Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

SubscribeStaking will be available after a successful launch of Kava blockchain on mainnet. To use this guide you should have an existing account with KAVA tokens and connection to the node.

Requirements:

1) First you have to download Make and Go

-Download Make and other packets:

sudo apt install build-essential

-Download Go:

wget https://dl.google.com/go/go1.13.1.linux-amd64.tar.gz

sudo tar -C /usr/local -xzf go1.13.1.linux-amd64.tar.gz

mkdir -p ~/go/{bin,src,pkg}

For correct work of Go you will need to define environment variables

Execute following commands by rotation:

export PATH=$PATH:/usr/local/go/bin

export GOPATH=$HOME/go

export GOBIN=$GOPATH/bin

export PATH=$PATH:$GOBIN

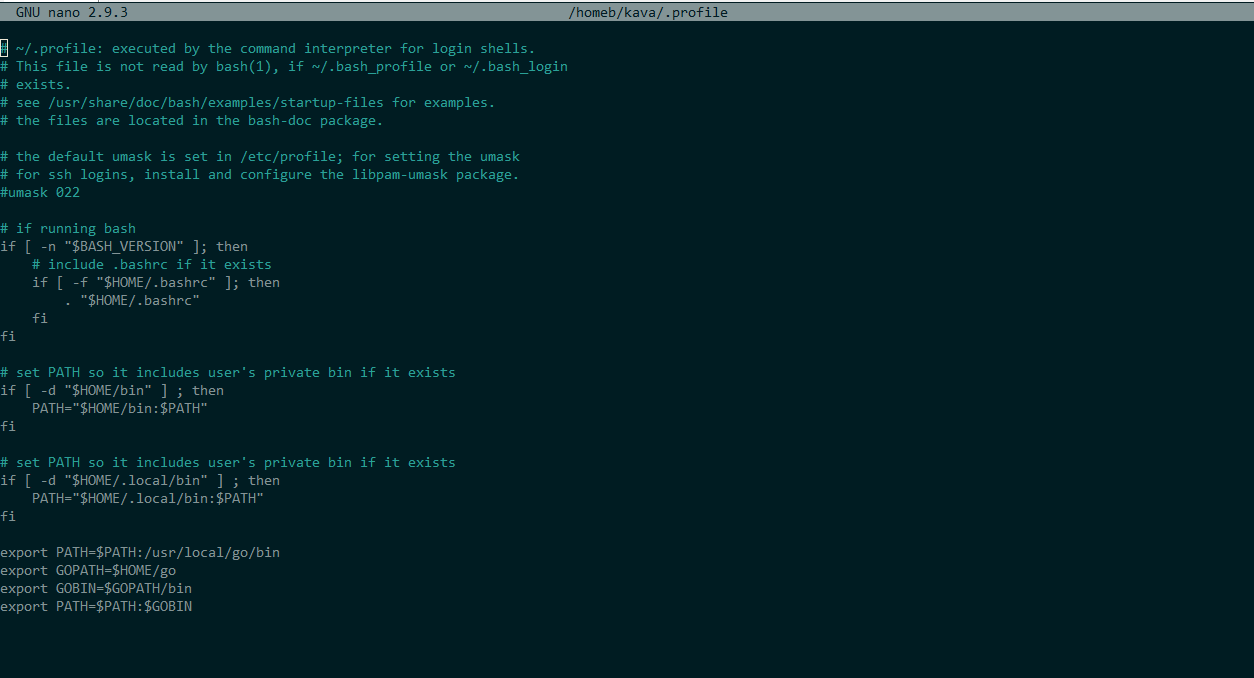

For convenience add these strings to the current user profile. In Ubuntu it is: ~/.profile. Execute nano ~/.profile and put strings from the previous step in the end of the file:

export PATH=$PATH:/usr/local/go/bin

export GOPATH=$HOME/go

export GOBIN=$GOPATH/bin

export PATH=$PATH:$GOBIN

After that execute: source ~/.profile

2) Build Kava:

Go to the folder cd ~/go/src/

Execute:

git clone https://github.com/kava-labs/kava

cd kava

git checkout tags/v0.3.1

make install

If everything went as it should in the folder ~/go/bin appeared - kvd and - kvcli packets

