Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

Institutional treasury managers stake billions in SOL, trusting validators to deliver consistent performance. But most don't realize the real performance bottleneck isn't validator hardware — it's the invisible infrastructure layer connecting validators.P2P.org just upgraded that layer with DoubleZero integration, joining 22% of staked SOL on a network purpose-built for institutional-grade reliability.

DoubleZero is a permissionless fiber optic network built specifically for validator communication. Think of it as a private highway system for blockchain infrastructure instead of the crowded public internet everyone else uses.

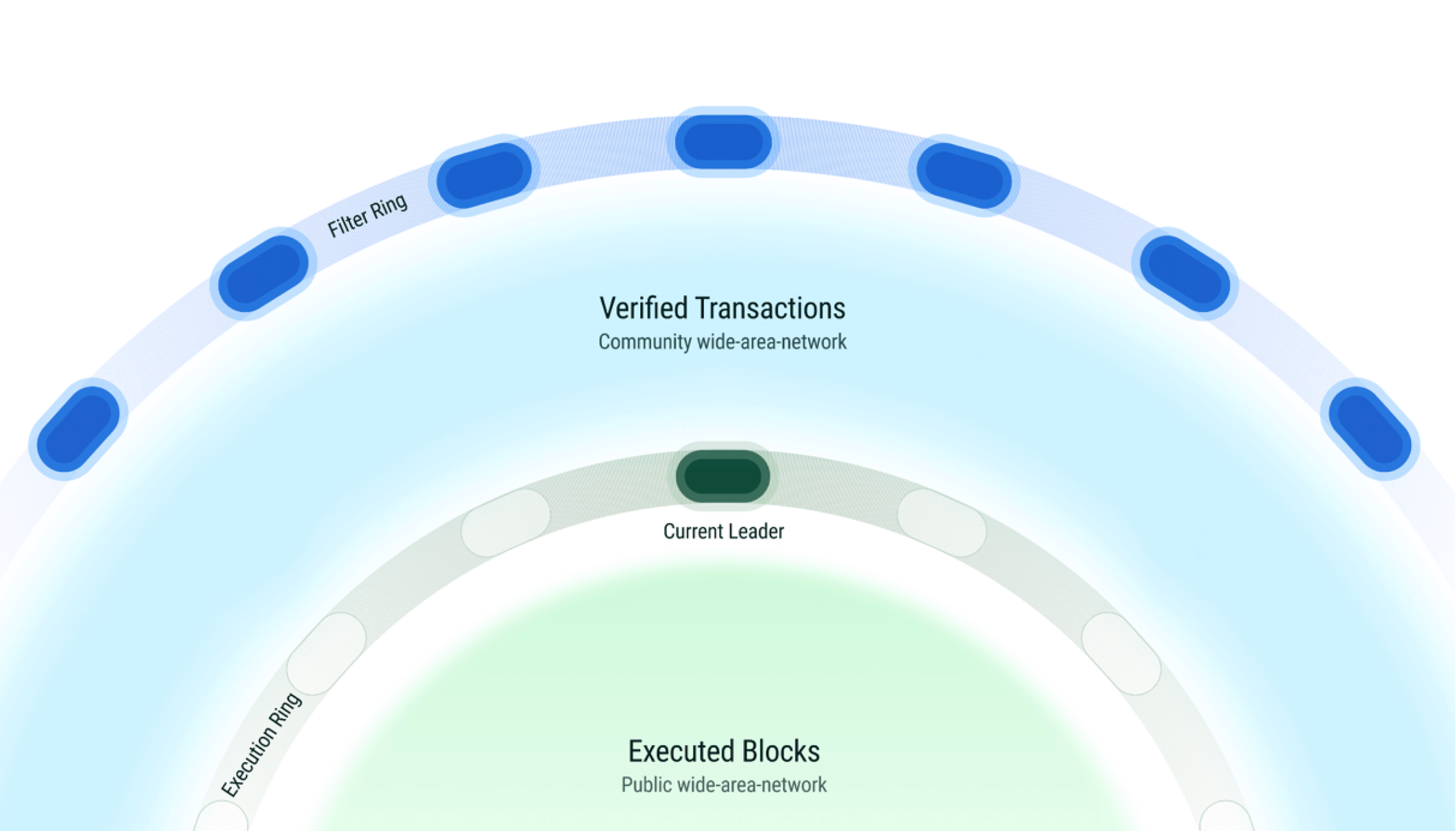

The architecture uses two concentric rings that work together. The outer ring deploys FPGA-powered hardware at key network entry points to filter spam, remove duplicate transactions, and verify signatures before data ever reaches validators. The inner ring provides dedicated fiber optic routes for block propagation and consensus — delivering low latency, high bandwidth, and minimal jitter.

