Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

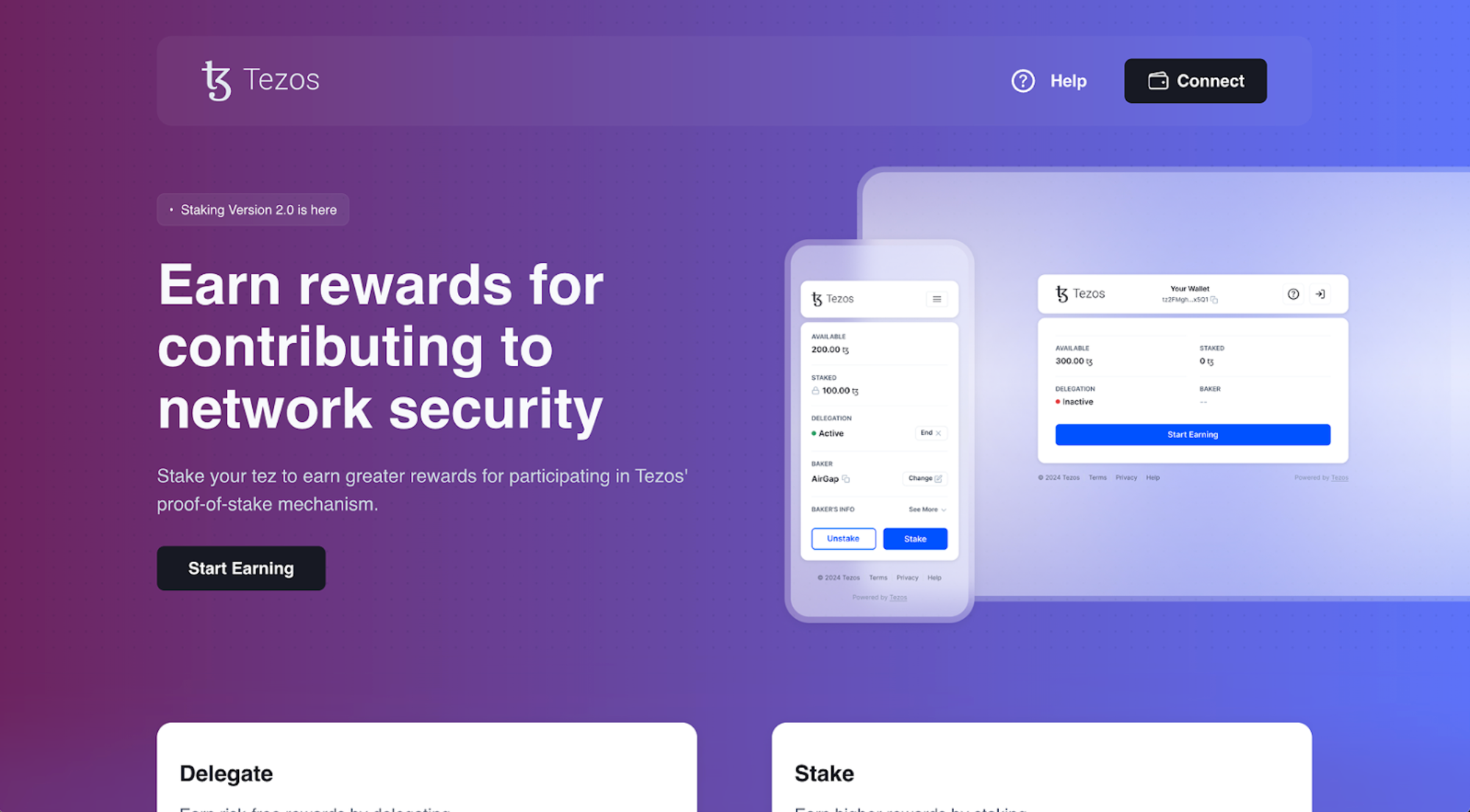

Delegating and staking your Tezos (XTZ) tokens is a great way to put your assets to work while supporting the security and decentralization of the Tezos network. Whether you’re new to staking or looking for a smoother experience, this guide will walk you through the full process, step by step.

We’ll show you how to:

By following this simple process using the official Tezos staking dApp, you’ll be earning network rewards in just a few minutes, all while keeping full custody of your assets.

Before you begin, make sure you own some Tezos (XTZ). You can purchase XTZ on various cryptocurrency exchanges and withdraw it to a supported non-custodial wallet such as Kukai, Temple, or Umami.

This guide follows the earning flow provided through the official Tezos staking dApp. Multiple wallets are supported. The steps explained mainly involve interacting with the dApp, with clear indicators of when to sign messages or transactions in your selected wallet. While the signing process may vary slightly between wallets, it’s simple overall. If you have any questions, feel free to reach out to our support team via our website (click the chat icon in the bottom-right corner).

