Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeWe are excited to introduce our ground-breaking Ethereum (ETH) auto-staking feature, powered by our audited immutable smart contract. This feature completely automates the Ethereum staking process, making staking ETH easier than ever.

Our ETH staking offer is completely non-custodial and there are no KYC requirements. You simply connect your wallet and stake.

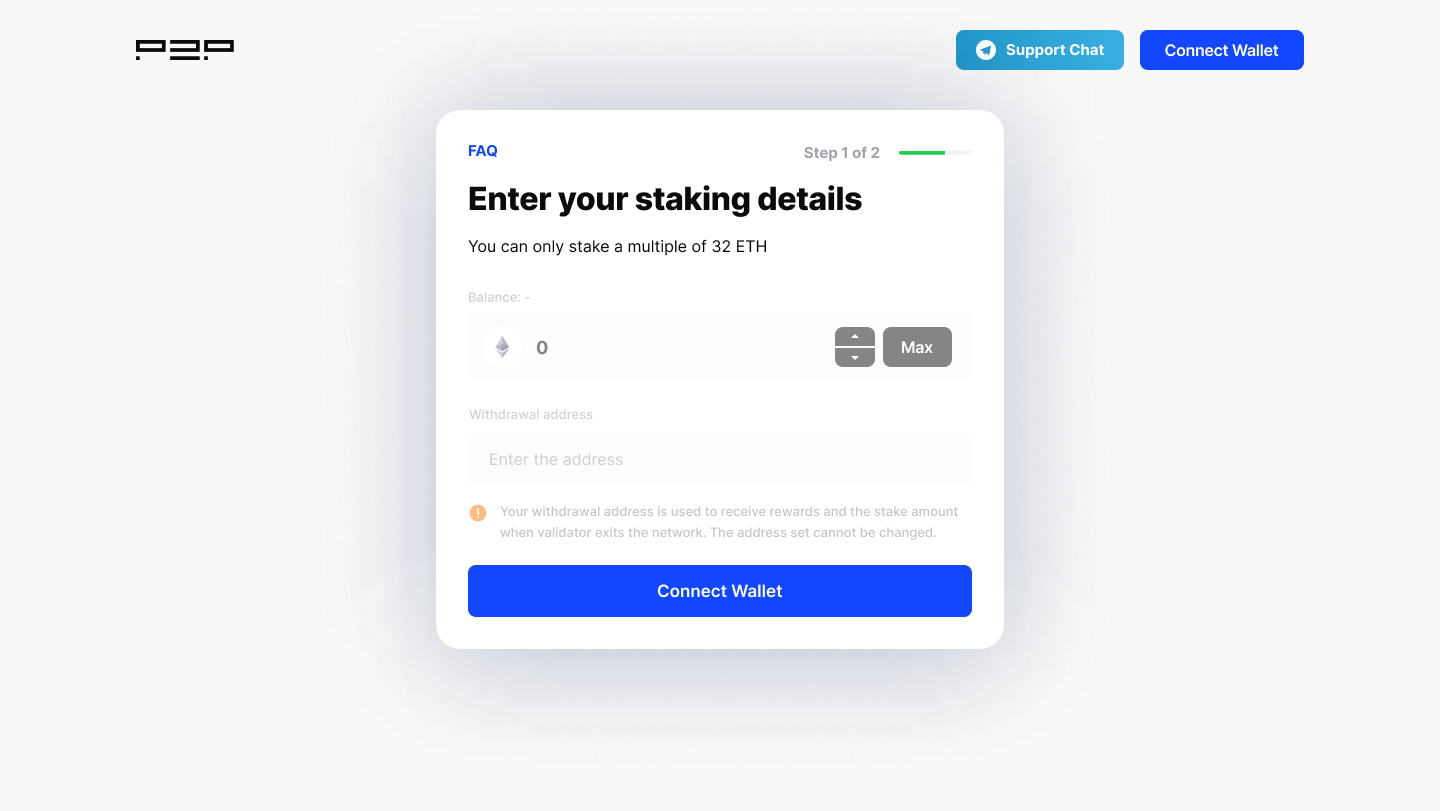

To set up a validator you will only need:

1) An Ethereum wallet

2) To specify the amount of stake - 1 validator per 32 ETH;

3) To specify the withdrawal address.

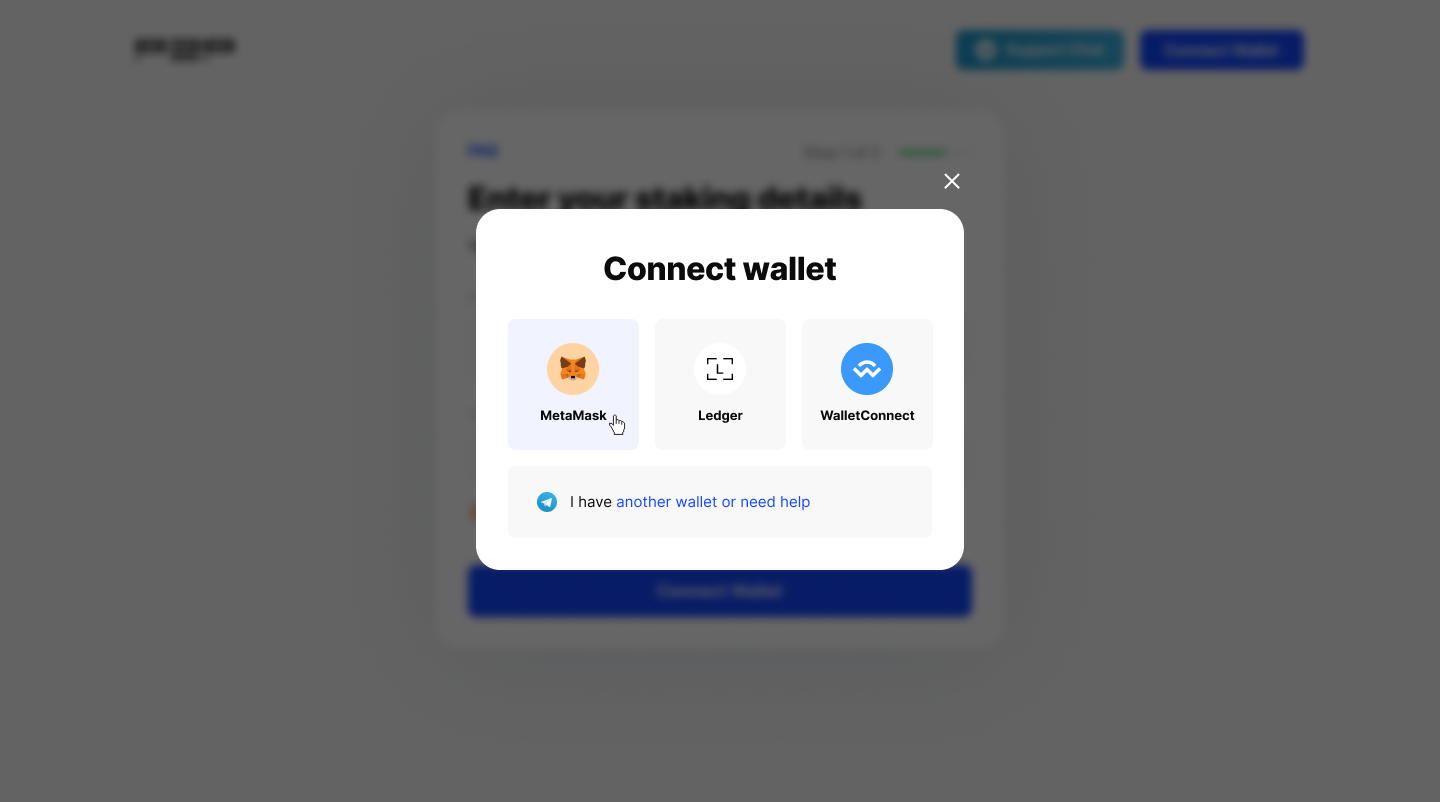

2. Then click "connect wallet" on the top right. We currently support Metamask and Ledger Wallet or you can use Wallet Connect.

