Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeMaximal extractable value (MEV) is the additional value that DeFi ecosystem participants (MEV searchers) can extract by influencing transaction inclusion and ordering in blocks produced by validators. Activities such as arbitrage, front-running, NFT sniping, sandwich trading and collateralized positions liquidation present in any DeFi ecosystem contribute to the MEV. Searchers are willing to pay extra fees for priority access to MEV opportunities. These fees ("MEV rewards") can generate significant amounts of additional revenue for validators and their delegators.

The Jito client, which was launched on Solana mainnet-beta in October, 2022, is the first third-party validator client for Solana which represents a significant improvement to Solana's validator software. Jito software enables more efficient transaction and bundle processing helping both validators and searchers effectively identify and exploit MEV opportunities while eliminating unproductive network spam. It allows validators running the Jito client and their delegators to earn additional revenue from MEV through the Tip Distribution on-chain program which collects and distributes the fees (or “tips”) in proportion equal to a commission set by a validator. The client adoption is good for the Solana ecosystem because it can increase the network's stability, incentivize more validator operators and stakers to join, and help Solana to become more attractive to DeFi ecosystem participants.

This article will explore statistics on the Jito client adoption within the Solana mainnet-beta cluster, such as the growth of the number of validators running the Jito client, their total active stake and market share. We will also explore the dynamics of MEV rewards generated and compare the performance of Jito validators with that of the rest of the cluster. Additionally, we will investigate whether the adoption of the Jito client has a significant impact on the performance of validators who started to use it. Through this analysis, we aim to shed light on the potential benefits and drawbacks of using the Jito client for validators operating within the Solana network. The data used in this report is publicly available through the P2P Validator public dashboard at: https://reports.p2p.org/superset/dashboard/jito_client_adoption/.

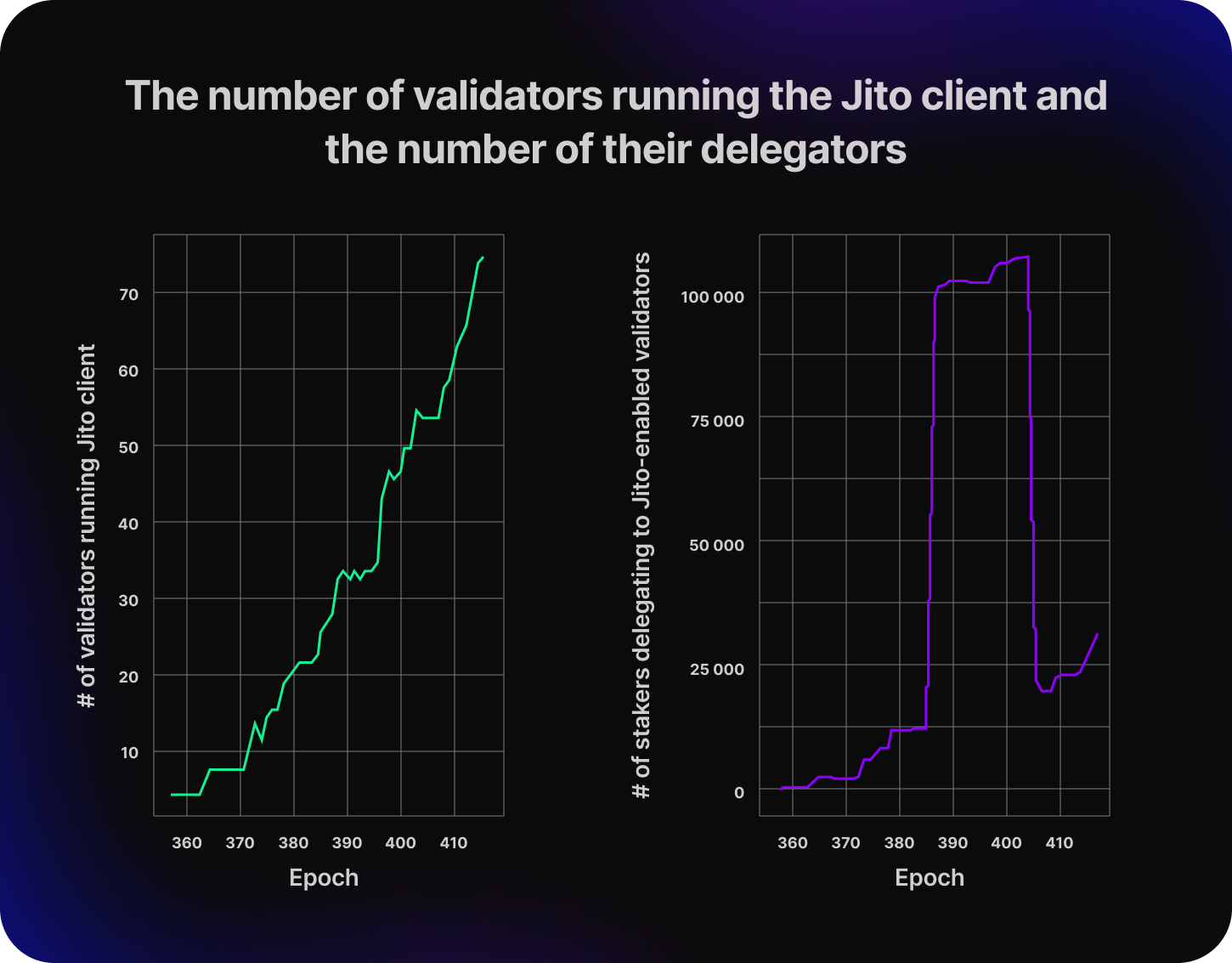

The Jito client has been gaining traction among Solana validator operators, as reflected by the growing number of Jito validators (see the left chart in the figure below).

The significant increase in the number of Solana validators using the Jito client indicates a growing recognition of the software's advantages among operators.

The number of stakers receiving MEV rewards from Jito-enabled validators (the right chart in the figure above) is showing a positive trend, with two anomalies observed in epochs 385 (+84,075 stakers) and 404 (-82,420 stakers). These anomalies can be explained by the fact that during the epoch 385, the Everstake validator started using the Jito client, and then stopped doing so during the epoch 404, resulting in a sharp change in the number of stakers receiving MEV rewards.