Tezos (XTZ) offers two flexible ways to participate and earn rewards: delegation and staking. Delegation is a simple, liquid option where your funds remain accessible at all times, while staking locks your tokens for a short 4-day unbonding period but provides up to 3× higher rewards. For more details on the differences, visit the dedicated P2P Tezos page.

Before you can stake your XTZ, you must first delegate it to a baker. This guide walks you through the full process. If you only wish to delegate, you can stop after Step 9.

Tezos does not allow partial delegation. Your entire wallet balance will be delegated to the selected baker, who will also be the one you stake with if you proceed further.

Need more in-depth information? Feel free to browse our materials in the Help Center!

Click the “Start Earning” or “Connect” button.

Click “Start Earning” to begin.

Now you will see two options:

Your choice here isn’t final—it’s flexible. After delegating, you can choose to stake at any time. Similarly, during the staking process, you can stop after delegation (Step 9 in this guide) if you prefer. In this guide, we walk through the full process, so we selected “Stake” at this stage.

Click “Select Baker” to proceed.

Click “Select” next to the baker of your choice.

Click “Continue” to proceed.

Note: This is the final step if you only wish to delegate. However, we encourage you to stake to potentially receive 3x higher network rewards.

Click “Continue” and sign the staking transaction in your wallet.

Click “Stake” and you’ll be prompted to sign the transaction in your wallet one more time.

Any remaining balance is delegated to the baker automatically.

The baker's name and details are shown.

That’s it! You are now earning XTZ with P2P.org Baker. Note that your XTZ remains fully in your custody, and you are free to undelegate or unstake at any time using the same interface and confirming the transactions through your wallet.

Are you looking for institutional staking?

We collaborate with leading custodians and institutional staking providers to ensure secure, compliant, and seamless Tezos (XTZ) staking solutions. Whether you use a third-party custodian or require a custom integration, we can help.

Contact us via p2p.org using the chat icon in the bottom-right corner — we’ll work with you to find the best path forward.

The information provided above is for informational purposes only and should not be construed as, or relied upon as, investment, financial, or any other type of professional advice. P2P.org or any associated parties do not offer any form of advisory services, and nothing shared here should be considered as a recommendation or endorsement for any financial decisions. P2P.org is not responsible for any decisions made based on the information provided. You are encouraged to consult with a qualified financial advisor or professional before making any investment or financial decisions.

