Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

With Monad's official staking documentation now live, P2P.org is positioned at the forefront of what promises to be one of the most innovative staking ecosystems in blockchain.

The release of Monad's staking documentation marks a pivotal moment for the network — and for P2P.org's role as an early validator partner. Having operated as a validator on Monad's testnet since earlier this year, we've witnessed firsthand how Monad's unique approach to staking infrastructure creates new opportunities for institutional reward strategies.

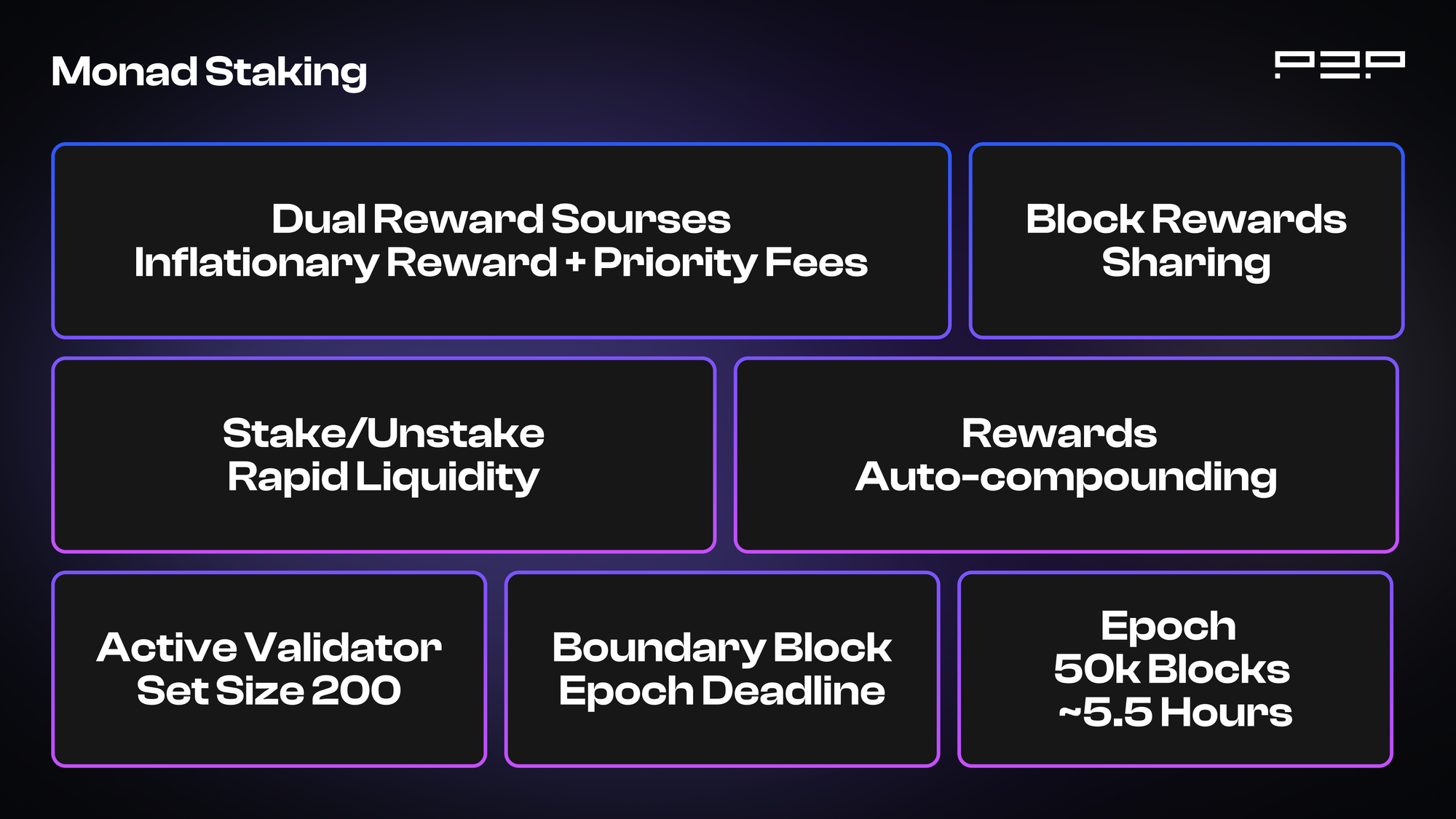

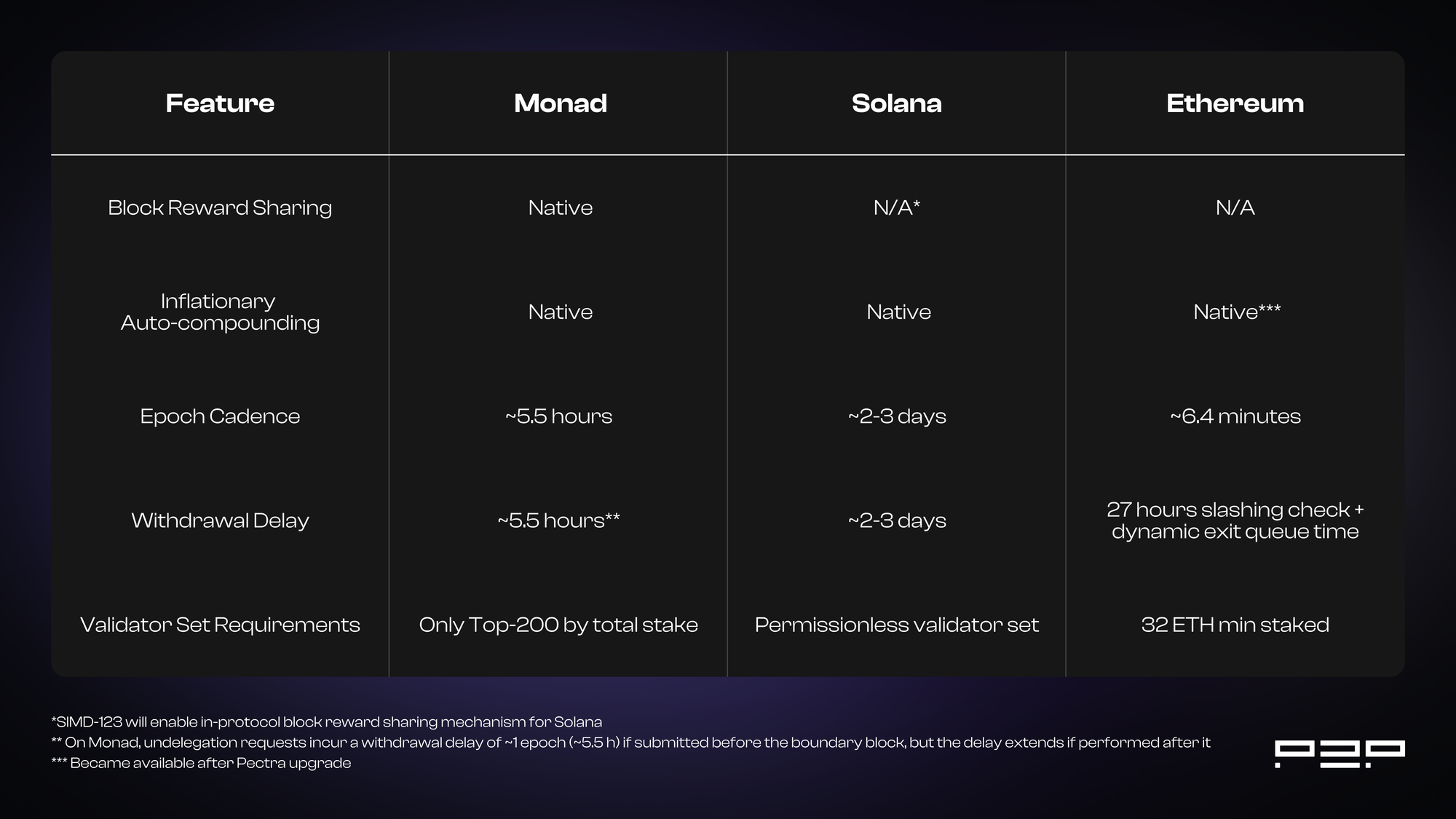

Monad’s staking architecture introduces several institutional-grade features that address key pain points we've observed across other networks:

Monad provides a native mechanism for validators to share block rewards (priority fees) with delegators: providing delegators access to this revenue stream and giving validators a powerful new way to compete for stake.

Monad’s short epoch length (~5.5 hours) enables a fast withdrawal period: giving end-users greater liquidity over their staked assets and providing validators a more dynamic, responsive staking market.

Monad enables automatic compounding of inflationary rewards each epoch, providing delegators the option to either compound or claim their staked funds.

