Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

Welcome to Part 2 of our Lido V3 for Institutions series.

Read Part 1: Why Lido V3 Matters for Institutions: https://x.com/P2Pvalidator/status/1981004391948652979

The gap between "you can choose your operators" and "you have effectively managed operator risk" requires understanding what professional validator operations actually entail, not just reviewing rankings on explorer sites.

With Lido V3's mainnet launch scheduled for December 2025, forward-thinking institutions are evaluating their operational frameworks now. While stVaults aren't live yet, the underlying validator operations that will power them are running today — and understanding these operations is critical for effective operator selection when V3 launches.

At P2P.org, we operate institutional validation infrastructure across 40+ networks, managing over $10B in staked assets. Our institutional validator operations demonstrate the standards that stVault operators should meet — standards that will be critical when institutions customize their Lido V3 deployments.

This article examines what institutional-grade node operations actually look like, why these operational standards matter, and what institutions should verify when selecting operators for their stVaults.

When institutions ask what they're paying node operators for, the answer centers on three operational layers that work together to protect capital and maximize returns.

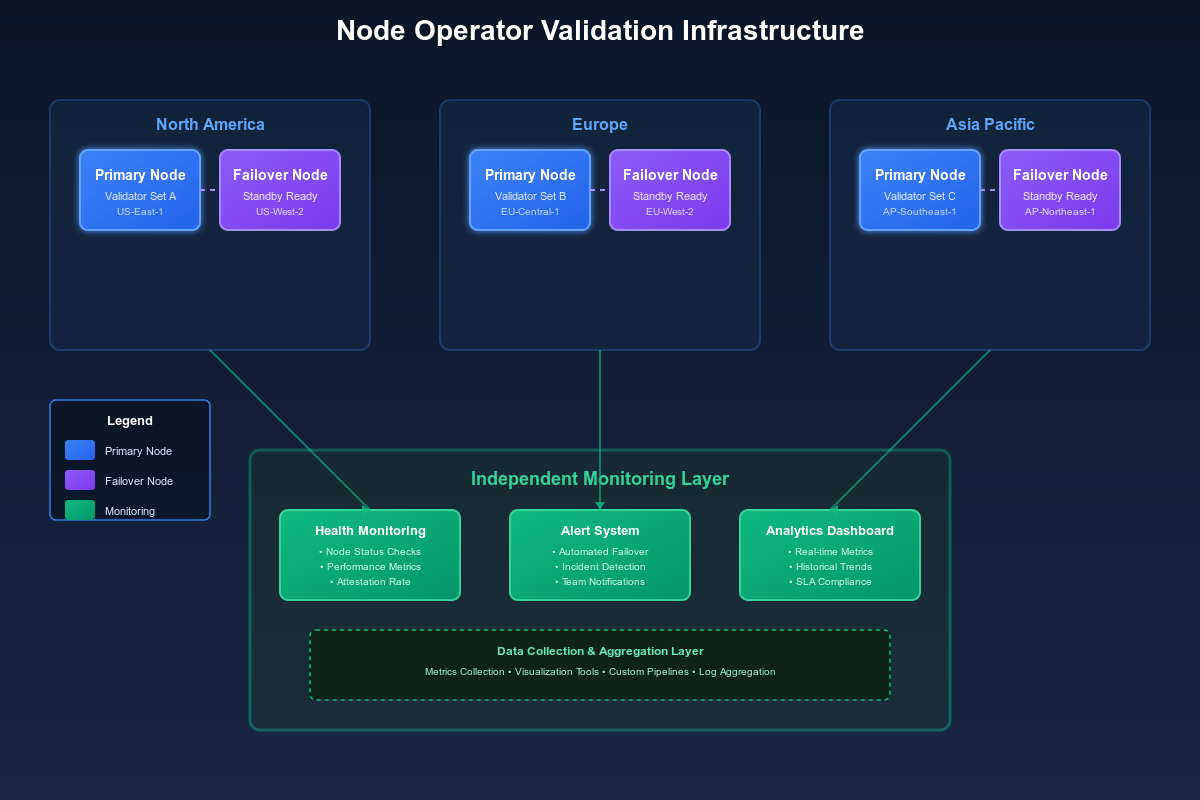

Professional node operations don't run validators on single servers. Institutional-grade operations require redundant infrastructure across multiple geographic locations.

