Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

Three years ago, we watched Solana validators melt down under load. Two years ago, we saw Avalanche's C-Chain grind to a halt during a popular NFT mint. Last year, we observed BSC validators desperately cranking up gas limits only to watch their nodes fall further behind. Every "Ethereum killer" followed the same pattern: promise the moon, deliver a cratered landscape of compromises.

Then we started validating on Monad's testnet. And something new happened — it actually worked.

When you're running a validator on a "high-performance" EVM chain and Block time is 1 second, everything is going smoothly while the network is humming along at 500 TPS. Then PancakeSwap launches a new farm, or a hyped NFT collection starts minting. Suddenly, every transaction wants to touch the same contract. Your parallel execution engine, so proud of its 32 cores, watches 31 sit idle while one core desperately processes a queue of dependent transactions.

This is the little-known fact of parallel execution: it only works when transactions don't interact. The moment everyone rushes for the same exit, even a supercomputer becomes a Pentium.

We've seen this scenario play out many times before. We know how it ends. So when Monad claimed they'd solved it, at P2P.org we were skeptical. At first, we read their architecture. Then we tested it, and this is how we realized they'd done something genuinely smart that pushes the boundaries of blockchain technology forward.

Every blockchain consensus protocol since 2018 has been a variation on HotStuff — linear communication complexity, pipelined rounds, rotating leaders. It's elegant, proven, and fundamentally exploitable.