<h3 id="introduction-how-l2s-think-about-zk-proof-generation-decentralization">Introduction: how L2s think about ZK proof generation decentralization</h3><p>The goal of this blog post is to add infrastructure providers’ point of view to the discussion of different methods on ZK proof generation decentralization. We found that this point of view is missing or misinterpreted by researchers and L2/ZK protocol creators. Since the decentralization mechanics are usually game-theoretic to some extent, the misconception of infrastructure providers’ behavior could lead to wrong conclusions, thus making the project not reaching its goal - proper reliable, censorship resistant and trustless system that we cherish so much in web3 (cherish less in recent years with surge of centralized L2s, but nevertheless, all of them <em>promise</em> to be properly decentralized one day and we <em>trust</em> them in our <em>trustless</em> industry).</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/04/Staking---ZK-proof-generation-2.png" class="kg-image" alt="" loading="lazy" width="904" height="174" srcset="https://p2p.org/economy/content/images/size/w600/2025/04/Staking---ZK-proof-generation-2.png 600w, https://p2p.org/economy/content/images/2025/04/Staking---ZK-proof-generation-2.png 904w" sizes="(min-width: 720px) 720px"></figure><p>It is hard to separate ZK proof generation decentralization from sequencer decentralization as both those parts of the stack should participate in the same tokenomics. But since we have shared sequencer protocols like Espresso, Astria, Radius and others, plus possible reluctance of L2 protocols to decentralize the sequencers, we will describe only separate decentralization of ZK proof generation.</p><p>We will present 3 articles regarding decentralization in ZK and experiments on proof generation parallelization. In the first one we will review staking tokenomics and its bad connectivity with the nature of the ZK proving process. The second article will focus on parallelization of proof generation tasks on different hardware. In the third article we will discuss the concept of idle GPUs that many protocols use as the cornerstone of their proof marketplace designs and the aggregation of aggregators problem in ZK space.</p><p>This article will not provide a definite answer to highlighted problems. The goal is to give additional data missing from other articles regarding this topic, combine them and emphasize on the fact that everything should be battletested and should not be presented as the best final solution while being only on paper. We encourage all protocols not to be afraid to change in the search of the perfect concept.</p><h3 id="taiko%E2%80%99s-numerous-experiments">Taiko’s numerous experiments</h3><p>The biggest practical research of this issue was done by the Taiko team that decided to make the 1st permissionless fully decentralized L2. For more than 1 year they have tested multiple setups: proof generation race, stake-based option, bond-based option and finally arrived at the stage with both proposer and prover role handled by the same entity. Let’s make a quick recap of all those tests and how they ended up with the current mainnet.</p><p><strong>Proof generation race.</strong></p><p>As the 1st step, Taiko started with the easiest solution. But due to the deterministic nature of ZK proof generation the race ended up with the clear single winner that took almost all of the proofs, so, the result was almost as centralized as current L2 solutions with 1 dominant player<strong>.</strong> Others were formally “on backup”, but in fact not present at all. It happened because the cost of running the operations is not compensated if you do not actively contribute to the chain's progress.</p><p>The stats from this testnet may show it otherwise with heavy centralization for Proposers and too beautiful pictures for Provers. We don’t want to get into conspiracy theories, we will just say that we were able to generate ZK proofs mostly at night, during the weekend, and by the end of the testnet when 3 main provers were not active. Nonetheless, the Taiko team made a good decision to test other methods since the community in discord was furious with this model.</p><figure class="kg-card kg-image-card kg-width-wide"><img src="https://p2p.org/economy/content/images/2025/04/Staking---ZK-proof-generation--1--1.png" class="kg-image" alt="" loading="lazy" width="927" height="527" srcset="https://p2p.org/economy/content/images/size/w600/2025/04/Staking---ZK-proof-generation--1--1.png 600w, https://p2p.org/economy/content/images/2025/04/Staking---ZK-proof-generation--1--1.png 927w"></figure><p><strong>Stake-based solution.</strong></p><p>The next attempt was a stake-based option with the active set of 32 provers and others beyond those 32 on backup. Usually Proof-of-Stake validator’s probability to produce the next block is equal to its share of the stake. But in Proof-of-Stake it is relatively easy to produce the next block, so validators do not have a scaling problem because of the number of blocks to produce (there is a scaling problem with constantly growing blockchain size overall, but it’s another one).