This way, infrastructure can be shared at scale. Rather than each validator independently provisioning resources to handle the full firehose of inbound transactions (such as spam and other unwanted traffic), DoubleZero filters at the network edge. Validators downstream receive a substantially smaller, pre-verified transaction set and can focus their computational resources where it matters: block production and transaction execution. It's a more efficient model than thousands of validators each doing the same filtering work independently.

This shared infrastructure approach is particularly relevant for institutions seeking operational efficiency: why pay for redundant filtering across multiple validator relationships when the work can be done once at the network edge?

Modern validators aren't constrained by CPU cores or memory capacity. They're bottlenecked by bandwidth and latency. A Solana validator receives thousands of transactions per second over the public internet, filters out spam, deduplicates, verifies signatures, constructs blocks, and reaches consensus with hundreds of other validators — all coordinating in real time.

The public internet wasn't designed for this. Variable latency creates jitter in consensus communication, which leads to missed slots. Bandwidth constraints limit throughput as transaction volume increases. Spam floods consume computational resources that could be spent on actual block production. As blockchains push for higher performance, these infrastructure limitations become the primary ceiling. You can throw faster hardware at the problem, but if the network layer can't keep up, you're just burning money on underutilized machines.

Better infrastructure translates directly to better validator performance. With spam filtering happening at the network edge, our validators spend less computational power on useless traffic and more on the work that matters. Dedicated fiber routes with lower latency mean faster block propagation and more consistent consensus participation. Fewer missed slots, more reliable rewards.

The network effects matter too. With over 22% of staked SOL now operating on DoubleZero, the system becomes increasingly resilient. A distributed denial-of-service attack that could overwhelm an individual validator would now need to simultaneously target hundreds of geographically distributed data centers. That's orders of magnitude more difficult. As more validators and fiber links join the network, these advantages compound — better routes, more redundancy, stronger protection.

We deployed DoubleZero for our first validators on October 24, following early-stage testnet validation that allowed our engineering team to refine the integration before production deployment. The implementation required integration with DoubleZero's Program Derived Address (PDA) system for network access, along with automated monitoring to ensure consistent connectivity and performance. Our engineering team built automation for PDA balance management to maintain uninterrupted network access. This is production infrastructure now, not a testnet experiment.

DoubleZero integration is part of a broader approach to validator infrastructure at P2P.org. We continuously evaluate infrastructure improvements that can enhance validator performance and reliability. As Solana continues to scale and push throughput limits, validators running on baseline public internet infrastructure will increasingly struggle. The gap between validators with dedicated high-performance networks and those without will widen.

We're positioning on the right side of that gap. This matters for institutional staking where performance consistency and infrastructure quality are risk management concerns, not just technical details.

P2P.org operates validators across 40+ networks with over $10 billion in assets under management and a zero slashing record over seven years. That track record comes from taking infrastructure seriously.

P2P.org's Solana validators now operate on DoubleZero's high-performance network, combining our proven operational excellence with cutting-edge infrastructure optimization.

Questions about our Solana infrastructure? Contact our institutional team here: https://link.p2p.org/bdteam