We have prepared a video guide on how to connect a Safe wallet:

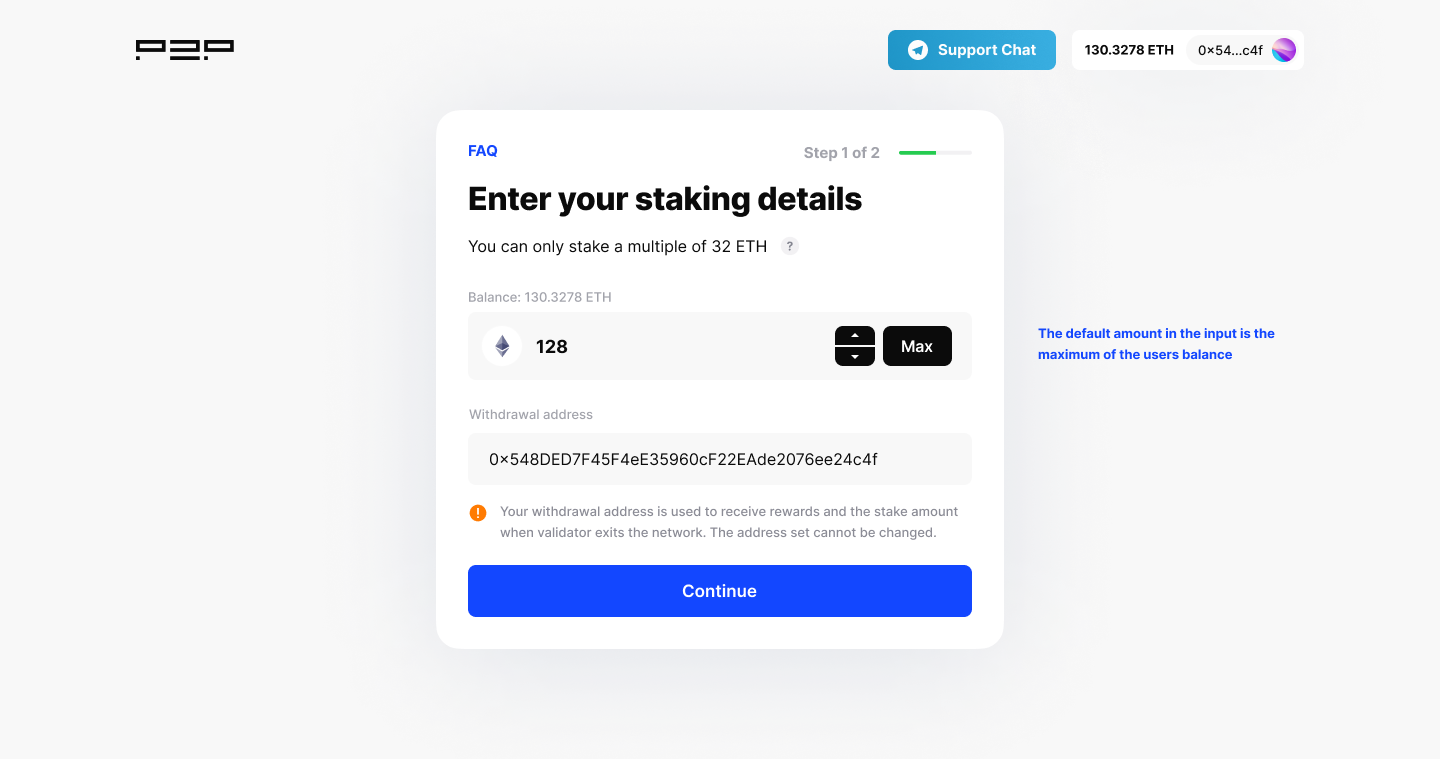

3. Once you successfully connect your wallet, we can begin the staking process. We can define how much ETH we want to stake and a withdrawal address.

Each Ethereum validator requires 32 ETH to set up so Ethereum can only be staked in multiples of 32 ETH.

We can also pick a different withdrawal address. The withdrawal address is used to receive rewards and withdraw the ETH staked.