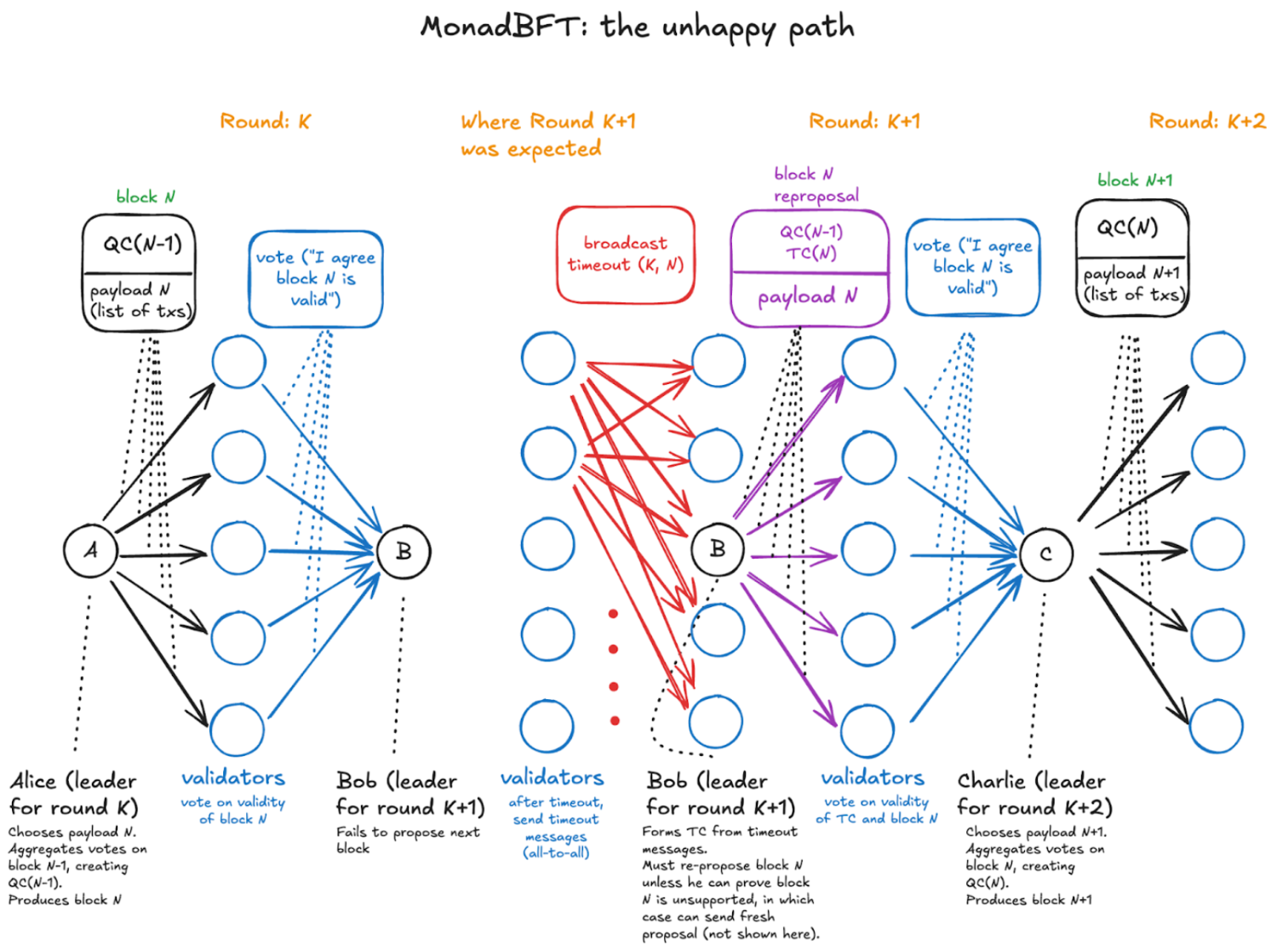

Here's the attack we've been watching for years, but nobody seems to talk about: Leader N+1 can always kill Leader N's block. Just refuse to include its certificate. Boom — Leader N loses their block rewards, their transactions get stolen, and Leader N+1 makes bank on the MEV. We call it tail-forking, and it's been happening on mainnet chains for years. The victims just don't realize it.

MonadBFT represents a totally new school of thought.

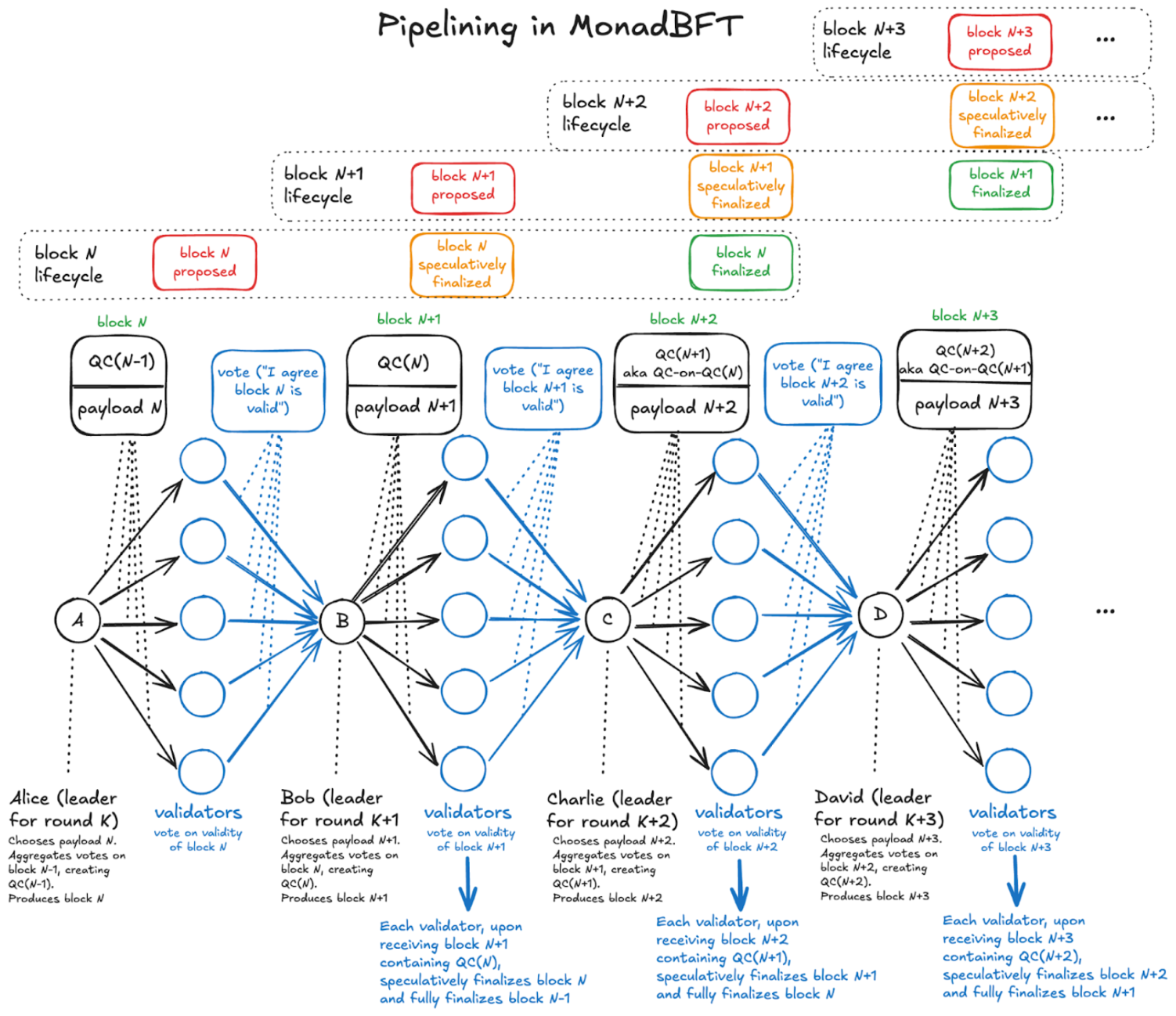

Traditional BFT makes you wait for absolute certainty. Two rounds of voting, 2f+1 confirmations, carved in stone. MonadBFT says, "What if we didn't?"