Primary validation infrastructure uses enterprise-grade servers with redundant networking and backup power systems. This isn't excessive — it's essential. Ethereum's network doesn't care why your validator missed attestations. Power outages, network issues, hardware failures, or software bugs all result in penalties.

Secondary failover infrastructure in geographically separate locations automatically assumes duties if issues are detected with primary systems. This geographic distribution protects against regional outages, data center problems, or localized network issues.

Independent monitoring infrastructure separate from validation systems ensures problems are detected even if validation environments experience issues. This separation is critical, as monitoring systems that rely on the same infrastructure they're monitoring create single points of failure.

At P2P.org, our institutional operations maintain this redundancy across all networks we operate. The infrastructure investment for institutional-scale operations is substantial—this is what institutional staking fees cover. The operational overhead ensures reliability that protects your capital and maximizes returns.

Lido V3 stVaults are designed to enable institutions to select operators based on their specific requirements, moving beyond the one-size-fits-all approach of pooled protocols.

Validator keys are the most critical assets in the operation. Compromise these keys, and attackers could cause slashing events that destroy principal. Lose these keys, and validators stop functioning.

Professional node operators implement multiple security layers that institutional stVault operators should demonstrate.

Hardware Security Modules (HSMs) store all validator keys in tamper-resistant devices that perform cryptographic operations internally without exposing private keys. Even system administrators cannot extract keys—they can only request the HSM perform signing operations.

Professional operators generate validator keys using HSMs in secure, air-gapped environments with strict access controls. At P2P.org, institutional security standards are foundational to our operations.

Geographic distribution means keys exist in multiple secure locations. If one location becomes unavailable, validators continue operating using keys in secondary locations. This redundancy protects against both security incidents and availability issues.

Access controls and monitoring ensure that every interaction with validator keys is logged, authorized, and auditable. Institutional clients need these audit trails for their own governance and compliance requirements.

Lido V3 stVaults aim to provide institutions with greater transparency into operator standards, enabling more informed selection decisions compared to pooled protocols.

Professional monitoring goes far beyond checking if validators are online. Institutional operations require comprehensive monitoring that detects problems early and enables rapid response.

Validator performance monitoring tracks not just uptime but effectiveness. An operator with 99.5% uptime but poor attestation effectiveness may deliver worse returns than an operator with 99.2% uptime and consistently optimal attestations. Institutional monitoring systems track these nuances rather than a simple binary online/offline status.

Infrastructure health monitoring tracks node synchronization, peer connectivity, hardware resource utilization, and network conditions. Problems in any of these areas can degrade performance before causing complete outages. Early detection enables corrective action before penalties occur.

Network condition monitoring tracks the broader Ethereum network for conditions that might affect validators—upcoming hard forks, client bugs affecting other operators, or network congestion that could impact attestation inclusion.

At P2P.org, our monitoring systems track validator performance continuously across all networks we operate, with alert systems designed to detect and respond to anomalies rapidly.

Lido V3 stVaults are expected to enable institutions to select operators with monitoring capabilities that meet their specific requirements.

The three layers we've described are proven operational standards from managing billions in institutional stakes across dozens of networks.