3) Delegate KAVA tokens

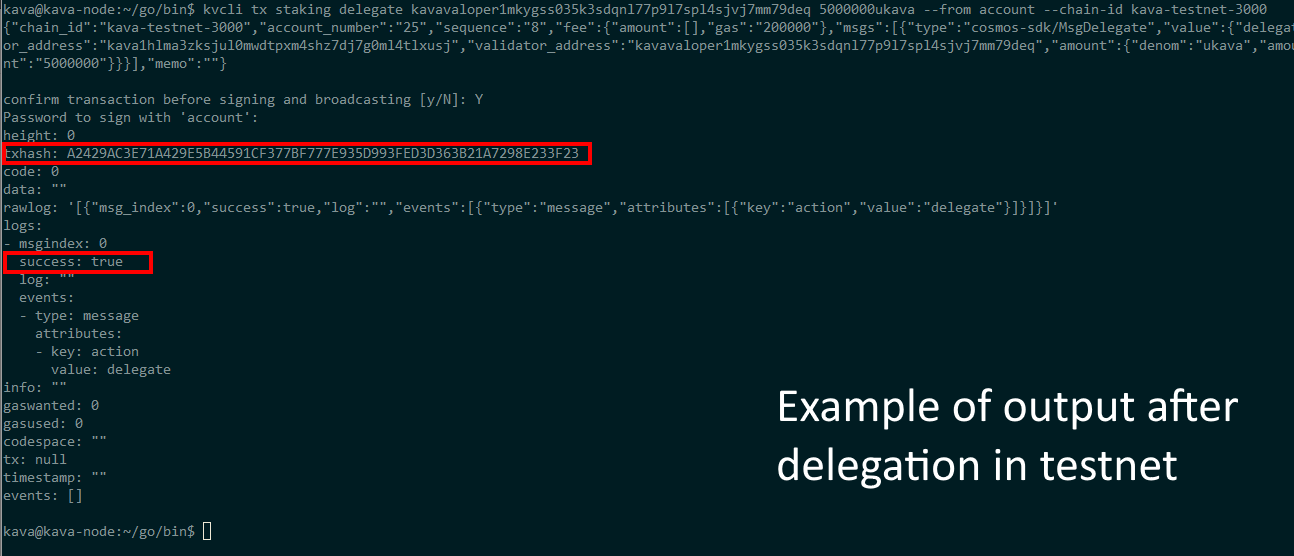

In the following instruction all commands were sent from a network node in testnet and chain id and validator address values on screenshots differ from the mainnet values. The actual values provided below.

To make actions further you should have:

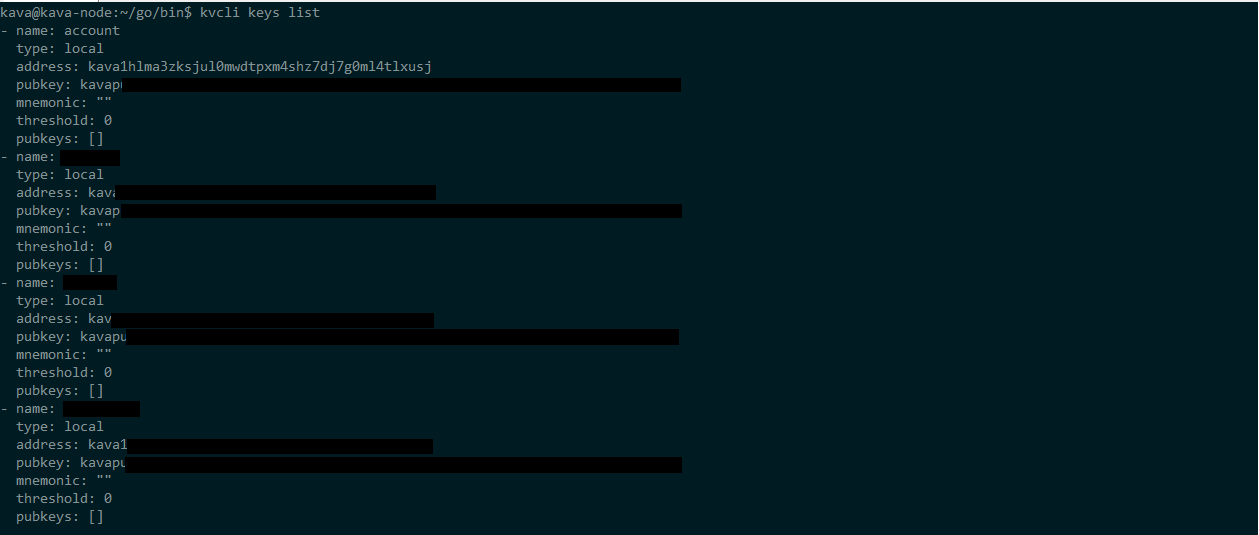

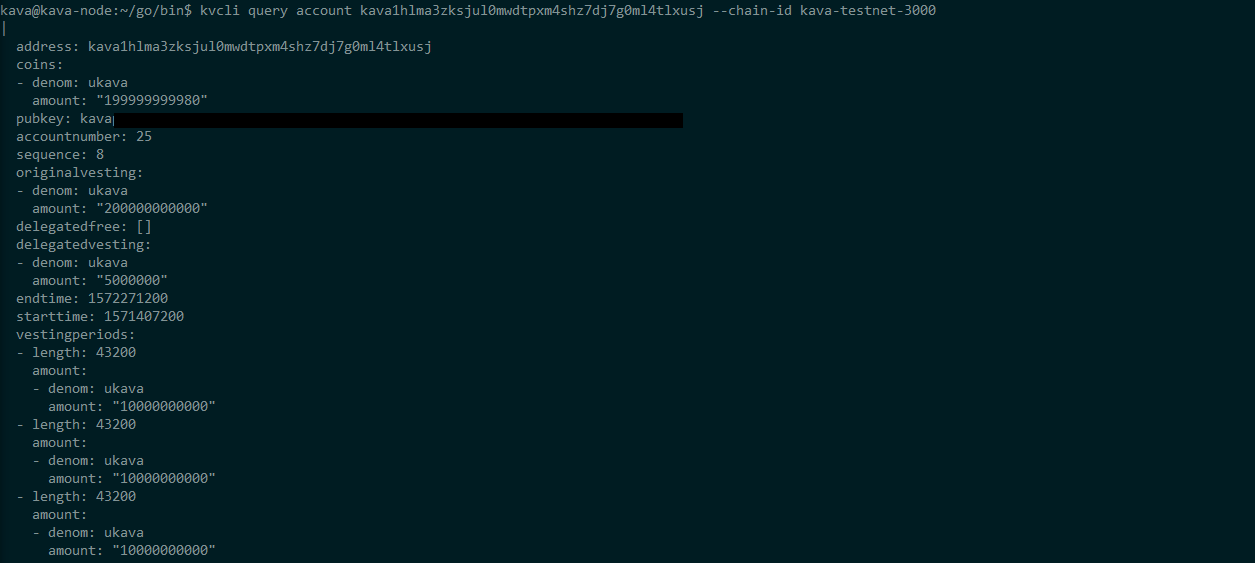

Make sure that account exists and has a positive balance:

kvcli keys list

kvcli keys show <your_key_name>

kvcli query account <your_address> --chain-id kava-2

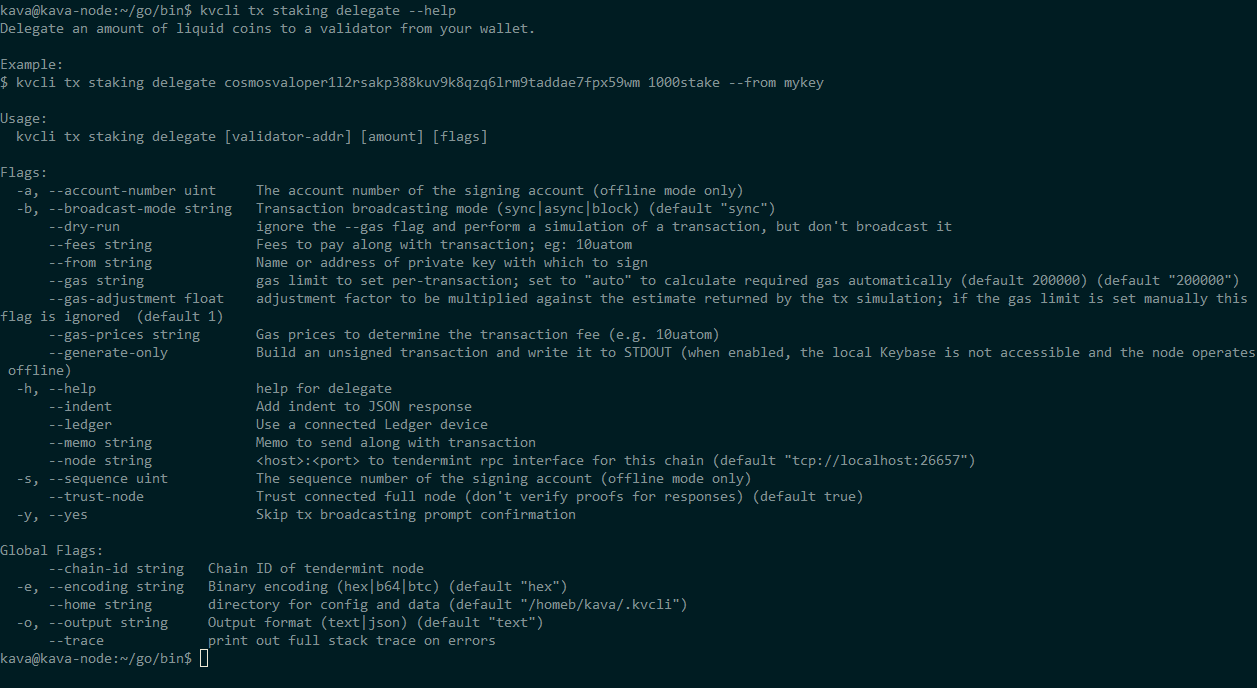

For assistance with command parameters you can execute kvcli tx staking delegate --help

Important note, delegation amount nominated in uKAVA. For instance, if you want to stake 100 KAVA you should enter 100000000 in the amount field. Read this chapter in full before choosing the command for your case.

P2P Validator address: kavavaloper12g40q2parn5z9ewh5xpltmayv6y0q3zs6ddmdg

Chain ID: kava-2

If you have connection to the node, for delegation execute:

kvcli tx staking delegate kavavaloper12g40q2parn5z9ewh5xpltmayv6y0q3zs6ddmdg <amount of KAVA you want to stake>ukava --from <address> --chain-id kava-2

If you don't have connection to the node you can use ours. Execute:

kvcli tx staking delegate kavavaloper12g40q2parn5z9ewh5xpltmayv6y0q3zs6ddmdg <amount of KAVA you want to stake>ukava --from <address> --chain-id kava-2 --node tcp://95.216.184.50:26657

If you used ledger to generate keys add --ledger in the end of command. Execute:

kvcli tx staking delegate kavavaloper12g40q2parn5z9ewh5xpltmayv6y0q3zs6ddmdg <amount of KAVA you want to stake>ukava --from <address> --chain-id kava-2 --node tcp://95.216.184.50:26657 --ledger

Below is an example of the output you should get after successful delegation.

If you have any questions or different operational system contact us at p2p.org or schedule a personal call with our development team to guide you through the whole process.

If you have any questions feel free to contact us. We are always open for communication.

P2P Validator offers high-quality staking facilities and provides up to date information for educational purposes. Stay tuned for updates and new blog posts.

Web: https://p2p.org

Stake KAVA with us: https://p2p.org/kava

Twitter: @p2pvalidator

Telegram:https://t.me/kava_p2p

Research & Analytics at p2p.org.

