Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

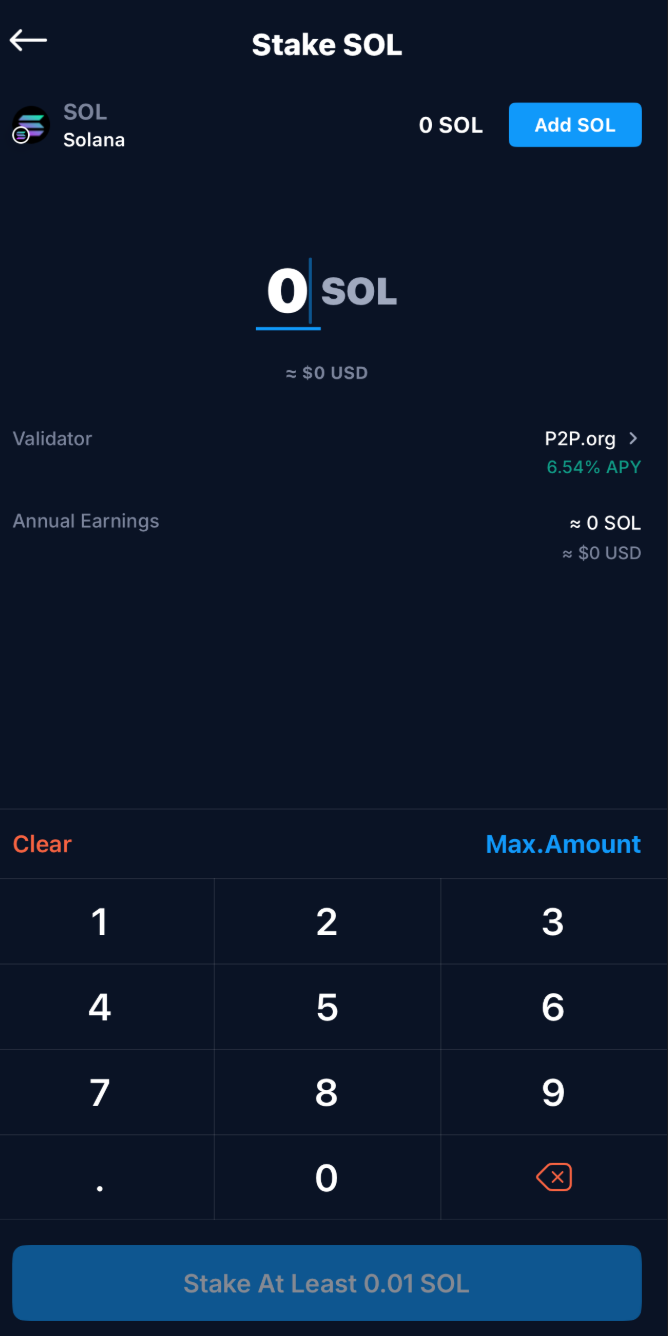

Crypto.com Onchain Wallet users can now delegate SOL directly to P2P.org, gaining access to a trusted, high-performance validator. This addition expands the validator options available in the wallet and increases the flexibility and confidence users have when staking SOL in a non-custodial environment.

When staking SOL through a non-custodial wallet, choosing a validator is one of the most important decisions a user makes. Validator quality impacts uptime, reward consistency, and long-term staking performance.

Crypto.com added P2P.org to its validator list to provide users with:

The experience stays simple:

No new steps. No new complexity.

What improves is choice and validator quality.

Users benefit from:

Everything happens directly in-app, with users retaining full control of their funds.

As wallets continue adding reputable validators, users gain safer and more transparent staking environments. P2P.org’s addition aligns with this broader trend by improving the validator ecosystem available to everyday users — not just institutions.

It also extends P2P.org’s footprint across leading wallets and platforms, reaffirming our commitment to making high-quality staking infrastructure easy to access across ecosystems.