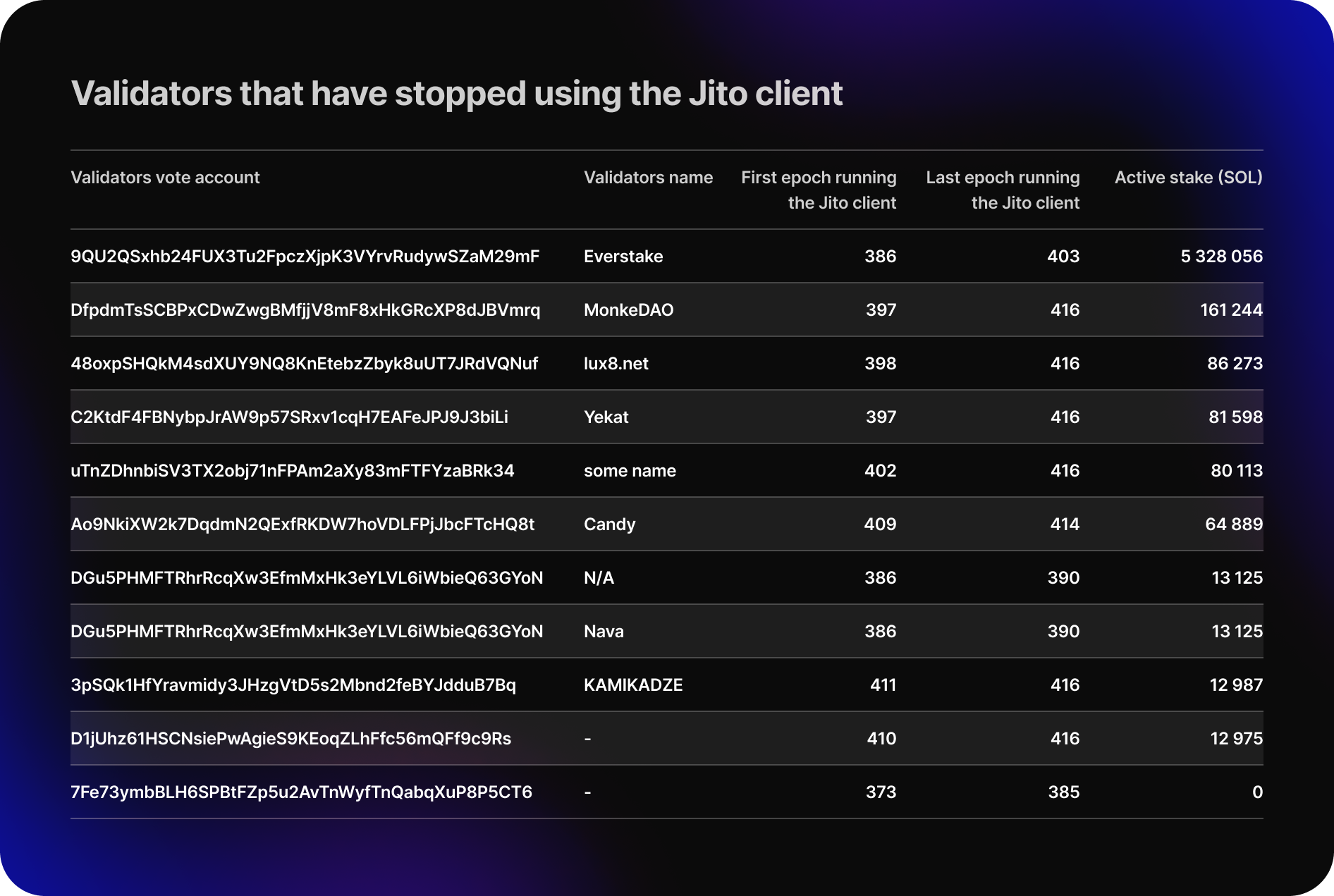

The table below shows that a few validators have discontinued using the Jito client, with Everstake validator being the most notable among them. The reasons for these validators stopped using the client are unclear as there were no significant changes in the validators performance during the usage of the Jito client.

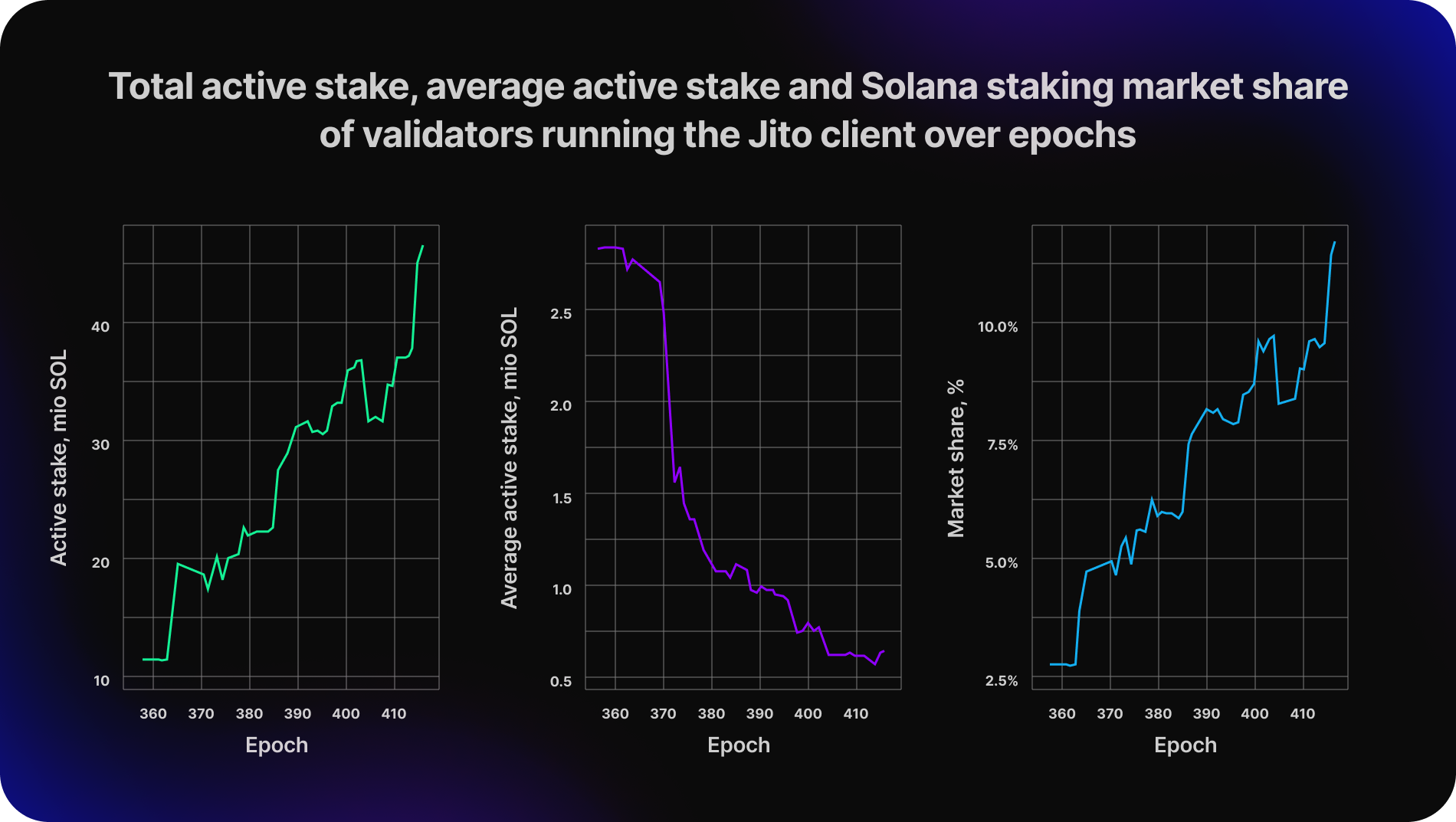

Such important metrics measuring the Jito client adoption as total active stake and market share of validators running Jito client have significantly increased over the last ~50 epochs (as seen in the left and right charts in the figure below). The more active stake the validators running the Jito client have, the more slots are processed with the Jito client, and the more MEV opportunities become available for efficient utilization and redistribution

The trend of decreasing average active stake per validator using the Jito client (see the middle chart in the figure above) indicates that more validators with smaller stakes are adopting the software. The increasing trend of Jito client adoption among smaller validators is a positive sign, indicating that even smaller validators can successfully run the software. The Jito client democratizes access to MEV with equal treatment for all validators. The growth in adoption by lower-stake validators demonstrates a strong interest in MEV opportunities from a community that was previously unable to access these benefits.