<p>The question of blockchains having trustless connection with external data is significant for the real-world implementation of highly functional smart-contracts in both new and traditional industries. Not only do they require connection to external resources, but the off-chain connection must maintain the same properties of decentralized security currently available on the underlying blockchain. With that in mind, P2P Validator is thrilled to announce the launch of our Chainlink node with the mission of providing smart-contracts with the required data feeds in an increasingly decentralized manner.</p><p>Decentralized oracles solve smart contract’s lack of connection with external resources without sacrificing trustworthiness. This keeps digital agreements reliable and tamper-proof end-to-end, which is crucial for real-world usage. This vision is in line with our mission to promote the value of blockchain assets and give people access to the emerging data-driven economy.</p><p>Our developer team has extensive experience in setting up secure infrastructure. P2P Validator maintains high-availability nodes and provides secure staking services for the most groundbreaking projects in the blockchain space. The node infrastructure is under advanced monitoring with 24/7 technical support, backups and alerts.</p><h3 id="about-chainlink"><strong>About Chainlink</strong></h3><p><a href="https://chain.link/?ref=p2p.org">Chainlink</a> is a decentralized oracle network that enables smart contracts to securely access off-chain data feeds, web APIs, and traditional bank payments. Chainlink is consistently selected as one of the top blockchain technologies by leading independent research firms such as Gartner. It is well known for providing highly secure and reliable oracles to great companies like <a href="https://cloud.google.com/blog/products/data-analytics/building-hybrid-blockchain-cloud-applications-with-ethereum-and-google-cloud?ref=p2p.org">Google</a>, <a href="https://www.forbes.com/sites/darrynpollock/2019/07/30/oracle-building-a-virtuous-cycle-of-innovation-with-start-ups-through-chainlink-and-blockchain/?ref=p2p.org#30d94a3c4ffc">Oracle</a>, <a href="https://www.coindesk.com/swift-startup-winner-demos-smart-contract-trade-5-financial-firms?ref=p2p.org">SWIFT</a>, and many other large enterprises, as well as many of the world's best smart contract projects/teams such as <a href="https://medium.com/web3foundation/web3-foundation-and-chainlink-announce-collaboration-df55ed462a3a?ref=p2p.org">Web3</a>, <a href="https://medium.com/hashgraph/hedera-hashgraph-and-chainlink-collaborate-to-provide-a-decentralized-oracle-network-for-hederas-3d1c77a6bcb9?ref=p2p.org">Hedera</a>, <a href="https://medium.com/reserve-currency/reserve-partners-with-chainlink-to-bolster-the-future-of-decentralized-stablecoins-5d486f37e92b?ref=p2p.org">Reserve</a>, <a href="https://blog.openzeppelin.com/chainlink-partnership/?ref=p2p.org">OpenZeppelin,</a> <a href="https://medium.com/@OpenLawOfficial/openlaw-teams-with-chainlink-to-bring-real-world-info-to-smart-contracts-4e7a3dac80a8?ref=p2p.org">OpenLaw</a>, <a href="https://medium.com/celer-network/celer-chainlink-combining-real-world-information-and-layer-2-scalability-24e5d478a4aa?ref=p2p.org">Celer</a>, <a href="https://blog.synthetix.io/synthetix-and-chainlink/?ref=p2p.org">Synthetix</a>, <a href="https://www.cryptoninjas.net/2019/07/30/zilliqa-smart-contracts-will-utilize-chainlink-decentralized-oracle-network/?ref=p2p.org">Zilliqa</a>, <a href="https://blog.oceanprotocol.com/ocean-protocol-chainlink-integration-e7335f880ea3?ref=p2p.org">OceanProtocol</a>, <a href="https://medium.com/amberdata/smart-contract-oracles-with-amberdata-io-358c2c422d8a?ref=p2p.org">Amberdata</a>, <a href="https://www.forbes.com/sites/sarahhansen/2018/11/08/consensys-kaleido-launches-full-stack-marketplace-platform-for-enterprise-blockchains/?ref=p2p.org#6d849d2ad8ca">Kaleido</a>, <a href="https://medium.com/harmony-one/harmony-to-partner-with-chainlink-for-off-chain-connectivity-fc0372819aca?ref=p2p.org">Harmony</a>, and many more.</p><p>Learn more by visiting the <a href="https://chain.link/?ref=p2p.org">Chainlink website</a>, <a href="https://twitter.com/chainlink?ref=p2p.org">Twitter</a> or <a href="https://t.me/chainlinkofficial?ref=p2p.org">Telegram</a>. To discover Chainlink use cases read the <a href="https://blog.chain.link/44-ways-to-enhance-your-smart-contract-with-chainlink/?ref=p2p.org">blog post</a>. If you’re a developer, visit the <a href="https://docs.chain.link/?ref=p2p.org">developer documentation</a> or join the technical discussion on <a href="https://discord.gg/FGNyjhF?ref=p2p.org">Discord</a>.</p><h3 id="about-p2p-validator"><strong>About P2P Validator</strong></h3><p><a href="https://p2p.org/?ref=p2p.org">P2P Validator</a> is a world-leading staking provider with the best industry security practices and proven expertise. We provide comprehensive due-diligence of digital assets and offer only top-notch staking opportunities. At the time of the latest update, more than 3 billion of USD value is staked with P2P Validator by over 10,000 delegators across 25+ networks.</p><hr><p><strong><strong>P2P Validator</strong></strong> offers high-quality staking facilities and provides up to date information for educational purposes. Stay tuned for updates and new blog posts.</p><p><strong><strong>Web:</strong></strong><a href="https://p2p.org/?ref=p2p.org"> https://p2p.org</a></p><p><strong><strong>Twitter:</strong></strong><a href="https://twitter.com/p2pvalidator?ref=p2p.org"> @p2pvalidator</a></p><p><strong><strong>Telegram:</strong></strong><a href="https://t.me/p2pvalidator?ref=p2p.org"> https://t.me/p2pvalidator</a></p>