</p><p>On the contrary, ZK proof generation is very demanding in computational power to generate a single proof, and if the prover's stake is growing, it should keep increasing the hardware capacities, otherwise it starts to get slashed. This is what happened in this testnet, and the amount of slashing was so big, that the best position was to be the 33rd prover (the 1st in non-active set) to receive blocks to prove and do the job without the fear of getting slashed. <strong>But then the stake grew (or others’ stake was slashed), prover ended up in the active set, got slashed, fell back, and it was a never ending cycle.</strong> As you can see, the system was enormously unstable, so Taiko decided to switch to other solutions.</p><p><strong>Proposer “buys” proofs.</strong></p><p>The idea is “if protocol can not handle it, let the invisible hand of the market do its magic”. <strong>In this solution each proposer can decide on where it can get the proof.</strong> At least this was for the first three weeks since mainnet was decentralized. But then the foundation announced “If you are proposing Taiko blocks, ensure you also prove your own blocks, or your liveness bond will be forfeited” also explaining this with “This change removes hook calls from the protocol for gas optimization and simplicity, as hooks are expensive”. Technically, it still can be two separate entities, but in fact the prover does not need the proposer and will always prove on its own.</p><p>Key aspects why Taiko permissionless decentralization works without both high congestion for proof submission:</p><ol><li>150 TAIKO tokens per each proof that are locked for 4 hours to dispute - a single entity needs a lot of TAIKO and ETH to proof all blocks in a day (<em>the numbers change with every network update</em>)</li><li>SGX proving - relatively complex technology which is hard to access and manage. This organically reduces the number of participants and prevents gas wars to submit the proof</li></ol><p>Nevertheless, from a community and tokenomics perspective there is a significant drawback to the model. With the current parameters 4 hours to return the bond and on average 2 proofs per minute only 72000 TAIKO tokens are being actively used for system functioning. In other words, 99.92% of circulating supply has no utility, apart from being used within DeFi and governance.</p><h3 id="other-protocols-discussions">Other protocols discussions</h3><p>In 2023 Starknet was actively discussing proposals on decentralization of their protocol on forum, so, let’s address the summary of the discussion. The Starknet protocol is divided into four layers: leader/proposer elections, consensus, proving, and L1 state updates. Starknet will use a variant of Tendermint. Starknet plans to use the chained proof protocol which is based on Mina’s design. It requires every block proposal to include a proof of a previous block.</p><p>Aztec’s testnet is underway, and in their initial series of blog posts they have created a design for stake-based sequencer decentralization protocol, while ZK proof generation will be outsourced. Sequencers are allowed to get the proof on external markets of their choice. They hope that the open market will provide the best quality and price.</p><p>Before the airdrop ZkSync also dropped a news bomb with a blog post and corresponding article about their thoughts on ZK proof generation decentralization. On a high level within the Prooφ described in the article corresponding to the post both staking and auction-based mechanisms are included, where staking is needed to slash provers if they send incorrect proofs. As for the auction part, a prover with the best bet (=lowest cost) wins, but gets paid the costs of the second price determined by the auction. At the same time the fee should always cover the cost of the proof generation for an auction to work.</p><h3 id="stake-based-solutions">Stake-based solutions</h3><p>We have described before how Taiko experimented with staking and went into mainnet with bonds instead. Overall, it makes some sense, but it also reduces the number of people that can use TAIKO as utility token, thus reducing its attractiveness to institutions and retail, since only a selected few can launch SGX prover and meaningfully utilize the token. Tokens are not only a financial or technological phenomenon, but also a social one, and engagement from as many participants as possible is crucial for project success, so, we will focus on a stake-based model of decentralization.</p><p>Sudden spikes of stake will not be possible to avoid, even by creating a hard cap on maximum stake, because the cap will not safe from the situation where several other provers lose their delegation, thus “promoting” the weak prover to get more proofs to generate while it does not have the required capacity. Some might argue “so slash them if they are not capable”, but constant slashing is exactly the reason why Taiko abandoned staking: this is bad delegators’ experience, and they will simply use other more safe protocols, for example Solana, where they don’t have slashing.