Monad staking offers two rewards: a constant inflationary block reward shared with delegators, and user-paid priority fees that validators can natively share on-chain. This dual design gives delegators broader yield and lets validators compete on more than just commission.

Monad’s boundary block locks stake/commission changes a fixed number of rounds before epoch end, ensuring deterministic validator set and reward splits across epochs.

Monad maintains a dynamic top 200 validator set each epoch, based on stake distribution, ensuring fairness, decentralisation, and competitive participation among validators.

Our early involvement with Monad testnet validation has given us deep insights into the network's operational requirements and reward mechanics. This positions P2P.org to offer institutional clients:

As Monad progresses toward Mainnet launch, P2P.org remains committed to delivering institutional-grade validation services that maximise the network's innovative staking features. Our Testnet experience has demonstrated that Monad's architecture delivers practical advantages for reward optimisation.

For institutional clients evaluating next-generation blockchain networks, Monad represents a significant step forward in staking infrastructure design. Combined with P2P.org's proven validation expertise, it offers a compelling opportunity for rewards.

<p></p><h2 id="tldr"><strong>TL;DR</strong></h2><ul><li><a href="http://p2p.org/?ref=p2p.org"><strong><u>P2P.org</u></strong></a><strong>’s new BTC Product Hub </strong>is the first destination to explore all BTC‑native reward products in one place.</li><li>Stake and access rewards directly in BTC, unlock additional rewards with LSTs, or explore institutional-grade opportunities with NRR up to 6%</li><li>Fully developed in-house solutions — including staking APIs, staking widgets, and BTC-in → BTC-out reward flows, created specifically for institutional use and full custody compatibility</li><li>The new BTC Product Hub solves fragmentation by consolidating BTC protocols/L2s (e.g., <strong>Babylon, Mezo, CoreDAO, Lombard</strong> and more) with clear risk notes and integration paths.</li><li>Built for custodians & exchanges, funds/treasuries, ETF issuers, wallets/platforms, miners — retail via partners.</li></ul><p></p><h2 id="p2porg-launches-the-btc-product-hub"><strong>P2P.org Launches the BTC Product Hub</strong></h2><p>Bitcoin is the world's most trusted digital asset — now surpassing a $2T market cap with accelerating ETF adoption. Yet for institutions, activating BTC beyond holding has been fragmented: every protocol has its own site, docs, and disclaimers, creating operational drag and compliance friction.</p><p>Today, we’re introducing the BTC Product Hub — a single, institution‑ready destination to discover, evaluate, and integrate BTC‑native reward opportunities. The Hub reframes the experience from “try a protocol” to “choose the right product for your needs,” with BTC‑in → BTC‑out flows and BTC-native APIs for flawless integrations.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://www.p2p.org/products/bitcoin?utm_source=blog&utm_medium=post&utm_campaign=btc_product_hub_19.09" class="kg-btn kg-btn-accent">Explore integration options</a></div><h2 id="why-institutions-struggle-with-btc%E2%80%91native-rewards"><strong>Why Institutions Struggle With BTC‑Native Rewards</strong></h2><p>Bitcoin just crossed $2 trillion in market cap, yet most institutional Bitcoin earns exactly 0% — not because institutions don't want rewards, but because activating Bitcoin has become an operational nightmare.</p><p><strong>Fragmented discovery</strong> <br>Every protocol lives on its own website with different documentation, different risk profiles, and different integration requirements. Your team spends weeks just mapping the landscape.Reward paths scattered across protocols and L2s with varying docs and risks.