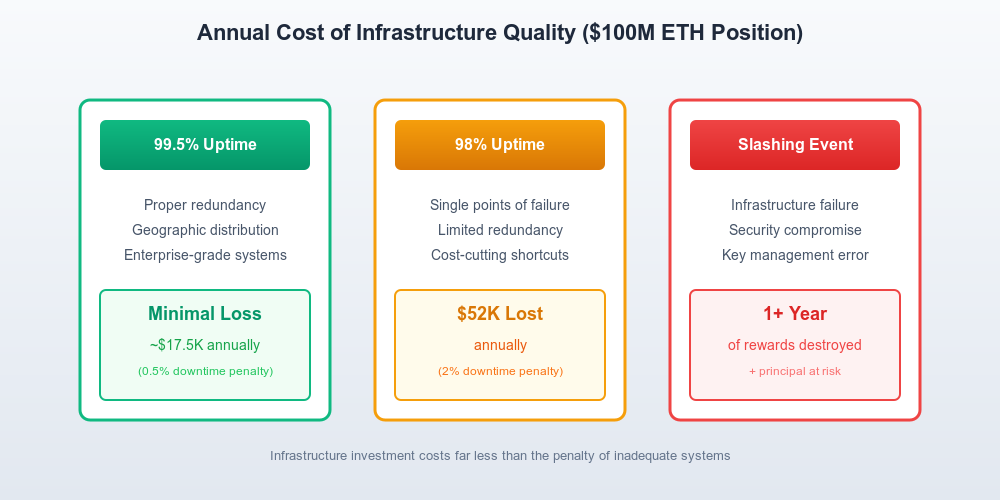

For a $100M ETH position, each percentage point of uptime below 99% costs approximately $35K annually in lost rewards. Inadequate infrastructure that delivers 98% uptime instead of 99.5% costs $52K annually — far more than the incremental cost of proper redundancy.

But the real risk isn't lost rewards — it's slashing. A single slashing event can cost 1+ full years of staking rewards. Infrastructure failures that lead to slashing can destroy principal that took years to accumulate.

Eliminating all risk is impossible in any system. Institutional security standards are instead about ensuring that when things go wrong, failures don't cascade into catastrophic losses.

HSMs ensure that even if validation systems are compromised, attackers cannot extract validator keys to cause slashing. Geographic distribution ensures that regional issues don't take down your entire validator set. Access controls and audit logs ensure that any security incident can be investigated and understood.

For Lido V3 stVaults, the ability to select operators with proven institutional security standards transforms staking from "hoping nothing goes wrong" to "confident that proper safeguards exist."

When configuring your stVault, operator selection is the beginning of an ongoing monitoring and optimization process.

At minimum, institutional stakers need alerting for validators going offline, attestation effectiveness falling below threshold levels, and any slashing or penalty events. But sophisticated monitoring tracks validator performance relative to network medians, identifies slow proposal times or inclusion distances, and monitors the broader network for conditions that might affect your validators.

The monitoring infrastructure supporting your stVault should integrate with your existing operational systems rather than requiring constant manual checking of dashboards. Alerts should flow to appropriate channels—critical operational issues to on-call staff or your infrastructure provider, performance anomalies to your treasury team, and routine status updates to automated logging systems.

At P2P.org, we provide institutional clients with detailed performance monitoring and regular reviews of validator operations, enabling evidence-based decisions about operator performance.

Lido V3 stVaults are designed to enable ongoing optimization of validator sets based on performance data — a key potential advantage over pooled staking where validator selection is fixed.

With Lido V3's December 2025 mainnet launch approaching, institutions have a window to understand what operational standards matter before they need to configure their stVaults.