</p><p>Let’s draw some possible scenarios</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/04/table1.png" class="kg-image" alt="" loading="lazy" width="2000" height="459" srcset="https://p2p.org/economy/content/images/size/w600/2025/04/table1.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/04/table1.png 1000w, https://p2p.org/economy/content/images/size/w1600/2025/04/table1.png 1600w, https://p2p.org/economy/content/images/2025/04/table1.png 2000w" sizes="(min-width: 720px) 720px"></figure><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/04/table2.png" class="kg-image" alt="" loading="lazy" width="2000" height="563" srcset="https://p2p.org/economy/content/images/size/w600/2025/04/table2.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/04/table2.png 1000w, https://p2p.org/economy/content/images/size/w1600/2025/04/table2.png 1600w, https://p2p.org/economy/content/images/2025/04/table2.png 2000w" sizes="(min-width: 720px) 720px"></figure><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/04/table3.png" class="kg-image" alt="" loading="lazy" width="2000" height="459" srcset="https://p2p.org/economy/content/images/size/w600/2025/04/table3.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/04/table3.png 1000w, https://p2p.org/economy/content/images/size/w1600/2025/04/table3.png 1600w, https://p2p.org/economy/content/images/2025/04/table3.png 2000w" sizes="(min-width: 720px) 720px"></figure><p>Some suggestions might be:</p><ul><li>Slash only Operators - then Delegator will have to unbond, wait for N days, delegate again to another operator, possibly repeating the situation.</li><li>Even if there’s no unbond period, still, delegator will have to monitor the activity precisely, so, either the rewards should be good (and not absorbed by sequencer), or a delegator will find better opportunities elsewhere</li><li>“Buying” proofs elsewhere including from A & B. Although A & B benefit from C getting slashed, but buying elsewhere requires business details negotiations, setting up provers elsewhere, possibly syncing with the network - it might take a long time, not all operators might have everything setup</li><li>Decoupling leader selection from staking</li></ul><p>The idea in general should be like in the bonding schema: if the prover knows that it can’t make another proof in time, it should not be forced to do it by leader election mechanism. Nevertheless, with a big stake comes great responsibility, and this should be reflected in the user-related metrics, for example in APR. ZkSync’s “Proof” partially solves the issues, but several months later another whitepaper also addressed the problem using another auction method.</p><p>Succinct’s proof contest is an interesting approach that helps to internalize the competition between provers and free them from gas wars on Ethereum for their respective proofs to be accepted on-chain. The staked collateral will be used not only for potential slashing, but also in the reverse auction to win proofs. Provers will use a part of staked collateral to pay for a chance to win the next proof. To prevent payment wars, the size of the payment only determines the probability to win, but not the one with the highest payment wins.</p><p>Overall, this model seems like a fascinating approach that definitely should be tried within the Web3 industry to test how it can be potentially gamed. As we’ve seen before with numerous Taiko experiments, there were a lot of ideas that seemed to work well on paper, but in the end turned out as a disaster, so we only wish for protocols to be flexible in the new environment and evolve to new challenges.</p><h3 id="conclusion">Conclusion</h3><p>Taiko has tested many different decentralization setups for more than 1 year before coming to the current solution. Whatever design other protocols might choose - it is better to test it properly and figure out all mistakes before mainnet. Hopefully, when most of the rollups achieve stage 2 decentralization, stage 3 will appear with decentralized parts of the stack for censorship resistance, so that everyone could have the same access to the ecosystem as everyone else, and not by forcing transactions from L1.</p><p>Overall, we wanted to thank the Taiko team for enormous work on the forefront of L2 decentralization and we encourage other protocols to follow their steps. We also want to thank the Starknet and Aztec teams for taking an active discussion with the community about decentralization designs, and the ZkSync team for their paper and blog post on future decentralization steps. Also we want to reference some of Figment's related blog posts on L2 decentralization. They have similar thoughts, but we tried to make our contribution as well and make a research based on new data from 2024.