</p><p><strong>Operational overhead</strong><br>Each opportunity requires bespoke monitoring systems, custom reporting frameworks, and separate compliance reviews. What should be a strategic decision becomes a resource drain.</p><p><strong>Exposure drift</strong> <br>Most solutions force you into wrapped tokens, liquid staking derivatives, or cross-chain bridges that fundamentally change your Bitcoin exposure. Your "Bitcoin strategy" suddenly involves explaining three other assets to your board.</p><p><strong>Custody complexity</strong> <br>New protocols often mean new custody requirements, additional security reviews, and extended approval processes that can stretch for months.</p><p>The result: promising initiatives stall, and idle BTC remains off the field.</p><h2 id="the-missed-opportunity-btcfi"><strong>The Missed Opportunity: BTCfi</strong></h2><p>BTC‑native finance (BTCfi) is becoming its own category. Early movers are enhancing products, differentiating ETFs and custody offerings, and unlocking new revenue — while keeping exposure in BTC terms. Institutions that standardize on a BTC‑only, non‑custodial approach gain the speed and clarity to move from pilots to production.</p><h2 id="what-the-btc-product-hub-does-differently"><strong>What the BTC Product Hub Does Differently</strong></h2><p><a href="http://p2p.org/?ref=p2p.org"><u>P2P.org</u></a>’s BTC Product Hub is the first institutional-grade destination that consolidates every major Bitcoin opportunity into a single, integration-ready platform.</p><p>One hub, complete coverageA consolidated view of BTC protocols and L2s — including <strong>Babylon, Mezo, CoreDAO, Lombard, Starknet, Solv</strong> and others — with plain‑English explanations and risk notes</p><p><strong>BTC‑in → BTC‑out</strong><br>All opportunities are evaluated for BTC‑only flows and BTC‑term reporting — minimizing exposure drift.</p><p><strong>Integration‑ready</strong><br>Options ranging from white‑label validator nodes, non‑custodial Bitcoin Staking Widgets and implementation support under enterprise SLAs.</p><p><strong>Reporting that fits your books</strong><br>BTC‑term statements are exportable as CSV/PDF for audit, operations, and stakeholder communication.</p><h2 id="how-different-institutions-benefit"><strong>How Different Institutions Benefit</strong></h2><p>Custodians & ExchangesOffer BTC rewards through the existing custody stack — client‑directed, non‑custodial operations, audit‑ready reporting.</p><p><strong>Funds & treasuries</strong><br>Maintain BTC‑only exposure with clean BTC‑term performance and exportable statements — no conversions, no new custody constructs.</p><p><strong>ETF issuers & asset managers</strong><br>Differentiate products while staying custody‑compatible.</p><p><strong>Wallets & platforms</strong><br>Embed BTC rewards in‑app via APIs and white‑label validators; ship safely with enterprise SLAs.</p><p><strong>Miners</strong><br>Put idle BTC to work across supported networks with 24/7 monitoring and slashing‑aware operations.</p><h2 id="building-the-gateway-to-btc%E2%80%91native-finance"><strong>Building the Gateway to BTC‑Native Finance</strong></h2><p>The BTC Product Hub brings order to a fragmented landscape and sets a new standard for Bitcoin participation: <strong>BTC in, BTC rewards out</strong>. From discovery to integration to BTC‑term reporting, institutions finally have a single place to put BTC to work confidently.</p><h2 id="ready-to-explore"><strong>Ready to Explore?</strong></h2><p>The BTC Product Hub is available now. <a href="https://calendly.com/d/csmk-nrr-7yh/intro-call-with-the-p2p-sales-team?ref=p2p.org" rel="noreferrer">Schedule a call with our institutional team here</a> to walk through your use case.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://www.p2p.org/products/bitcoin?utm_source=blog&utm_medium=post&utm_campaign=btc_product_hub_19.09" class="kg-btn kg-btn-accent">Explore the BTC Product Hub</a></div>