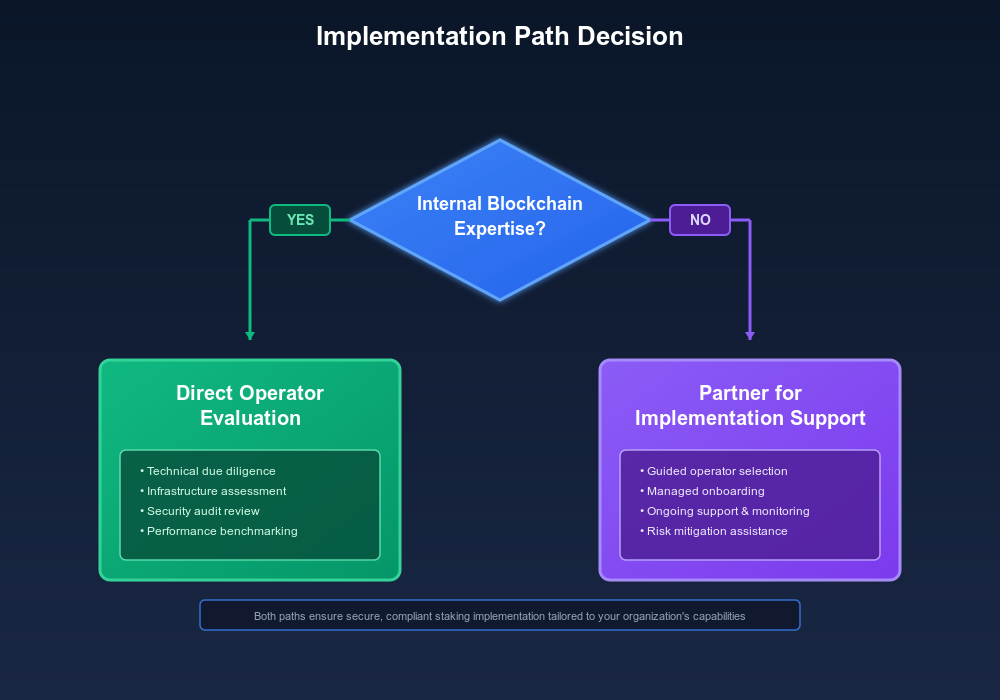

The operational standards we've described require significant expertise and infrastructure investment. Many institutions lack internal resources for this level of validator oversight, which is why institutional infrastructure providers like P2P.org exist.

An institution with $100M in ETH and sophisticated internal blockchain operations might evaluate operators directly and maintain its own monitoring infrastructure. An institution with $200M in ETH but limited internal blockchain expertise should partner with an infrastructure provider who handles operator evaluation while delivering the transparency and control that governance requires.

At P2P.org, we work with institutions in both models. Some leverage our infrastructure for execution while maintaining direct oversight of operational decisions. Others prefer we handle operational aspects while maintaining visibility into performance and key metrics.

The right model depends on your organization's capabilities, risk tolerance, and preference for control versus operational efficiency.

The operational transparency and validator control that Lido V3 will enable through stVaults only provides institutional value if paired with an understanding of what professional node operations actually entail.

Customization through stVaults creates both opportunity and obligation. The opportunity is operational transparency and validator control that enables confident large-scale Ethereum staking. The obligation is understanding what operational standards matter so you can make informed operator selections.

Institutions that prepare now — by understanding what institutional node operations look like and what standards to demand — will be positioned to configure effective stVaults when V3 launches on mainnet in December. Those starting from scratch after launch will face steeper learning curves while their capital remains unstaked.

At P2P.org, we're working with forward-thinking institutions now to prepare operator evaluation frameworks and monitoring configurations. Our years of institutional validator operations across 40+ networks provide the proven standards that we'll bring to Lido V3 stVault implementations.

When Lido V3 mainnet goes live, institutions working with us will be ready for rapid deployment with operator selections backed by actual operational track records rather than guesswork.

P2P.org's institutional validator operations demonstrate the infrastructure, security, and monitoring standards that stVault operators should meet. With Lido V3's December 2025 mainnet launch approaching, now is the time to understand what operational standards matter for your operator selections.

Contact us to review P2P.org's institutional node operations, understand the monitoring infrastructure we provide clients, and develop your operator evaluation framework for the December launch: https://link.p2p.org/bdteam

Stay tuned for Part 3 of our Lido V3 series coming soon.