</p><h3 id="references">References:</h3><p>Taiko vision (and impressions on them):</p><ul><li>Taiko changing complaints (twitter): <a href="https://x.com/bkiepuszewski/status/1798987014047670565?ref=p2p.org"><u>https://x.com/bkiepuszewski/status/1798987014047670565</u></a></li><li>Taiko proposer must be the prover as well:<a href="https://x.com/taikoxyz/status/1803838265046491409?ref=p2p.org"><u>https://x.com/taikoxyz/status/1803838265046491409</u></a> </li><li>Impressions on P2P’s participation in Taiko’s testnet №3 on Starknet forum <a href="https://community.starknet.io/t/starknet-decentralized-protocol-iv-proofs-in-the-protocol/6030/18?ref=p2p.org"><u>https://community.starknet.io/t/starknet-decentralized-protocol-iv-proofs-in-the-protocol/6030/18</u></a></li><li><a href="https://taiko.mirror.xyz/qvZV19UrPOPbWwJ3hwdppNlnqn4nM_LXoS1uztKs6DE?ref=p2p.org"><u>https://taiko.mirror.xyz/qvZV19UrPOPbWwJ3hwdppNlnqn4nM_LXoS1uztKs6DE</u></a> </li><li>The update where prover & proposer were united <a href="https://taiko.mirror.xyz/Od8CVUstKAr6bvuHac5DHuv9jdePOhW6pb5pNOr3VX0?ref=p2p.org"><u>https://taiko.mirror.xyz/Od8CVUstKAr6bvuHac5DHuv9jdePOhW6pb5pNOr3VX0</u></a> </li><li>Proof generation race stats from ZKPool <a href="https://data.zkpool.io/public/dashboards/Aebs8y0nZ9w20wokJeFlIjWsi9DQcTVOzmBDpQXe?ref=p2p.org"><u>https://data.zkpool.io/public/dashboards/Aebs8y0nZ9w20wokJeFlIjWsi9DQcTVOzmBDpQXe</u></a> </li><li>Taiko governance <a href="https://taiko.mirror.xyz/9lW3JdFnMJGtoPbmXqFS32XNxf_iK0VDx0vGWk2K7Eo?ref=p2p.org"><u>https://taiko.mirror.xyz/9lW3JdFnMJGtoPbmXqFS32XNxf_iK0VDx0vGWk2K7Eo</u></a> </li></ul><p>Starknet vision:</p><ul><li>Overview <a href="https://community.starknet.io/t/starknet-decentralized-protocol-i-introduction/2671?ref=p2p.org"><u>https://community.starknet.io/t/starknet-decentralized-protocol-i-introduction/2671</u></a></li><li>Leader election <a href="https://community.starknet.io/t/starknet-decentralized-protocol-ii-candidate-for-leader-elections/4751?ref=p2p.org"><u>https://community.starknet.io/t/starknet-decentralized-protocol-ii-candidate-for-leader-elections/4751</u></a> </li><li>Consensus <a href="https://community.starknet.io/t/starknet-decentralized-protocol-iii-consensus/5386?ref=p2p.org"><u>https://community.starknet.io/t/starknet-decentralized-protocol-iii-consensus/5386</u></a> </li><li>Prover decentralization <a href="https://community.starknet.io/t/starknet-decentralized-protocol-iv-proofs-in-the-protocol/6030?ref=p2p.org"><u>https://community.starknet.io/t/starknet-decentralized-protocol-iv-proofs-in-the-protocol/6030</u></a> </li><li>Checkpoints for fast finality <a href="https://community.starknet.io/t/starknet-decentralized-protocol-v-checkpoints-for-fast-finality/6032?ref=p2p.org"><u>https://community.starknet.io/t/starknet-decentralized-protocol-v-checkpoints-for-fast-finality/6032</u></a></li><li>Chained proof protocols <a href="https://community.starknet.io/t/starknet-decentralized-protocol-vii-chained-proof-protocols-braiding/18831?ref=p2p.org"><u>https://community.starknet.io/t/starknet-decentralized-protocol-vii-chained-proof-protocols-braiding/18831</u></a> </li><li>Tendermint for Starknet <a href="https://community.starknet.io/t/tendermint-for-starknet/98248?ref=p2p.org"><u>https://community.starknet.io/t/tendermint-for-starknet/98248</u></a></li><li>Summary <a href="https://community.starknet.io/t/simple-decentralized-protocol-proposal/99693?ref=p2p.org"><u>https://community.starknet.io/t/simple-decentralized-protocol-proposal/99693</u></a> </li></ul><p>ZkSync vision:</p><ul><li><a href="https://zksync.mirror.xyz/z3GvALZwgxN5CrU2kvHV1LuPf14GHc2Ul5dGDC8AZzs?ref=p2p.org"><u>https://zksync.mirror.xyz/z3GvALZwgxN5CrU2kvHV1LuPf14GHc2Ul5dGDC8AZzs</u></a> </li><li><a href="https://arxiv.org/search/cs?searchtype=author&query=Wang%2C+W&ref=p2p.org">Wenhao Wang</a>, <a href="https://arxiv.org/search/cs?searchtype=author&query=Zhou%2C+L&ref=p2p.org">Lulu Zhou</a>, <a href="https://arxiv.org/search/cs?searchtype=author&query=Yaish%2C+A&ref=p2p.org">Aviv Yaish</a>, <a href="https://arxiv.org/search/cs?searchtype=author&query=Zhang%2C+F&ref=p2p.org">Fan Zhang</a>, <a href="https://arxiv.org/search/cs?searchtype=author&query=Fisch%2C+B&ref=p2p.org">Ben Fisch</a>, <a href="https://arxiv.org/search/cs?searchtype=author&query=Livshits%2C+B&ref=p2p.org">Benjamin Livshits</a> Mechanism Design for ZK-Rollup Prover Markets <a href="https://arxiv.org/abs/2404.06495?ref=p2p.org"><u>https://arxiv.org/abs/2404.06495</u></a> </li></ul><p>Aztec vision:</p><ul><li><a href="https://forum.aztec.network/t/on-proving-marketplaces/5218/5?ref=p2p.org"><u>https://forum.aztec.network/t/on-proving-marketplaces/5218/5</u></a> </li></ul><p>Figment vision:</p><ul><li>Proof supply chain <a href="https://figmentcapital.medium.com/the-proof-supply-chain-be6a6a884eff?ref=p2p.org"><u>https://figmentcapital.medium.com/the-proof-supply-chain-be6a6a884eff</u></a> </li><li>Decentralized Proving, Proof Markets, and ZK Infrastructure <a href="https://figmentcapital.medium.com/decentralized-proving-proof-markets-and-zk-infrastructure-f4cce2c58596?ref=p2p.org"><u>https://figmentcapital.medium.com/decentralized-proving-proof-markets-and-zk-infrastructure-f4cce2c58596</u></a> </li></ul>