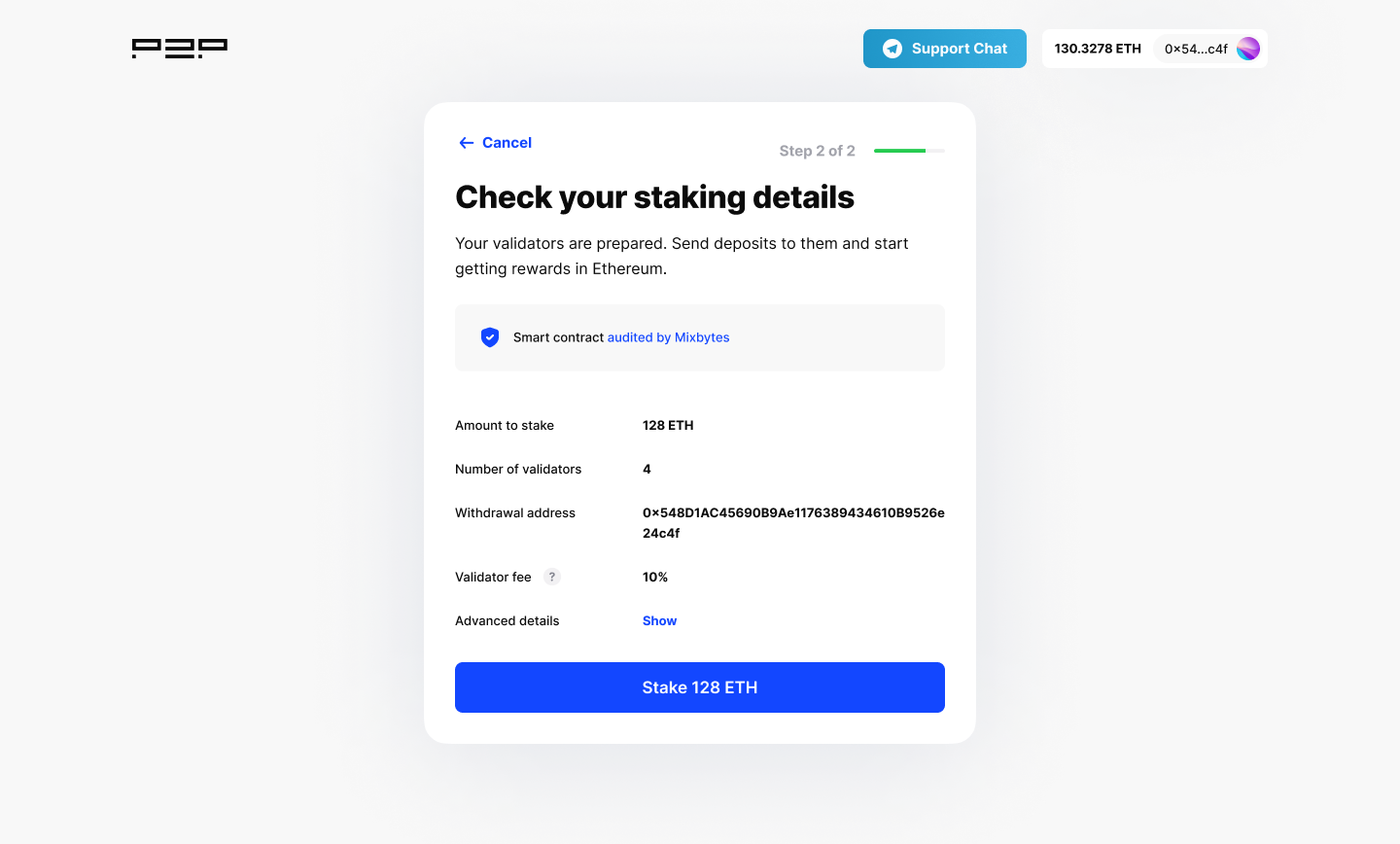

4. Once everything is set up, we can press continue and we will be taken to a confirmation screen. If everything is set up correctly we can press Stake.

