Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

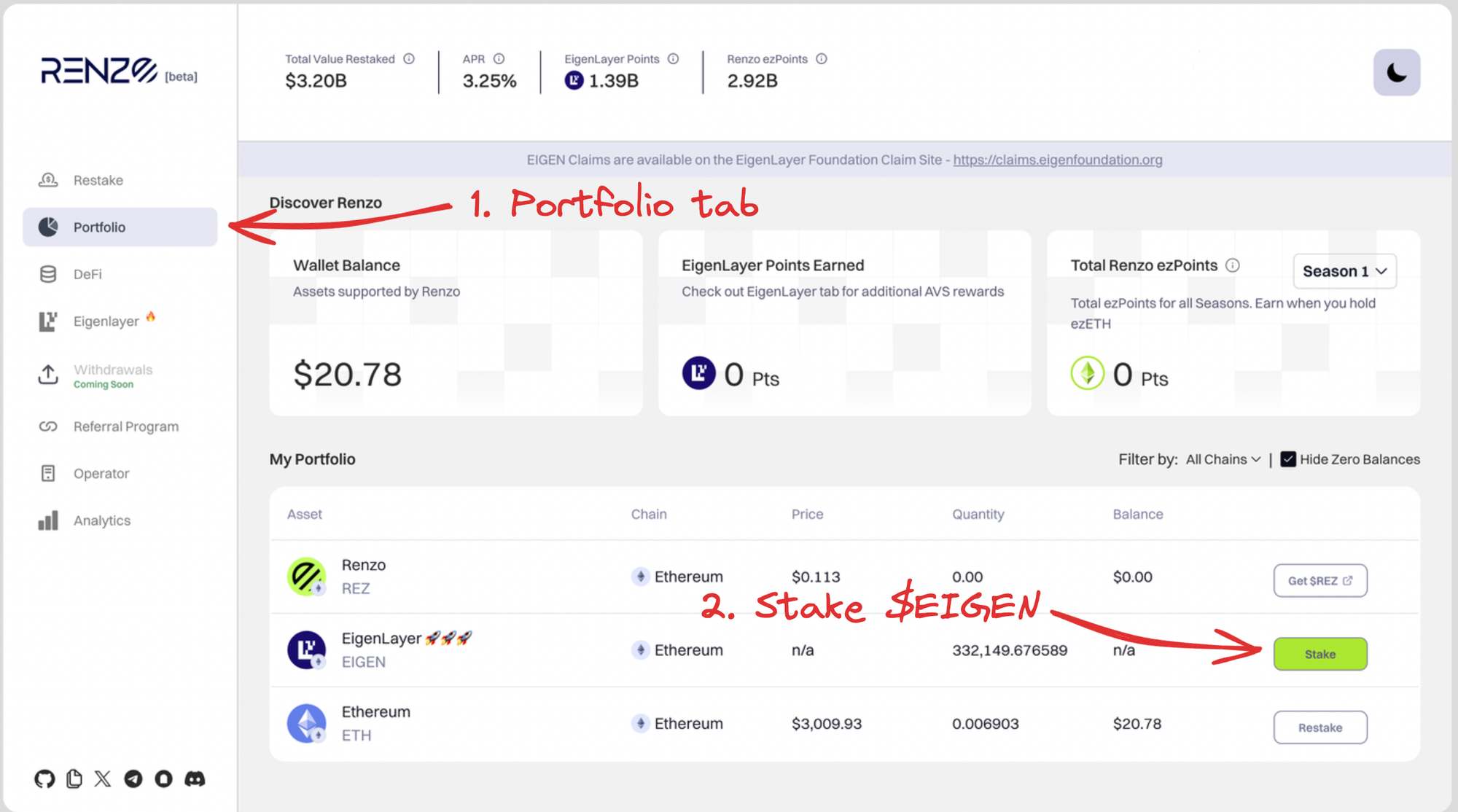

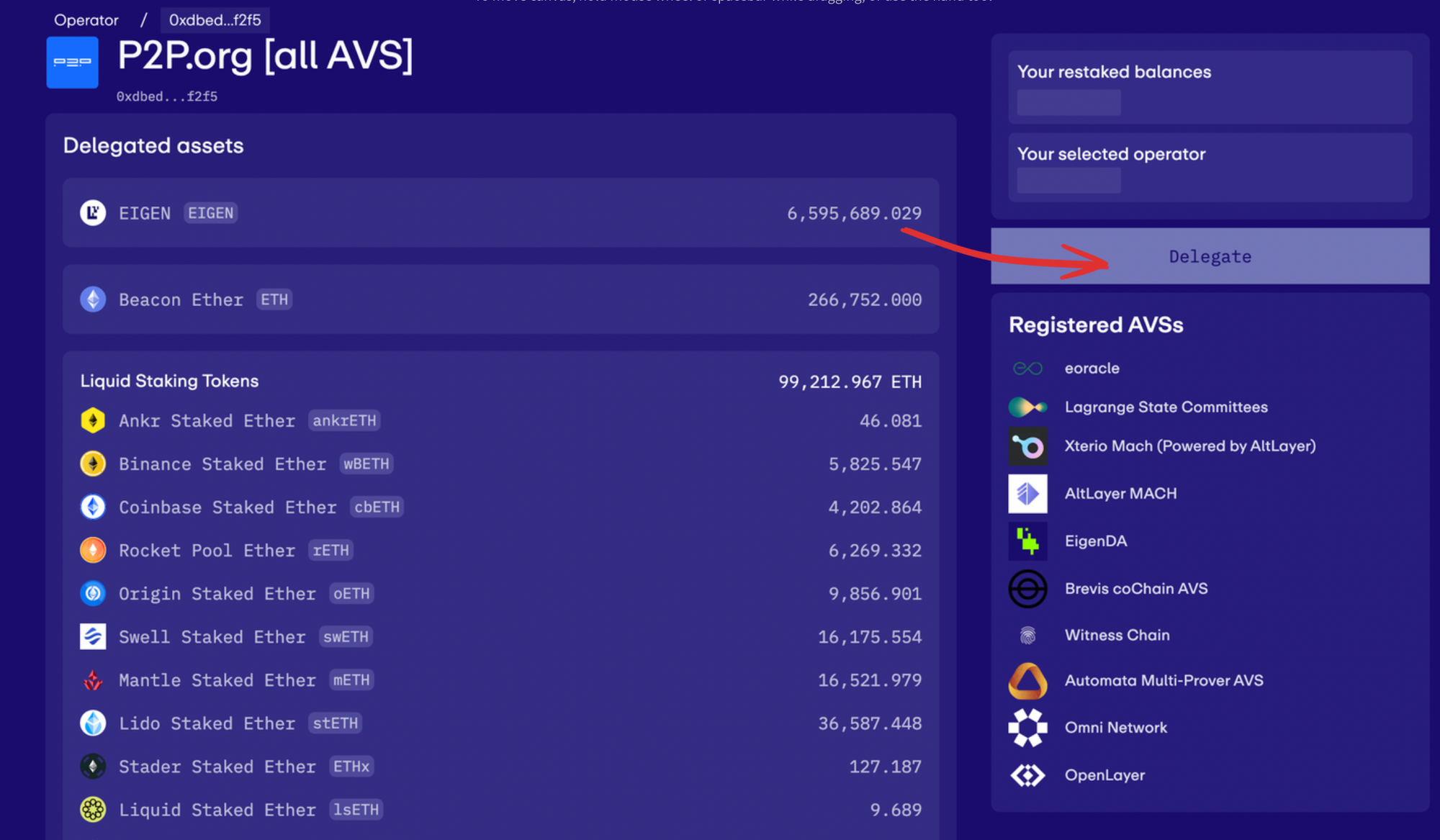

EIGEN stakedrop claims are open. Season 1 starts with 6.05% of the initial supply ready to claim. Eigen Foundation has already announced the next stakedrop season plans and is considering distributing 8.95% of the initial token supply for ecosystem participation.

This guide will explain how to participate in the ecosystem and secure EigenDA and other AVS that will soon accept $EIGEN as staking collateral.

While $EIGEN can secure ONLY EigenDA it doesn't matter how many AVS supports your operator (because your $EIGEN stake won't participate in securing other AVS except EigenDA). A few considerations to take into account:

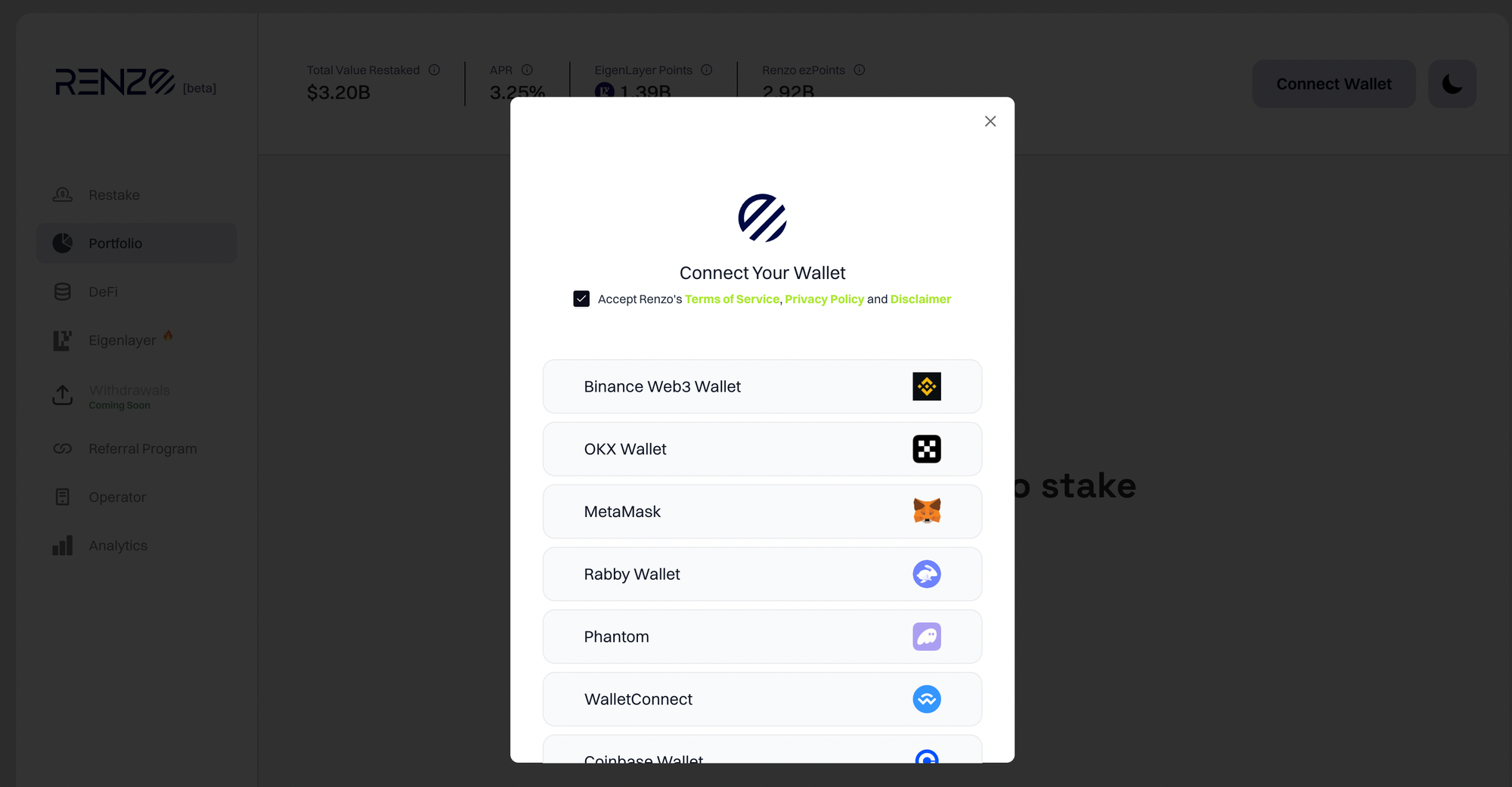

We proudly announce that we are partnering with Renzo to provide users with better UX and increase farming opportunities. Renzo makes staking your $EIGEN and giving you ezPoints as incentive while P2P.org ensures validator infrastructure uptime and manages associated risks of securing EigenDA