from p2p validator

<p></p><h2 id="tldr"><strong>TL;DR</strong></h2><ul><li><strong>Increased network rewards</strong>: Tezos staking now offers 12.9% NRR (3x more than delegation) with daily automatic compounding.</li><li><strong>Faster access to funds</strong>: The Rio upgrade reduces the unstaking period to just 4 days (down from 10) making staking even more attractive.</li><li><strong>Zero-fee promotion</strong>: For a limited 30-day period, P2P.org is offering 0% fees on Tezos (XTZ) staking.</li></ul><p>The Tezos blockchain has just rolled out another significant improvement with the activation of its 18th protocol upgrade — Rio. To celebrate this milestone, P2P.org is offering a limited-time promotion: 0% fees on Tezos (XTZ) staking for the next 30 days!</p><h2 id="the-rio-upgrade-whats-new"><strong>The Rio Upgrade: What's New?</strong></h2><p>The Rio upgrade brings several important improvements to the Tezos network that benefit both bakers (validators) and users:</p><h3 id="faster-cycles-quicker-access-to-your-funds"><strong>Faster Cycles, Quicker Access to Your Funds</strong></h3><p>One of the most user-friendly changes in Rio is the reduction of cycle length from approximately 3 days to just 1 day. This seemingly simple change has profound implications:</p><ul><li><strong>Unstaking period reduced from 10 days to just 4 days</strong> — access your staked XTZ much faster</li><li>Changes to staked balances are reflected in consensus rights after only 2 days (previously 6 days)</li><li>Staking parameter changes activate after 5 days instead of 14 days</li><li>Rewards are distributed daily rather than every 3 days</li></ul><div class="kg-card kg-button-card kg-align-center"><a href="https://www.p2p.org/networks/tezos?ref=p2p.org#stake" class="kg-btn kg-btn-accent">STAKE HERE</a></div><h3 id="incentivized-data-availability-layer-dal"><strong>Incentivized Data Availability Layer (DAL)</strong></h3><p>Rio introduces changes to the distribution of participation rewards, allocating 10% to active Data Availability Layer node operators — a crucial component for Layer 2 scalability and the Tezos X roadmap. This positions Tezos for significant growth in transaction throughput and overall network utility. The updated reward weights, effective since the start of the Rio upgrade, can be found on <a href="https://octez.tezos.com/docs/rio/adaptive_issuance.html?ref=p2p.org#reward-weights"><u>the Tezos Documentation</u></a>.</p><h3 id="improved-network-resilience"><strong>Improved Network Resilience</strong></h3><p>The upgrade also increases network reliability by reducing tolerance for inactive bakers. Bakers are now marked inactive after 2 days (down from 8 days) but can return to active status in just 2 days (previously 6 days).</p><h2 id="the-staking-advantage-why-you-should-consider-staking-over-delegating"><strong>The Staking Advantage: Why You Should Consider Staking Over Delegating</strong></h2><p>While delegation has been the traditional way to participate in the Tezos network, direct staking was introduced last year to further contribute to network security while offering compelling advantages at the same time.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/05/Screenshot-2025-05-01-at-11.27.29.png" class="kg-image" alt="" loading="lazy" width="2000" height="707" srcset="https://p2p.org/economy/content/images/size/w600/2025/05/Screenshot-2025-05-01-at-11.27.29.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/05/Screenshot-2025-05-01-at-11.27.29.png 1000w, https://p2p.org/economy/content/images/size/w1600/2025/05/Screenshot-2025-05-01-at-11.27.29.png 1600w, https://p2p.org/economy/content/images/2025/05/Screenshot-2025-05-01-at-11.27.29.png 2000w" sizes="(min-width: 720px) 720px"></figure><h3 id="1-increased-network-rewards"><strong>1. Increased Network Rewards</strong></h3><p>After <a href="https://p2p.org/economy/tezos-staking-3x-rewards-after-the-quebec-upgrade/"><u>the introduction of Tezos staking</u></a>, it initially provided rewards that were twice (2x) as large as those from delegation. However, following the Quebec upgrade implemented on January 20, staking XTZ now provides three times (3x) greater rewards than delegation. While network rewards are continuously adjusted by the Adaptive Issuance mechanism, you can rest assured that staking will continue to offer three times the rewards. This is one of the key factors that makes staking particularly attractive.</p><h3 id="2-automatic-daily-compounding"><strong>2. Automatic Daily Compounding</strong></h3><p>Unlike delegation rewards, which rely on baker payments that can be irregular, staking rewards on Tezos are automatically distributed and compounded daily at the network level. This maximizes your earnings without requiring any extra steps.</p><h3 id="3-quick-access-to-funds"><strong>3. Quick Access to Funds</strong></h3><p>Now the unbonding period for staked XTZ equals just 4 days — a significant improvement that balances earning potential with reasonable access to your funds. While delegated funds remain liquid at all times, a short lock-up in exchange for up to three times higher rewards through staking offers an attractive trade-off, especially when compared to the lengthy unbonding periods on other networks.</p><h2 id="limited-time-offer-0-fees-on-staking-with-p2porg"><strong>Limited Time Offer: 0% Fees on Staking with P2P.org</strong></h2><p>To celebrate the Rio upgrade and encourage more Tezos holders to experience the benefits of staking, P2P.org is offering <strong>0% fees on all Tezos staking</strong> for a limited time.</p><p>As one of the original Tezos network participants (operating since 2018), P2P.org combines industry expertise with institutional-grade security for your staked assets. Our perfect uptime record and transparent operations make us an ideal partner for your Tezos staking needs.</p><h3 id="why-stake-with-p2porg"><strong>Why Stake With P2P.org?</strong></h3><ul><li><strong>Zero fees</strong> for a limited time (30 days with potential extension)</li><li>Operating as a Tezos baker since 2018, nearly since network inception</li><li>Full commitment to governance processes</li><li>Institutional-grade security and reliability</li><li>Dedicated support team</li></ul><h2 id="how-to-get-started"><strong>How to Get Started</strong></h2><p>Ready to increase your Tezos rewards? Whether you're new to staking or want to convert your delegated XTZ to staked XTZ, we've got you covered. Please refer to our comprehensive guide covering the most popular wallets to get started. </p><div class="kg-card kg-button-card kg-align-center"><a href="https://p2p.org/economy/tezos-delegation-staking-guide/?