<p>Most SafePal users hold stablecoins that sit idle in their wallets. Now, through P2P.org, those assets can be allocated directly to DeFi protocols — securely, non-custodially, and without leaving the app.</p><p>This integration gives users real utility: stablecoin access that’s simple, transparent, and powered by the same infrastructure that secures $10B+ across 40+ networks.Learn how to get access to it with this simple guide: </p><h3 id="step-1-open-the-safepal-app"><strong>Step 1: Open the SafePal App</strong></h3><p>Make sure you have the latest version of the SafePal app installed.From the home screen, tap the Earn tab at the top.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-ff184843-f18f-4194-8cf9-33f4637bc01f.jpeg" class="kg-image" alt="" loading="lazy" width="632" height="1280" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-ff184843-f18f-4194-8cf9-33f4637bc01f.jpeg 600w, https://p2p.org/economy/content/images/2025/11/data-src-image-ff184843-f18f-4194-8cf9-33f4637bc01f.jpeg 632w"></figure><h3 id="step-2-explore-the-earn-marketplace"><strong>Step 2: Explore the Earn Marketplace</strong></h3><p>Scroll through or use the search bar to find available dApps in SafePal Earn. You’ll see featured partners like Binance, MEXC, and now <strong>P2P.org</strong>.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-77a75c89-d5ea-46c7-a56c-b28ef53d4670.jpeg" class="kg-image" alt="" loading="lazy" width="629" height="1280" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-77a75c89-d5ea-46c7-a56c-b28ef53d4670.jpeg 600w, https://p2p.org/economy/content/images/2025/11/data-src-image-77a75c89-d5ea-46c7-a56c-b28ef53d4670.jpeg 629w"></figure><h3 id="step-3-search-for-p2porg"><strong>Step 3: Search for P2P.org</strong></h3><p>Tap the search icon and type <strong>“P2P”</strong>.You’ll find <strong>Stablecoins | P2P.org</strong> listed as one of the Earn dApps.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-3593dd47-d8a2-45db-8d97-39a5ecf9876f.jpeg" class="kg-image" alt="" loading="lazy" width="620" height="1280" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-3593dd47-d8a2-45db-8d97-39a5ecf9876f.jpeg 600w, https://p2p.org/economy/content/images/2025/11/data-src-image-3593dd47-d8a2-45db-8d97-39a5ecf9876f.jpeg 620w"></figure><h3 id="step-4-connect-and-enter-the-app"><strong>Step 4: Connect and Enter the App</strong></h3><p>When you tap to open P2P.org, you’ll see a <strong>Security Warning</strong> — this is standard for all third-party dApps. Confirm to continue.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-81d4ea20-3845-4ab0-b4b9-344303eaf617.jpeg" class="kg-image" alt="" loading="lazy" width="626" height="1280" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-81d4ea20-3845-4ab0-b4b9-344303eaf617.jpeg 600w, https://p2p.org/economy/content/images/2025/11/data-src-image-81d4ea20-3845-4ab0-b4b9-344303eaf617.jpeg 626w"></figure><h3 id="step-5-allocate-your-stablecoins"><strong>Step 5: Allocate Your Stablecoins</strong></h3><p>Inside the P2P.org interface, select your asset (USDC, USDT, or DAI) and the protocol you want to allocate to.For example, you can choose Morpho — one of the DeFi protocols available through P2P.org infrastructure.</p><p>Check the details, agree to the terms, and tap Deposit to complete your allocation.</p><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-ff8e5c43-b1b5-47a8-aeff-cd1d3ad2f3e6.jpeg" class="kg-image" alt="" loading="lazy" width="620" height="1280" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-ff8e5c43-b1b5-47a8-aeff-cd1d3ad2f3e6.jpeg 600w, https://p2p.org/economy/content/images/2025/11/data-src-image-ff8e5c43-b1b5-47a8-aeff-cd1d3ad2f3e6.jpeg 620w"></figure><p><em>Screenshot for illustration only. Actual rewards vary. See latest rates directly in-app.</em></p><h3 id="step-6-track-your-positions"><strong>Step 6: Track Your Positions</strong></h3><p>Once your allocation is complete, you can view your position directly inside the SafePal app under the Earn tab.</p><p>Everything remains non-custodial — your assets stay in your wallet, and you can manage or withdraw at any time.</p><h2 id=""></h2><h2 id="why-it-matters"><strong>Why It Matters</strong></h2><p>Until now, most stablecoins in SafePal wallets were sitting idle. This integration changes that — bringing institutional-grade infrastructure directly to users in one of the largest non-custodial wallets in the world.</p><p>With SafePal and P2P.org, stablecoin allocation becomes as simple as tapping “Earn.”</p><p><strong>Access it now:</strong> <a href="https://www.safepal.com/channel/earn0925?ref=p2p.org">https://www.safepal.com/channel/earn0925</a></p><p><strong>Learn more:</strong> <a href="https://p2p.org/economy/25m-wallet-users-one-integration-stablecoin-opportunities-on-safepal-powered-by-p2p-org/"><u>https://p2p.org/economy/25m-wallet-users-one-integration-stablecoin-opportunities-on-safepal-powered-by-p2p-org/</u></a></p><h2 id="for-partners"><strong>For Partners</strong></h2><p>If you’re building a wallet or financial app and want to offer your users seamless access to stablecoin allocations, P2P.org’s widget can be integrated directly into your interface. It’s simple to embed, fully non-custodial, and backed by infrastructure securing over $10B across 40+ networks.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://link.p2p.org/bdteam ?ref=p2p.org" class="kg-btn kg-btn-accent">Get in touch</a></div>