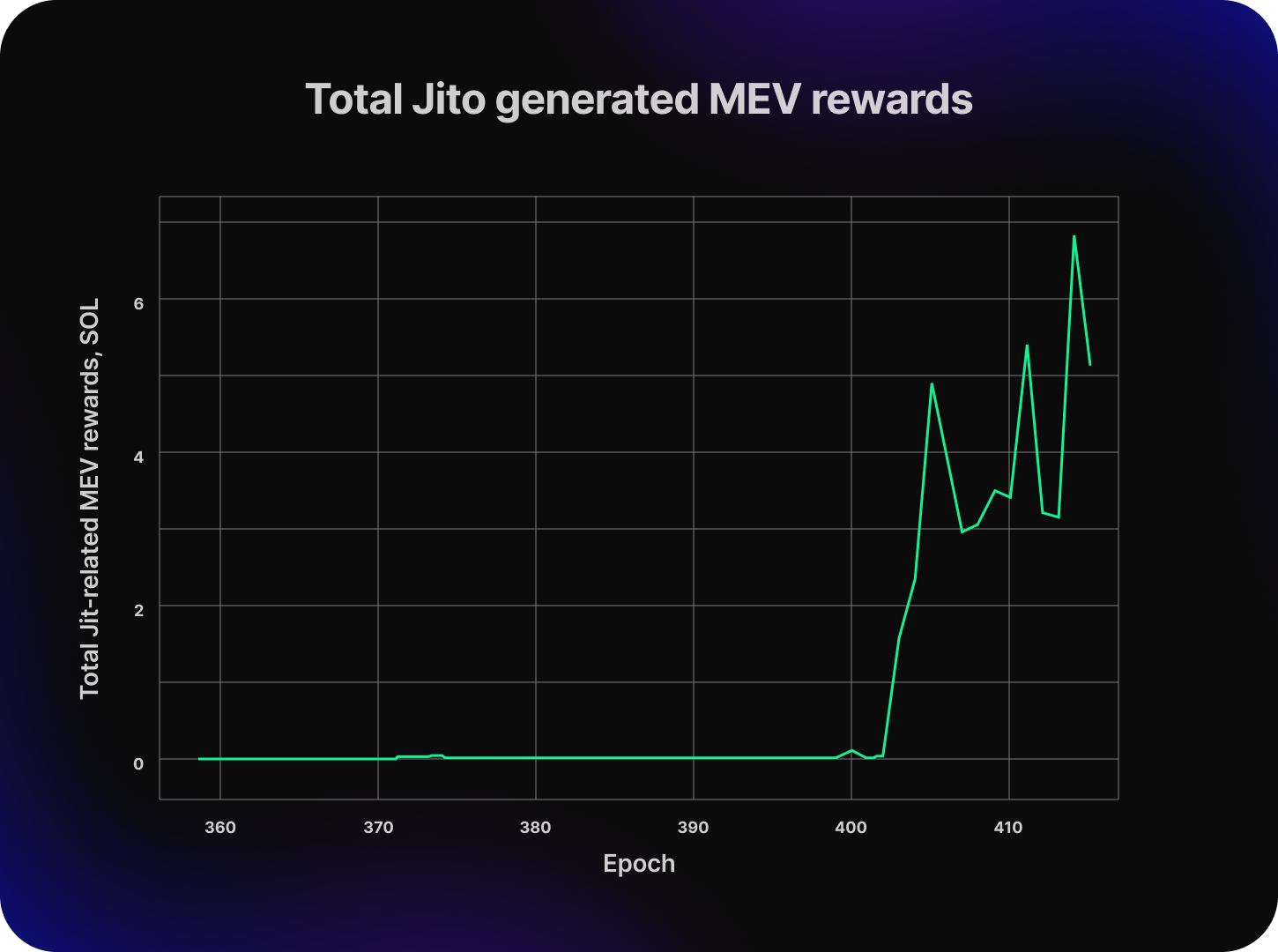

The Jito-related MEV rewards currently are very low (as seen in the figure below), which can be attributed to the current limited adoption of the client and lack of participation from MEV searchers. However, a sudden MEV rewards level change after epoch #403 cannot be solely attributed to the increase in the number of validators using the client or the growth of Jito-related active stake. This indicates that a relatively large DeFi ecosystem participant might have started leveraging the MEV extraction tools offered by Jito. As the Jito client gains validator market share, MEV searchers may see more benefits from integration and MEV rewards could rise.

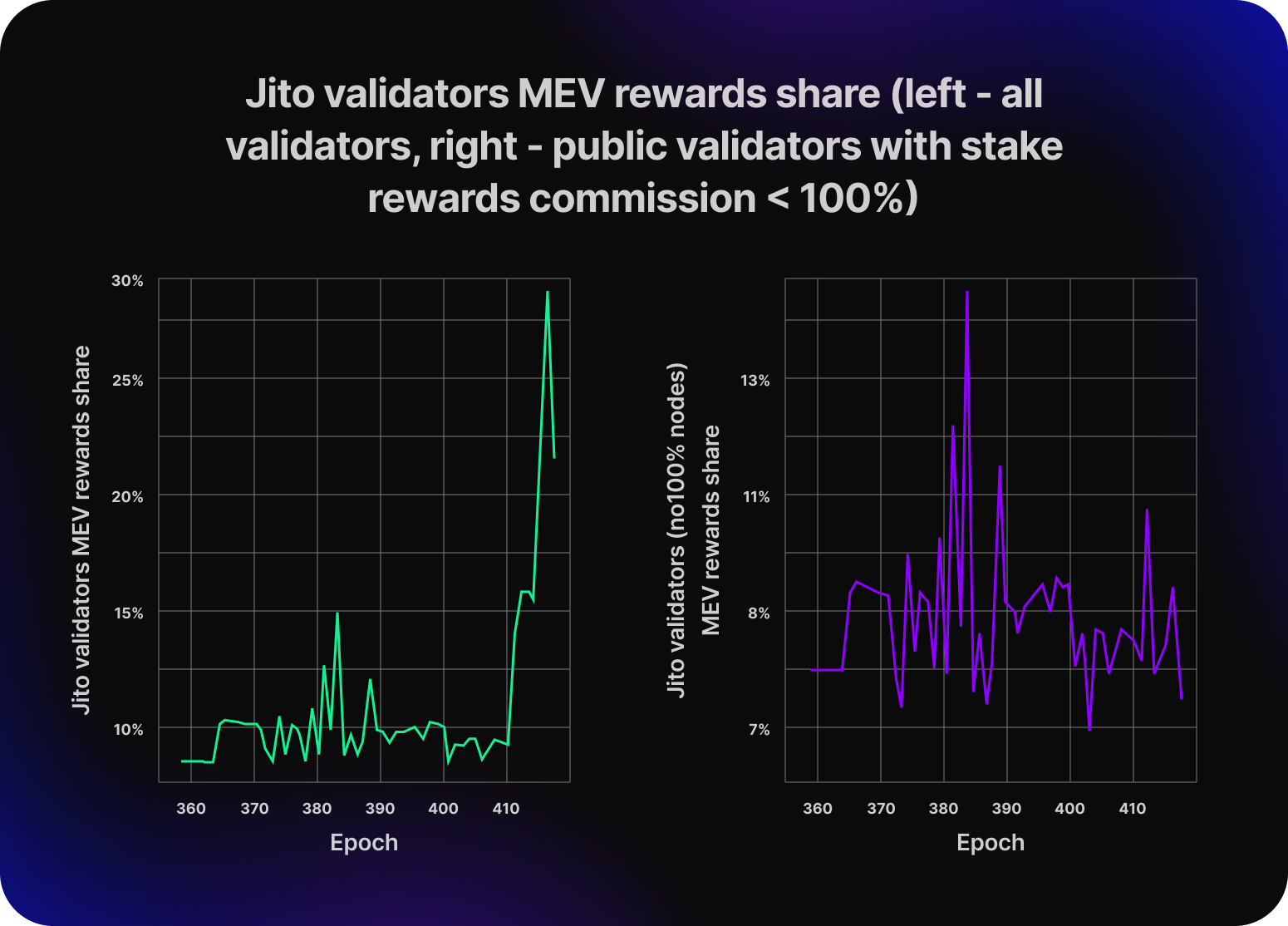

The share of MEV rewards taken by validators running the Jito client has recently increased from about 8% to 21.5% (see figure below). This is mainly due to new validators setting their MEV rewards commission rate to 100%, with many of them being unnamed validators taking 100% stake rewards commission, such as private or white label validators.