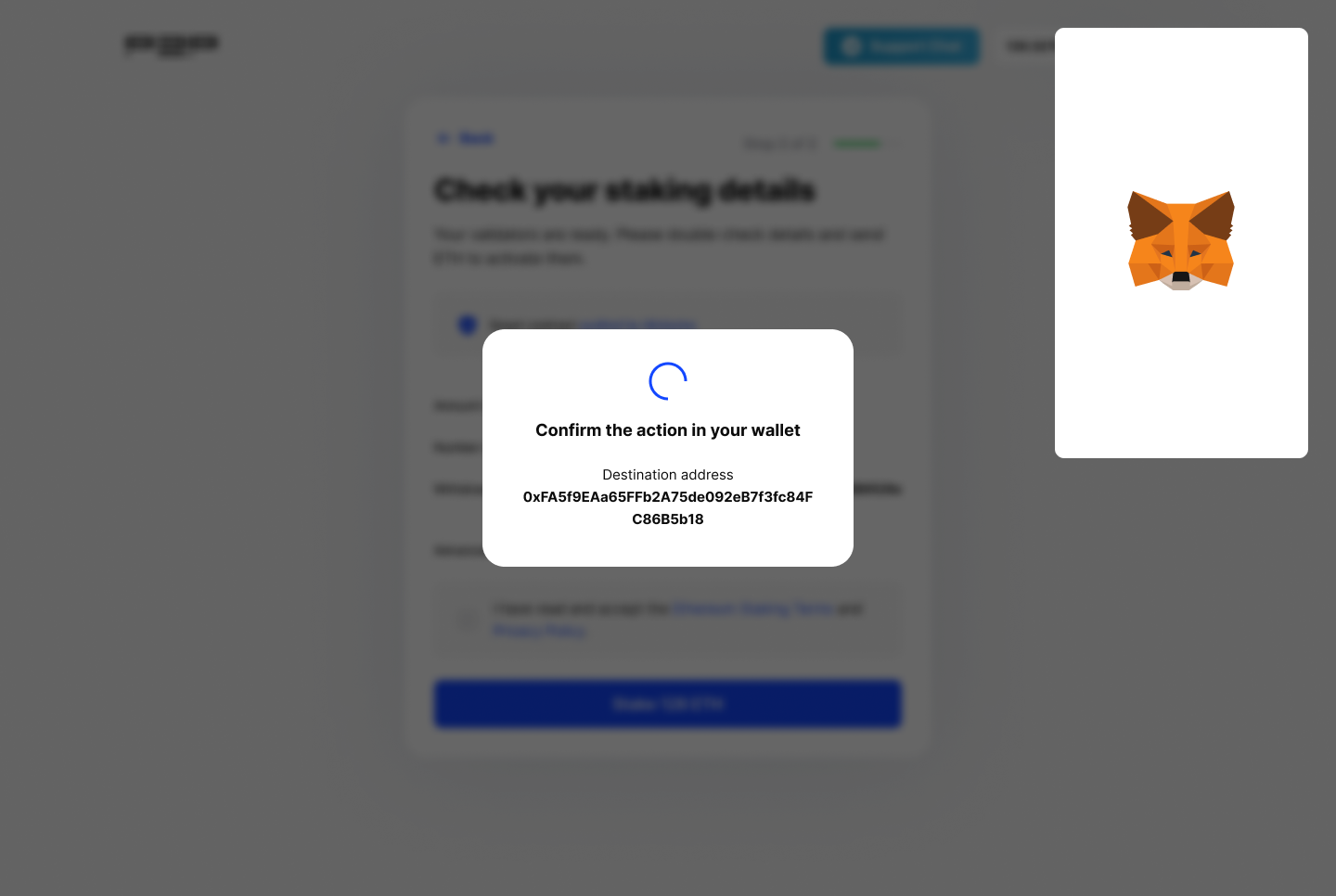

5. You will be prompted to confirm the transaction on your wallet.

6. After you confirm the transaction in your wallet, wait a few minutes for it to be completed in the network.

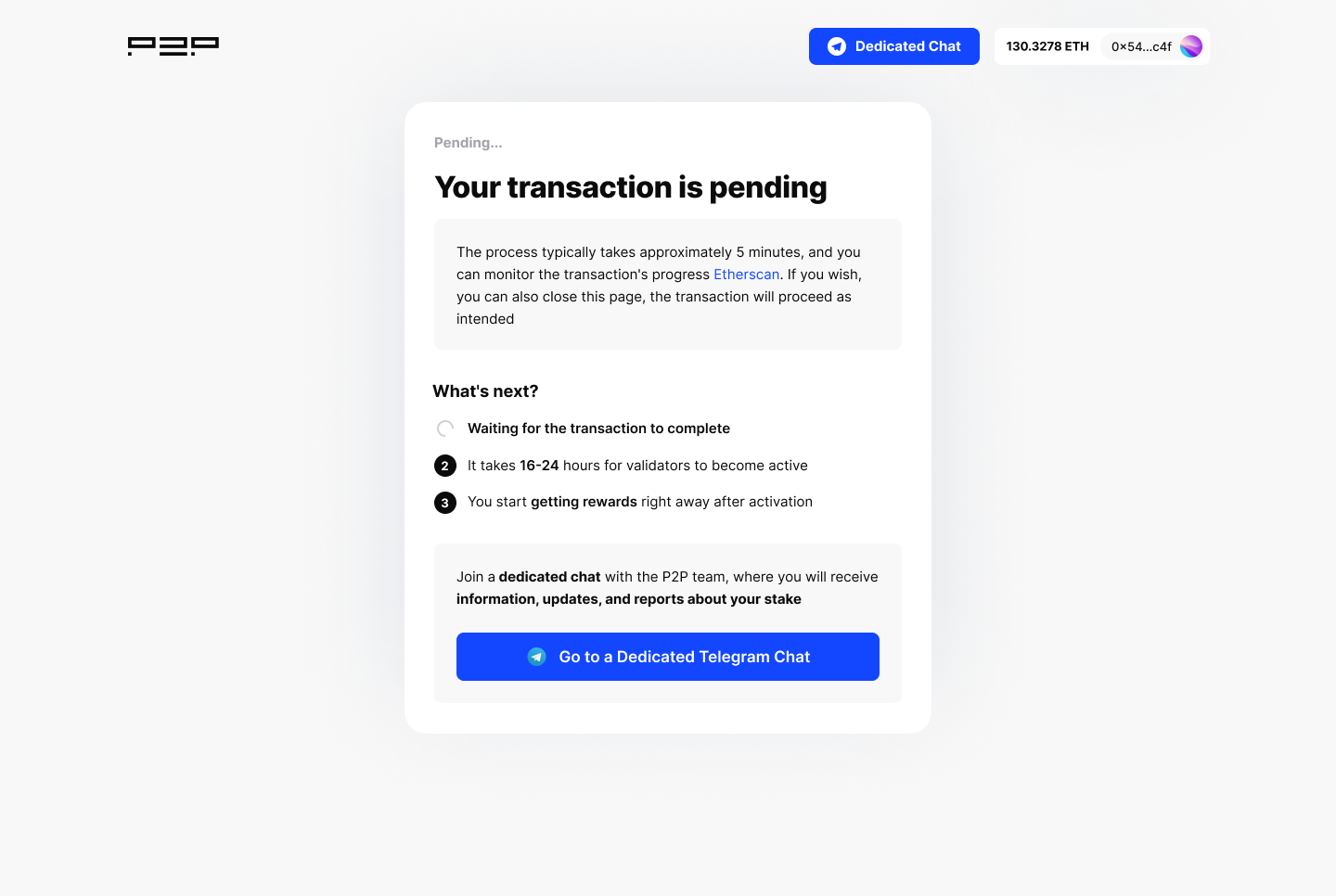

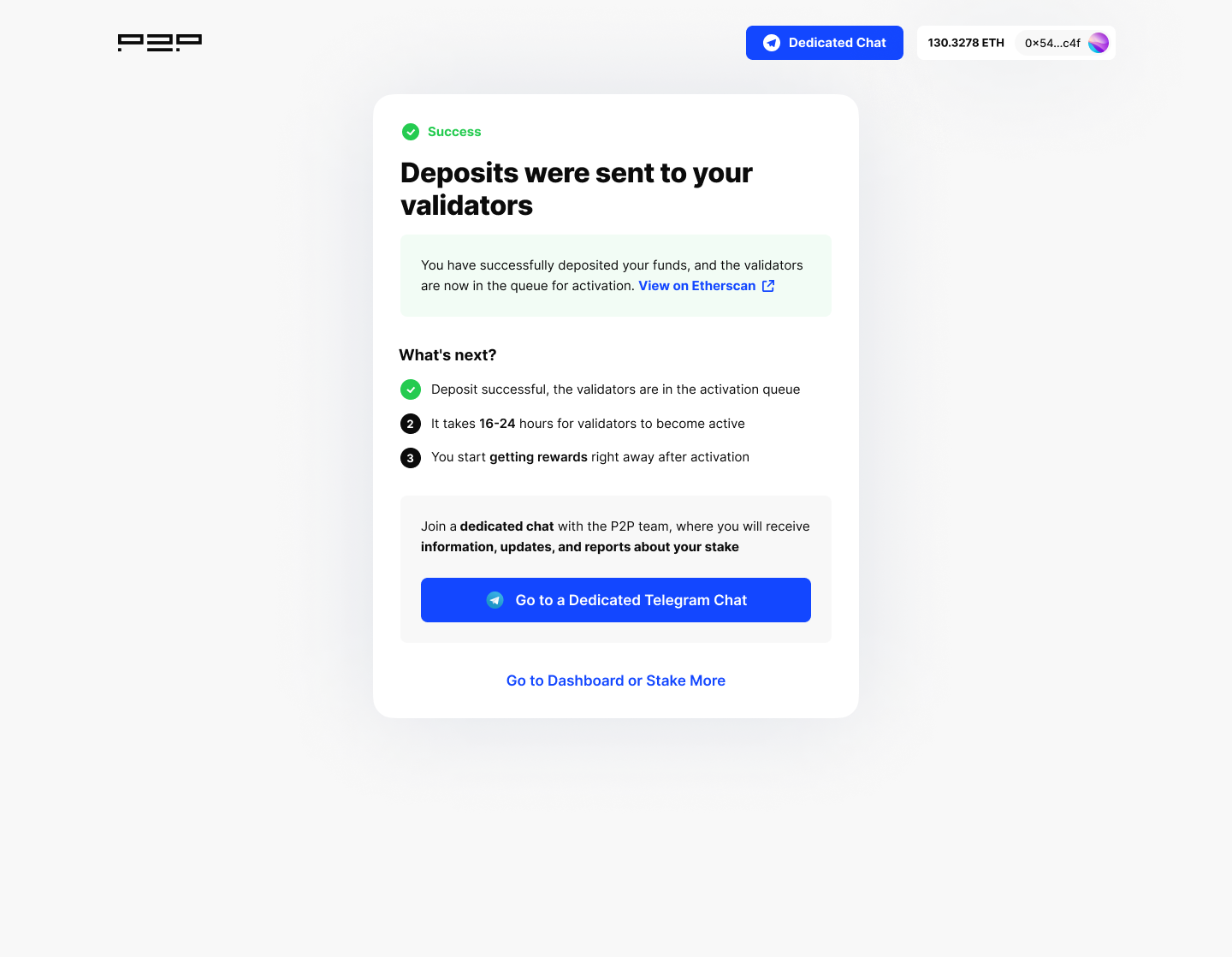

7. Once the transaction has been successfully confirmed we need to wait for the validators to become active. Under normal circumstances can take up to 24 hours but this is subject to change based on the number of people trying to stake.

While you wait you can join a personal telegram chat with our team. There we will share updates about your stake and can answer all of your questions.