Learn more about P2P.org’s Solana staking and validator operations: https://link.p2p.org/021d26

<h2 id="at-a-glance">At a Glance:</h2><ul><li>P2P.org's new report provides actionable frameworks for evaluating protocols, sizing positions, and implementing risk controls.</li><li>Leveraged staking can amplify returns by 2-5x through strategic use of borrowed capital, with institutional protocols now offering 15-30%+ APYs.</li><li>Advanced strategies combine liquid staking tokens, DeFi lending protocols, and yield optimization to maximize capital efficiency while managing risk.</li><li>Institutional adoption requires understanding liquidation mechanics, smart contract risks, and tax implications—areas where proper infrastructure is critical.</li></ul><p>In 2025, U.S. institutions are no longer asking whether digital asset yield is accessible — they’re asking what’s compliant, what’s operational, and what’s worth allocating to.</p><p>Ethereum staking now exceeds 40 million ETH, driven in part by validator consolidation among regulated operators. Tokenized Treasury products — including bills, repo, and MMF wrappers — have surpassed $1.3 billion in active issuance. Stablecoin reserves are generating meaningful interest income, with some issuers introducing partial pass-through models for institutional clients.</p><p>Each of these yield streams has a different structure. But for U.S.-regulated firms, the relevant dividing line isn’t technical — it’s legal and operational. Custody configuration, accounting treatment, and regulatory perimeter define what’s viable, not just what’s possible.</p><p>That’s the purpose of this report.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://link.p2p.org/7731a6?ref=p2p.org" class="kg-btn kg-btn-accent">Download the full report</a></div><h2 id="our-institutional-framework"><strong>Our Institutional Framework</strong></h2><p>The Next Chapter of Institutional Yield in the United States (2025) provides a structured, U.S.-specific view of how institutions can access on-chain yield today — and what guardrails shape that access.</p><p>Topics include:</p><ul><li><strong>Where yield comes from</strong>: ETH staking post-Pectra (EIP-7251), validator MEV, restaking mechanics, tokenized treasuries, and stablecoin reserve yield.</li><li><strong>Access and constraints</strong>: How staking works under qualified custody; how rewards are taxed and booked; what’s green-lit, gray, or off-limits under current federal guidance.</li><li><strong>Market sizing and adoption signals</strong>: TVL, tokenized asset issuance, custodian activity, and float concentration across protocols and products.</li><li><strong>Product archetypes and risk models</strong>: A breakdown of viable staking and tokenized yield structures, including liquidity profiles, operational overhead, and risk controls.</li><li><strong>Institutional case studies</strong>: Examples of custody-linked staking, on-chain treasury strategies, and yield optimization using stablecoin float.</li></ul><p>It also includes a one-page compliance matrix summarizing access pathways across the current U.S. legal and regulatory environment.</p><h2 id="who-this-report-is-for"><strong>Who This Report Is For</strong></h2><p>This guide is designed for institutional decision-makers evaluating DeFi yield strategies:</p><ul><li><strong>Treasury Managers</strong> seeking to optimize returns on digital asset holdings</li><li><strong>Asset Managers</strong> building DeFi exposure for institutional clients</li><li><strong>Family Offices</strong> diversifying into sophisticated crypto strategies</li><li><strong>Crypto-Native Funds</strong> looking to maximize capital efficiency</li></ul><p>Whether you're taking your first steps into DeFi or optimizing existing positions, this report provides the framework to evaluate opportunities and manage risks effectively.</p><h2 id="why-now"><strong>Why Now</strong></h2><p>The yield mechanics in crypto have matured — but clarity has lagged behind. This report is built to bridge that gap using verifiable data, public guidance, and a neutral framework.</p><p>The focus is on structure: how yield is created, how it can be accessed, and how institutions are doing so today — within the limits of what’s currently permitted.</p><p><strong>Download the full report</strong> to access our complete framework for institutional leveraged staking, including detailed protocol comparisons, risk matrices, and implementation playbooks.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://link.p2p.org/7731a6?ref=p2p.org" class="kg-btn kg-btn-accent">Download the full report</a></div><p><strong>Ready to discuss implementation?</strong> P2P.org provides institutional-grade staking infrastructure with the technical expertise to support sophisticated DeFi strategies. Contact our institutional team to explore how we can support your yield objectives.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://link.p2p.org/bdteam?ref=p2p.org" class="kg-btn kg-btn-accent">Contact our team</a></div>