from p2p validator

<h2 id="at-a-glance"><strong>At a Glance:</strong></h2><ul><li>Network rewards increased from 5% to 20%+ NRR<strong> </strong>— a 4x jump in returns for $EIGEN restakers</li><li>EigenAI and EigenCompute launched on mainnet alpha, introducing verifiable AI infrastructure to solve enterprise trust gaps</li><li>Protocol inflation adjusted from 4% to 8% to fund the higher reward structure</li><li>P2P.org reduced commission from 10% to 5% through end of 2025 for all $EIGEN restakers</li></ul><p>EigenLayer made two major announcements this week that fundamentally shift the restaking landscape: a 4x increase in network rewards and the mainnet alpha launch of the first revenue-generating applications built on restaking infrastructure.</p><p>Here's what changed, why it matters for institutional allocators, and how the pieces connect.</p><h2 id="the-economics-from-5-to-20-nrr"><strong>The Economics: From 5% to 20%+ NRR</strong></h2><p>Programmatic Incentives v2 is now live, raising the Network Reward Rate (NRR) from 5% to over 20% annually for $EIGEN restakers.</p><h3 id="what-actually-changed"><strong>What actually changed</strong></h3><p><strong>Base rewards increased 4x.</strong> The 20% NRR is the new baseline, not a temporary promotion.</p><p><strong>Inflation rate doubled.</strong> Total $EIGEN issuance increased from 4% to 8% annually, directly funding the higher rewards. An additional 1% goes toward Ecosystem Growth initiatives.</p><p><strong>Incentive structure realigned.</strong> The new model rewards long-term restakers who provide consistent security to Actively Validated Services (AVS), rather than optimizing purely for TVL growth.</p><p><strong>Why this matters:</strong> At 5% NRR, restaking competed with traditional Ethereum staking (3-4% NRR) while adding operational complexity. At 20%+, it becomes one of the highest risk-adjusted yields in crypto infrastructure — a 16-17 percentage point premium that justifies the additional overhead for institutional treasuries.</p><h2 id="the-infrastructure-what-gets-secured"><strong>The Infrastructure: What Gets Secured</strong></h2><p>The 4x rewards increase raises an important question: what are restakers actually securing?</p><p>EigenCloud's mainnet alpha launch provides the answer: <strong>EigenAI</strong> and <strong>EigenCompute </strong>— the first real-world services that demonstrate restaking economics in practice.</p><h3 id="eigenai-verifiable-llm-inference"><strong>EigenAI: Verifiable LLM Inference</strong></h3><p>Enterprise AI deployment faces a fundamental trust gap. When you query an LLM through cloud providers, you're trusting the model hasn't been tampered with, the response came from the claimed model, and results haven't been altered.</p><p>For regulated institutions and compliance-heavy industries, this opacity is a blocker.</p><p><strong>What EigenAI does:</strong> Provides an API for LLM inference where every input, output, and model version is cryptographically guaranteed. Prompts, responses, and models remain provably unchanged, with complete audit trails for all interactions.</p><p><strong>Why enterprises care:</strong> Deterministic, reproducible AI outputs with full auditability. If you need to prove to regulators exactly what your AI system processed and returned, EigenAI provides cryptographic proof.</p><p><strong>OpenAI-compatible API:</strong> Developers can integrate verifiable inference into existing systems with minimal code changes.</p><p><strong>Use cases:</strong></p><ul><li>Financial institutions running AI-powered risk models</li><li>Healthcare applications requiring audit trails for diagnostic AI</li><li>Legal tech where AI-assisted research needs to be defensible</li><li>Any regulated industry where AI decisions require proof of execution</li></ul><p></p><h3 id="eigencompute-verifiable-off-chain-computation"><strong>EigenCompute: Verifiable Off-Chain Computation</strong></h3><p><strong>What it does:</strong> Executes complex computational tasks off-chain with on-chain-level trust guarantees.</p><p><strong>How it works:</strong> Current alpha leverages Trusted Execution Environments (TEEs) — hardware-based secure enclaves that prove code executed correctly. Future releases will add cryptoeconomic guarantees and zero-knowledge proofs.</p><p><strong>Why this matters:</strong> Many blockchain applications need heavy computation that's too expensive or slow to run on-chain. EigenCompute provides a verified alternative — execute off-chain, prove on-chain.