The comparison of performance metrics between validators using the Jito client and those who are not is important to gain insights into the differences between the two groups and understand the potential impact of the Jito client on the Solana network.

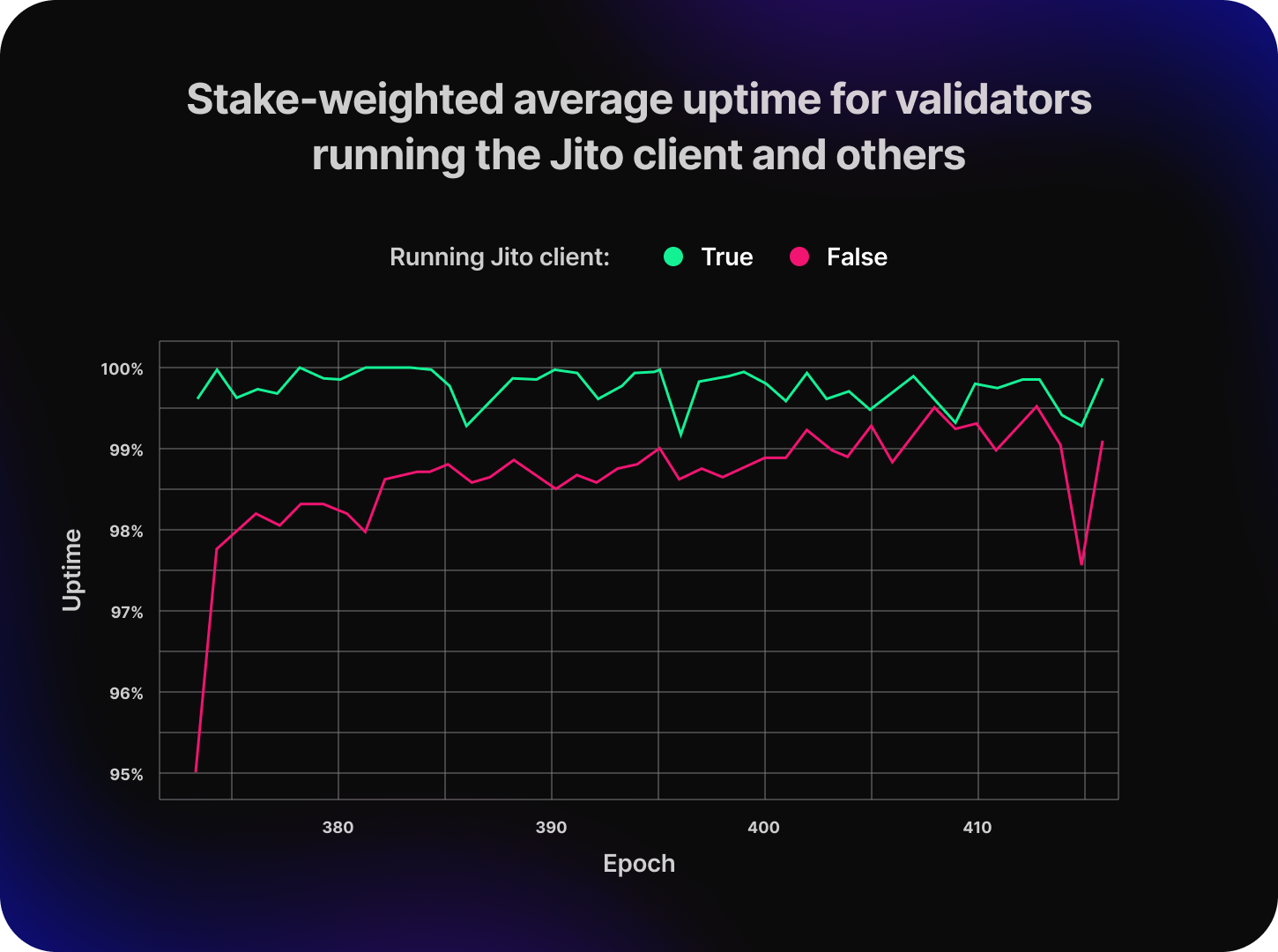

Based on the chart below (see figure below), it appears that, on average, Jito validators have better uptime than other validators. This outcome is likely due to the fact that more experienced validators are more likely to experiment with the new Jito client software, while Solana also has a significant number of inexperienced validators with small stake who may not have yet developed the skills or infrastructure necessary to maintain high uptime.

There are outliers for some epochs where the average uptime for Jito validators dropped significantly which is due to a specific validator named “DO NOT DELEGATE” with the vote account pubkey Dn2cRSWAfQpb3NyUJ2q33t1scBLxzo8TZBAyKsWhX7zh, which experienced downtime for 2700 minutes during that epoch and also experienced several very long periods of downtime in other epochs.

The average vote success rate chart displayed below (see figure below) indicates that Jito validators also generally earn more vote credits for their participation in Solana consensus compared to all other validators. However, due to the metric's volatility, the difference seems insignificant.

The chart below (see figure below) displays the dynamics of the stake-weighted average block production rate for Jito validators and others, indicating a significant difference in favor of Jito validators. This suggests that the Jito client may indeed optimize transaction block processing.

In the previous section, we visually compared the performance metrics of validators running the Jito client and those who are not and observed that there could be statistically significant differences between the two groups. However, the observed differences cannot be solely attributed to the client switch and suggest that other factors may be at play. For instance, early adopters of the Jito client may have more experience in operating validators, and there may be differences in hardware configurations, network connection, or operating conditions that affect performance. Additionally, there are over 2000 Solana validators not running the Jito client, many of which may be operated by inexperienced operators using cheaper hardware, which could further contribute to the observed performance differences.

In this section we estimate the impact of adopting the Jito client on the performance of Solana validators by comparing their performance metrics before and after adoption, while considering the unique characteristics of each validator. Due to the considerable variation in metrics epoch over epoch caused by external factors, the data was normalized by dividing their values in each epoch by the corresponding epoch average. This normalization method enables a better comparison of validators' relative performance over time and accounts for external factors that greatly impact the metrics for each validator in the cluster. The normalized metrics for each validator before and after the Jito client adoption were averaged to form two samples, which can be compared using the Wilcoxon signed-ranks test. By using the test on the averaged normalized data, we determined whether the adoption of the Jito client had a statistically significant impact on the performance metrics of Solana validators. To ensure sufficient statistical data for both periods, we only compared the performance metrics of 52 validators who ran the Jito client during 25% to 75% of the observed epochs (from 345 to 415). Comparing the relative uptime of validators before and after adopting the Jito client one can observe (see figure below) that the distribution of relative uptime before adoption is wider and has a heavier right tail.

Using the Wilcoxon signed-ranks test, we found strong evidence (N = 52, V = 371, p < 0.01) that adopting the Jito client had a small negative impact on the relative uptime reducing the median by ~1.9 p.p. (from 105.8% to 103.9%).