from p2p validator

<p>Tezos ecosystem includes solid tools to monitor network performance and staking rewards. Block explorers represent a major part of the ecosystem transparency and health. Delegators and bakers often rely on such tools before making decisions such as, should I add to my self-bond or which baker to stake with. Diversity of these services provide users with unique experience and allow them to choose one that corresponds to a particular need.</p><p>Analytical explorers display two types of parameters. The first is derived right from the blockchain data and in most cases they are identical on different analytical tools. Values of these parameters can be slightly different on various explorers because of the network data update frequency. The second type of parameters is calculated using network variables and blockchain data.</p><p>It may lead to a confusion when the same variable has different values on multiple resources. It can be because of different approaches taken for calculation or using different timeframes. Currently, <em><em>available staking capacity</em></em> has different values for the same bakers on various analytical websites. It represents an amount of XTZ that can be staked with a particular baker without making him over-delegated. Delegated tokens above the limit will not contribute to the power of the baker.</p><h3 id="example"><strong>Example</strong></h3><p>Stats for P2P Validator on various analytical tools for 19.03.2020:</p><p><em><em>Tzstats.io</em></em>: staking capacity = 14 048 492 XTZ resulting in available staking capacity = <strong><strong>1 971 806 XTZ</strong></strong>.</p><p><em><em>MyTezosBaker</em></em>: available staking capacity = <strong><strong>802 752 XTZ</strong></strong>| staking capacity = 12 881 681 XTZ.</p><p><em><em>Tezos Nodes</em></em>: available staking capacity = <strong><strong>2 007 769 XTZ</strong></strong> resulting in staking capacity = 14 079 769 XTZ.</p><p><em><em>Baking Bad:</em></em> available staking capacity = <strong><strong>1 972 000 XTZ</strong></strong> resulting in staking capacity = 14 044 000 XTZ.</p><p>In some cases, the difference between the values above is significant and cannot be explained by fluctuations of baking rights and endorsements. Who is right?</p><p>The purpose of this post is to establish a single approach for available staking capacity calculation and eliminate errors and confusion for end users on various analytical resources. Below I share my understanding of the correct approach to calculate this parameter and invite everyone in Tezos community to join the discussion, express your point of view or suggest other ways of thinking about this parameter.</p><h1 id="security-deposit"><strong>Security deposit</strong></h1><p>In order to create blocks baker should maintain a specific amount of self-bond that is used for security deposit required by the Tezos protocol and subjected to slashing as a measure against misbehavior. Security deposit per created block is equal to 512 XTZ and per endorsement is equal to 64 XTZ. When validator bakes block or endorses, these funds become frozen for a number of preserved cycles defined by the protocol and unfreeze at their end.</p><p>If we assume that 100% of total supply participate in staking we can calculate the minimum bond requirement for a baker: <code>((block_security_depo + endorsement_security_depo * endorsers_per_block) * blocks_per_cycle * (preserved_cycles+1)) / total_supply</code></p><p>Let's split this formula into parts:</p><p>Part 1: <code>block_security_depo + endorsement_security_depo * endorsers_per_block</code></p><p>In this part we calculate the total amount of security deposit per block.</p><p>Part 2: <code>blocks_per_cycle * (preserved_cycles+1)</code></p><p>By multiplying the total security deposit per block by the number of blocks in the cycle and frozen period plus one we get the total amount of XTZ that are frozen for preserved cycles.</p><p>Part 3: <code>Part 1 * Part 2 / total_supply</code></p><p>Here we finally calculate the security deposit share of the total supply.</p><p>Let's crunch some numbers:</p><p><code>block_security_depo = 512 XTZ</code></p><p><code>endorsement_security_depo = 64 XTZ</code></p><p><code>endorsers_per_block = 32</code></p><p><code>blocks_per_cycle = 4096</code></p><p><code>preserved_cycles = 5</code></p><p>All these parameters are derived from a Tezos protocol and represent constant values until community decides to propose changes via governance procedure. The only dynamic parameter is <code>total_supply</code> which is equal <em><em>~ 829,34 million XTZ</em></em> (19.03.2020).