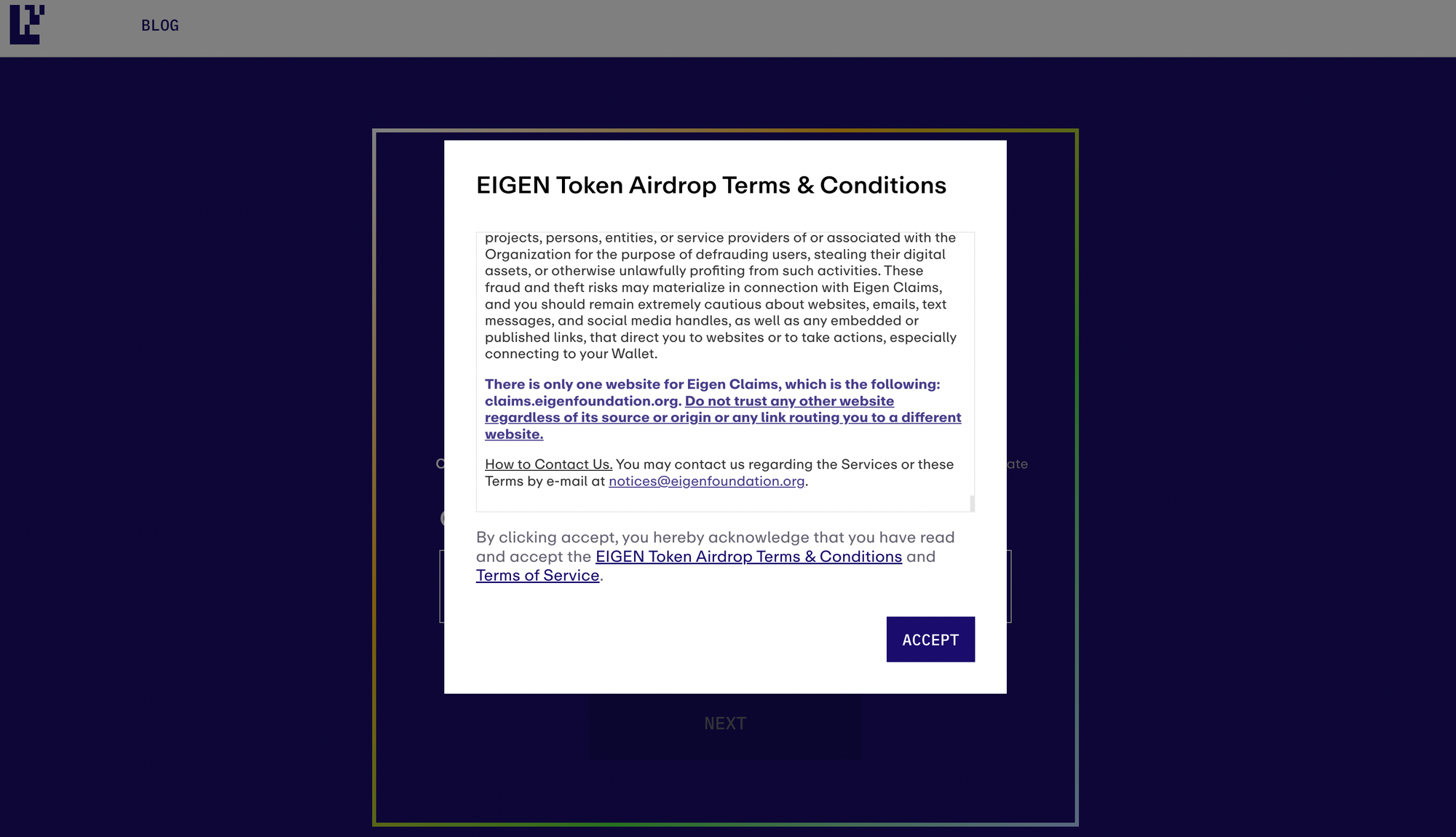

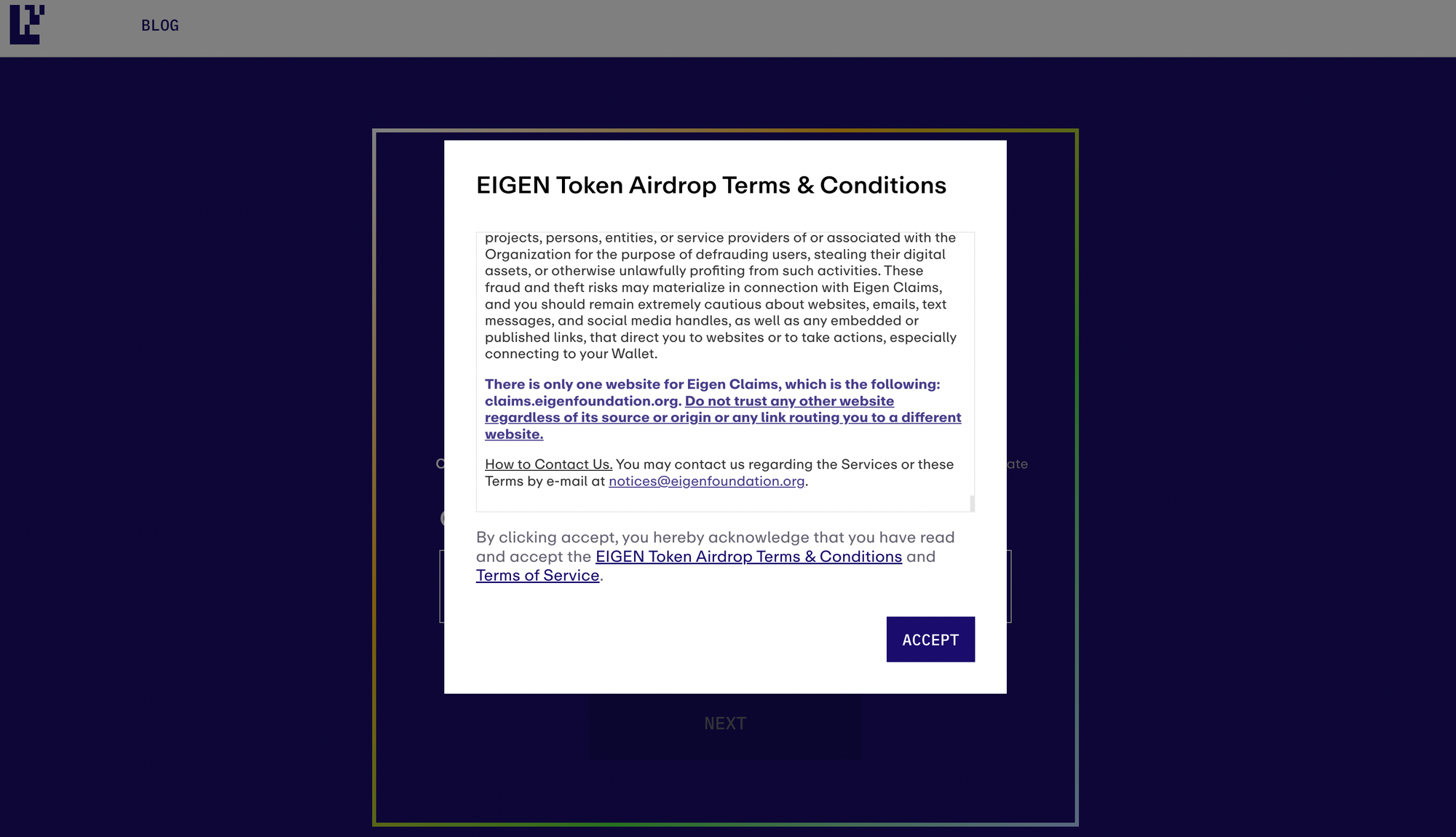

1.Check eligibility & claim $EIGEN https://claims.eigenfoundation.org/. You have to connect the wallet and accept the Terms to do that. Note you will need to turn off the VPN to do that.