It's possible that the negative impact on relative uptime is due to the fact that the software is relatively new and still undergoing updates and improvements. Testing of new features requires validator restarts that contribute to some of the downtime. Further research and analysis is needed to better understand the specific factors contributing to the observed differences.

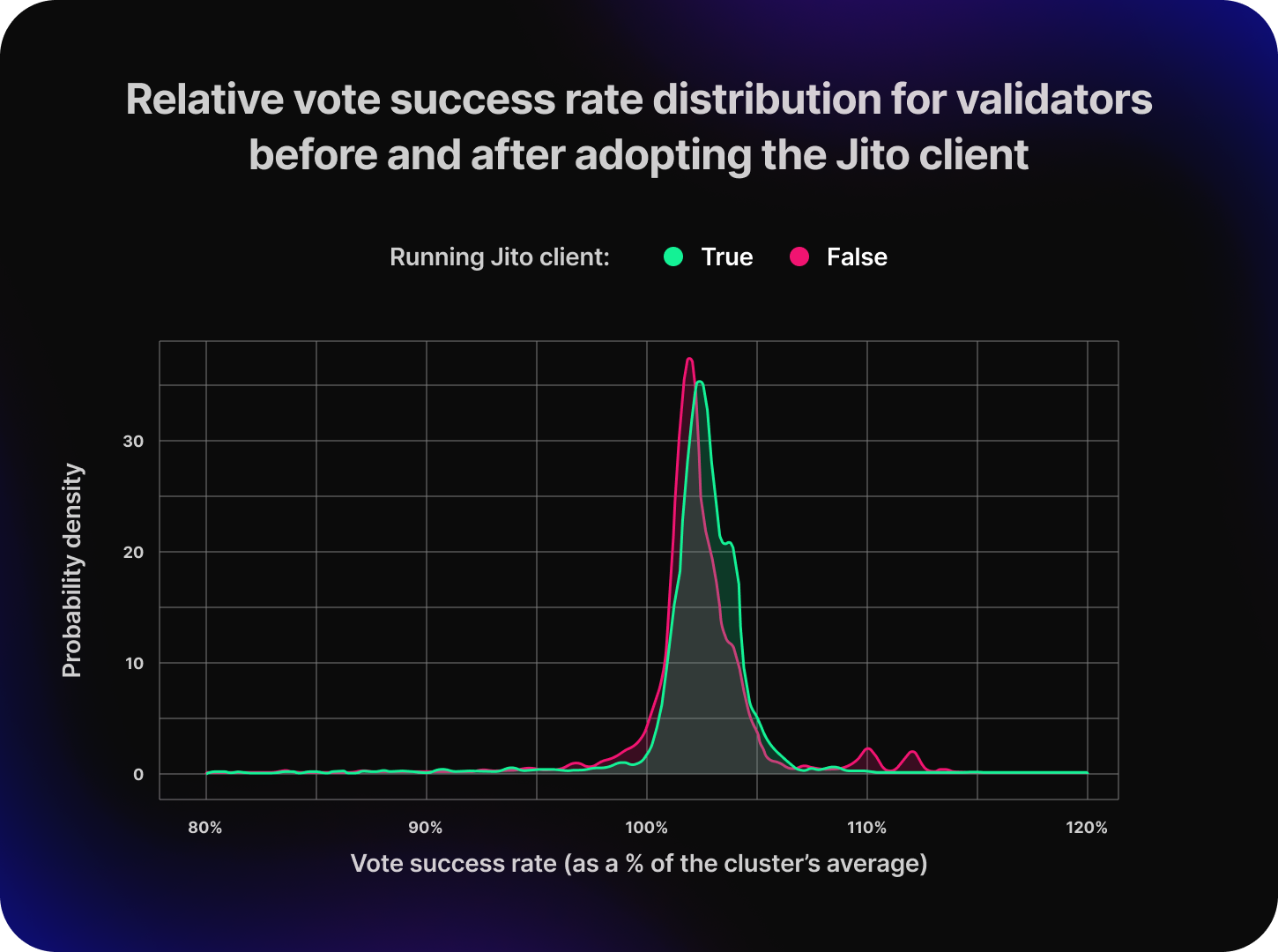

Comparing the relative vote success rate of validators before and after adopting the Jito client, one can observe (see figure below) that the two distributions are almost identical.

The Wilcoxon signed-ranks test showed no significant positive impact of adopting the Jito client on the relative vote success rate (N = 52, V = 648, p > 0.05).

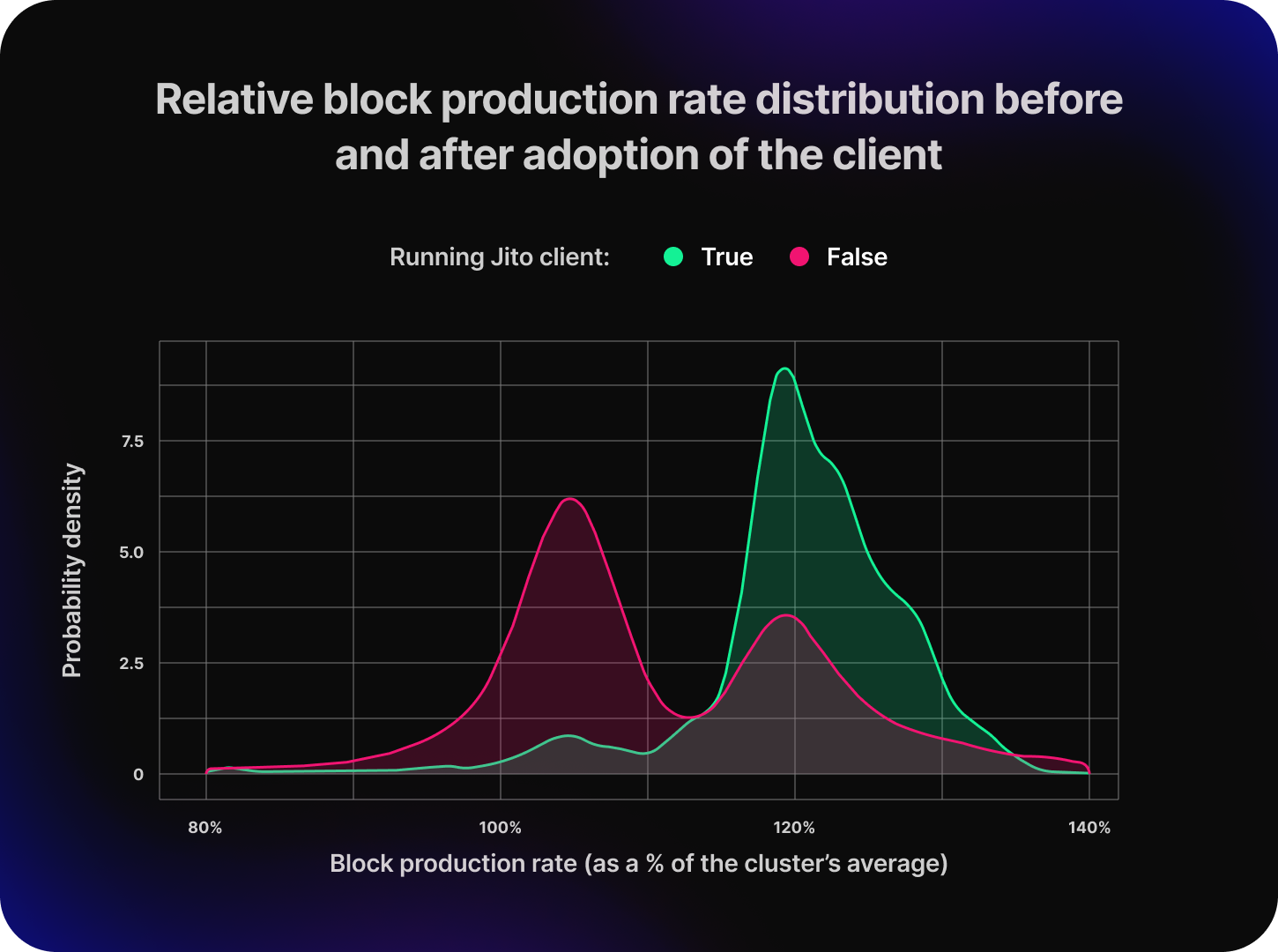

Comparing the relative block production rate of validators before and after the adoption of the Jito client, one can observe (see figure below) that there are significant differences in the two distributions: the distribution of relative block production rate after adopting the Jito client is centered around 120%, while the distribution before adoption is centered around 105%.

