Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

Turning staking data into actionable insight is the difference between operating and leading in today’s institutional staking landscape.

Staking is entering a new era — one where surface-level stats and basic dashboards are no longer enough. Institutions, custodians, and protocol teams are looking at creating lasting business models out of their staking operations, where their activity leads to consistent growth. In other words, they don’t just want to compete in a busy market, they want to lead.

But here’s the problem: most staking operations run blind. Common issues like limited visibility and delayed metrics lead to a huge gap in operational intelligence. That’s leaving massive value on the table.

The real opportunity lies in transforming staking data into an engine of strategic insight. Done right, it is an invaluable tool to keep you outperforming.

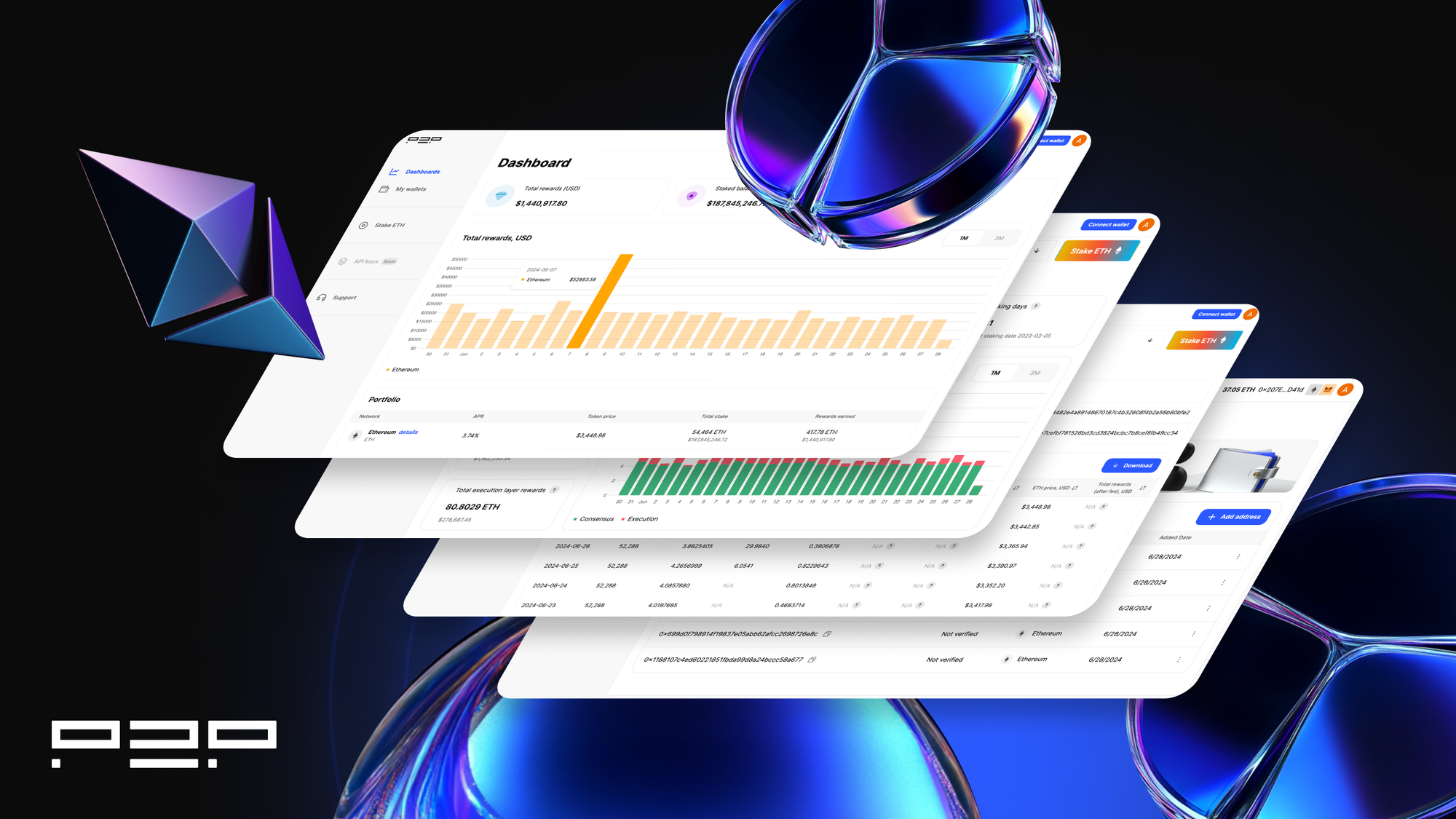

At P2P.org, we don’t just run validators. We run infrastructure designed to make your staking data a competitive weapon. Through high-performance infra and institutional-grade reporting, we help institutional teams turn operational noise into insights (and insights into rewards).

Here’s how it works.

Network rewards are just the end result. What matters is how effectively your validator is participating in the network:

These metrics tell you whether your validator is simply functioning, or truly optimized. For institutions managing large allocations, even a 0.5% difference in validator performance can equate to millions in annualized upside.

The P2P.org Advantage

We provide per-validator performance tracking across all supported networks, benchmarked against network averages. Clients get real-time clarity on how well their assets are performing, and where to optimize fast.

What This Looks Like

You're an asset manager staking $50M in ETH. By identifying validators with suboptimal uptime or delayed inclusion, you rotate delegations to higher-performing validators via P2P.org’s dashboard, increasing your net staking outcome by 1.2% annually.

Curious how Pectra could impact your validator returns? P2P.org has built the only Validator Consolidation Calculator on the market that gives you personalized projections based on your wallet and validator set.

In ecosystems like Ethereum, rewards are no longer a simple equation. MEV (Maximal Extractable Value) now drives a growing share of validator income.

If you’re not actively tracking MEV dynamics, you’re missing a huge piece of the puzzle, and the opportunity.

The P2P.org Advantage

Our MEV-ready infra logs and reports validator reward composition so clients can identify MEV opportunities and take action without any need for guesswork.

What This Looks Like