1.Check eligibility & claim $EIGEN https://claims.eigenfoundation.org/. You have to connect the wallet and accept the Terms to do that. Note you will need to turn off VPN to do that.

Ethereum Product Manager at P2P.org

<p>On April 29, EigenLayer introduced the $EIGEN, which has a unique token design and utility. We dived deeper to explain intersubjective faults, how tokens may be forkable, and the nature of $bEIGEN.</p><h1 id="what-is-eigen">What is $EIGEN?</h1><p>Before discussing $EIGEN and its design, it's essential to understand some concepts introduced by EigenLayer.</p><p>The main idea behind any decentralized network or service is trustlessness. This means you don't need a central supervisor. Instead, the network's nodes work together to verify each other's work. If a node breaks the network rules, it gets punished through a process called slashing. For example, if an Ethereum validator creates two different blocks simultaneously, it's considered an attempt to split the network into two forks, and the validator is punished by slashing.</p><p>Decentralized services rely on the ability to verify if nodes violate network rules and punish bad behavior. However, not all types of bad behavior are easy to verify and punish. EigenLayer divides bad behavior (faults) into two types:</p><ol><li><strong>Objective Faults</strong>: These are behaviors that can be verified within a blockchain using mathematical or cryptographic methods.</li><li><strong>Intersubjective Faults</strong>: These are behaviors that cannot be objectively identified on-chain, but any reasonable observer would agree that a fault occurred and deserves a penalty.</li></ol><figure class="kg-card kg-image-card"><img src="https://lh7-us.googleusercontent.com/iG7oqosSleJ4W2xN_FNg4d-B6vFNCbTL1HtpmImB2uqhCCDamkgrXcLaRJdewETTpfBrL9zYCuOzOMgKHukhO7GZ6H5w85LMZ7VGyxdu2Vic3exRkJhpFrAViInyLXiTRT0eA1QsPPOb7nadNw0uZwc" class="kg-image" alt="" loading="lazy" width="1600" height="840"></figure><p>ETH restaking provides a way to penalize objective faults, extending Ethereum's security to other protocols. The new $EIGEN token introduces a mechanism specifically designed to address intersubjective faults.</p><p>$EIGEN works like staking, where slashing is imposed through mechanisms similar to formalized social disputes because these slashing conditions cannot be tracked on-chain. Another analogy is governance: voting for or against proposals to charge malicious actors. You can read more about objective and intersubjective faults in the white paper.</p><p>The purposes of $EIGEN are:</p><ol><li>To cover off-chain slashing conditions. Examples include transaction ordering, databases, prediction markets, storage services, oracles, artificial intelligence, and more.</li><li>To enable protocols to implement some form of slashing without designing on-chain slashing. This can be used in new launches before ETH restaking is enabled.</li></ol><figure class="kg-card kg-embed-card"><blockquote class="twitter-tweet"><p lang="en" dir="ltr">What are some usecases of AVSs with intersubjective slashing <a href="https://twitter.com/eigenlayer?ref_src=twsrc%5Etfw&ref=p2p.org">@eigenlayer</a><br>---------------<br>1) EigenDA - to slash for data withholding (not onchain verifiable)<br><br>2) Ordering service - to slash for censorship (not onchain verifiable)<br><br>3) Validity on arbitrary VM - to slash for… <a href="https://t.co/uvhGHdDWwJ?ref=p2p.org">https://t.co/uvhGHdDWwJ</a></p>— Sreeram Kannan (@sreeramkannan) <a href="https://twitter.com/sreeramkannan/status/1788093177288601851?ref_src=twsrc%5Etfw&ref=p2p.org">May 8, 2024</a></blockquote> <script async="" src="https://platform.twitter.com/widgets.js" charset="utf-8"></script></figure><h1 id="token-fork%E2%80%A6-how-will-it-work">Token fork… how will it work?</h1><p>$EIGEN is represented in two forms: bEIGEN and EIGEN, both of which are ERC-20 tokens that can be interchanged.</p><ul><li><strong>bEIGEN</strong>: This is a bonded (staked) token used for staking. It can be withdrawn by converting it back into EIGEN. bEIGEN is subject to forking, which is a slashing mechanism.</li><li><strong>EIGEN</strong>: This is a transferable token used for non-staking purposes, such as DeFi. It can be bonded by converting it into bEIGEN.</li></ul><p>The purpose of having two representations is to simplify the process and avoid complications related to forking. If there were only one token, every forking event would require DeFi platforms and CEXes to register a new fork and supply liquidity, which is inconvenient.</p><p>Now, let’s imagine that some AVS adopted $EIGEN to secure intersubjective slashing conditions. This AVS defines the mechanism for how the intersubjective slashing will work, i.e., conditions, dispute periods, voting design, etc. Here’s a step-by-step explanation of the forking process when an operator commits an intersubjective fault:</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2024/05/image-4.png" class="kg-image" alt="" loading="lazy" width="1414" height="646" srcset="https://p2p.org/economy/content/images/size/w600/2024/05/image-4.png 600w, https://p2p.org/economy/content/images/size/w1000/2024/05/image-4.png 1000w, https://p2p.org/economy/content/images/2024/05/image-4.png 1414w" sizes="(min-width: 720px) 720px"></figure><ol><li><strong>Social Deliberation</strong>:<ul><li>A fault alert is raised by a bEIGEN staker.