from p2p validator

<p></p><h2 id="tldr"><strong>TL;DR</strong><br></h2><ul><li><strong>P2P.org expands to Canton Network:</strong> Backed by 99.99% uptime and $10B+ secured across 40+ networks, we deliver validator infrastructure through our Staking-as-a-Business model.</li><li><strong>Canton ecosystem participants:</strong> Goldman Sachs, JPMorgan, Citi, BNP Paribas, Bank of America, Barclays, Circle, BitSafe and others are exploring tokenized finance on Canton.</li><li><strong>Institutional adoption barrier:</strong> Most public blockchains expose transaction data, blocking institutions from participating. Canton’s approach is privacy-enabled finance.</li><li><strong>Market opportunity:</strong> Tokenized assets could reach $10T by 2030 (source: CoinDesk/21.co). Early movers are already gaining an edge.</li><li><strong>Immediate benefits:</strong> Atomic settlement reducing timelines from days to minutes, automated compliance, and access to global liquidity.</li></ul><h2 id="p2porg-expands-institutional-infrastructure-to-canton"><strong>P2P.org Expands Institutional Infrastructure to Canton</strong></h2><p>P2P.org is proud to announce our onboarding as a validator for the Canton Network — a privacy-enabled blockchain designed for institutional finance. With this expansion, institutions exploring tokenization and digital asset pilots can now rely on P2P.org’s proven validator infrastructure to participate with confidence.</p><p>For more than a decade, we’ve delivered institutional-grade staking and validator services across 40+ networks, securing over $10 billion in assets with 99.99% uptime. Joining Canton extends that track record to one of the most ambitious initiatives in institutional blockchain adoption.</p><h2 id="why-institutions-struggle-with-public-blockchains"><strong>Why Institutions Struggle With Public Blockchains</strong></h2><p>Financial institutions face a fundamental dilemma: public blockchains unlock programmability, composability, and settlement efficiency — but they expose every transaction to all participants.</p><p>When institutions execute large bond trades, process cross-border payments, or manage repo agreements, revealing counterparties and transaction volumes to the entire market simply isn’t an option. As a result, most initiatives remain trapped in private networks or proofs-of-concept, missing the network effects that make blockchains transformative.</p><h2 id="missing-the-10-trillion-tokenization-wave"><strong>Missing the $10 Trillion Tokenization Wave</strong></h2><p>The financial impact of the transparency barrier grows every day:<strong>Operational Inefficiency:</strong> Manual settlement processes requiring days instead of minutes, with massive back-office overhead and counterparty risk accumulating at every step.</p><p><strong>Trapped Liquidity:</strong> Fragmented systems that can't interoperate, preventing access to global liquidity pools and optimal pricing across $200B+ in DeFi markets.</p><p><strong>Innovation Penalty:</strong> Missing entirely new revenue streams while competitors explore tokenized asset opportunities in a market projected to reach $10 trillion* by 2030. (<em>*source: Coindesk)</em></p><p><strong>Network Effect Loss:</strong> Inability to participate in composable financial applications that could create unprecedented business models and operational efficiencies.</p><p>Every day institutions wait, early movers capture more market share in the rapidly expanding tokenized asset ecosystem.</p><h2 id="canton-network-p2porg-infrastructure-excellence"><strong>Canton Network + P2P.org Infrastructure Excellence</strong></h2><p>Canton delivers protocol-level privacy, but institutions can only rely on it with validator infrastructure that matches their standards. That’s where P2P.org comes in. With 99.99% uptime, $10B+ secured across 40+ networks, and a proven track record serving institutional clients, we provide the reliability and operational excellence that financial institutions require to participate in Canton with confidence.</p><h2 id="what-canton-does-different"><strong>What Canton Does Different</strong></h2><p><strong>Protocol-Level Privacy</strong>According to the Canton team, the network enables confidential multi-party contracts where sensitive terms remain private between counterparties while still being programmable and enforceable on-chain.</p><p><strong>Atomic Composability</strong>As described by the protocol, financial applications can interconnect seamlessly while preserving confidentiality — enabling complex institutional workflows not feasible on other public chains.</p><p><strong>Proven at Scale</strong>The Canton team reports that the network has already processed more than $4 trillion in tokenized assets across bonds, repos, money market funds, loan commitments, and insurance products.</p><p><strong>Why P2P.org’s Validator Role Matters</strong></p><p><strong>Institutional-Grade Reliability: </strong>99.99% uptime securing $10B+ across 40+ networks</p><p><strong>Staking-as-a-Service Excellence: </strong>Complete technical setup and operation, enabling institutions to access Canton's ecosystem without infrastructure complexity.</p><p><strong>Proven Track Record: </strong>Trusted by institutional clients across multiple blockchain networks, with the operational expertise to support finance at scale.</p><h2 id="building-the-infrastructure-for-privacy-enabled-finance"><strong>Building the Infrastructure for Privacy-Enabled Finance</strong></h2><p>Institutions are actively exploring tokenization, settlement, and digital asset pilots — but adoption depends on infrastructure they can trust. Canton positions itself as one solution, and P2P.org ensures institutions can access it with the same reliability and security we deliver across 40+ networks.</p><p>While many competitors are still debating blockchain adoption, P2P.org is already providing the validator infrastructure that allows financial institutions to participate confidently in the next wave of privacy-enabled finance.</p><p><strong>Ready to explore Canton Network opportunities?</strong></p><p><strong>Schedule a consultation to discuss your privacy-enabled blockchain opportunity: </strong><a href="https://calendly.com/d/cq26-96v-sr3/intro-call-with-the-p2p-sales-team?ref=p2p.org"><u>https://calendly.com/d/cq26-96v-sr3/intro-call-with-the-p2p-sales-team</u></a> </p><p><em>This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase any product, service, or security. P2P.org is not affiliated with or endorsed by any of the third-party institutions named herein. </em></p>

from p2p validator