You're operating Ethereum validators and realize 25% of your expected returns are missing due to underutilized MEV relay connections. With P2P.org's breakdowns, you switch to optimized relays and improve net rewards, without any infra rework.

Staking is capital allocation. Your position in the validator set determines your relevance. Delegation flows can show you:

The P2P.org Advantage

Our dashboards track real-time delegation and historical shifts. Use this data to win more stake, enter new networks early, and defend your market share like a pro.

What This Looks Like

You’re operating validators across multiple chains and notice a delegation uptick to P2P.org-managed validators on Polkadot and Cosmos. Using P2P’s dashboards and account reporting, you identify where trust and stake are shifting, and use that insight to focus your business development on those networks.

It’s not just about uptime. Your validators have power, and responsibility. Governance participation, vote alignment, and reaction time tell LPs and partners how seriously you take your network commitments.

The P2P.org Advantage

We capture governance activity, validator reputation metrics, and security events across all major chains we support. We help you turn governance into a badge of trust, not a black box.

What This Looks Like

Your validator is listed on a DeFi platform as a potential delegate. A foundation partner asks for your governance track record. You export data from P2P.org’s dashboard showing 95% proposal participation and no slashing history, helping to win the integration.

Staking isn’t a set-it-and-forget-it feature. For institutions, it’s a revenue stream that demands P&L visibility. You should be asking:

The P2P.org Advantage

We give you the dashboards, reports, and APIs to turn staking into a trackable, accountable line of business. That’s how modern staking teams scale.

What This Looks Like

You’re building an investor update. Using P2P.org's custom reporting, you export monthly ETH and ATOM staking performance by network and wallet cohort. Your team uses the data to justify expanding the staking program.

Institutional-grade staking isn’t just about observing performance — it’s about adapting based on what the data reveals. With proper analytics and infrastructure in place, you can build a feedback loop that continuously improves results.

This looks like:

The P2P.org Advantage

Our tools allow clients to take action, not just observe. Whether it’s automated alerts on performance dips or exportable dashboards for internal ops reviews, we help teams move faster on staking decisions.

What This Looks Like

You’re running a white-label staking product and notice engagement dropping for a specific asset. By tracing the issue to a small rise in missed attestations, you rotate your stake to P2P.org-optimized validators. This can restore performance and user trust.