<h2 id="at-a-glance"><strong>At a Glance:</strong></h2><ul><li>Copper clients can now stake Ethereum directly through their custody platform, powered by P2P.org's validator infrastructure securing $10B+ in assets across 40+ networks.</li><li>The integration delivers Pectra-level efficiency: scale validators up to 2,048 ETH, auto-compound rewards, consolidate in ~1 day, and stake/unstake in 1 ETH increments — all without leaving Copper's MPC custody.</li><li>Institutions get the staking provider they specifically requested, combining 99.9%+ uptime and zero major slashing incidents with custodial security that meets compliance standards.</li><li>ETH remains in Copper's custody throughout — no third-party custody risks, full institutional control, and immediate access to Ethereum's evolving reward mechanics.</li></ul><p>Copper clients demanded access to the industry’s most trusted and performant staking infrastructure.Today, they have it.</p><p>Institutions can now stake Ethereum directly through Copper’s custody platform, powered by P2P.org — the validator behind more than $10B in staked assets, trusted by over 100 institutional clients across 40+ networks.</p><p>Copper doesn’t integrate partners lightly. The reason for this collaboration is simple: institutions asked for P2P.org. They wanted the same validator infrastructure already securing assets for leading custodians, asset managers, and funds — combined with the security and control Copper is known for.</p><p>This integration gives them both. A Pectra-ready, custodial ETH staking experience that combines Copper’s MPC-based custody with P2P.org’s institutional-grade performance, uptime, and reporting — built for scale, designed for compliance, and proven in production.</p><h2 id="key-features-for-copper-clients"><strong>Key Features for Copper Clients</strong></h2><p><br><strong>1. Direct Custodial Staking</strong><br><br>ETH remains securely within Copper’s MPC architecture throughout the process.No third-party custody, minimal external dependencies, and full alignment with institutional compliance standards.</p><p><strong>2. Pectra-Level Efficiency</strong></p><ul><li>Scale validator balances up to 2,048 ETH per validator</li><li>Auto-compounding rewards without manual reinvestment</li><li>Consolidate validators in ~1 day</li><li>Partial stake and unstake in 1 ETH increments</li></ul><h2 id="why-p2porg"><strong>Why P2P.org?</strong></h2><p>Copper doesn't integrate partners without reason. Their clients specifically requested P2P.org for:</p><ul><li><strong>Highest validator reliability</strong>: Industry-leading uptime and performance metrics</li><li><strong>Institutional-grade operations</strong>: Proven track record with the world's largest crypto institutions</li><li><strong>Superior reward optimization</strong>: Advanced MEV strategies and validator efficiency</li><li><strong>Battle-tested infrastructure</strong>: Securing over $10 billion with zero major incidents</li></ul><p>The result: institutions get the staking provider they asked for, with the custodial security they require — all without leaving the Copper environment.</p><h2 id="how-to-get-started"><strong>How to Get Started</strong></h2><ol><li>Log in to your Copper platform.</li><li>Navigate to the ETH staking section.</li><li>Select P2P.org as your staking provider.</li><li>Choose your preferred amount (between 32 and 1,920 ETH per validator) and confirm.</li></ol><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/10/data-src-image-81e61d7d-6031-4282-b04c-b6fe220bc580.png" class="kg-image" alt="" loading="lazy" width="512" height="720"></figure><p>You’ll be staking directly from custody, with immediate exposure to all Pectra benefits.</p><p>By uniting Copper’s trusted custody infrastructure with P2P.org’s validator technology, institutions gain access to Ethereum’s evolving reward mechanics — without compromising on security or operational simplicity.</p><h2 id="learn-more"><strong>Learn More</strong></h2><p>To explore how Pectra changes institutional staking and view validator consolidation scenarios, visit →<a href="https://p2p.org/pectra?ref=p2p.org"> </a><u>https://www.p2p.org/networks/pectra.</u></p><p>To start staking today, log in to Copper and select <strong>P2P</strong> in your ETH staking dashboard. → <a href="https://link.p2p.org/7117a5?ref=p2p.org">https://link.p2p.org/7117a5</a></p>