When you receive a block proposal, you vote immediately. When you see that vote certificate (QC) come back (just one round) you speculatively execute. But here's the genius part: you also save a "tip," the header of what you just voted for. If the next leader tries to fork away your block, your tip becomes evidence. The subsequent leader sees it in the timeout certificate and must repropose your block or prove nobody has it.

The math is beautiful. If 2f+1 validators voted for a block, at least f+1 are honest. Those f+1 honest validators have the tip. Any timeout certificate must include at least one honest tip. The chain can't progress without including that block.

The result? Once an honest leader proposes a block, it can only be excluded if that leader equivocates (double-signs), which is slashable. The MEV honeypot just became a trap.

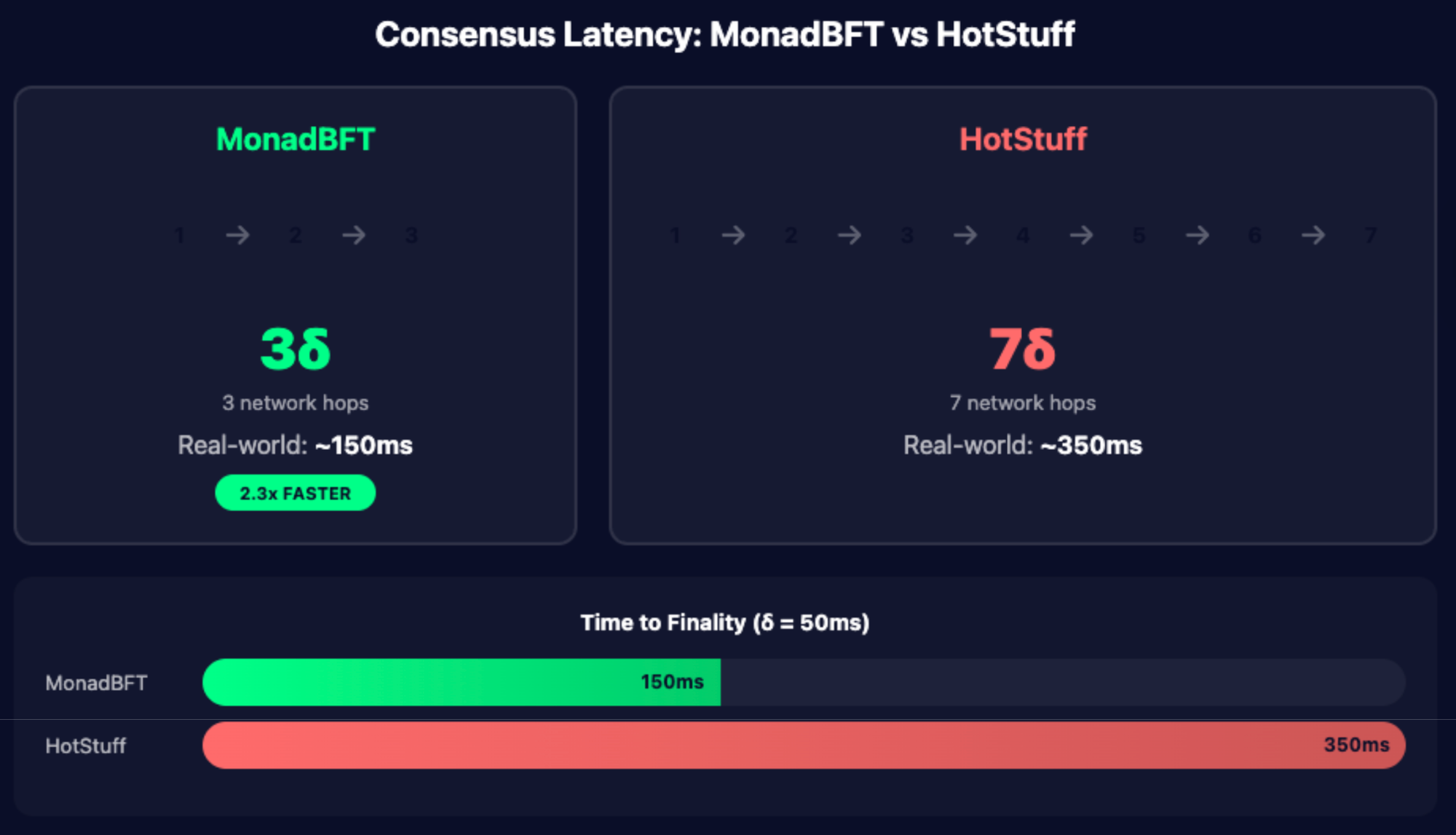

By speculating after one round instead of waiting for two, MonadBFT achieves 3δ latency (three network hops) versus HotStuff's 7δ. In real networks where δ is 50-100ms, that's the difference between 150ms and 350ms to finality.