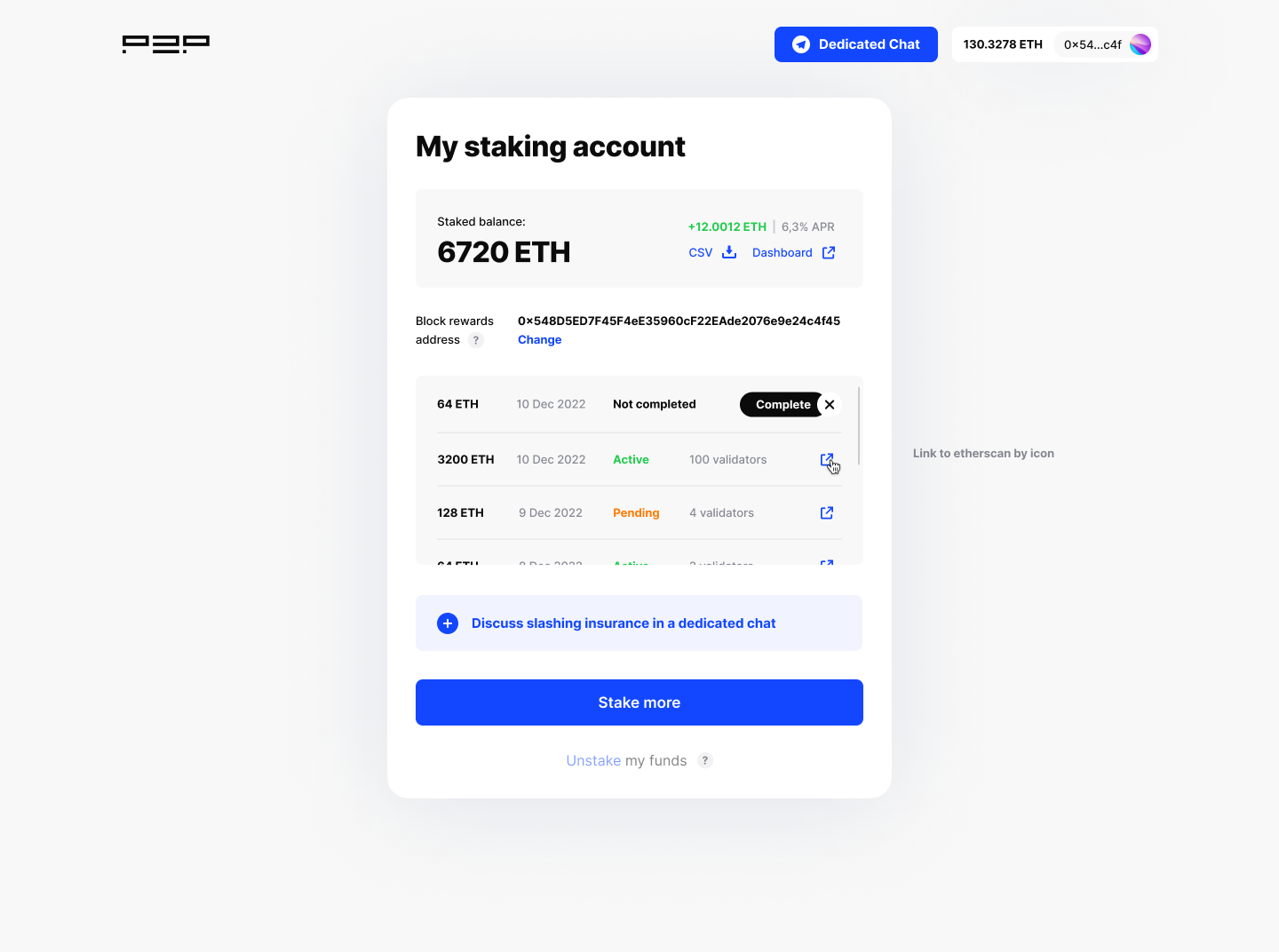

8. Once the validators are active you will start earning rewards. You will also have access to a personal dashboard where you can check the status of your staked account.

No, when working with P2P, there is no need to go through KYC because staked assets never touch our account and are sent directly to the Ethereum network.

No Ethereum is necessary to run a node. However, it is necessary to stake 32 ETH x [amount of validators] to activate the validators and start getting rewards.

The withdrawal address is the Ethereum address used to unstake and receive rewards. This address is specified once and it can't be changed after the staking deposit is sent, because the network cements the association of a particular validator and withdrawal address. Access to the private key for this withdrawal address is required to unstake (seed phrase). It is also important to note that P2P is not a custodian and has no exposure to the client’s withdrawal private key. P2P will never ask, under any circumstance, at any time for access to the withdrawal key.

A validator key is a private key for maintaining the validator’s work (setting up validators, updating software etc.). P2P owns the validator keys and guarantees the highest standards for protecting these keys from being compromised, breached, or otherwise misused. This is accomplished through Threshold signatures, which are the gold standard for internal/external security threats. This solution is used by leading custodians, crypto banks, and Multi-Party Computation solutions.

By design, ETH staking requires one staking transaction per 32 ETH. By using smart contracts we significantly simplify staking, reduce the cost of staking and minimize the risk of any human error. Thanks to our audited smart contracts it is possible to activate up to 100 validators with a single transaction.

Yes, it is possible to stake ETH with a Ledger (via native connection) or a Trezor wallet (via Metamask).

Ethereum rewards are comprised of 2 parts associated with performing validation duties and block creation.

No, the staked ETH is locked in the Ethereum smart contract and cannot be used.

P2P takes its service fee from the execution layer rewards. By default, a special immutable smart contract is used to automatically split rewards between the user and P2P by the previously agreed rules. Other invoicing strategies can be employed by prior agreement.

Slashing punishes validators for actions that are very difficult to do accidentally, and it’s very likely a sign of malicious intent. It’s a really rare event: there's only been 5 slashed validators within the whole network over the last month (or 0.001%). beaconcha.in/validators/slashings

What is “slashable” behaviour? In a nutshell, it’s a violation of consensus rules in the network. As of right now, it needs to meet three conditions: proposal of two conflicting blocks at the same time, double vote attestation and surround attestation. This can happen due to either an intentional malicious action or misconfiguration of the validator (the most often being, running two of the same validators in the network).

Slashing results in burning 1,0 ETH at once, and removing the validator from the network forever, which takes 36 days. During this time, the validator continues to work but can no longer participate in validation and block creation, getting a penalty of around 0.1 ETH in total.

For the most part that's the sum of the penalty incurred, but there is also an additional midpoint (Day 18) penalty that scales with the number of slashed validators. This is called "correlation penalty” and it's currently only theoretical and has never been encountered on the Ethereum mainnet. This mechanism is there to protect the network from large attacks. The math for calculation penalty is pretty complicated, but the summary is if there are only 1, 100, or even 1000 slashed validators within 36 days the penalty will equal zero ETH. However, if the number of slashed validators increases to roughly 1.1% of all validators (currently 5.1k), this penalty becomes 1 ETH and an additional 1 ETH for every additional 1.1% validator slashed. So if 1/3 of the network is slashed, the penalty will nullify the whole stake (32 ETH). This mechanism is in place to prevent an attack on the network and it should never be triggered by accident.

There are special mechanisms in place to prevent validators from meeting the slashing conditions called slashing protection. These mechanisms usually consist of a database with a signing history which the validator uses to check if the block can be signed (coupled with the default levels of monitoring and alerting protection). Additional protection levels will depend on the validator’s setup. P2P uses double-checking with a separate database at the key-manager stage and secures validators' key’s by Threshold, which means that no single person, even a P2P engineer, can run a second validator and a quorum is required for that. The final level of protection we have in place is an institutional grade slashing insurance.

Anyone who stakes with P2P gets access to a personal staking dashboard that can be used to track rewards and the validators' performance (APR, staking balance, % of blocks created with MEV, attestation rate, missed block, market comparisons, etc.)

P2P direct staking infrastructure is located in Europe and distributed among 5 separate physical locations for protection from downtime.

P2P validators have no single point of failure and are downtime resistant with back-ups of all critical infrastructure parts between 5 different physical locations, including:

Signing infrastructure - 3 location-independent key managers with 2-of-3 threshold quorum required for consensus;

Validators Nodes - we have a reserve in a secure region ready to be activated within a maximum of 1 minute in case of an outage;

Consensus layer nodes - our setup has top-3 consensus layer clients (Lighthouse, Prysm, Teku) simultaneously for diversity and preventing outrages related to soft bugs in one client. It also increases availability for validators.