</p><p>The actual self-bond requirement is floating as baking frequency and endorsement rights are changing but for this case we will not take possible baking deviations into consideration.</p><p>The whole calculation of minimum self-bond requirement <em><em>if 100% tokens at stake</em></em> look like: <code>((512 + 64 * 32) * 4096 * (5+1)) / 829 340 996 = 7,59%</code>.</p><p>With a decrease of total supply percentage at stake, minimum self-bond requirement will increase as overall share of frozen XTZ in a security deposit related to the participating tokens will be higher.</p><p>To calculate the exact self-bond requirement we can simply put the exact number of tokens at stake instead of <code>total_supply</code> or divide the result of previous calculation, made for 100% staked tokens, by the actual percentage of staked XTZ. It will result in <strong><strong>~9,64%</strong></strong> of <em><em>actual self-bond requirement</em></em> for a baker.</p><p>The only caveat here is that <code>total_supply</code> is growing over time while security deposits remain the same. In the long run it will result in lower self-bond requirement as well as the network security.</p><h1 id="available-staking-capacity"><strong>Available staking capacity</strong></h1><p>After finding the exact self-bond requirement we can answer two questions:</p><p>1) Does a particular baker maintain sufficient self-bond?</p><p>2) How many XTZ a particular baker can accept before it becomes over-delegated?</p><p>To answer the first question we should find a self-bond share in the total staking balance.</p><p><code>staking_balance = self_bond + delegated_balance</code></p><p><code>self_bond / staking_balance * 100 = X%</code>.</p><p>If <code>X > actual_self_bond_req</code> then baker has enough self-bond and won't miss baking or endorsement slots.</p><p>The answer to the second question is available staking capacity. To find this value we should substract staking balance from the maximum balance.</p><p><code>max_balance = self_bond / actual_self_bond_req</code></p><p><code>available_staking_capacity = max_balance - staking_balance</code></p><p>To make calculation of available capacity even more precise you can adjust <code>self_bond</code> by <code>frozen_fees</code> + <code>frozen_rewards</code> as they do not take part in security deposits and use actual rolls of a baker to get the actual <code>staking_balance</code>.</p><p>Using formulas from above we get <code>available staking capacity of P2P Validator ~ 1 997 663 XTZ</code> (19.03.2020).</p><p>Seems like <a href="https://baking-bad.org/?ref=p2p.org">Baking Bad</a>, <a href="https://tzstats.com/tz1P2Po7YM526ughEsRbY4oR9zaUPDZjxFrb?ref=p2p.org">Tzstats</a> and <a href="https://www.tezos-nodes.com/?ref=p2p.org">Tezos Nodes</a> are quite aligned with the value and use similar approach for calculation of a baker free space.</p><p>Now you have all the necessary information to check by yourself if the self-bond is sufficient enough to bake and what is the available staking capacity of a baker. In addition, we have created a <a href="https://docs.google.com/spreadsheets/d/1ZxRBHETPixxeYAG0efJbXsKeiIHPq1nGWJ2ZazND2a8/edit?ref=p2p.org#gid=1765745933">spreadsheet with prepared calculations</a> for simplicity. We also improved a calculation for self-bond and staking balance of a baker to make available capacity value even more precise.</p><hr><p><em><em>Special thanks to Baking Bad and StakeNow for paying attention to the article and facilitating valuable discussions.</em></em></p><hr><p><strong><strong>P2P Validator</strong></strong> provides secure non-custodial staking. Subscribe to our channels and stay tuned for updates and new blog posts.</p><p><strong><strong>Web:</strong></strong><a href="https://p2p.org/?ref=p2p.org"> https://p2p.org</a></p><p><strong><strong>Stake XTZ with us:</strong></strong> <a href="https://p2p.org/economy/p2p.org/tezos">p2p.org/tezos</a></p><p><strong><strong>Twitter:</strong></strong><a href="https://twitter.com/p2pvalidator?ref=p2p.org"> @p2pvalidator</a></p><p><strong><strong>Telegram:</strong></strong><a href="https://t.me/p2pvalidator?ref=p2p.org"> https://t.me/p2pvalidator</a></p>

from p2p validator