><strong>What This Partnership Represents</strong></h1><p>✅ First publicly-traded company deploying institutional TON staking<br>✅ First BitGo-integrated TON staking in production<br>✅ First dual-audited smart contract solution meeting public company standards<br>✅ Infrastructure validated through AlphaTON's institutional due diligence</p><p>"The combination of P2P.org's proven validator operations and Ton Whales' innovative smart contracts creates exactly the infrastructure we needed," said <strong>Brittany Kaiser, CEO of AlphaTON Capital</strong>. "This integration builds the foundation for institutional participation in TON's growth."</p><h2 id="what-this-means-for-everyone-else"><strong>What This Means for Everyone Else</strong></h2><p><strong>Institutional Infrastructure, Universally Accessible</strong></p><p>AlphaTON validated what exchanges, custody platforms, and treasury managers needed to know: TON infrastructure is ready for institutional capital.</p><p><strong>For Exchanges</strong>: Offer TON staking without minimum restrictions or delegator caps. Infrastructure scales with your user base.</p><p><strong>For Custody Platforms</strong>: Enable client rewards through audited, non-custodial architecture that integrates with existing operations.</p><p><strong>For Treasury Managers</strong>: Generate returns on TON holdings with security standards and reporting that passed AlphaTON's due diligence.</p><p><strong>For TON Network</strong>: Increased staking strengthens security, reduces token velocity, and signals ecosystem maturity.</p><h2 id="the-infrastructure-is-live"><strong>The Infrastructure Is Live</strong></h2><p><strong>Access the Same Infrastructure </strong></p><p>The technology powering AlphaTON's treasury is available now. Whether you're managing billions or starting with 10 TON, you access identical infrastructure:</p><p>Integration Options: </p><ul><li>Widget deployment in under one week </li><li>API integration for custom experiences </li><li>White-label solutions for platforms</li><li>Direct staking through our dApp </li></ul><p>No custody handoffs. No operational complexity. </p><h2 id="ready-to-deploy"><strong>Ready to Deploy?</strong></h2><p>The precedent is set. The infrastructure is proven. The opportunity is now.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://link.p2p.org/bdteam?ref=p2p.org" class="kg-btn kg-btn-accent">Schedule a call with our BD Team</a></div><p><br><strong>Technical docs</strong>: <a href="https://docs.p2p.org/docs/unified-api-ton?ref=p2p.org" rel="noreferrer">https://docs.p2p.org/docs/unified-api-ton</a><br><strong>Direct staking</strong>: <a href="https://ton.p2p.org/deposit?ref=p2p.org">https://ton.p2p.org/deposit</a></p><h2 id="about-the-partners"><strong>About the Partners</strong></h2><p><strong>AlphaTON Capital (Nasdaq: ATON)</strong> is a specialized digital asset treasury company focused on building and managing a strategic reserve of TON tokens. Led by CEO Brittany Kaiser and Chairman/CIO Enzo Villani, the company provides public market investors with institutional-grade exposure to the TON ecosystem.</p><p><strong>Ton Whales</strong> is a key development team in the TON ecosystem, specializing in smart contracts and infrastructure. Their open-sourced staking contract has become the standard in the TON community for its security, transparency, and accessibility.</p><p><strong>P2P.org</strong> is one of the world's leading non-custodial staking providers, operating validator infrastructure across 40+ networks with over $10 billion in staked assets. Founded in 2018, we maintain a perfect track record with zero slashing incidents and 99.9% uptime.</p>

from p2p validator