But the real magic happens on the unhappy path. When leaders fail, HotStuff variants either sacrifice responsiveness (HotStuff-2) or communication complexity (Fast-HotStuff). MonadBFT keeps both by using Bracha's reliable broadcast — validators amplify timeout messages, achieving view synchronization in 2∆ without waiting for worst-case timeouts.

We've triggered thousands of leader failures on testnet. Recovery is consistently sub-second. No other BFT protocol achieves this combination of speed, efficiency, and resilience.

In Monad, validators agree on transaction ordering without executing those transactions. Execution happens asynchronously, lagging consensus by three blocks. This sounds insane until you realize a fundamental truth: the outcome is determined the moment ordering is determined. Execution just reveals what already is.

Think about it. Once transactions are ordered, their results are deterministic. Whether you execute them now or in three blocks doesn't change the outcome. It just changes when you learn the outcome.

This decoupling does something completely new: it gives execution the full block time instead of fighting consensus for milliseconds. In Ethereum, execution gets ~100ms out of a 12-second block. In Monad, execution gets the full 2 seconds while consensus runs in parallel. That's a 20x increase in execution budget without changing the block time.

But wait… if you don't execute transactions, how do you know the state root for the block?

You don't. And that's fine.

Monad includes a delayed merkle root from three blocks ago. If validators diverge in execution, they'll produce different roots. Three blocks later, when that root appears in a proposal, the divergent validator gets kicked out of consensus. They roll back to the last verified state and re-execute.

We've intentionally corrupted the state on our test validators to trigger this. Recovery is automatic and takes seconds. The delayed verification provides eventual consistency without sacrificing immediate progress.

Every parallel execution engine faces the same problem: transactions aren't naturally parallel. Alice pays Bob, Bob pays Carol, Carol pays Alice. Execute these in parallel and you'll get the wrong answer. Execute them sequentially and why did you buy that 64-core processor?

Monad's solution is wonderfully simple: execute first, apologize later.

Transaction 1 reads Alice's balance and adds 100. Transaction 2 reads Alice's balance and subtracts 50.

Traditional parallel execution would lock Alice's account, forcing sequential processing. Monad says, "screw it, run both simultaneously."

Transaction 2 starts with Alice's original balance, not knowing that Transaction 1 is about to change it. Both transactions are complete. Then comes the reconciliation.

Monad checks: Did Transaction 2 read the state that Transaction 1 modified? Yes? Transaction 2's results are discarded, and it runs again with Transaction 1's updates. This continues—Transaction 3 might depend on Transaction 2's corrected results, causing a cascade of re-execution.

Sounds inefficient? It isn't, because a vast majority of transactions don't conflict.

Most blockchain teams think parallel execution is the answer. Add more cores, run transactions simultaneously, watch the TPS counter explode. Except it doesn't work that way.

Multiple studies analyzing millions of Ethereum transactions tell a consistent story. Sei Protocol examined 2.49 million transactions and found 64.85% could execute in parallel with zero conflicts. Khipu's mainnet analysis showed 80% parallelizability. Block-STM demonstrates this in practice: 16-20x speedup with low contention, degrading gracefully to 3-4x when conflicts increase.

The math looks beautiful. Then you hit production and discover the truth.

State access consumes 70% of execution time (Flashbots research). You can parallelize computation all you want; you're fighting over the 30% that doesn't matter. Is signature verification, the operation everyone assumes is expensive? Less than 1% of total processing time. The actual killer is reading from and writing to the Merkle Patricia Trie.

Think about what this means. Every SLOAD operation becomes a randomized treasure hunt through a database that wasn't built for concurrent access. Block-STM proved the pattern: exceptional speedups with independent transactions, but even their optimized engine hits walls when everyone queues for the same state.

This is where Monad actually innovates.

When transactions conflict and require re-execution, the expensive work doesn't repeat. Signature results cache. The state stays in memory. JIT compilation persists. Only the state transitions run again. But the real breakthrough goes beyond handling conflicts, and focuses on eliminating the bottleneck everyone else accepts as inevitable.

Monad's own engineering team said it plainly: "Parallelization alone made little impact on performance because the bottleneck is state access."

Databases are where blockchain dreams go to die. You can have the fastest consensus, the cleverest execution, but if your disk can't keep up, you're building a very expensive space heater.

Ethereum clients use LevelDB or RocksDB — general-purpose key-value stores designed in 2011 for Facebook's social graph. They're embedding a Merkle-Patricia Trie into a B-tree or LSM-tree. It's trees all the way down, and every level adds overhead.

MonadDB said, "What if we just... didn't?"

MonadDB implements Patricia Tries natively. Not as a data structure stored in a database, but as THE database. When you query the state, you're traversing the actual on-disk trie structure, not some interpretation of it.