The staking landscape is professionalizing. Competition is heating up, margins are tightening, and institutions are demanding more transparency, more performance, and more value.

At P2P.org, we believe that data is the next big unlock in staking. Not because it looks good, but because it drives better decisions, higher performance, and faster growth.

We’re already delivering this to clients across 60+ networks. If your staking strategy isn’t insights-driven yet, it’s time to change that.

<p></p><h3 id="tldr"><strong>TL;DR</strong></h3><ul><li><strong>Validator infra isn’t “set and forget.”</strong> Small missteps like missed attestations or key mismanagement can quietly erode rewards or lead to slashing.</li><li><strong>Institutional staking demands more than uptime.</strong> It requires security, chain-specific tuning, real-time monitoring, and reporting that actually informs action.</li><li><strong>P2P.org takes the technical risk off the table.</strong> We build high-performance, secure, and scalable validator infrastructure that helps institutions stake smarter and safer.</li></ul><h2 id="why-validator-infrastructure-breaks"><strong>Why Validator Infrastructure Breaks</strong></h2><p>Validator infrastructure is often treated like a set-and-forget service. But in reality, it’s one of the most failure-prone layers in a staking operation, especially at institutional scale. Missed rewards, security breaches, slashing events, and opaque reporting can turn staking from a revenue source into a liability.</p><p>Instead, think of validating as the engine room of proof-of-stake networks. There are a lot of moving parts, and these precise components must work in harmony for long-term reliability. </p><p>At P2P.org, we're trusted with over $10 billion in delegated assets from 90,000+ delegators. Through that, we’ve seen what breaks, what scales, and what separates top-tier validators from everyone else. In this article, we’ll walk through eight of the most common technical pitfalls we see, and how we help institutions avoid them.</p><p></p><h3 id="1-missed-attestations-cut-into-returns"><strong>1. Missed Attestations Cut into Returns</strong></h3><p>Attestations are how validators prove they’re doing their job. On Ethereum and other networks, timing matters. If your infrastructure can’t keep up, even small delays can result in skipped rewards.</p><p>This kind of underperformance usually isn’t obvious until it starts impacting the bottom line. It becomes more noticeable during periods of network congestion or when running multiple validators under load.<br><br><strong>The solution?</strong> Infrastructure needs to be fast, resilient, and able to handle peak demand without lag.</p><p><strong>How P2P.org handles it</strong><br>We deploy regionally distributed infrastructure with built-in load balancing and failover capacity. Our systems are tuned for low-latency response across networks, so our clients get more consistent results.</p><p></p><h3 id="2-slashing-events-from-double-signing"><strong>2. Slashing Events from Double Signing</strong></h3><p>If a validator signs two conflicting messages on the same network, it can get penalized or ejected. This often happens when infrastructure is misconfigured or improperly backed up.</p><p>We’ve seen this impact operators who were running high volumes of validators without clear separation between active and backup nodes.</p><p><strong>The solution?</strong> There must be strict controls to ensure only one active validator signs at a time — no exceptions.</p><p><strong>How P2P.org handles it</strong><br>We separate key roles, implement strict failover logic, and configure validators with chain-specific slashing protections. All this is designed to prevent double-signing before it ever becomes a risk.</p><p></p><h3 id="3-poor-monitoring-delays-fixes"><strong>3. Poor Monitoring Delays Fixes</strong></h3><p>Issues don’t always come from downtime. They can creep in through latency, network desync, or validator drift. Without the right alerting in place, these problems can go unnoticed until it’s too late.</p><p>In the past year, we’ve seen network upgrades cause unanticipated sync issues that left many operators scrambling.</p><p><strong>The solution? </strong>Proactive, real-time monitoring is essential to catch problems early and act before rewards are lost.</p><p><strong>How P2P.org handles it</strong><br>We track dozens of health indicators for each validator and set up automated alerts to flag problems before they lead to missed rewards.