</li><li>Consensus participants engage in deliberation to discuss the issue.</li><li>Honest participants converge on an opinion and agree on who will raise the challenge.</li></ul></li><li><strong>Challenge</strong>:<ul><li>Raising a challenge involves launching a new version of bEIGEN (an ERC-20 contract fork), a new challenge contract, and a new fork-distributor contract.</li><li>These contracts specify how malicious operators are penalized and how challengers are rewarded.</li><li>A challenger must submit a significant number of bEIGEN tokens as a bond, which will be returned if the challenge is successful.</li><li>The new bEIGEN accounts for the operators' malicious actions, slashes them, and rewards the challengers.</li></ul></li><li><strong>Configuring the EIGEN Contract</strong>:<ul><li>If the challenge is successful, EIGEN should be tied to the new fork of bEIGEN through an upgrade transaction.</li></ul></li></ol><h1 id="eigen-allocation-details">$EIGEN allocation details</h1><p>You can read all details about token allocation and check your eligibility on the official site <a href="https://eigenfoundation.org/?ref=p2p.org">https://eigenfoundation.org/</a> Here is a summary</p><p>The total supply of EIGEN at launch is 1,673,646,668.28466 tokens.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2024/05/image-6.png" class="kg-image" alt="" loading="lazy" width="1418" height="806" srcset="https://p2p.org/economy/content/images/size/w600/2024/05/image-6.png 600w, https://p2p.org/economy/content/images/size/w1000/2024/05/image-6.png 1000w, https://p2p.org/economy/content/images/2024/05/image-6.png 1418w" sizes="(min-width: 720px) 720px"></figure><p>Notable that In the initial phase, the $EIGEN will be non-transferable and non-forkable. That means you can’t trade it and get slashing. According to the EigenLayer plans, we can expect enabling transferability by the end of Q3 after the <a href="https://blog.eigenfoundation.org/announcement/?ref=p2p.org#:~:text=Responsible%20Rollout%3A%20Non%2DTransferability" rel="noreferrer">following milestones</a>:</p><ul><li>Community Discussions and agreement about EIGEN’s novel design, parameters, and proposed implementation.</li><li>Payments and Slashing enable the improvement of key features for a sustainable marketplace.</li><li>Enhanced Decentralization with token allocation to the community of 15% of the EIGEN supply and community participation in upcoming protocol governance.</li></ul><h1 id="what-to-do-with-eigen">What to do with $EIGEN?</h1><p>EigenLayer <a href="https://blog.eigenfoundation.org/announcement/?ref=p2p.org#:~:text=Enhanced%20Decentralization" rel="noreferrer">announced the plans</a> to empower decentralization and distribute 8.95% more of the initial token supply for ecosystem participation before the token become transferable and forkable (so approx. next four months). </p><p>One of the few options to participate in the ecosystem right now is by staking $EIGEN. Since the token is currently non-transferable, staking is the only available action. By staking $EIGEN, you will help secure EigenDA and other upcoming intersubjective AVSs.</p><p>To get started with staking $EIGEN, check out our step-by-step staking guide in our detailed article.</p><figure class="kg-card kg-bookmark-card"><a class="kg-bookmark-container" href="https://p2p.org/economy/eigen-staking-guide-with-p2p/"><div class="kg-bookmark-content"><div class="kg-bookmark-title">$EIGEN Staking Guide</div><div class="kg-bookmark-description">EIGEN stakedrop claims are open. Season 1 starts with 6.05% of the initial supply ready to claim. Eigen Foundation has already announced the next stakedrop season plans and is considering distributing 8.95% of the initial token supply for ecosystem participation. This guide will explain how to participate in</div><div class="kg-bookmark-metadata"><img class="kg-bookmark-icon" src="https://p2p.org/economy/content/images/2020/09/favicon.ico" alt=""><span class="kg-bookmark-author">P2P.org Blog: Insights, Guides, and News</span><span class="kg-bookmark-publisher">Vladislav Kurenkov</span></div></div><div class="kg-bookmark-thumbnail"><img src="https://p2p.org/economy/content/images/2024/05/Guide-2.jpeg" alt=""></div></a></figure><h1 id="more-reading-about-eigen">More reading about $EIGEN</h1><ol><li><a href="https://blog.eigenfoundation.org/announcement/?ref=p2p.org" rel="noreferrer">Blog announcement</a></li><li><a href="https://github.com/Layr-Labs/whitepaper/blob/master/EIGEN_Token_Whitepaper.pdf?ref=p2p.org" rel="noreferrer">$EIGEN whitepaper</a></li><li><a href="https://docs.eigenfoundation.org/?ref=p2p.org" rel="noreferrer">Stakedrop season1 FAQ</a></li></ol>