This sounds simple but its implementation isn’t. It requires rethinking everything:

Asynchronous I/O: With parallel execution, dozens of transactions query state simultaneously. MonadDB uses io_uring (Linux's newest async I/O interface) to handle thousands of concurrent disk operations without thread spawning overhead.

Filesystem Bypass: Files are an abstraction. Filesystems are an abstraction on top of an abstraction. MonadDB says "Give me the raw block device." No filesystem fragmentation, no metadata overhead, no buffer cache confusion. Just bytes on disk exactly where MonadDB put them.

Persistent Data Structures: Updates don't modify existing trie nodes. They create new versions. This enables lock-free reads (critical for parallel execution) while maintaining atomicity. Old versions get garbage collected asynchronously.

The performance difference is staggering. Our benchmarks show 10x improvement in random state access versus RocksDB. But the real win is write amplification—MonadDB reduces it by 3x, extending SSD lifespan and reducing infrastructure costs.

Here's a fun math problem: You need to send a 2MB block to 100 validators. Your upload bandwidth is 1 Gbps. How long does it take?

Traditional broadcast: 2MB × 100 = 200MB = 1.6 seconds. Your 2-second block time just died.

RaptorCast doesn't multiply — it divides.

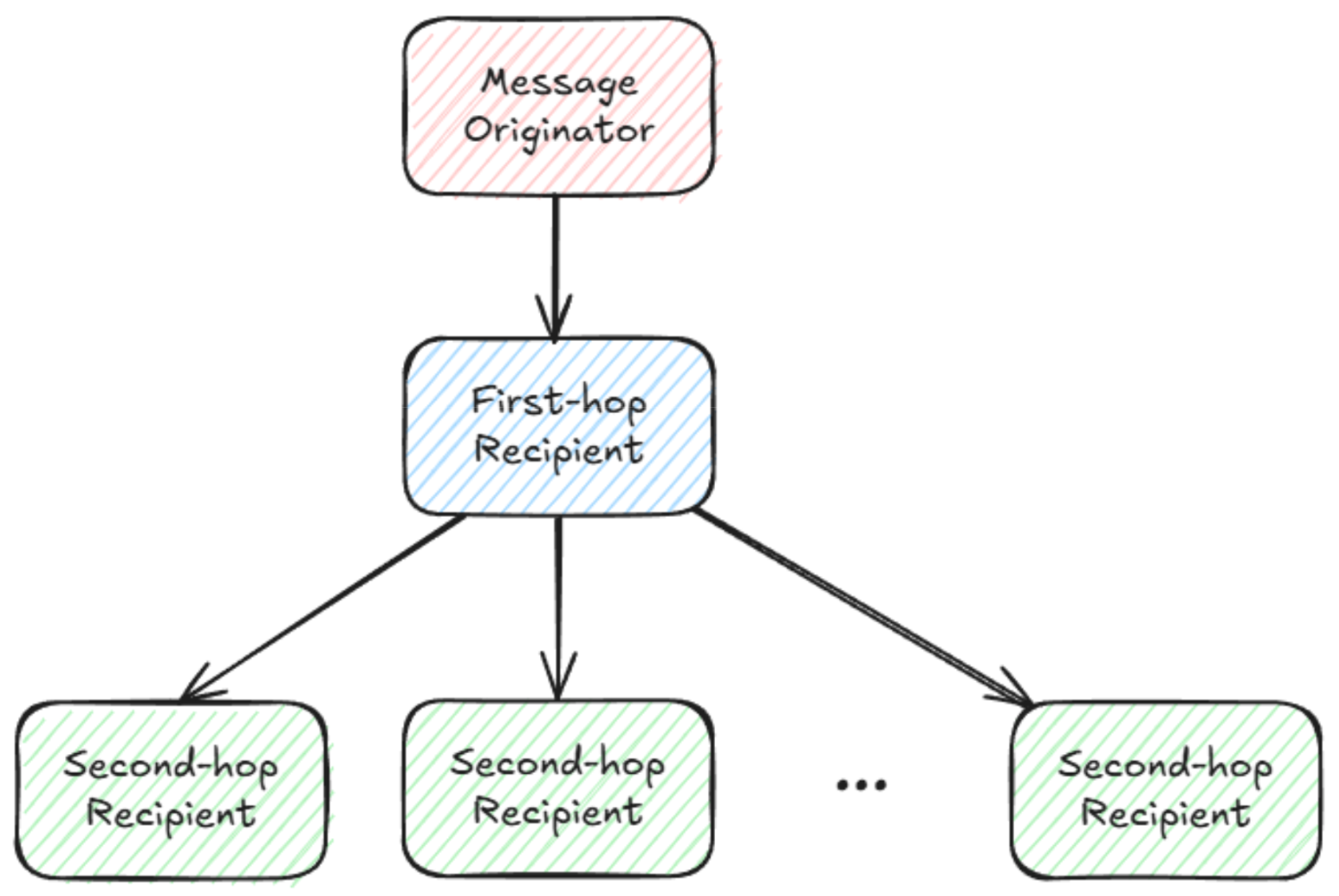

Instead of sending the full block to everyone, RaptorCast uses Raptor codes (RFC 5053) to create 300 encoded chunks where any 100 chunks reconstruct the original block. Each validator gets 3 chunks (weighted by stake). Then — and this is the clever part — validators share chunks with each other.The math:

But the real innovation is in failure recovery. If a block doesn't decode, validators can prove it with the malformed chunks. The leader can't claim "you didn't receive it correctly", as the cryptographic proofs make failures attributable.

We've tested RaptorCast under adversarial conditions — 50% packet loss, coordinated Byzantine validators, and network partitions. It recovers every time. The redundancy auto-adjusts based on observed failure rates. It's an antifragile infrastructure.

We've validated on 40+ networks. We've seen every flavor of failure. Chains that work in simulation but die under load. Chains that scale perfectly until someone deploys Uniswap. Chains that achieve 100,000 TPS (on a private network, with one validator, processing empty transactions).Monad is different because it solves the right problems:

After two years on testnet, here's what we know:

The Verdict: Monad delivers on its promises. Not through magical breakthroughs but through systematic engineering. Every bottleneck identified, analyzed, and eliminated.

Before we get into institutional specifics, let's translate the technical architecture into practical outcomes:

For Everyone Staking MON:

Higher, More Reliable Yields

10,000 TPS means more network activity. More activity means more fees. More fees mean higher staking rewards. But only if your validator can actually capture them—which requires infrastructure optimized for Monad's architecture.

Faster Reward Compounding

2-second finality means staking rewards compound multiple times per minute, not once per day. Over time, this creates measurably better returns compared to slower chains.

Lower Slashing Risk

Parallel execution reduces validator race conditions that cause most slashing events on other chains. MonadBFT's design makes it nearly impossible for honest validators to get penalized.

Shorter Unstaking Periods

Approximately 5.5 hours from unstake to withdrawal. Compare this to Ethereum's 2-5 days. Liquidity when you need it, security when you don't.

For LST Protocol Users:

The liquid staking protocols we're integrated with (aPriori, Kintsu, Magma, Fastlane) each leverage Monad's performance differently—from MEV capture to distributed validator technology. But they all depend on validator infrastructure that can keep pace with 10,000 TPS.

For Institutional Allocations:

The technical architecture translates to risk mitigation. When you're allocating significant capital, you need validators who've stress-tested the edge cases, optimized for the specific bottlenecks, and built monitoring for Monad's unique requirements.

That's where institutional-grade infrastructure separates from commodity validation services.

We don't chase hype. We've turned down validator opportunities on chains with bigger treasuries and louder marketing. We validate where the technology deserves it.

Monad deserves it.Their architecture is fast and correct in practice, not just theory. And not only on testnet, but under adversarial conditions.

When mainnet launches, we'll be running validators on hardware specifically optimized for Monad's architecture. NVMe arrays configured for MonadDB's access patterns. Network topology optimized for RaptorCast. Monitoring systems tracking parallel execution efficiency.

Because when you find a blockchain that actually solves the hard problems, you build for it.

P2P.org has been stress-testing Monad since Testnet-1. We're accepting institutional staking partnerships for mainnet launch.

If you're performance hungry but value risk-averse infrastructure, reach out to our team: https://link.p2p.org/bdteam