</p><p></p><h3 id="4-weak-key-management"><strong>4. Weak Key Management</strong></h3><p>Validator keys are high-value targets. Poor key storage or weak access policies increase the risk of compromise, and in some cases, even accidental slashing.</p><p>This is a growing concern for custodians and enterprise clients that need to prove they aren’t introducing risk at the infra level.</p><p><strong>The solution? </strong>Key handling must be airtight, auditable, and protected by strong physical and logical controls.</p><p><strong>How P2P.org handles it</strong><br>We maintain secure key-handling protocols, such as isolated signing environments and non-custodial key management, to safeguard validator keys with enterprise-grade practices. </p><p></p><h3 id="5-mev-isn%E2%80%99t-managed-effectively"><strong>5. MEV Isn’t Managed Effectively</strong></h3><p>Ethereum validators earn more by capturing MEV, but only if they’re plugged into the right relays and builders. Many setups miss this entirely, leaving value on the table.</p><p>Operators often assume that MEV just works out of the box. In reality, poorly configured relays or weak strategies can hurt performance.</p><p><strong>The solution? </strong>You need reliable, optimized access to top MEV relays and builders without introducing risk or downtime.</p><p><strong>How P2P.org handles it</strong><br>We maintain curated relay and builder lists, monitor relay reliability, and optimize relay usage to increase MEV returns without adding risk.</p><p></p><h3 id="6-chain-specific-nuances-are-overlooked"><strong>6. Chain-Specific Nuances Are Overlooked</strong></h3><p>Each protocol operates differently. A validator setup that’s fine for Cosmos might not work well on Solana or Ethereum. Still, many operators try to use one configuration for everything.</p><p>This leads to avoidable issues like downtime, syncing problems, or failing to meet network-specific performance thresholds.</p><p><strong>The solution? </strong>Infrastructure must be tailored to each protocol, with up-to-date configs and custom tuning.</p><p><strong>How P2P.org handles it</strong><br>We tailor validator operations to each supported network, configuring setups based on protocol needs and deploying performance tracking tools for chains like Polkadot. This ensures validators run optimized and compliant across different ecosystems.</p><p></p><h3 id="7-infra-bottlenecks-during-high-demand"><strong>7. Infra Bottlenecks During High Demand</strong></h3><p>Major upgrades, forks, or governance events can cause traffic spikes and increased validator workload. Without the ability to scale, infra gets overwhelmed.</p><p>Operators who aren’t prepared for these spikes often end up missing out on rewards or even getting penalized.</p><p><strong>The solution? </strong>Infrastructure must auto-scale to handle sudden load without breaking performance.</p><p><strong>How P2P.org handles it</strong><br>We run resilient, multi-region validator clusters with automated failover and flexible capacity, so infrastructure scales with demand and maintains high uptime.</p><p></p><h3 id="8-no-clear-reporting"><strong>8. No Clear Reporting</strong></h3><p>Institutions need to show results. But without validator-level metrics, reward breakdowns, and performance benchmarking, it’s hard to report or improve.</p><p>We’ve worked with clients who initially relied on outdated or manual reporting, which slowed down everything from investor updates to risk reviews.</p><p><strong>The solution? </strong>You need clear, real-time metrics that show how your validators are doing — across all networks.</p><p><strong>How P2P.org handles it</strong><br>We provide dashboards, APIs, and automated reports that show validator-level detail across networks.</p><p></p><h2 id="what%E2%80%99s-at-stake"><strong>What’s at Stake</strong></h2><p>Validator performance affects revenue, compliance, and reputation. Yet many operators still miss basic risks, or don’t have the tooling to manage them.</p><p>At P2P.org, we build staking infrastructure that takes these risks off the table. Our focus is on performance, resilience, and visibility, so institutions can scale confidently.</p><p>✅ 99%+ uptime across 60+ networks</p><p>✅ Real-time monitoring and reporting</p><p>✅ Slashing protection and MEV optimization</p><p>✅ Secure, non-custodial infrastructure from day one</p><p>Want to strengthen your validator setup?</p><div class="kg-card kg-button-card kg-align-center"><a href="mailto: [email protected]" class="kg-btn kg-btn-accent">Connect with our staking experts</a></div><p></p>