The Wilcoxon signed-ranks test showed strong evidence (N = 52, V = 946, p < 0.01) that the adoption of the Jito client had a significant positive impact on the relative block production rate of Solana validators increasing the median by ~9.4 p.p. (from 111.5% to 120.9%). The increased block production rate is likely due to the more efficient transaction processing enabled by the Jito client's optimized block engine.

The Jito client represents a valuable addition to the Solana ecosystem, providing validators and their delegators with a new revenue stream from MEV opportunities, while helping the Solana network to be more stable.

The Jito client has yet to gain widespread adoption, however, the number of validators utilizing the software is steadily growing, along with the total active stake and staking market share attributed to the Jito client. Some validators have stopped using the client, but they constitute a small fraction and the reasons for this are unclear.

Additionally, Jito validators and their stakers have not yet earned significant MEV rewards, which may be due to the lack of usage of the client by MEV searchers and users. This situation should improve with broader adoption of the client and as searchers become more accustomed to the new tools.

On average, validators running the Jito client have better performance than others, although statistical analysis shows that uptime of the validators currently running Jito client has slightly decreased after the switch, while vote success rate has remained largely unchanged and block production rate has increased significantly.

For those interested in exploring the data further, P2P Validator's public dashboard provides access to all the data used in the report preparation: https://reports.p2p.org/superset/dashboard/jito_client_adoption/.

We would like to express our gratitude and appreciation to the P2P Validator team members, including Pavel Pavlov, Anton Yakovlev, Steven Quinn, and Alexey Bondar , for their invaluable guidance, support, and encouragement throughout this research. Furthermore, we would like to express gratitude to the Jito Labs team, especially Brian Smith and Lucas Bruder, for their support and openness during the research. We would also like to thank Brian Long and his team for creating the Validators.app API.

Overall information on Jito & MEV:

Dashboards:

Data sources / APIs:

Data analyst @ p2p.org (previously dentsu inc.), graduated from Moscow State University of Psychology and Education, PhD, father, blockchain enthusiast & investor.

