Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeWe can define a cosmos network as a social galaxy with various entities and different types of participants who are fully self-responsible for decisions they make. To make such system as healthy as possible, minimize cheating and other fraudulent behavior that cause loss of confidence, it should contain a set of rules, instruments and other incentives which will determine the right direction together with moral ethics.

Slashing is an event, which results in a loss of stake percentage, depending on the type of network violation and jeopardizing the safety of other participants. It represents not only a financial incentive to act properly but also is a measure to prevent nothing at stake problem.

Cosmos is a complex ecosystem where atom act not only as an economic incentive but also represent a governance unit playing a crucial role in ecosystem security. In that way, slashing becomes a tool that influences voting power distribution.

Besides, it affects the authority of caught fraudlent participant, motivates validators to improve their infrastructure and in case of delegators, to provide a deeper due-diligence and diversification amongst validators. Slashing also act as a decentralization mechanism motivating re-delegate atoms to more reliable or even smaller validators with equal level of security and infrastructure set up.

For now this motivation can be not so obvious but after enabling Inter Blockchain Communication (IBC) and feature of shared security when validators will be slashable on multiple validated chains slashing risk will be different for all validators depending on conditions and number of chains they operate.

There are two types of events when stake liquidation happens:

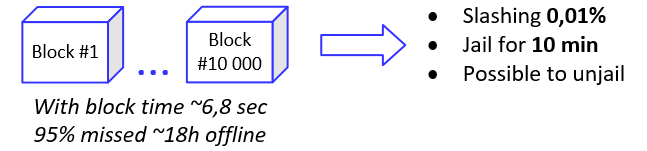

5% of the blocks in a row of 10 000. This situation leads to loss of 0,01% stake not only for validator but for bonded to him delegators as well. In addition, validator drops out of the consensus and do not earn block rewards for at least 10 minutes. After fixing the issues validator can re-join validators set by sending un-jail transaction.

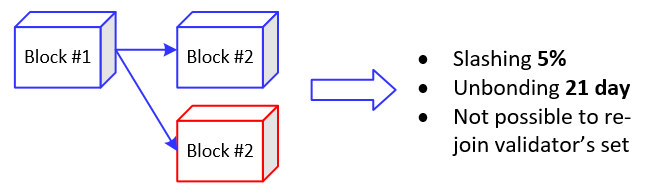

5% and validator loses the right to propose blocks and earn rewards without an ability to un-jail. All delegators of this validator enter the unbonding period, which lasts 21 days.

Slashing also affect atoms, which were in unbonding phase at the moment when one of these events happened. If a validator have low self-bonded ratio (low self-delegated amount) and large amount bonded then, in theory, it could have economic incentive to double-sign. This behaviour will lead to a loss of confidence in this validator and as a consequence inability to earn transaction fees and atom provisions in future missing opportunity of the long term ecosystem adoption and development.

Validators with low self-delegated amount should be able or will have to find the way to maintain resilent infrastructure with low costs in order to increase self-delegation and/or commision rate while bonded atoms to them are increasing.

If self-bonded ratio is decreasing or low in some cases (for instance, validator bonded to other validators in order to diversify holdings or increase network decentralization), if validator charges fair commission long term incentives should overcome short term gains. Commission rate should be reasonable and cover existing expences. If a validator with high stake is not earning to maintain infrastructure and operations (by self-bonded amount that generate rewards and/or commission rate) it is at least concerning.

Assume that we have three validators:

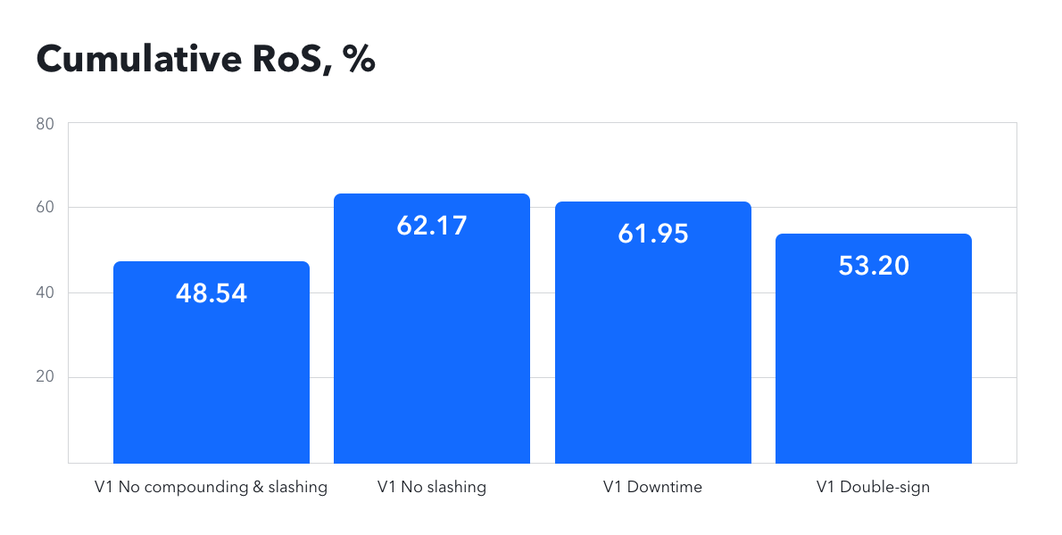

V1 with a commission of 5%V2 with a commission of 8%V3 with a commission of 9%If delegator bond to V1 with an annual return on staking (RoS) around 10,2% for 5 years and without taking advantage of compounding, then his cumulative interest for five years nominated in atoms will be 48,5%. Let’s have a look at how monthly compounding with slashing will affect this number. To simplify calculation we assume that: In the case of downtime, it happened three times and delegators stake passively without re-delegating after the first event:

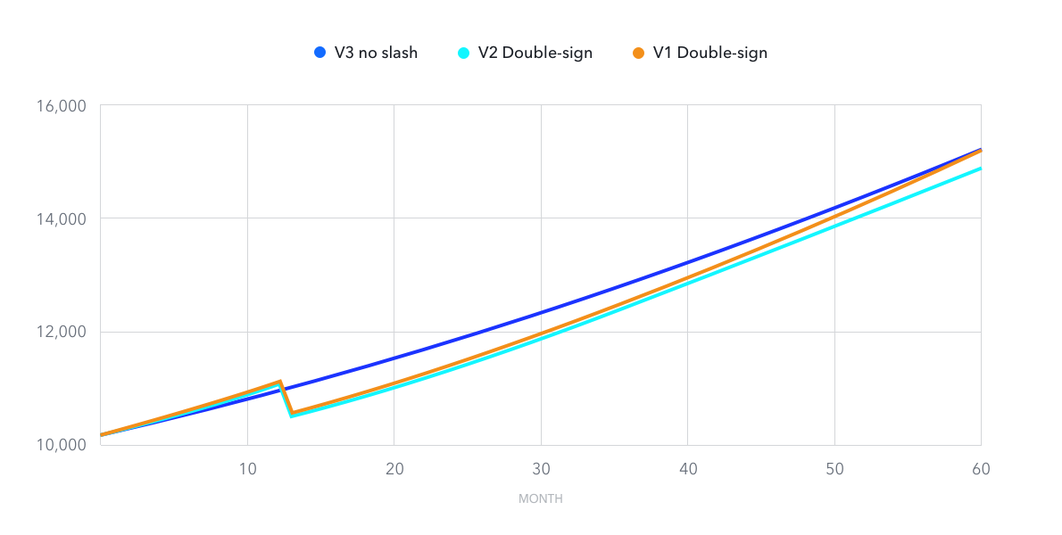

2 days passed before un-jail1 day passed before un-jail1 day passed before un-jailIn the case of double-sign, slashing and unbonding period occurred once at the end of the 12th month. After 21 day of unbonding delegator bonded to another validator with the same commission rate. I will use the same conditions for other comparisons in this article. Overall result for delegator will look like:

We can notice that:

9% in comparison with delegator who have chosen an honest and secure validatorIf we will compare the performance of delegators who bonded to different validators with a various commission rate, we will see that RoS for V3 is higher than RoS for V1 and V2 if double-sign occurred. For a taken period of 5 years this will be correct even if the commission of V3 will be 16% that is more than three times higher than the 5% commission of V1.

You can notice that in the longer term (in our example >5 years) current double-sign slashing do not cause huge effect on the performance and there still exist high incentive for delegators to choose validators basing predominantly on the commission rate. In theory, this may cause weaker decentralization level of the network.

Downtime slashing has even less voting and economic influence. Current slashing conditions should be considered as a starting point for further discussion on that topic and may be changed in future via governance mechanism.

For example, every repeating downtime event over the period of X could cause atom slashing equivalent to prev_slashing_percentage * 2. If a validator constantly goes offline this will cost more for him and his delegators thus increasing incentive to properly maintain the state of own infrastructure and for delegators to re-delegate to others. One of concerns about changing initial parameters is a lack of empirical data so as the network evolve we will see more experiments in this field.