from p2p validator

<p></p><h2 id="tldr"><strong>TL;DR</strong></h2><p>Staking is no longer just about passive rewards. With the right infrastructure partner, it’s a full-stack business model. P2P.org empowers institutions to:</p><ul><li>Launch white-label staking services</li><li>Capture MEV and restaking rewards</li><li>Build long-term staking brands and analytics businesses</li></ul><p></p><h2 id="modern-staking-is-a-business-model"><strong>Modern Staking Is a Business Model</strong></h2><p>Staking has evolved. Once seen as a passive income mechanism for token holders, it has transformed into a strategic revenue channel for institutions, wallets, and custodians. With innovations like MEV, restaking, and LRTs, staking is now central to crypto-native financial infrastructure.</p><p>Question is, are you making the most out of your staking strategies? Too often, businesses settle for surface-level network rewards without tapping into the deeper potential staking offers.</p><p>With the right infrastructure partner, staking can do far more than simply earn passive income. Institutions are now widely focusing on diverse staking operations to provide a robust, strategic revenue engine. Whether it's accessing new streams like MEV or integrating restaking, the full spectrum of staking opportunities is unlocked when you work with a platform designed for scale, flexibility, and reliability.</p><p>In this guide, we break down seven powerful revenue-generating strategies that go beyond traditional staking rewards, and show how P2P.org helps power each one.</p><p></p><h2 id="1-validator-rewards-the-classic-model"><strong>1. Validator Rewards (the Classic Model)</strong></h2><p>At its core, staking provides token rewards to validators for securing and maintaining blockchain networks. This remains the most direct way to earn network rewards, but maximizing it requires infrastructure that minimizes downtime, latency, and missed attestations.</p><p><strong>P2P.org’s Advantage</strong><br>Our infrastructure has maintained a long-standing >99,9% uptime across all supported networks. Our engineering team fine-tunes validators per network to reduce latency, while our monitoring stack ensures validator performance is never compromised. We take on the risk, so our partners don’t have to.</p><p>This technical uptime translates into peace of mind for staking businesses that need to scale without infrastructure concerns that might otherwise necessitate longer risk assessment processes.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://www.p2p.org/networks?ref=p2p.org" class="kg-btn kg-btn-accent">Explore our networks</a></div><p></p><h2 id="2-commission-based-white-label-staking"><strong>2. Commission-Based White-Label Staking</strong></h2><p>Monetize user activity directly by offering staking services under your own brand. With P2P.org’s white-label staking API, wallets and custodians can introduce staking functionality in-app, set user-facing commissions, and unlock a recurring revenue model. </p><p>When looking at implementation of this, Ethereum staking and Solana staking are some of the most actively integrated networks by wallets and exchanges today. Ethereum has become a cornerstone of institutional staking strategies post-Merge, while Solana offers compelling staking incentives and high-speed UX. This makes both ideal for white-labeled in-app staking experiences</p><p><strong>How P2P.org Delivers</strong><br>We offer full branding flexibility, seamless integration, and direct payout options. Our partners can launch staking in under two weeks with enterprise-grade security baked in.</p><p>White-label staking turns staking into a product line that requires zero in-house infrastructure and still earns long-term commissions. Our team supports partners from integration through to UX best practices.</p><p>Key to <a href="http://p2p.org/?ref=p2p.org"><u>P2P.org</u></a>’s offering in this space is our Unified API. The Unified API provides a standardized platform to manage staking, transaction broadcasting, and unstaking across multiple blockchain networks, providing a truly multi-chain solution.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://www.p2p.org/products/api?ref=p2p.org" class="kg-btn kg-btn-accent">Discover the Unified API</a></div><p></p><h2 id="3-restaking"><strong>3. Restaking </strong></h2><p>Restaking protocols like EigenLayer enable capital efficiency by allowing the same staked assets to secure additional services. This layered approach to staking opens up new dimensions of opportunity, particularly with restaking protocols like EigenLayer and emerging players such as Symbiotic, which are expanding the design space for validator services and modular security.</p><p><strong>How P2P.org Supports It</strong><br>We're actively integrating with restaking protocols to ensure our validators can support these advanced setups. Our internal slashing protection and policy management ensure that restaked assets maintain integrity across chains and services.