<p>On January 25th, 2023, P2P joined the Sui network testnet wave-2. We had also participated in the first wave of the testnet with the goal of understanding the node operation nuances of the Sui blockchain. The second testnet was a game played by validators and delegators to understand the network economics and staking specifics.</p><h3 id="high-level-overview-of-sui-economics-specifics">High-level overview of Sui economics specifics</h3><p>Sui is a layer one blockchain focused on scalability, user and developer experience, and utilizes its own variant of the Move programming language. It allows for consensus to be forgotten in simple use cases, and transaction processing is parallelized.</p><p><em>In this article, we will briefly cover two elements of the Sui economy:</em></p><ul><li>Storage Fund</li><li>Reference Gas Price Mechanism</li></ul><p>Let’s start with the <strong>storage fund</strong>. It plays the role of a compensation buffer to reward validators for on-chain data storage. It is evenly staked to validators and a portion of staking rewards get reinvested back into the fund. This parameter influences the overall reward calculation. It starts relatively low in the beginning but its share steadily increases slowly along with the storage growth.</p><p>Another element influencing the validator rewards is a <strong>Reference Gas Price [RGP]</strong>. It represents the minimum price at which validators are willing to process transactions. For users, it plays the role of a guide when propagating transactions ensuring that gas prices close to the reference price will be executed appropriately. Every epoch, validators submit their quotes for RGP and the protocol chooses the 2/3's percentile by stake as the epoch reference price.</p><p><strong>Staking rewards</strong> consist of stake subsidies and gas revenue. Subsidies are known for each epoch. For testnet-2 epoch, subsidies were equal to 0,01% * total stake (mainnet subsidies will differ from wave-2) making them relatively low compared to gas revenue. Validators could calculate expected gas revenue based on the selected RGP and on-chain activity. Each participant received random costs and had to select RGP to remain profitable but at a reasonable level to improve UX and maintain lower transaction costs for users.</p><h3 id="testnet-overview">Testnet overview</h3><p>The Sui team has prepared a dashboard to track the progress of the validators during the testnet If validators selected an RGP that was equal to or lower than the final epoch RGP, they received a bonus point. Points were also assigned for maintaining positive profitability during the epoch. The score rules were changed after the 6th epoch to switch the behavior of participants during the game, so some data will be split in two groups: The first group from epoch 2 to epoch 6, and the second group from epoch 7 to epoch 31. The first two epochs were experimental and were not counted and we excluded them from the analysis.</p><p>Validator shares and costs varied during the testnet, resulting in different capabilities to remain profitable and get into the ⅔ percentile in RGP voting leading to a semi-random points distribution. The analytics below can bring some clarity to the actual activity of participants during the testnet. <br><br><em>Important note, validators could have different goals and strategies for the game, and the data below should not be taken as a representation of participation quality. We set the following goals for the testnet:</em></p><ul><li>To align with Sui economics specifics</li><li>To understand the RGP selection process and build a reliable model to calculate it</li></ul><p>We decided to prioritize the calculation precision and set our RGP quotes for each epoch with a targeted profitability margin of 5-15%. Our goal was to strike a balance between maintaining profitability without overpricing the user experience. It’s important to note that the logic for the mainnet may differ from that of the testnet.</p><h3 id="wave-2-analytics">Wave-2 Analytics</h3><p>The economic conditions during the testnet changed every epoch, requiring validators to adjust their strategies in order to remain profitable. Out of the 41 validators, only 17 changed their RGP for 80% of the epochs during the testnet.</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/Kz0Q0-DgbF35ujQVJbD2hJ083ZFVCJ6HzY7JjfBd5sOgr3J5roudMxqoFNfpFMZobviLue1kpd_mbU2G2ebHCyPrTMdO1PttWC8dPs5dOw9ZtxLYO6QDxizl4W-ryEAfUZtM5M8HH4pvN18x48Vw8tE" class="kg-image" alt loading="lazy" width="615" height="351"></figure><p>Profitability was an important part of the assessment, and the following breakdown shows the number of epochs in which each validator had positive profits. However, it is important to note that validators may have had different goals for the testnet. Nonetheless, over 50% of participants were able to make a profit in 80% of the epochs.</p><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/DBwnNdG7x-WMqH9NevDtILzT8muOnKQmAA1vi00V3Olo_x9nC713a98Au4BYljCHAqJ-Ey-QovfX9OhRbk3tAswqGlhvwPS-O3YXS6LhQ2nmAzoCGNEsoJ-5ToA1_AQduBzBEDNbhZ2AFFbPOuv6M7k" class="kg-image" alt loading="lazy" width="624" height="296"></figure><p>This chart shows the total margin of validators during the testnet. We can observe changes in behavior after the rule change that stopped punishing validators for not being in the ⅔ percentile with their RGP quotes.</p><figure class="kg-card kg-image-card kg-card-hascaption"><img src="https://lh4.googleusercontent.com/MNJK1YAe8-t2MqRNbiAK-PqKKofoEi02oNgVaCcVdIivrJN8m7fmeuy5rw3PKfFqZeavV5wibb-7ewuWHHxCO1KRh_hBlAzh4K2KRNvTGmaDqTJzSSIivrA4bP4HrmuHdAXxY59N1zKqbG2jvi93YOY" class="kg-image" alt loading="lazy" width="624" height="304"><figcaption>Epochs 2-6</figcaption></figure><p>Epoch 7-31 resulted in a more selective approach that takes profit into consideration.</p><figure class="kg-card kg-image-card kg-card-hascaption"><img src="https://lh3.googleusercontent.com/P1bFZ02CXinViO1MTRo4xpJFGiJbf6io0xZX2Uz26PPDUAbCx9BjTKDnmTvV3TkobVWkxKrs3yFfLKH3KDkB_wrUseLcaPqrOSxR4D9-OctEFIjTDVQr_oddggTDX4qTECOVJ7ZNKotFUdj-KZ76rh8" class="kg-image" alt loading="lazy" width="624" height="304"><figcaption>Epochs 7-31</figcaption></figure><p>In the following plots, we will display the standard deviation of each validator, which indicates how stable and precise their margin was. A lower standard deviation indicates more precise and consistent RGP quotes. For instance, if a validator quoted around 10% margin most of the time, their deviation would be low.</p><figure class="kg-card kg-image-card kg-card-hascaption"><img src="https://lh5.googleusercontent.com/wn2t8VuyRxjTSWm8oBEYyNClUV-2WRc2jWuPrjFr27lGjFs0zqJmctTxbk65mpOcC1Db6SWJMD772ok_U5ZTCMlFUgplSQg6ghdFGsWzDtXDHuNBxkxuuIJtTecFg86wE59lfDVg0I0symK6pJhwxVQ" class="kg-image" alt loading="lazy" width="624" height="315"><figcaption>Epochs 2-6</figcaption></figure><figure class="kg-card kg-image-card kg-card-hascaption"><img src="https://lh3.googleusercontent.com/sofwFnKTNhtRXpRCAKN2bdZBsJUsOOCpkZ_Rsql67YEMFuChDmYKIfOvPZ0o6iFYiPoRwkWq-OMOsznP5SUVOgvehZ68yboAda2HJXpoGDaVIClwEJfyuRAmlRoFWtOYwDFcyMizoslIhFd9_VCn3TU" class="kg-image" alt loading="lazy" width="624" height="272"><figcaption>Epochs 7-31</figcaption></figure><p>Another way to represent margin statistics is through the mean, total and median margin parameters, which also provide insights into validator behavior. This chart excludes extreme values that deviate from the average by more than 2.5 standard deviations. If all three parameters are similar, it indicates that a participant successfully targeted and maintained the margin. For instance, the mean, total and median parameters for P2P vary from 8 to 11 percent, falling within the selected 5-15 percent range that we aimed for internally beforehand.</p><figure class="kg-card kg-image-card"><img src="https://lh3.googleusercontent.com/zYeUw2njbpfDchttyajDZN5o_z0yS6SuhDXBHSdDCqhIQuhJb0RBZcNjzXf5ZoEFLlU-XNfNADzqUD4j5pk4q_WD9rieY2NG7Kc8WJ7yvf_BclWRA-O_FWYI99ZZdN1MvfQMuhAJ-zf918yo-3auryU" class="kg-image" alt loading="lazy" width="624" height="268"></figure><p><em>Feel free to explore the </em><a href="https://docs.google.com/spreadsheets/d/1XAe7rFMQ2I9BZHNiJHbcMZvgRXdu9KcGKXPfQo84Yus/edit?usp=sharing&ref=p2p.org"><em>spreadsheet with the data</em></a><em> and graphs provided in the article.</em></p><p>For a more detailed picture we have compiled a heatmap showing the deviation from each validator’s optimal RGP for each epoch. We assumed that the validator's optimal RGP is calculated based on a random margin value within the 5-15% interval. We can infer that In the second part of the game, validators moved towards profitability and calculated their RGP more precisely.</p><figure class="kg-card kg-image-card"><img src="https://lh4.googleusercontent.com/rmUHootLT_PQVFlI-hVLXMDAbtiYWtVGUIiMbvWZiNS1B1n6cn5vtI4Rr2wS3gx-d6MDlQlhV1oRv3inaytTRf_fHexlbeyskVzNPJKmv9QVeGUKKXTYRvPgbp1JqUqjGL6mka5tL_BW_4zYK2Kvj2c" class="kg-image" alt loading="lazy" width="624" height="573"></figure><h3 id="summary">Summary</h3><p>The Sui testnet-2 was an intriguing experiment that contributed to a better understanding of staking economics and network specifics.</p><ul><li>Validators were able to experiment with different calculations to develop their own strategies during the game</li><li>The main purpose of RGP is to maintain a balance between validator profitability and end-user experience</li><li>Using an optimal margin level for calculating RGP may be an effective way to achieve both goals</li><li>Calculating RGP involves multiple parameters that can fluctuate and may be difficult to predict in advance leaving room for modeling improvements over time</li><li>Participating in a testnet is an excellent opportunity to familiarise with network specifics and prepare for mainnet launch.</li></ul><p><em>If you’re interested in staking or in launching a white-label validator with us, feel free to express interest on p2p.org. We’ll keep you informed about key milestones and help you get onboarded to the mainnet from the very beginning.</em></p><hr><p><em>Special thanks to Alexey Toporov for aggregating the data and creating the charts for the article.</em></p><hr><h3 id="about-p2p-validator">About P2P Validator</h3><p><a href="https://p2p.org/?ref=p2p.org">P2P Validator</a> is a world-leading staking provider with the best industry security practices AAA SR-rating and proven expertise. We provide comprehensive due diligence on digital assets and offer only top-notch staking opportunities. At the time of the latest update, more than 1 billion USD value is staked with P2P Validator by over 40,000 delegators across 40+ networks. We have successfully participated in Sui testnet-1 & testnet-2 to become the most comprehensive partner for staking and branded node maintenance.</p>