from p2p validator

<h3 id="preface"><strong>Preface</strong></h3><p>Polkadot has a staking architecture that encourages its token holders to take significant active participation in the security of the network; a strategy game that requires frequent monitoring and re-configuring of nominators' validator set which is incentivised through financial rewards and penalties. The aim of Polkadot is to obtain a continuously revised optimal selection of validators securing their Network. However, the P2P Polkadot team noticed that many DOT nominators were not receiving consistent daily rewards which raised the question of whether the anticipated behaviour was being achieved. The following research paper is devoted to the analysis of nominators behaviour in the active participation of managing their validator set in the Polkadot network. We hope that this will not only inform nominators on how to best manage their stake, but to provide the Polkadot community with a better understanding of the current state of nominator participation, and how to best manage the expectations moving forwards.</p><p>All data used for analysis in the research was obtained from publicly available sources such as MBELT and Subscan.</p><h3 id="how-does-polkadot-staking-work"><strong>How does Polkadot Staking work?</strong></h3><p>Polkadot uses a nominated proof of stake consensus algorithm to achieve consensus in the network.</p><p>Token holders can nominate their DOT holdings to validators (node operators) who will earn staking rewards on their behalf and redistribute it daily to their nominators after taking a fee for their service.</p><p>Validators go through an election phase at the end of each era (24h) where the top 297 validators (ranked by volume of stake) qualify to be part of the elected set responsible for staking in the subsequent era.</p><p>Nominators are given the option to nominate up to 16 validator addresses they trust. At the start of each era, through the use of Sequential Phragmén Method, each nominator's stake is allocated to one <strong><em>elected</em></strong> validator in their selected set. The aim is to evenly distribute the stake amongst validators.</p><figure class="kg-card kg-image-card"><img src="https://lh5.googleusercontent.com/ZhD2cZBlBnJBj345F6kwQ2X7WuZ2VFO2b8cK_Q60IHqQq8Q9xsyCq_aUOr5jA0F92f1SptBgqa61klseoOummmcrh6n_H08XiqKZizaG4Jl8C39LfOpy1lZ4yC0nkrQ0TFwa5SVzmQmdYboeSQ" class="kg-image" alt="" loading="lazy"></figure><h3 id="why-should-nominators-care-about-updating-their-validator-list"><strong>Why should nominators care about updating their validator list?</strong></h3><p>Regularly updating your validator list has two key benefits; maximising rewards and ensuring the security of funds.</p><p>The Polkadot protocol seeks to provide an even rewards distribution among well performing validators. Therefore, a nominator that has their stake allocated to an active validator with a lower amount of stake will receive higher rewards had their stake been allocated to a validator with a greater amount of stake. This is because the same amount of rewards will be distributed to less DOT.</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/ko4MROAwnoq6JDCWA6EfRUTnEjYAsYiOJcRp7QTe1U8aMTw240saLJPmmXAuuQ97SNrtA_704Vgw8zoAbaQ5EXWoduP8lHwNT6OZpDX1J9bHAKx3cErQFWdTicFS70QffzpJv-cf0UdUJEUWgA" class="kg-image" alt="" loading="lazy"></figure><p>Additionally, only the top 256 nominators (ranked by the volume of their stake) will receive rewards per active validator. Which means nominators, especially ones with lower stakes, should avoid <a href="https://help.p2p.org/en/articles/5271375-over-subscribed-polkadot-dot-pool?ref=p2p.org">oversubscribed validators</a>. On the other hand, only the top 297 validators (ranked by volume of stake) qualify to be part of the elected set responsible for staking in the subsequent era. It is therefore important for nominators to verify whether their validator set contains some validators that will likely be elected in the next era.</p><p>If any of their validators stop behaving accordingly, it is important for nominators to remove them from their list to avoid being slashed. Validators, including their nominators, can be punished financially for compromising the security of the network. This incentivises nominators to only nominate trustworthy validators, which in turn creates a strong set of validators to secure the network.</p><p>While it is clear that nominators curating their validator set increases the network performance by ensuring a continuously renewed optimal validator set, it is important to note that the staking architecture should be developed in a way where the cost of researching and updating the validator set is not greater than the rewards earned. The lower the stake of a nominator, the lower the rewards earned for a similar amount of research required. It can therefore be estimated that nominators with lower stake are more likely to inadequately re-configure their validator set.