<p>The Shapella upgrade, which happened on April 12, 2023, has been the most significant event for Ethereum since The Merge in September 2022. In our <a href="https://p2p.org/economy/the-shapella-upgrade-a-deep-dive-into-withdrawals/" rel="noopener noreferrer">recent article</a>, we explored the important features of the Shapella upgrade, with a focus on partial and full withdrawals. In this article, we will go deeper into the upgrade. We will look at the current network status a week after the upgrade, full and partial withdrawals, and who withdrew. We also examine how this transition affected the performance metrics of pools and operators.</p><h3 id="table-of-contents"><strong>Table of contents</strong></h3><!--kg-card-begin: markdown--><ul> <li><a href="#T1"><span style=" font-size:16px"> Network Overview </span></a></li> <li><a href="#T2"><span style=" font-size:16px"> The first hours after the upgrade </span></a></li> <li><a href="#T3"><span style=" font-size:16px"> Withdrawals<br> </span></a></li> <li><a href="#T4"><span style=" font-size:16px"> Operators performance </span></a></li> </ul> <!--kg-card-end: markdown--><!--kg-card-begin: markdown--><h2 id="network-overview-a-namet1a">Network Overview <a name="T1"></a></h2> <!--kg-card-end: markdown--><p>One week after Shapella, the current total staked amount is 17,972,763 ETH, 54k lower than the maximum on April 12th. This stake represents approximately 15.65% of the total circulating supply of Ethereum, indicating strong investor confidence in the platform. The network's effectiveness has decreased to 91.46% because it experienced minor struggles after the upgrade.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/10.png" class="kg-image" alt loading="lazy" width="1680" height="307" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/10.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/10.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/10.png 1600w, https://p2p.org/economy/content/images/2023/04/10.png 1680w" sizes="(min-width: 720px) 720px"></figure><!--kg-card-begin: markdown--><h2 id="the-first-hours-after-the-upgrade-a-namet2a">The First hours after the upgrade <a name="T2"></a></h2> <!--kg-card-end: markdown--><p>The most noticeable inaccuracies occurred in the first three hours after the activation slot. During this period, around 15% of blocks were missed, 7% of attestations did not occur, and approximately 30% of head votes were incorrect. Naturally, these inaccuracies led to a decrease in the share of consensus layer rewards. It should also be noted that the correlation between incorrect head votes and missed blocks is observed due to consensus rules - the lifetime of attestation of a valid head vote block is one slot, and if it is not submitted, then there was no block.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/11.png" class="kg-image" alt loading="lazy" width="1680" height="1679" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/11.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/11.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/11.png 1600w, https://p2p.org/economy/content/images/2023/04/11.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>Going into detail, we have identified several reasons for the network indicators observed in the first hours after the update. Firstly, the reduced percentage of correct attestations suggests that up to 9% of validators were not updated, which directly affected block misses. Secondly, <a href="https://github.com/prysmaticlabs/prysm/pull/12263?ref=p2p.org">Prysm experienced problems with obtaining MEV-blocks</a>. It was unable to produce blocks while connected to relays. Thirdly, <a href="https://github.com/sigp/lighthouse/issues/4184?ref=p2p.org">Lighthouse was 100% CPU-loaded for about 2 hours</a>, which led to missed attestations and late block proposing. Another reason, in our experience, is that the Teku client took a long time, about 15 seconds, to import blocks, causing lag on the network. These facts highlight the importance of client diversity in ensuring network stability.</p><p>However, the minor nature of the problems is confirmed by the fact that with each epoch, effectiveness slowly but constantly improved, and in a day, though not without emergency releases of CL clients, it reached the usual indicators.</p><p>Additionally, with the Capella update, validators who specified the "old" BLS address as withdrawal credentials were able to change it to the ETH1 address with the 0x01 prefix. This operation requires more RAM, bandwidth, and CPU power from the CL Node in each slot and <a href="https://twitter.com/TimBeiko/status/1646289478326145026?ref=p2p.org">had a small impact on the degradation of network performance metrics</a>.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/12.png" class="kg-image" alt loading="lazy" width="1680" height="970" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/12.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/12.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/12.png 1600w, https://p2p.org/economy/content/images/2023/04/12.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>In the first 6 days, 226k validators changed their addresses, it’s about 70% of all validators with BLS withdrawal credentials. This means that the time needed for one iteration of the withdrawal clock has increased significantly, but has not reached its maximum.</p><!--kg-card-begin: markdown--><h2 id="withdrawals-a-namet3a">Withdrawals <a name="T3"></a></h2> <!--kg-card-end: markdown--><p>The Shapella upgrade introduces two types of withdrawals: full withdrawals (also known as exits) and partial withdrawals (staking reward collection). If you would like to dive deeper into how withdrawals work, you can explore our <a href="https://p2p.org/economy/the-shapella-upgrade-a-deep-dive-into-withdrawals/" rel="noopener noreferrer">Shapella Upgrade article</a>.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/13.png" class="kg-image" alt loading="lazy" width="1680" height="1230" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/13.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/13.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/13.png 1600w, https://p2p.org/economy/content/images/2023/04/13.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>After the Ethereum update, the total amount of Ethereum withdrawn was found to be 1,323,637 ETH, with only 1.6% of validators exiting the system. This withdrawal led us to analyze the amount of Ethereum that was sold on DEX, and we found that only 0.25% of the total ETH was actually sold.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/14.png" class="kg-image" alt loading="lazy" width="1680" height="982" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/14.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/14.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/14.png 1600w, https://p2p.org/economy/content/images/2023/04/14.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>The analysis also revealed that most of the validators who withdrew were from Kraken, accounting for over 90% of the total withdrawals. The reason behind this mass withdrawal was a fine imposed by the SEC, which forced the exchange to wind down its US staking operations.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/15.png" class="kg-image" alt loading="lazy" width="1680" height="1075" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/15.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/15.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/15.png 1600w, https://p2p.org/economy/content/images/2023/04/15.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>We can see that a large number of full withdrawals occurred between April 15th and April 20th. The Kraken validators' indexes are sequential, meaning their withdrawals also occurred sequentially. As a result, we observe large volumes on those days. All 333k ETH withdrawn from Kraken's validators is currently being held in the withdrawal address 0x210b3cb99fa1de0a64085fa80e18c22fe4722a1b.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/16.png" class="kg-image" alt loading="lazy" width="1680" height="1065" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/16.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/16.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/16.png 1600w, https://p2p.org/economy/content/images/2023/04/16.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>In addition, it’s important to note that there are currently 19,029 validators waiting to exit the active validator set. Currently, only 8 validators can exit every epoch. After that, there is a waiting period of 27 hours to ensure that the validator is unslashed. Finally, the withdrawal process involves a looped queue that can take up to 5 days. Therefore, at this time, the exit queue is approximately 12-16 days.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/17.png" class="kg-image" alt loading="lazy" width="1680" height="971" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/17.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/17.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/17.png 1600w, https://p2p.org/economy/content/images/2023/04/17.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>The number of validators in the exit queue is gradually decreasing. Our analysis suggests that over 72% of active exiting validators belong to centralized exchanges (CEX). Meanwhile, the number of validators waiting to enter the active validator set is increasing and currently stands at 8,152.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/18--1-.png" class="kg-image" alt loading="lazy" width="1680" height="931" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/18--1-.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/18--1-.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/18--1-.png 1600w, https://p2p.org/economy/content/images/2023/04/18--1-.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>This trend indicates a growing interest in Ethereum staking, as evidenced by the observable increase in the waiting time within the queue. Currently, the waiting time is equal to 1 day and 20 hours.</p><!--kg-card-begin: markdown--><h2 id="operators-performance-a-namet3a">Operators performance <a name="T3"></a></h2> <!--kg-card-end: markdown--><p>We examined how this transition affected on validator’s performance metrics divided by pools and operators. As we can observe, after the update on 13th April validator effectiveness dropped over 10 p.p for operators.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/19.png" class="kg-image" alt loading="lazy" width="1680" height="981" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/19.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/19.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/19.png 1600w, https://p2p.org/economy/content/images/2023/04/19.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>The effectiveness of a validator is determined by its block proposal and attestation rates, which are the measures of performing the validator’s duties like timely block proposals and attestations. Let's take a closer look at each of these indicators.</p><p>After a recent update, there were a significant number of missed blocks in the network. On April 13th, there were a total of 633 missed blocks, which is 342% higher than the number of missed blocks on April 12th. As shown in the plot, this had a negative impact on the block proposal rate and led to a drawdown.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/20.png" class="kg-image" alt loading="lazy" width="1680" height="981" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/20.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/20.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/20.png 1600w, https://p2p.org/economy/content/images/2023/04/20.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>The attestation rate is measured by three factors: participation rate, correctness, and inclusion delay.</p><p>We can see that the participation rate didn't change much after the update for most validators, except for RocketPool, whose uptime dropped by around 2.5 percentage points. However, the correctness plot shows that there were many incorrect head votes and target votes after the update. Additionally, the average inclusion distance between the attestation slots attributed and the actual slots the votes were included in, also increased.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/21--1-.png" class="kg-image" alt loading="lazy" width="2000" height="944" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/21--1-.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/21--1-.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/21--1-.png 1600w, https://p2p.org/economy/content/images/size/w2400/2023/04/21--1-.png 2400w" sizes="(min-width: 720px) 720px"></figure><p>However, during the week, the operator's performance improved, allowing them to recover to the values of the level before the update.</p><h3 id="slashings">Slashings</h3><p>This week was unfortunate for several validators. There were 11 slashings on the next day after Shapella by validators of RockLogic GmbH in Lido pool, but this is not related to the update, just the operator suffered from a bug with keystore in the Prysm client. This case, certainly, was analyzed in detail, accompanied by a <a href="https://blog.lido.fi/loe-rocklogic-gmbh-slashing-incident/?ref=p2p.org">post-mortem</a> and has already been fixed.</p><p>The good side of this news is that since Lido has a money-back policy and treasury, none of the clients will definitely suffer losses.</p><!--kg-card-begin: markdown--><h2 id="conclusion-a-namet4a">Conclusion <a name="T4"></a></h2> <!--kg-card-end: markdown--><p>In conclusion, the Shapella upgrade has had a significant impact on the Ethereum network. The transition was not without its challenges, with a significant number of missed blocks in the network and a decrease in effectiveness. However, the network has shown resilience and has been able to recover to pre-upgrade levels in terms of performance. The increase in the waiting time for validators to enter the active validator set indicates a growing interest in Ethereum staking, which bodes well for the future of the network. While there were some issues with the upgrade, the Ethereum community has shown its ability to adapt and overcome challenges, which is a positive sign for the future development of the platform.</p>