<p></p><h2 id="at-a-glance"><strong>At a Glance:</strong></h2><ul><li><strong>Bron launched ETH and Solana staking in weeks</strong> using P2P.org's Unified API — one integration, multiple networks, zero infrastructure overhead.</li><li><strong>MPC security meets staking revenue:</strong> Bron users get institutional-grade protection linked to Copper with features like seedless recovery, hidden vaults, and inheritance controls — all while earning staking rewards directly in-wallet.</li><li><strong>Powered by $10B+ validator infrastructure:</strong> The same P2P.org network securing assets for 100+ institutional clients now enables seamless, non-custodial staking inside Bron's wallet interface.</li><li><strong>Unified API in action:</strong> This integration proves how fast wallets and custodians can add multi-chain staking without running validators, managing rewards, or compromising security.</li></ul><p>Institutional-grade staking infrastructure just became exponentially more accessible. </p><p>Bron's integration of P2P.org's Unified API delivers native ETH and Solana staking through enterprise-level MPC security — proving that institutional custody and seamless user experience aren't mutually exclusive.</p><h2 id="a-new-chapter-for-wallet-staking"><strong>A New Chapter for Wallet Staking</strong></h2><p>Users expect staking to work like every other wallet feature — seamless, secure, and native to the interface. But most wallets face a brutal choice: build and maintain expensive validator infrastructure across multiple networks, or skip staking entirely and leave revenue on the table.</p><p>Bron’s team wanted to bring staking to its users in a way that was both seamless and secure. With P2P.org’s Unified API, they found a way to do exactly that, without building any infrastructure in-house.</p><h2 id="the-integration"><strong>The Integration</strong></h2><p>The integration connects Bron’s wallet interface directly to P2P.org’s Unified API, allowing users to delegate ETH and SOL in just a few clicks. The entire flow happens inside the wallet’s native UI:Users choose an asset, confirm the transaction through their MPC-secured keys, and track rewards in real time.</p><p>Under the hood, P2P.org’s Unified API handles all staking operations — validator management, network interactions, and reward distribution — while Bron retains complete control over the user experience and key security.</p><p>This collaboration brings the best of both worlds together: Bron’s MPC (multi-party computation) security linked to Copper’s infrastructure, and P2P.org’s proven validator network securing over $10B in assets across 40+ blockchains.</p><p><strong>This is institutional-grade staking infrastructure made instantly accessible.</strong></p><h2 id="security-architecture-that-doesnt-compromise"><strong>Security Architecture That Doesn't Compromise</strong></h2><p>Bron's wallet is purpose-built for institutional use cases, and the staking integration preserves every security guarantee. Its architecture is built around security and recoverability — a key reason this integration stands out. The wallet uses MPC technology to eliminate single points of failure: private keys are divided into multiple encrypted shards, and no single party ever has full access.</p><p>Bron extends this foundation with features specifically designed for institutional asset management:</p><ul><li><strong>Seedless recovery mechanisms</strong> that enable account restoration without vulnerable seed phrases</li><li><strong>Hidden vaults</strong> for privacy-critical holdings</li><li><strong>Inheritance controls</strong> for long-term wealth transfer planning</li><li><strong>Policy engine</strong> supporting multi-signature approvals and role-based access controls</li></ul><p>With these protections in place, staking through Bron is fully non-custodial.Users maintain complete control of their assets, while P2P.org provides validator reliability, slashing protection, and uptime guarantees through the Unified API.</p><h2 id="scaling-staking-through-unified-api"><strong>Scaling Staking Through Unified API</strong></h2><p>For wallets, custodians, and fintech platforms, the Bron integration demonstrates what’s now possible with P2P.org’s Unified API.A single integration unlocks staking across multiple chains, removing the need for protocol-specific SDKs, custom logic, or validator infrastructure.</p><p>By connecting once, Bron immediately enabled two networks — Ethereum and Solana — and can add new ones as P2P.org expands coverage. The same API layer also handles performance tracking and reward reporting, simplifying both the developer experience and operational overhead.</p><p>This modular approach lets wallets focus on what they do best — designing user experiences — while P2P.org handles everything under the hood.</p><h2 id="built-on-trust"><strong>Built on Trust</strong></h2><p>Both teams share a vision for the next generation of wallet infrastructure: combining security, compliance, and user autonomy with best-in-class network infrastructure.</p><p>Bron brings advanced key management, recovery, and policy tools that make digital asset ownership more resilient. P2P.org provides the staking foundation trusted by some of the largest institutions and networks in the industry.</p><p>Together, we’re setting a new standard for how wallets integrate staking — secure by design, production-ready, and infinitely scalable.</p><h2 id="for-wallets-and-platforms"><strong>For Wallets and Platforms</strong></h2><p>Unified API is now live and available for new integrations.Wallets, custodians, and exchanges can implement staking-as-a-feature through the same endpoints that power Bron’s integration — bringing institutional-grade staking to their users in weeks, not months.</p><p>If you’re building a wallet or custody product and want to integrate staking through P2P.org’s Unified API, reach out to our API team.</p><p>Let’s build the next generation of staking together.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://link.p2p.org/bdteam?ref=p2p.org" class="kg-btn kg-btn-accent">Book a Unified API Demo</a></div>