No one can predict the future and one of the best ways for delegators to protect themselves from misbehavior is diversification. Suppose that delegator bonded all his atoms to V1 with the lowest commission possible, 5% in our case. Another delegator diversified amongst all three validators equally - 33% for each. If V1 will be caught on double-sign, the second delegator will get 2,5% higher RoS than the first one who put all atoms in one basket even if V2 & V3 went offline for some reason.

Another idea is responsible behavior. Bonding to a validator is not a blind step and simple way to earn passive income. To be up to date delegators should continue to monitor validator uptime. Frequent downtimes may indicate unreliable infrastructure.

Answers to these questions can help delegators to diversify amongst the most remarkable validators.

The most prominent validators who set up well-protected infrastructure and have a high level of confidence can offer refunds for their delegators in case of slashing event. In this case reserve funds or the idea of developing slashing insurance for delegators make sense. For some delegators who have no ability to follow up with the state of their atom performance this could be a reasonable solution.

The first rule – do not lose your money, the second rule – remember of the first one.

"Warren Buffet"

In the cosmos ecosystem, your atoms are your assets, which can generate additional income for you. Take care of your holdings and be responsible for the decisions you make.

P2P Validator offers high-quality staking facilities and provides up to date information for educational purposes. Stay tuned for updates and new blog posts.

Web: https://p2p.org

Stake ATOMs with us: https://p2p.org/cosmos

Twitter: @p2pvalidator

Telegram: https://t.me/p2pvalidator

Research & Analytics at p2p.org.