from p2p validator

<h3 id="at-a-glance">At a Glance:</h3><ul><li>Billions in crypto are sitting idle. Our latest research finds over $200B in stablecoins, ETH, and protocol rewards remain unproductive.</li><li>The opportunity cost is massive. Unstaked ETH alone misses out on <strong>3–5% annual rewards</strong>, and billions in unclaimed yields go unrecovered each year.</li><li>Account Abstraction (AA) could unlock this capital by automating staking, restaking, and reward compounding — turning wallets into self-managing financial engines.</li></ul><p><strong>Crypto has a hidden inefficiency. </strong>Despite maturing into a multi-trillion–dollar asset class, billions of dollars in stablecoins, ETH, and protocol rewards remain idle — sitting in wallets, exchanges, or unclaimed balances earning nothing.</p><p>Our latest research, <em>The Idle Assets Report</em>, quantifies the scale of this “dead money” and explains how Account Abstraction (AA) can turn it into productive capital.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://link.p2p.org/18ae4b?ref=p2p.org" class="kg-btn kg-btn-accent">Download the Idle Assets Report</a></div><h3 id="the-scale-of-the-problem"><strong>The Scale of the Problem</strong></h3><ul><li>Stablecoins: Over $300B in circulation, with the majority sitting idle and earning 0%</li><li>Ethereum: Only 28% of supply (~35M ETH) staked; 70% remains unstaked, missing 3–5% annual rewards </li><li>Restaking: Just 25–30% of stakers have adopted EigenLayer</li><li>Unclaimed rewards: Billions lost each year to friction, gas fees, and complexity.</li></ul><p>In total, more than $200B sits dormant—a massive pool of underutilized capital that weakens network security, liquidity, and reward generation.</p><h3 id="why-so-much-crypto-stays-idle"><strong>Why So Much Crypto Stays Idle</strong></h3><p>Earning yield in crypto still requires manual effort. Users must move assets across dApps, stake and restake, claim rewards, and manage gas. Institutions face similar friction — regulatory complexity, fragmented infrastructure, and risk concerns.</p><p>As a result, most assets stay where they are: static.</p><h3 id="account-abstraction-the-unlock"><strong>Account Abstraction: The Unlock</strong></h3><p>Account Abstraction (via ERC-4337 and EIP-7702) makes wallets programmable, enabling reward automation, restaking, and payments to run in the background.</p><ul><li>Stablecoins can earn network rewards by default.</li><li>ETH can be staked or restaked in one click.</li><li>Rewards can auto-compound.</li><li>Recurring payments can be funded from reward streams.</li></ul><p>This is how wallets evolve from storage to <em>self-managing financial engines</em> — and how billions in idle crypto can be reactivated.</p><h3 id="regional-dynamics"><strong>Regional Dynamics</strong></h3><ul><li>U.S.: Regulatory clarity (GENIUS Act, SEC guidance) is driving demand for compliant yield.</li><li>APAC: The fastest-growing crypto market, led by Hong Kong and Singapore’s stablecoin frameworks.</li><li>LATAM: Over 50% of crypto transactions in Argentina and Brazil involve stablecoins — mostly sitting idle.</li></ul><p>Every region faces the same problem: huge adoption, low activation.</p><h3 id="the-path-forward"><strong>The Path Forward</strong></h3><p>If just 25% of idle assets were mobilized, it would unlock $80–100B in active capital. A 50% activation scenario would exceed $150B — the next real growth phase for crypto.</p><h3 id="read-the-full-report"><strong>Read the Full Report</strong></h3><p>P2P.org’s <em>Idle Assets Report</em> explores these dynamics in detail — with market data, regional breakdowns, and more.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://link.p2p.org/18ae4b?ref=p2p.org" class="kg-btn kg-btn-accent">Download the Idle Assets Report</a></div>

from p2p validator