from p2p validator

<p>MultiversX is a recently redesigned blockchain that enables innovative applications in various fields, including the emerging metaverse. The platform has a bold vision, and its staking scheme is also quite unique. At P2P.ORG, we have decided to closely examine the rewards formula, analyze validators’ and delegators’ intentions, and try to predict the future of MultiversX's staking economy.</p><p><strong>MultiversX. A high-margin validator market. Less institutional, more community-oriented approach</strong><br></p><p>Unique facts about MultiversX staking:</p><ul><li>The Palm Tree Network takes a 70% higher commission from their clients than P2P.ORG and still their clients have a better APR P2P.ORG clients</li><li>White Label nodes services are not widely distributed</li><li>Institutional clients tend to distribute their stake across multiple validators, and do not heavily focus on one</li><li>Fees are higher compared to other blockchain networks. E.g: Let’s compare it with Near Protocol</li></ul><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/2573.png" class="kg-image" alt loading="lazy" width="1680" height="944" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/2573.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/2573.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/2573.png 1600w, https://p2p.org/economy/content/images/2023/04/2573.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>As we can gather from the official explorers, most of the heavily staked validators charge 15% fee or higher. This makes MultiversX attractive even for small validators looking to survive the severe bear market conditions.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/2574.png" class="kg-image" alt loading="lazy" width="1680" height="944" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/2574.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/2574.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/2574.png 1600w, https://p2p.org/economy/content/images/2023/04/2574.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>Many validators are also big community contributors and work hard on projects alongside the foundation. This is because nodes can currently only be allocated by the foundation or by the "queue". There are currently 79 nodes in the queue waiting to join the active set. During this period, they use stake but do not generate any profit. This queue can take several months due to high demand and a fixed number of nodes. This explains why white-label node services are not widely distributed.</p><p>In short, the interest in staking is consistently rising among MultiversX users. Due to the fixed number of nodes, there is high demand for each staking provider, and they can therefore charge higher fees. It is also worth noting that validating in MultiversX requires running multiple nodes instead of just one. Validators typically spend more on infrastructure and engineering teams.</p><p>The greater the stake a validator receives, the lower the APR it can offer. This is why institutional clients tend to distribute their stake across multiple validators, rather than heavily focusing on one.</p><p><strong>A detailed description of the MultiversX staking model. All the possible ways to maximize the number of rewards</strong></p><p>Stake in MultiversX is separated into 2 parts:</p><p>• Base stake</p><p>• Top-up stake</p><p>The base stake is allocated to nodes participating in network validation. The maximum number of nodes that can participate in validation is 3200, and each node must be staked with a minimum of 2,500 EGLDs. Validators can have as many nodes as they want, but there are a few points to keep in mind:</p><p>Imagine you have five nodes, all of which participate in the validation process and generate income for you. Your total stake is 12,500 EGLDs. Someone has given you an additional 5,000 EGLDs, which you can use to run two more nodes, increasing your stake to a total of 17,500 EGLDs across seven nodes. However, the maximum capacity of 3,200 nodes in the network is already occupied by nodes of other validators, which means that your two new nodes, with only 5,000 EGLDs each, must wait in a queue before they can begin validation. While they wait in the queue, they do not generate any rewards but still cost to maintain. Unfortunately, the queue moves slowly, and it's possible that you'll have to wait for months because there are other nodes ahead of yours and nodes in the validating pool don't leave very often. What's the solution? The solution is to top-up your stake.</p><p>The top-up stake is a type of stake that you can use if you don't have the possibility to run new nodes or wait in a long queue. In the example above, we have 5 nodes with 2,500 EGLDs each, totalling 12,500 EGLDs at stake. We have an extra 5,000 EGLDs of stake, but we can't run new nodes to stake it. In this case, these 5,000 EGLDs will automatically become a Top-up stake. Therefore, we have a total of:</p><ul><li>12,500 EGLDs of base stake, as we have 5 nodes allocated with 2,500 EGLDs each</li><li>5,000 EGLDs of Top-up stake</li><li>Total of 17,500 EGLDs<br></li></ul><p>So, what is the difference between Top-up and base stake? The difference lies in the number of rewards that the validator gains for each stake.</p><p>You can find all the formulas behind our calculations <a href="https://docs.multiversx.com/economics/staking-providers-apr?ref=p2p.org">here</a>:</p><p>Genesis Total Supply = 20M EGLDs<br>inflation Rate = 8.56% (year 3)<br>P = 2 000 000<br>Total Nodes = 3 200<br>Eligible Top Up Stake = 3 863 418,56 <br>Total Top Up Stake = 7 571 288,70<br>Protocol Sustainability Rewards = 10%<br>Num Days in A Year = 365<br>Top-up Factor = 0.5</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/2575.png" class="kg-image" alt loading="lazy" width="1680" height="774" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/2575.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/2575.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/2575.png 1600w, https://p2p.org/economy/content/images/2023/04/2575.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>As you can see, there is a reward of 2753 EGLDs for base stake and 1469 EGLDs for Top-up stake. The reward for base stake is twice as large as the reward for Top-up stake, and it will be distributed among validators. To calculate these rewards, use the following formulas:</p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/XCjZMlY_E8eHou6miZvWZhzMuW5ghPl9vd7GnZ1pSgnAyZa4bWxAOtBHgNghMm50deO39RhWVxZ5T4TwsMGkWQBYNFAR9kq7MBP5H5KXT8ziqwvOIwlhUEMqDMNGLSzRzyrgJoiz3-hAIPiutXoYhcg" class="kg-image" alt loading="lazy" width="602" height="48"></figure><figure class="kg-card kg-image-card"><img src="https://lh5.googleusercontent.com/W5v_rqksWhmKMDevkORzCmELj6kD3Io8h72AQ1T_AGwiGBbq0o2RDFa7yw0HEfy2JHdgyuU6LuG_llcoAG5KqvA3FAQ0durjtw8lbZoruKzs1SH6zAqkvqbZD-FG4n7BuqfIp90Fh-jaKbj-QPAnyCs" class="kg-image" alt loading="lazy" width="602" height="48"></figure><p>We can calculate final rewards for an epoch. Let’s consider P2P.ORG and The Palm Tree Network:</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/2576.png" class="kg-image" alt loading="lazy" width="1680" height="331" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/2576.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/2576.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/2576.png 1600w, https://p2p.org/economy/content/images/2023/04/2576.