from p2p validator

<p>We are pleased to announce that P2P has launched an MEV-enabled client on Solana validators which will allow P2P stakers to receive extra rewards from MEV starting today. <br></p><p>Maximum extractable value (MEV) is a growing capability in blockchain. It refers to the maximum profit a validator can make through its ability to include, exclude, or reorder transactions in the blocks it creates. By running a MEV-enabled client on validators, P2Ps gain access to MEV Opportunities, which can increase staker APR while having a positive impact on the quality of the Solana network.</p><h3 id="mev-boosted-client-adoption">MEV-boosted client adoption</h3><p>To maximize MEV rewards for stakers, P2P will use the open-source Jito-Solana Client, which has been <a href="https://jito-foundation.gitbook.io/mev/audits/audits?ref=p2p.org">audited by Neodyme</a>, a leading security and blockchain auditing firm. Jito-Solana represents a meaningful improvement to Solana’s validator software. It was intentionally designed to maximize MEV rewards and optimize their distribution to network validators and stakers. In addition, Jito-Solana was designed to combat spam and improve network efficiency. One of the ways that Jito-Solana achieved this is through its optimization of transaction processing. Jito-Solana offers more efficient transaction processing by bundling transactions and optimizing transaction ordering, which reduces the number of duplicated and unnecessary transactions and enables faster processing times.</p><p>For implementation, we conducted an in-depth analysis of the impact of the Jito MEV client on Solana’s network performance and adoption among Solana validators. You can find the full report <a href="https://p2p.org/economy/jitos-mev-boosted-client-adoption-impact-on-solana-validators-performance/">here</a>. </p><p>The key takeaways are:</p><ul><li>The Jito client has been gaining traction among Solana validator operators, as reflected by the growing number of validators running the client (currently 80), their total active stake (~55M SOL), and their market share (~15%).</li><li>We also observed a decrease in the average active stake per validator using the Jito client which indicates that more validators with smaller stakes are adopting the software. This trend is a positive sign as it shows that even smaller validators can successfully run the Jito client. The Jito client democratizes access to MEV with equal treatment for all validators. The growth in adoption by lower-stake validators demonstrates a strong interest in MEV opportunities from a community that was previously unable to access these benefits.</li><li>The total Jito-generated MEV rewards are currently relatively low due to limited adoption and lack of MEV searcher participation. This situation should improve with broader adoption of the client and as searchers become more accustomed to the new tools. We observed a significant increase in MEV rewards after January 2023 suggesting that a large DeFi participant started using Jito's MEV extraction tools and we believe that others will soon follow.</li><li>Jito-enabled validators have shown higher average uptime, a higher number of vote credits, and a significantly higher stake-weighted average block production rate.</li><li>Careful statistical analysis showed that block production rate for validators that switched to the Jito client has increased significantly. The increase is likely due to the more efficient transaction processing enabled by the Jito client's optimized block engine.</li></ul><figure class="kg-card kg-image-card"><img src="https://lh6.googleusercontent.com/YjlzfIMapEo0xV1CVCjMjZYeX1VMVKYrb-_mYKrB5D0_Ts3e6SqmHxcAnZOSO2fhMr1gA0lWNRPABEWSp62KhP5ZeU4P4AlhJgCPmj_ro9r-SV-hoEPLfV-tWq5oj-L-JpZ0aIhJU2h-0GSLwgDuUwI" class="kg-image" alt loading="lazy" width="624" height="361"></figure><p>Based on our research, we believe that the Jito client is a valuable addition to the Solana ecosystem, providing validators and their delegates with a new revenue stream from MEV capabilities while also improving the Solana network stability. Feel free to view the validator performance data, MEV validators rewards, MEV stakers rewards, and more using the public P2P Validator dashboard at: <a href="https://reports.p2p.org/superset/dashboard/jito_client_adoption/?ref=p2p.org">https://reports.p2p.org/superset/dashboard/jito_client_adoption/</a>.</p><h3 id="security-assurance">Security assurance</h3><p>To implement the MEV client on P2P nodes, automation was prepared and tested to seamlessly switch between Jito and the standard Solana client with 0-downtime in this case. Infrastructure security is the most important thing and we would like to add details about the possible security risks validators may face when switching to the Jito client.</p><p>Basically, Jito client is a set of patches applied to a standard Solana client, so theoretically it may have new vulnerabilities or performance degradations in some situations on current or future releases. We discussed these issues with Jito labs and found that 2 independent auditors checked Jito code base and checked the stability of the client on our testnet validator.</p><p>Although the probability of validator performance degradation caused by Jito client is not zero, we don’t think it is a big problem since we always monitor the performance of our validators against cluster average performance statistics (vote success rate, block skip rate) with automated alerting if performance issues are detected. Generally, our monitoring system will allow us to make quick decisions about falling back to a standard Solana client.</p><p>There are certain things that must be taken into account when switching to a standard Solana client:</p><ul><li>Solana Foundation releases a new client with a request to update immediately. Usually, it happens, when the Foundation wants to close a vulnerability or fix stability issues. Jito labs need days or weeks to release its patched version (since it requires a lot of testing) so in such cases, we will switch to the standard client and wait for the Jito client release.</li><li>We detect abnormal behavior of a validator according to our monitoring metrics or detect significant performance degradation (for example vote success rate is lower than the cluster average).</li><li>We receive information from public or closed sources about a vulnerability revealed in the Jito client. In this case, all our validators immediately get moved to a standard client and we will get in touch with Jito labs to clarify the situation.</li></ul><p>If switching to a standard client happened and it has been going on for more than 2 weeks we will notify you about that on our <a href="https://twitter.com/P2Pvalidator?ref=p2p.org">Twitter</a>, so please subscribe to our Twitter to be up-to-date about our services</p><p>We believe that adopting the Jito client will drive MEV rewards. Performance should also improve even further as the client becomes more widely adopted and as searchers become accustomed to the new tools.</p><h3 id="sharing-mev-rewards-with-sol-stakers">Sharing MEV rewards with SOL stakers</h3><p>New and old P2P stakers alike have the opportunity to increase their revenue through extra MEV rewards. P2P will take an 8% commission from MEV rewards, distributing 92% of the rewards to stakers, according to their share.</p><p>The Jito Tip Distribution Program is the on-chain program that collects and distributes MEV rewards to eligible validators and stakers. At the end of an epoch, the MEV rewards earned by a validator are stored in a special account derived from the validator's vote account and the corresponding epoch.</p><p>Once the epoch is over, the validator generates a data structure containing the rewards claims for all validators and stake accounts and uploads it on-chain. Then validators and stakers receive the MEV rewards in the form of an automatic airdrop performed by Jito to the validators’ vote accounts and stakers stake accounts. The claim action is permissionless, meaning others could execute it if Jito failed to do so properly. Note that distributed rewards are not automatically staked (auto compounded) and the stake account owner is required to withdraw or stake the airdropped rewards.</p><p>Stakers and validators can check their rewards using the <a href="https://reports.p2p.org/superset/dashboard/jito_client_adoption/?ref=p2p.org">P2P Validator’s dashboard with Jito & MEV </a>statistics or <a href="https://jito.retool.com/embedded/public/e9932354-a5bb-44ef-bce3-6fbb7b187a89?ref=p2p.org">Jito’s MEV rewards dashboard</a>. Anyone can check their rewards using public explorers, the details to do so are available in <a href="https://jito-foundation.gitbook.io/mev/mev-payment-and-distribution/faqs?ref=p2p.org">Jito’s documentation</a>.</p><h3 id="about-p2p">About P2P</h3><p>P2P Validator began in 2018 with a mission to positively influence the development of POS technologies. At the time of the latest update, more than 750 million USD value is staked with P2P Validator by over 35,000 delegators across 40+ networks. We work closely with each network we support to push the developments of each project to new limits. <br></p><p>Beginning as seed investors and validating from the genesis block, we have shown tremendous support to the Solana ecosystem since day one and are now trusted with over $120m under management. Our proficiency is shown not only by our excellent validating track record & our published research papers written on network performance (<a href="https://www.stakingrewards.com/journal/solana-validators-performance-research-report-part-1-downtime-analysis/?ref=p2p.org">Downtime</a>, <a href="https://www.stakingrewards.com/journal/solana-validators-performance-research-report-part-2-skip-rate-analysis/?ref=p2p.org">Skip Rate</a>) to improve the network health and development, but also by our involvement across projects including <a href="https://portalbridge.com/?ref=p2p.org#/transfer">Wormhole Bridge</a>, <a href="https://pyth.network/?ref=p2p.org">Pyth</a>, and <a href="https://neon-labs.org/?ref=p2p.org">Neon EVM</a> to help build Solana’s network infrastructure.<br></p>

from p2p validator