</p><p><strong>Practical applications:</strong></p><ul><li>Complex financial modeling for DeFi protocols</li><li>AI model training and inference requiring verification</li><li>Data processing pipelines where results need on-chain confirmation</li><li>Any computation where proving correct execution matters more than running everything on-chain</li></ul><h2 id="how-the-pieces-connect-dual-revenue-model"><strong>How the Pieces Connect: Dual Revenue Model</strong></h2><p>EigenAI and EigenCompute represent the economic model of restaking playing out in practice.</p><p>When enterprises use these services, they pay fees. Those fees flow to:</p><ol><li>The AVS operators who validate the services</li><li>The restakers who provide economic security to those operators</li></ol><p>This creates a dual-revenue model for restakers:</p><ul><li><strong>Base protocol rewards</strong> (the 20%+ NRR from Programmatic Incentives v2)</li><li><strong>Service fee revenue</strong> from actual usage of EigenAI and EigenCompute</li></ul><p>As these services gain enterprise adoption, early restakers who secured them capture both yield streams. This is why the 4x rewards increase and the EigenCloud launch matter together — higher protocol rewards plus revenue-generating applications that those rewards secure.</p><h2 id="p2porg-5-commission-through-2025"><strong>P2P.org: 5% Commission Through 2025</strong></h2><p>To align with EigenLayer's new incentive structure, P2P.org has reduced commission from 10% to 5% through the end of 2025 for all $EIGEN restakers.</p><p><strong>What you get:</strong></p><ul><li><strong>Zero slashing events</strong> across 7 years of validator operations on 40+ networks</li><li><strong>Professional AVS management </strong>— we handle all technical implementation, including EigenAI and EigenCompute validation</li><li><strong>99.9% uptime</strong> with enterprise SLAs</li><li><strong>Dedicated institutional support</strong> for compliance and custom reporting</li><li><strong>5% commission applies to all yields </strong>— both base protocol rewards and AVS fee revenue</li></ul><p>*Important:** The 5% commission rate applies specifically to our dedicated <a href="https://app.eigenlayer.xyz/operator/0xd2bca64ad01f77de84be4a8acbd2e8beceed9ab3?ref=p2p.org"><u>EIGEN Restaking Operator</u></a>. P2P.org operates multiple EigenLayer validators — make sure you're delegating to the correct operator address to receive the promotional rate.</p><p><strong>Our AVS selection process evaluates:</strong></p><ul><li>Security architecture and audit history</li><li>Economic sustainability and revenue potential</li><li>Technical requirements relative to our infrastructure</li><li>Risk/reward profiles considering slashing conditions</li></ul><p>Both EigenAI and EigenCompute met our criteria for institutional-grade AVS participation.</p><h2 id="why-early-positioning-matters"><strong>Why Early Positioning Matters</strong></h2><p>The combination of 4x rewards and revenue-generating applications creates a compelling window for institutional restakers.</p><p><strong>Higher base rewards:</strong> 20%+ NRR changes the risk/reward calculation versus traditional staking and DeFi alternatives.</p><p><strong>Fee revenue upside:</strong> As EigenAI and EigenCompute move from alpha to production and gain enterprise adoption, fee revenue flows to validators and restakers.</p><p><strong>First-mover advantage:</strong> Early restakers capture both yield streams while building operational expertise before restaking becomes commoditized.</p><p>The shift from 5% to 20% NRR combined with the launch of actual revenue-generating services demonstrates restaking economics moving from theory to practice.</p><h2 id="next-steps"><strong>Next Steps</strong></h2><p>The shift from 5% to 20% NRR changes the strategic calculation for institutional restaking. Accessing those returns safely requires infrastructure built for institutional requirements — proven reliability, professional risk management, and dedicated support.</p><p>P2P.org has secured over $10 billion in assets for 130+ institutional clients across 40+ networks. Our EigenLayer infrastructure brings the same operational standards to restaking that we've delivered since 2018.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://www.p2p.org/products/eigenlayer?ref=p2p.org" class="kg-btn kg-btn-accent">Restake $EIGEN with P2P.org</a></div>

from p2p validator