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>The main reason is that The Palm Tree Network's base stake accounts for 58% of their total stake, which is allocated on 76 nodes. On the other hand, P2P.ORG only has 39% of their base stake out of the total. The current APR for each type of stake is as follows:</p><p>Reward Base x 365/ Base Stake = 12.5% for base stake</p><p>Reward Top-up x 365/ Top-up Stake = 7% for Top-up stake</p><p>One key point is the idea that if you have a large amount of base stake, you can charge higher fees to your clients while still providing a good APR. To calculate a client's APR with the real validator fees of P2P at 10% and Palm Tree at 17%, use the following formula:</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/2577.png" class="kg-image" alt loading="lazy" width="1680" height="331" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/2577.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/2577.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/2577.png 1600w, https://p2p.org/economy/content/images/2023/04/2577.png 1680w" sizes="(min-width: 720px) 720px"></figure><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/2579.png" class="kg-image" alt loading="lazy" width="1680" height="974" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/2579.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/2579.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/2579.png 1600w, https://p2p.org/economy/content/images/2023/04/2579.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>We have been delegated approximately 6,000 EGLDs twice. As a result, our overall stake has increased by almost 10%, while our top-up stake has increased by 20%. Although our TVL and share have both increased and our APR has dropped. The Palm Tree Network, on the other hand, has not experienced any major changes in their stake. They only received an additional 1,500 EGLDs, which is approximately 1% of their top-up stake.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/2580.png" class="kg-image" alt loading="lazy" width="1680" height="974" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/2580.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/2580.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/2580.png 1600w, https://p2p.org/economy/content/images/2023/04/2580.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>Should a validator increase their Total Value Locked (TVL) if they do not have enough nodes to allocate all stakes? Increasing your Top-up stake may result in a drop in client APR, making you less attractive to potential delegators. However, you must grow your TVL to be profitable or at least cover costs, which is not easy these days. Cryptocurrency prices are not as high as they were a year ago, while infrastructure costs have increased significantly.</p><p>After some research, we have found a solution that may seem strange at first, but will ultimately help us work efficiently, cover all costs, and provide a stable service for our delegators. The solution is to raise fees. While raising fees will increase our income, there is a good possibility that our delegators won't lose in the long run.</p><p>Initially, after the fee raise, our delegators may lose some of their rewards, and we should expect a churn of delegators and TVL. However, just as new delegations become a top-up stake due to a lack of nodes, in the case of an unstake, the top-up stake goes first. As a result, the share of the base stake increases, and the client's APR starts to grow along with the growth of rewards share for the base stake.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/2581.png" class="kg-image" alt loading="lazy" width="1680" height="974" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/2581.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/2581.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/2581.png 1600w, https://p2p.org/economy/content/images/2023/04/2581.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>The plot above illustrates how income and APR will change after a fee raise and the next stake churn. The blue vertical line represents our current APR, which is around 8.15%. The lowest blue horizontal curve shows our current state where we have the same fee at 10%, and how income and APR will change if we face churn of stake. Churn will lead us to a situation where our top-up stake and income drops at the same time. However, the client's APR will grow as the share of the base stake grows. The end of the line signals that all top-up stake was unstaked, and we are left only with the base stake. The result is a high client's APR; however, we face a loss of 1/3 of our current income.</p><p>All other lines show the same for different fees. The more fees we take, the more income we have. However, it also provides a very low client's APR, and we have to lose a significant amount of our TVL to return to the situation of our current APR.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2023/04/2582.png" class="kg-image" alt loading="lazy" width="1680" height="904" srcset="https://p2p.org/economy/content/images/size/w600/2023/04/2582.png 600w, https://p2p.org/economy/content/images/size/w1000/2023/04/2582.png 1000w, https://p2p.org/economy/content/images/size/w1600/2023/04/2582.png 1600w, https://p2p.org/economy/content/images/2023/04/2582.png 1680w" sizes="(min-width: 720px) 720px"></figure><p>To give you a better understanding of how it works, we have provided a plot above. The blue line indicates the optimal point for the current APR (~8.15%), which depends on stake, top-up stake, and fee. The top point on the blue line represents the current state with a fee of 10%, stake at 116,000 EGLD, and top-up stake near 71,000 EGLD.</p><p>If we were to raise the fee to 34-35%, we would need to lose nearly half of our stake (55,000 EGLD) to return to the value of 8.15% for the client's APR. This would occur if our TVL dropped to 62,000 EGLD from 116,000 EGLD, and the share of base stake became nearly 70% (currently only 39%).</p><p>However, after some time, the APR will return to its previous values as the share of top-up stake drops.</p><h3 id="future-prospects"><br>Future prospects.<br></h3><p>In the MultiversX network, the amount of staked tokens is rapidly increasing. According to the MultiversX roadmap, liquid staking is coming, which will cause a slight decrease in the average APR across the entire network. It's good that the foundation is not trying to increase the APR, it could affect the stability of the exchange rate and prevent the coin from becoming deflationary.</p><p>The next big change in MultiversX is called "Phase 4", in which the queue will be replaced by the auction list. Validators who are shuffled out of the Eligible list will be moved to this auction list, and only the ones with the highest top-up will be further promoted to the waiting list and made eligible. The amount of base stake per node will remain at 2,500 EGLD. Thus, validators will have the intention to attract delegation, making the field more competitive. This might transform validators into builders, while maintaining high margins for validators.</p><p>As shown in the previous section, P2P.ORG could be more efficient and save the current APR by reducing the TVL and increasing the fee. <strong>On April 25th, P2P.ORG will change the fee to 17%</strong> and for a short period of time, the APR will decrease from 8.1% to 7.5%, but we expect growth to the previous values after some time due to the churn of top-up stake.</p><p>We want to thank all our delegators for their continuous support and for staking with us!</p><p><br></p>

from p2p validator