_gl=1*cvijm5*_up*MQ..*_ga*MjEzOTkxMzg2Ni4xNzQ2MTExOTE1*_ga_KGHZN80HE4*MTc0NjExMzg5OC4yLjAuMTc0NjExMzg5OC4wLjAuMTg1NjQzMzYxOQ.." class="kg-btn kg-btn-accent">STAKING GUIDE</a></div><h2 id="dont-miss-this-opportunity"><strong>Don't Miss This Opportunity</strong></h2><p>Taking into account all the recent changes favoring staking — including the 3× rewards and the reduced four-day unbonding period — <strong>now is the perfect time to make the switch</strong> and maximize your Tezos rewards. Notably, staking activation is instant for current delegators, leaving no reason for hesitation.</p><p>The limited-time 0% staking fee promotion is our way of celebrating Rio and helping the Tezos community capitalize on the latest network improvements. Join us in embracing this exciting new chapter for Tezos!</p><h2 id="frequently-asked-questions"><strong>Frequently Asked Questions</strong></h2><h3 id="about-the-rio-upgrade"><strong>About the Rio Upgrade</strong></h3><p><strong>Q: How does the cycle reduction affect my staking rewards distribution?</strong> <br><strong>A:</strong> With Rio, staking rewards are now distributed daily instead of every 3 days. This provides more regular compounding, helping your rewards grow faster.</p><p><strong>Q: Will my delegator rewards be paid out daily now?</strong> <br><strong>A:</strong> The protocol doesn't specify when delegation rewards must be paid — this remains at the baker's discretion. P2P.org will always be responsible for providing reasonable timelines that take into account effective compounding and cost efficiency</p><p><strong>Q: What is the Data Availability Layer (DAL) and do I need to worry about it?</strong> A: The DAL is a key component for Tezos scalability. As a staker or delegator, you don't need to take any action — the benefits will come automatically as the network capacity grows.</p><p><strong>Q: Are there any security risks with this upgrade?</strong> A: No, the Rio upgrade maintains Tezos' strong security model while improving user experience. The shorter unstaking period doesn't impact security but makes many network operations smoother.</p><h3 id="about-staking-vs-delegation"><strong>About Staking vs. Delegation</strong></h3><p><strong>Q: If I'm currently delegating with P2P.org, how do I switch to staking?</strong> <strong>A:</strong> Visit <a href="http://stake.tezos.com/?ref=p2p.org"><u>stake.tezos.com</u></a>, connect the wallet you're currently using for delegation, and follow the prompts to "Convert to Staking." The process takes just a few minutes.</p><p><strong>Q: Will I lose rewards if I switch from delegation to staking?</strong> <br><strong>A:</strong> No. Any pending delegation rewards will still be distributed to you according to our regular schedule, while your new staking rewards will begin accruing immediately.</p><p><strong>Q: How often can I expect rewards distribution?<br>A: </strong>Considering that the delegation activation and freezing periods are over, delegation reward payouts will follow your baker’s specific payout schedule. In the case of staking, rewards will always be distributed daily.</p><p><strong>Q: What's the main difference between staking and delegation?</strong> <br><strong>A:</strong> The key differences are: (1) Staking offers 3x higher network rewards (12.2% vs 4.1%), (2) Staking rewards compound automatically daily, and (3) Staked XTZ has a 4-day unbonding period while delegated XTZ remains fully liquid.</p><p><strong>Q: Do Tezos (XTZ) rewards compound?<br>A: </strong>Yes, for both delegation and staking, though there are slight differences. In the case of delegator rewards, the compounding effect depends on the baker’s payment schedule. That’s why it’s important to choose a baker with regular, timely payouts who also covers transaction fees (such as P2P.org). On the other hand, staking rewards are automatically distributed and compounded daily at the network level, maximizing your earnings without additional steps.</p><p><strong>Q: Is there a minimum amount required for staking?</strong> <br><strong>A:</strong> No, you can stake any amount of XTZ. However, given transaction fees on the network, we recommend staking amounts where the higher rewards will meaningfully outweigh the cost of transactions.</p><h3 id="about-the-0-fee-promotion"><strong>About the 0% Fee Promotion</strong></h3><p><strong>Q: How long will the 0% fee promotion last?</strong> <br><strong>A:</strong> The promotion is initially set for 30 days and will end on 31.01.2025, but we may extend it based on community response.</p><p><strong>Q: What happens to my staking fees after the promotion ends?</strong> <br><strong>A:</strong> After the promotion period, our standard competitive fee structure will apply to new rewards earned. The exact rate will be announced before the end of the promotion.</p><p><strong>Q: Can I unstake during the promotion period?</strong> <br><strong>A:</strong> Yes, you can initiate unstaking at any time. Remember that the new 4-day unbonding period will apply.</p><p><strong>Q: Does P2P.org have stake capacity limits?</strong> <br><strong>A:</strong> Yes, our staking capacity is determined by our self-stake amount. Currently, we're only at 11.9% of our staking capacity, so there's plenty of room for new stakers.</p><p>Have more questions? Contact our support team at [email protected] or join our <a href="https://t.me/P2Pstaking?ref=p2p.org"><u>Telegram community</u></a>.</p><p><em>The information provided above is for informational purposes only and should not be construed as, or relied upon as, investment, financial, or any other type of professional advice. P2P.org or any associated parties do not offer any form of advisory services, and nothing shared here should be considered as a recommendation or endorsement for any financial decisions. P2P.org are not responsible for any decisions made based on the information provided. You are encouraged to consult with a qualified financial advisor or professional before making any investment or financial decisions.</em></p>

from p2p validator