</p><h3 id="investigation-into-the-missed-rewards"><strong>Investigation into the missed rewards</strong></h3><p>The aim of this research was to see how often nominators were missing out on rewards. We collected data from all 22500 active nominators on June 20 2022 and summed the number of days that nominators did not receive rewards in the last 30 days. We only included nominators that did not receive rewards for 10 or more days during the month.</p><p>There are several reasons why nominators may not receive their rewards:</p><p>1. The nominators do not meet the minimum stake requirement of ~120 DOT. The minimum is dynamic and is set based on the top 256 nominators of a validator receiving rewards.</p><p>2. Their nominated validator set is being mismanaged by selecting oversubscribed validators in their list or by only having validators that are not elected.</p><p>3. Validators did not pay out the rewards by increasing commissions to 100%.</p><p>The below graph charts our findings.</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/13JffpFYTi_crQca1bigWYqOKzwQH2SyReN2tXEMql2mPFAE6e0NL3OtRqujKQiUu_Gx21_j0KHuAroIl_gX6R3ce8Zq6VDmJy8MxFOdJyKKtOq1vMjXcN9H9LU218KuLmqrGYvVfhVtj03iHg" class="kg-image" alt="" loading="lazy"></figure><p>A total of 2 166 nominators holding 1 928 751 DOT stake did not receive rewards for 10 or more days. Out of the nominators that we retrieved, 89 had a stake greater than 500 DOT, 2 050 with a stake between 120 (the minimum stake) and 500 DOT, and only 27 with less than 120 DOT.</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/sK2EPkb75eOxZ76Oj7vJppGfNgroiCZplO_AMivZvFmcK-LTTcmMwdPTLLYVADDcsE84VlZJlW39fwcLC60SRsIDm2WnkBzqLZBszmIQKFIhw1lKri_USxsH9n3E_vD962zHVTeUQkWzaGM_Rg" class="kg-image" alt="" loading="lazy"></figure><p>A total of 2139 out of 22,500 (~10%) nominators with stakes over the minimum requirement (120 DOT) did not receive rewards for 10 or more days of rewards and are currently being left out of at least 1/3 of potential rewards.</p><p>Our data points to the fact that there is a clear lack of participation in the management of the selection of validators from retail token holders.</p><p>Further research needs to be made to specify whether this lack of participation comes from the insufficient knowledge from individual token holders, or whether the labour required to research and reconfigure validator sets is too large versus the earnings they make from staking. In either case, it is clear that the process needs to be made simpler to retail clients.</p><p>While there are significant amounts of educational material out there to guide users on how to manage their stake, the extensiveness of the guides available can be daunting for beginners.</p><p>Polkadot.js is arguably the most popular analytical tool provided by the community to help curate a nominators validator set, however it is complex. There needs to be more made available tools (such as <a href="https://yieldscan.app/setup-wallet?ref=p2p.org">yieldscan</a>) that incorporate ease of use and choice given to the nominator. <br><br>In the meantime, we have created a list of active and undersubscribed validators to help nominators select a set that will generate daily rewards. You can find it below.</p><p>https://docs.google.com/spreadsheets/d/1OCS5YALL7Dt_C5SWHEG7Zzxc6OqHtC5e9lQHfjH8f8c/edit#gid=0</p><h3 id="conclusion">Conclusion</h3><p>The security of the Polkadot network relies on the active participation of nominators. Our investigation has highlighted that, while Polkadot’s idea to gain an edge in becoming the securest validator is a great concept, the execution hasn't seen the uptake they were hoping for. There is a high % of individual token holders that are currently not receiving daily rewards due to the lack of participation in the relatively complex staking architecture. There are a lot of compelling reasons for nominators to be participating in Polkadot’s architecture but the complexity of the system and the time investment for those with less stake can be off-putting.</p><p>As the number of nominators are on the uptrend, it is important for the development of more user-friendly tools to simplify the inclusion and participation of all nominators while still giving them freedom of choice. If Polkadot can find a way to simplify its architecture and invest in more user friendly tools, not only will it attract more retail nominators but also highly likely the uptake of retail nominators consistently updating their validators becomes significantly higher, leading to the selection of a more optimal validator set to secure the network.</p><h3 id="about-p2p">About P2P</h3><p><a href="https://p2p.org/?ref=p2p.org">P2P Staking</a> is a world-leading staking provider with the best industry security practices and proven expertise. We provide comprehensive due-diligence of digital assets and offer only top-notch staking opportunities. At the time of the latest update, <strong>more than 1.5 billion of USD value is staked with P2P Validator by over 25,000 delegators across 25+ networks.</strong> We are early DOT investors and the largest validator by staking volume. We are committed to provide long term support for the network.</p><p>If you have any questions, feel free to join our<a href="https://t.me/P2Pstaking?ref=p2p.org"> Telegram chat</a>, we are always open for communication.<br></p>

from p2p validator