<p>Previously <a href="https://p2p.org/economy/5-reasons-to-stake-your-atoms">we discussed</a> why staking is important for the ecosystem and how people interested in the network potential can benefit increasing their overall share without suffering from inflation implications. In this short blog post I want to cover some strategies which participants could utilize with their outcomes and possible risks.</p><p>There are three key options for stakers in existing conditions:</p><ul><li>Stake and forget</li><li>Stake and use the power of compounding in order to increase a total share of the network</li><li>Stake and save the current network share while withdrawing gains diluted by inflation from other participants who do not stake.</li></ul><p>In fact each of these options could be supplemented with the idea of diversification amongst various validators to decrease <a href="https://p2p.org/economy/slashing-overview-in-cosmos-network">slashing risk</a>.</p><p>For simplicity let’s assume that we have two delegators, the first is staking the second one is not. Initial total supply is <code>100 atoms</code> inflation is <code>7%</code>, staking ratio is equal to the target value of <code>67%</code> and considered period of observation is <code>5 years</code>.</p><h1 id="1-stake-and-forget"><strong>1) Stake and forget</strong></h1><p>This strategy may look convenient at a first glance but such behavior has many disadvantages. Inactive delegator can miss the moment when a node of a validator he bonded to goes offline for a long period resulting in slashing of a stake. Community may decide to change initial network parameters via governance. It may influence overall staking performance and an inactive delegator can miss that. In this case, accumulated rewards do not secure the cosmos hub.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/1-13.png" class="kg-image" alt loading="lazy" width="758" height="206" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/1-13.png 600w, https://p2p.org/economy/content/images/2020/09/1-13.png 758w" sizes="(min-width: 720px) 720px"></figure><p>Network share growth is slowing down as rewards become diluted by inflation and in following years it will become negative. Slashing will affect the whole holdings including rewards.</p><h1 id="2-stake-and-compound"><strong>2) Stake and compound</strong></h1><p>This strategy is especially effective when inflation is rising and there exists a strong belief in future ability of atom to capture transaction fees flow from validating on different chains, issuing assets and so on. In this case, additional gains from people who do not stake are re-delegated on an annual basis.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/2-16.png" class="kg-image" alt loading="lazy" width="679" height="205" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/2-16.png 600w, https://p2p.org/economy/content/images/2020/09/2-16.png 679w"></figure><p>Staking ratio stays constant so return on staking (RoS) is not changing and network share growth is stable in this example. Obviously rewards of this delegator outperformed the previous one. This strategy also has trade-offs. If a big fish bonded to a single validator or validator itself has a big stake or delegated amount, implementing this approach may lead to high network centralization and power concentration. This will not benefit network participants and would undermine security of the cosmos hub.</p><p>This scenario is also subject to slashing risk the most. To increase safety of the funds it is highly recommended to diversify stake amongst various validators even if slashing sounds like something unrealistic.</p><h1 id="3-stake-and-maintain-the-same-share-slightly-releasing-profit-exceeding-standard-inflation"><strong>3) Stake and maintain the same share slightly releasing profit exceeding standard inflation</strong></h1><p>If <code>100%</code> of total atom supply is locked in staking every holder will have equal provisions. In fact, there would be no difference in their network ownership and no one would be diluted. In this case we cannot gain extra atoms and total yield would be zero. Inflation should be considered as a <strong><strong>feature that protects ownership of the network from dilution and as a punishment for every holder who does not contribute to the cosmos hub security</strong></strong>. Profit from inflation accrues only from those who do not stake. Their network share is redistributed among others and there is always an option to withdraw this addition without ownership reduction.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/3-15.png" class="kg-image" alt loading="lazy" width="758" height="206" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/3-15.png 600w, https://p2p.org/economy/content/images/2020/09/3-15.png 758w" sizes="(min-width: 720px) 720px"></figure><p>This approach is also good as a hedge against slashing in the long run. The more frequently you withdraw and sell rewards the less atoms will be affected. This way of staking is especially effective if inflation and annual RoS are falling and network ownership growth is slowing down. Selling portions of atom provisions may be considered as a hedge against price fluctuations. If atom price is expected to decrease in a particular period released profits could be used to buy back with a better price. If price is expected to rise and future dynamic is uncertain then it could be a great cure against greed and a good way to release profit without taking away the ability to generate revenue in future from assets and losing network ownership.</p><h1 id="comparison-in-dynamics"><strong>Comparison in dynamics</strong></h1><p>Let’s take <code>15 year</code> period and look at the performance of these strategies in dynamics. Initial atom supply in this example is <code>100 atoms</code>. In the beginning, four delegators have <code>10 atoms</code> each:</p><ul><li>D1 stake & forget</li><li>D2 stake and compound</li><li>D3 stake and maintain the network ownership selling the rest</li><li>D4 just hold not staking at all Inflation is <code>7%</code> staking ratio constantly rises from <code>57%</code> to <code>77%</code> with a five year stop at <code>67%</code></li></ul><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/4-10.png" class="kg-image" alt loading="lazy" width="938" height="524" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/4-10.png 600w, https://p2p.org/economy/content/images/2020/09/4-10.png 938w" sizes="(min-width: 720px) 720px"></figure><p>For that period of time D1 ended with <code>34,82 atoms</code> accumulating <code>24,82 atoms</code> pending withdrawal, D2 ended with <code>98,88 atoms</code>, D3 earned <code>65,07 atoms</code> selling <code>17,32</code> of them during that time maintaining stake of <code>47,75 atoms</code> and D4 left with <code>10 atoms</code> like in the beginning. Overall holdings could be visualized in the following graph.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/5-10.png" class="kg-image" alt loading="lazy" width="1190" height="600" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/5-10.png 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/5-10.png 1000w, https://p2p.org/economy/content/images/2020/09/5-10.png 1190w" sizes="(min-width: 720px) 720px"></figure><p>On that graph we do not count sold atoms of D3, even so, after some time a delegator who was selling the surplus of atoms would have more holding than one who had just passively staked. If we look at a network ownership dynamics we notice that at the finish D3 maintains higher share even without increasing it. If at the end of the experiment total holdings of each delegator are affected by double-sign slashing (except D4) we see that D2 will lose twice as many as D3.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/6-6.png" class="kg-image" alt loading="lazy" width="1190" height="600" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/6-6.png 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/6-6.png 1000w, https://p2p.org/economy/content/images/2020/09/6-6.png 1190w" sizes="(min-width: 720px) 720px"></figure><p>In the first half of the period D1 had more atoms than D3 but It is possible to be higher on the graph for this period if D3 will release less profit and re-delegate more atoms in order to slightly increase his share but not as much as D2. For the first year you can re-delegate all provisions and slightly decrease re-delegation percentage for the following years but not breaking the initial ownership. In fact you can mix the option of compounding and partial selling in any variation that suits your expectations.</p><p>Network share changes differently for delegators. At the end of a period when inflation is decreasing because staking ratio is <code>>67%</code>, D2 experiences the highest decrease in the network share growth while others experience a decrease in their network ownership losses.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/7-4.png" class="kg-image" alt loading="lazy" width="1190" height="600" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/7-4.png 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/7-4.png 1000w, https://p2p.org/economy/content/images/2020/09/7-4.png 1190w" sizes="(min-width: 720px) 720px"></figure><p>Simply speaking, it becomes more reasonable to implement the strategy of D3 when annual RoS is decreasing. If RoS is rising, network share growth rate is also rising boosting total holdings.</p><h1 id="conclusion"><strong>Conclusion</strong></h1><p>We discussed various options of managing staking balance mostly for educational purposes and deeper understanding of staking process economic variables. Inflation mechanism may drastically change in the near future as it would not be necessary to hold such a high rate of dilution if there were enough economic incentives to stake for participants, and revenues from transaction fees and other options would exceed inflationary rewards providing a stable source of income for validators to maintain their infrastructure and fund operational costs.</p><hr><p><strong><strong>P2P Validator</strong></strong> offers high-quality staking facilities and provides up to date information for educational purposes. Stay tuned for updates and new blog posts.</p><hr><p><strong><strong>Web:</strong></strong><a href="https://p2p.org/?ref=p2p.org"> https://p2p.org</a></p><p><strong><strong>Stake ATOMs with us:</strong></strong><a href="https://p2p.org/cosmos?ref=p2p.org"> https://p2p.org/cosmos</a></p><p><strong><strong>Twitter:</strong></strong><a href="https://twitter.com/p2pvalidator?ref=p2p.org"> @p2pvalidator</a></p><p><strong><strong>Telegram:</strong></strong><a href="https://t.me/p2pvalidator?ref=p2p.org"> https://t.me/p2pvalidator</a></p>