from p2p validator

<p>Most SafePal users hold stablecoins that sit idle in their wallets. Now, through P2P.org, those assets can be allocated directly to DeFi protocols — securely, non-custodially, and without leaving the app.</p><p>This integration gives users real utility: stablecoin access that’s simple, transparent, and powered by the same infrastructure that secures $10B+ across 40+ networks.Learn how to get access to it with this simple guide: </p><h3 id="step-1-open-the-safepal-app"><strong>Step 1: Open the SafePal App</strong></h3><p>Make sure you have the latest version of the SafePal app installed.From the home screen, tap the Earn tab at the top.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-ff184843-f18f-4194-8cf9-33f4637bc01f.jpeg" class="kg-image" alt="" loading="lazy" width="632" height="1280" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-ff184843-f18f-4194-8cf9-33f4637bc01f.jpeg 600w, https://p2p.org/economy/content/images/2025/11/data-src-image-ff184843-f18f-4194-8cf9-33f4637bc01f.jpeg 632w"></figure><h3 id="step-2-explore-the-earn-marketplace"><strong>Step 2: Explore the Earn Marketplace</strong></h3><p>Scroll through or use the search bar to find available dApps in SafePal Earn. You’ll see featured partners like Binance, MEXC, and now <strong>P2P.org</strong>.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-77a75c89-d5ea-46c7-a56c-b28ef53d4670.jpeg" class="kg-image" alt="" loading="lazy" width="629" height="1280" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-77a75c89-d5ea-46c7-a56c-b28ef53d4670.jpeg 600w, https://p2p.org/economy/content/images/2025/11/data-src-image-77a75c89-d5ea-46c7-a56c-b28ef53d4670.jpeg 629w"></figure><h3 id="step-3-search-for-p2porg"><strong>Step 3: Search for P2P.org</strong></h3><p>Tap the search icon and type <strong>“P2P”</strong>.You’ll find <strong>Stablecoins | P2P.org</strong> listed as one of the Earn dApps.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-3593dd47-d8a2-45db-8d97-39a5ecf9876f.jpeg" class="kg-image" alt="" loading="lazy" width="620" height="1280" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-3593dd47-d8a2-45db-8d97-39a5ecf9876f.jpeg 600w, https://p2p.org/economy/content/images/2025/11/data-src-image-3593dd47-d8a2-45db-8d97-39a5ecf9876f.jpeg 620w"></figure><h3 id="step-4-connect-and-enter-the-app"><strong>Step 4: Connect and Enter the App</strong></h3><p>When you tap to open P2P.org, you’ll see a <strong>Security Warning</strong> — this is standard for all third-party dApps. Confirm to continue.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-81d4ea20-3845-4ab0-b4b9-344303eaf617.jpeg" class="kg-image" alt="" loading="lazy" width="626" height="1280" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-81d4ea20-3845-4ab0-b4b9-344303eaf617.jpeg 600w, https://p2p.org/economy/content/images/2025/11/data-src-image-81d4ea20-3845-4ab0-b4b9-344303eaf617.jpeg 626w"></figure><h3 id="step-5-allocate-your-stablecoins"><strong>Step 5: Allocate Your Stablecoins</strong></h3><p>Inside the P2P.org interface, select your asset (USDC, USDT, or DAI) and the protocol you want to allocate to.For example, you can choose Morpho — one of the DeFi protocols available through P2P.org infrastructure.</p><p>Check the details, agree to the terms, and tap Deposit to complete your allocation.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-ff8e5c43-b1b5-47a8-aeff-cd1d3ad2f3e6.jpeg" class="kg-image" alt="" loading="lazy" width="620" height="1280" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-ff8e5c43-b1b5-47a8-aeff-cd1d3ad2f3e6.jpeg 600w, https://p2p.org/economy/content/images/2025/11/data-src-image-ff8e5c43-b1b5-47a8-aeff-cd1d3ad2f3e6.jpeg 620w"></figure><p><em>Screenshot for illustration only. Actual rewards vary. See latest rates directly in-app.</em></p><h3 id="step-6-track-your-positions"><strong>Step 6: Track Your Positions</strong></h3><p>Once your allocation is complete, you can view your position directly inside the SafePal app under the Earn tab.</p><p>Everything remains non-custodial — your assets stay in your wallet, and you can manage or withdraw at any time.</p><h2 id=""></h2><h2 id="why-it-matters"><strong>Why It Matters</strong></h2><p>Until now, most stablecoins in SafePal wallets were sitting idle. This integration changes that — bringing institutional-grade infrastructure directly to users in one of the largest non-custodial wallets in the world.</p><p>With SafePal and P2P.org, stablecoin allocation becomes as simple as tapping “Earn.”</p><p><strong>Access it now:</strong> <a href="https://www.safepal.com/channel/earn0925?ref=p2p.org">https://www.safepal.com/channel/earn0925</a></p><p><strong>Learn more:</strong> <a href="https://p2p.org/economy/25m-wallet-users-one-integration-stablecoin-opportunities-on-safepal-powered-by-p2p-org/"><u>https://p2p.org/economy/25m-wallet-users-one-integration-stablecoin-opportunities-on-safepal-powered-by-p2p-org/</u></a></p><h2 id="for-partners"><strong>For Partners</strong></h2><p>If you’re building a wallet or financial app and want to offer your users seamless access to stablecoin allocations, P2P.org’s widget can be integrated directly into your interface. It’s simple to embed, fully non-custodial, and backed by infrastructure securing over $10B across 40+ networks.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://link.p2p.org/bdteam ?ref=p2p.org" class="kg-btn kg-btn-accent">Get in touch</a></div>

from p2p validator