from p2p validator

<p>While most validators are still figuring out what BAM means, P2P.org is already running it in production.</p><p>We were one of the first validators to run Jito's Block Assembly Marketplace testnet back in August — months before the ecosystem realized execution quality would redefine Solana validation. We've been testing, optimizing, and proving BAM under real-world institutional conditions while others were still reading the docs.</p><p>Now we're live on mainnet. Our delegators get execution quality that most of the Solana ecosystem won't have access to for months.</p><p>Validator performance used to mean uptime and low commission. That era is over. Execution quality (how your transactions are ordered, your MEV exposure, the predictability of outcomes) now separates institutional-grade infrastructure from everyone else.</p><h2 id="the-problem-execution-opacity-on-solana"><strong>The Problem: Execution Opacity on Solana</strong></h2><p>Trading high-value positions on Solana comes with hidden costs. Front-running, bot exploitation, unpredictable transaction ordering — all of these drain value from institutional operations. Your transaction either executes cleanly or it doesn't, and when things go wrong, there's limited visibility into why, how much it cost you, or who profited.</p><p>Transaction ordering felt random. For institutions moving serious capital, that randomness is unacceptable.</p><h2 id="what-bam-delivers"><strong>What BAM Delivers</strong></h2><p>BAM transforms how transactions are assembled before they reach validators. Think institutional-grade order routing, applied to blockchain validation.</p><p><strong>Delegators and clients gain:</strong></p><ul><li><strong>Transparent execution</strong>: Clear visibility into how and why transactions are ordered</li><li><strong>Reduced toxic MEV exposure</strong>: Less vulnerability to front-running and predatory bot activity</li><li><strong>Predictable outcomes</strong>: Consistent block production with lower variance</li><li><strong>Safer high-value trading</strong>: Protection where it matters most — on your largest transactions</li></ul><p>For institutional treasuries, liquidity providers, and DeFi protocols, this upgrade changes how you evaluate validator infrastructure. Execution quality becomes measurable, comparable, and optimizable.</p><h2 id="why-p2porg-was-already-there"><strong>Why P2P.org Was Already There</strong></h2><p>We secure over $10 billion in digital assets across 40+ networks for 130+ institutional clients. Over $1 billion of that is SOL — making us one of the largest institutional validators on Solana. Zero slashing. 99.9% uptime. And a track record of adopting breakthrough infrastructure before the rest of the market knows it matters.</p><p>When we became a first-wave BAM validator in August, we built institutional-grade operational playbooks around it. While other validators were watching from the sidelines, we were gathering production data, identifying edge cases, and proving that BAM delivers under the conditions that matter to serious capital allocators.</p><p>Solana is becoming an institutional-grade settlement layer. Institutions demand measurable execution quality above validator philosophy. BAM makes that quality quantifiable, and P2P.org spent months ensuring we could deliver it at scale.</p><h3 id="our-approach"><strong>Our Approach</strong></h3><p>We validated performance under institutional trading conditions. We stress-tested stability across network scenarios. We documented everything and shared insights with the Solana ecosystem. By the time most validators start their BAM evaluation, we'll already be optimizing version 2.0.</p><p>That's the difference between infrastructure leadership and infrastructure followers.</p><h2 id="the-solana-block-space-economy"><strong>The Solana Block Space Economy</strong></h2><p>BAM represents the future of how professional-grade Solana validation operates. P2P.org's early adoption places us at the centre of Solana's evolving block space economy — a position we've earned through consistent infrastructure leadership.</p><p>Your validator choice now has an additional dimension: Does your validator support the infrastructure that protects your execution quality?</p><p>For liquidity providers, trading desks, DeFi protocols, and institutional treasuries, the answer matters.</p><h2 id="breakpoint-will-catch-up-to-what-were-already-running"><strong>Breakpoint Will Catch Up to What We're Already Running</strong></h2><p>Solana Breakpoint will feature panels about MEV optimization and next-generation validator infrastructure. Speakers will discuss the theoretical benefits of BAM and what the future might look like.</p><p>We're past theory. We're running that future in production.</p><p>P2P.org operates at the bleeding edge of Solana's block space economy. We build the infrastructure that defines trends rather than chase them. When the ecosystem catches up to BAM adoption over the next 6-12 months, we'll already be iterating on what comes next.</p><p>For Solana natives building serious DeFi protocols, for institutions allocating real capital, and for delegators who understand that APY is only part of the equation — BAM-powered validation represents the infrastructure standard everyone else will be scrambling to match.</p><p><strong>Want to discuss how P2P.org's BAM infrastructure impacts your Solana operations?</strong></p><p>Connect with our institutional team or delegate to P2P.org. Experience what next-generation Solana validation looks like while the rest of the market is still reading the announcement blog posts.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://link.p2p.org/bdteam?ref=p2p.org" class="kg-btn kg-btn-accent">Contact our team</a></div>

from p2p validator