from p2p validator

<h2 id="step-1-download-imtoken-wallet"><strong>Step 1. Download imToken wallet</strong></h2><p>Download imToken wallet for <a href="https://itunes.apple.com/us/app/imtoken2/id1384798940?ref=p2p.org">iOS</a> or <a href="https://play.google.com/store/apps/details?id=im.token.app&ref=p2p.org">Android</a>, securely save mnemonic phrase and password</p><h2 id="step-2-select-cosmos-and-transfer-your-atoms"><strong>Step 2. Select Cosmos and transfer your Atoms</strong></h2><ul><li>Select Cosmos from the list & copy your address</li><li>Transfer your Atoms to imToken wallet</li></ul><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/47861351251_5ecee94080_o.png" class="kg-image" alt loading="lazy" width="2000" height="1665" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/47861351251_5ecee94080_o.png 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/47861351251_5ecee94080_o.png 1000w, https://p2p.org/economy/content/images/size/w1600/2020/09/47861351251_5ecee94080_o.png 1600w, https://p2p.org/economy/content/images/size/w2400/2020/09/47861351251_5ecee94080_o.png 2400w" sizes="(min-width: 720px) 720px"></figure><h2 id="step-3-stake-your-atoms-and-get-rewards"><strong>Step 3. Stake your Atoms and get rewards</strong></h2><ul><li>Select “Staking” button to start delegating</li><li>Select “Validators” tab</li><li>Choose P2P Validator from the validator list</li><li>Enter the amount and press the “delegate” button.</li><li>Enter your password to confirm the delegation</li></ul><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2020/09/40894825453_44d5b3b78e_o.png" class="kg-image" alt loading="lazy" width="2000" height="644" srcset="https://p2p.org/economy/content/images/size/w600/2020/09/40894825453_44d5b3b78e_o.png 600w, https://p2p.org/economy/content/images/size/w1000/2020/09/40894825453_44d5b3b78e_o.png 1000w, https://p2p.org/economy/content/images/size/w1600/2020/09/40894825453_44d5b3b78e_o.png 1600w, https://p2p.org/economy/content/images/size/w2400/2020/09/40894825453_44d5b3b78e_o.png 2400w" sizes="(min-width: 720px) 720px"></figure><h1 id="congratulations-now-you-can-sit-back-and-watch-your-rewards-grow-"><strong>Congratulations! Now you can sit back and watch your rewards grow.</strong></h1><p>If after following this guide you still have questions, issues or other concerns please follow us on <a href="https://twitter.com/p2pvalidator?ref=p2p.org">Twitter</a>. We will provide a personal consultation and guide you through the following process.</p><p>Whether you chose to delegate your digital assets to P2P Validator or not, we welcome you to join our social channels, educational hub and use our DApps, all of which will be open-source.</p><p><strong><strong>Public website:</strong></strong> <a href="https://p2p.org/?utm_source=lunie_post&utm_medium=creds_link&utm_campaign=blog">p2p.org</a></p><p><strong><strong>Medium:</strong></strong> <a href="http://medium.com/p2peconomy?ref=p2p.org">medium.com/p2peconomy</a></p><p><strong><strong>Twitter:</strong></strong> <a href="http://twitter.com/p2pvalidator?ref=p2p.org">twitter.com/p2pvalidator</a></p><p><strong><strong>Telegram:</strong></strong> <a href="http://t.me/p2porg?ref=p2p.org">t.me/p2porg</a></p>

from p2p validator