</p><p>As restaking ecosystems mature, institutions will need a partner who can navigate evolving risk vectors and infrastructure demands. P2P.org is engineering restaking-native systems to support these high-efficiency, high-impact reward models.</p><p></p><h2 id="4-mev-and-order-flow-revenue"><strong>4. MEV and Order Flow Revenue </strong></h2><p>Maximal Extractable Value (MEV) is becoming one of the largest untapped reward sources for professional validators. By leveraging this technology and working with trusted builder relays, validators can increase returns without affecting base staking operations.</p><p><strong>How P2P.org Enables It</strong><br>Our infrastructure includes MEV-ready architecture with secure relay integration and real-time risk monitoring. We help partners capture MEV safely and compliantly, turning order flow into a new revenue stream.</p><p>By managing MEV at the protocol level and incorporating pre-configured relay logic, P2P.org helps staking partners unlock next-level economics that many still miss.</p><p></p><h2 id="5-tokenized-staking-lsts-lrts"><strong>5. Tokenized Staking (LSTs + LRTs) </strong></h2><p>Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) allow for staked positions to remain liquid. This opens doors for DeFi participation, collateralization, and secondary market trading.</p><p><strong>How P2P.org Adds Value</strong><br>We provide the foundational infrastructure behind tokenized staking initiatives. Whether you're launching your own LST product or integrating one, our infrastructure ensures validator stability, performance, and compliance support.</p><p>The future of composable staking requires the ability to have one asset across multiple touchpoints with constant performance. Institutions looking to enter the LST and LRT arena need a validator partner equipped to handle network complexity, slashing mitigation, and real-time responsiveness.</p><p></p><h2 id="6-validator-reputation-governance-influence"><strong>6. Validator Reputation & Governance Influence </strong></h2><p>As a validator grows in prominence, its role in governance expands. From helping shape protocol direction to influencing proposals, validator reputation becomes a brand asset and a political tool.</p><p><strong>How P2P.org Leverages It</strong><br>We actively participate in governance discussions across almost every proof of stake protocol. By aligning with us, partners gain visibility and influence in top-tier ecosystems. Our reports and governance insights are made available to strategic partners.</p><p>This influence translates to a stronger strategic position, both for internal growth and public-facing credibility. Validator reputation is earned through consistency, transparency, and participation. We help our partners build it.</p><p></p><h2 id="7-data-monetization-analytics"><strong>7. Data Monetization & Analytics </strong></h2><p>The operational data generated through validator performance and network behavior is a valuable asset. Institutional users increasingly demand transparent insights and performance analytics.</p><p><strong>How P2P.org Empowers It</strong><br>We offer real-time dashboards, API-based analytics, and customizable reporting for our partners. These tools not only help you monitor performance but can be productized into institutional offerings or operational KPIs.</p><p>We turn complex metrics into usable tools. For clients managing portfolio-level staking, these insights are critical for both internal strategy and external reporting.</p><p></p><h2 id="expanding-your-revenue-stack"><strong>Expanding Your Revenue Stack</strong></h2><p>The future of staking isn’t just the rate of rewards, but layered revenue strategies built on top of dependable infrastructure. Whether you’re running a non-custodial wallet or managing institutional capital, the ability to offer diverse staking services can become a core business line.</p><p>At P2P.org, we help you:</p><ul><li>Launch staking features fast with our white-label API</li><li>Capture MEV, LST, and restaking opportunities without the technical debt</li><li>Back your business with the support of 24/7 monitoring, slashing protection, and tailored dashboards</li></ul><p>Our end-to-end staking infrastructure is trusted by exchanges, wallets, custodians, and institutional asset managers around the globe. If you’re serious about staking, it’s time to think bigger than just network rewards.</p><p>Talk to our team of experts today to learn more about crafting your own bespoke staking approaches that utilize a broad portfolio of products and services. </p><div class="kg-card kg-button-card kg-align-center"><a href="mailto: [email protected]" class="kg-btn kg-btn-accent">Connect with our staking experts</a></div>

from p2p validator