Subscribe to P2P-economy

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Subscribe

Welcome to Part 3 of our Lido V3 for Institutions series.

Read Part 1: — Why Lido V3 Matters for Institutions: https://x.com/P2Pvalidator/status/1981004391948652979

Read Part 2 — What Institutions Should Know About Lido V3 Node Operators: https://x.com/P2Pvalidator/status/1983546982527332777

Most institutional Lido V3 conversations focus exclusively on Ethereum. That makes sense, as Ethereum represents the largest opportunity and Lido's strongest institutional product. But treasury teams managing diversified crypto portfolios inevitably ask: if Lido V3 solves our Ethereum staking needs, what about the rest of our holdings?

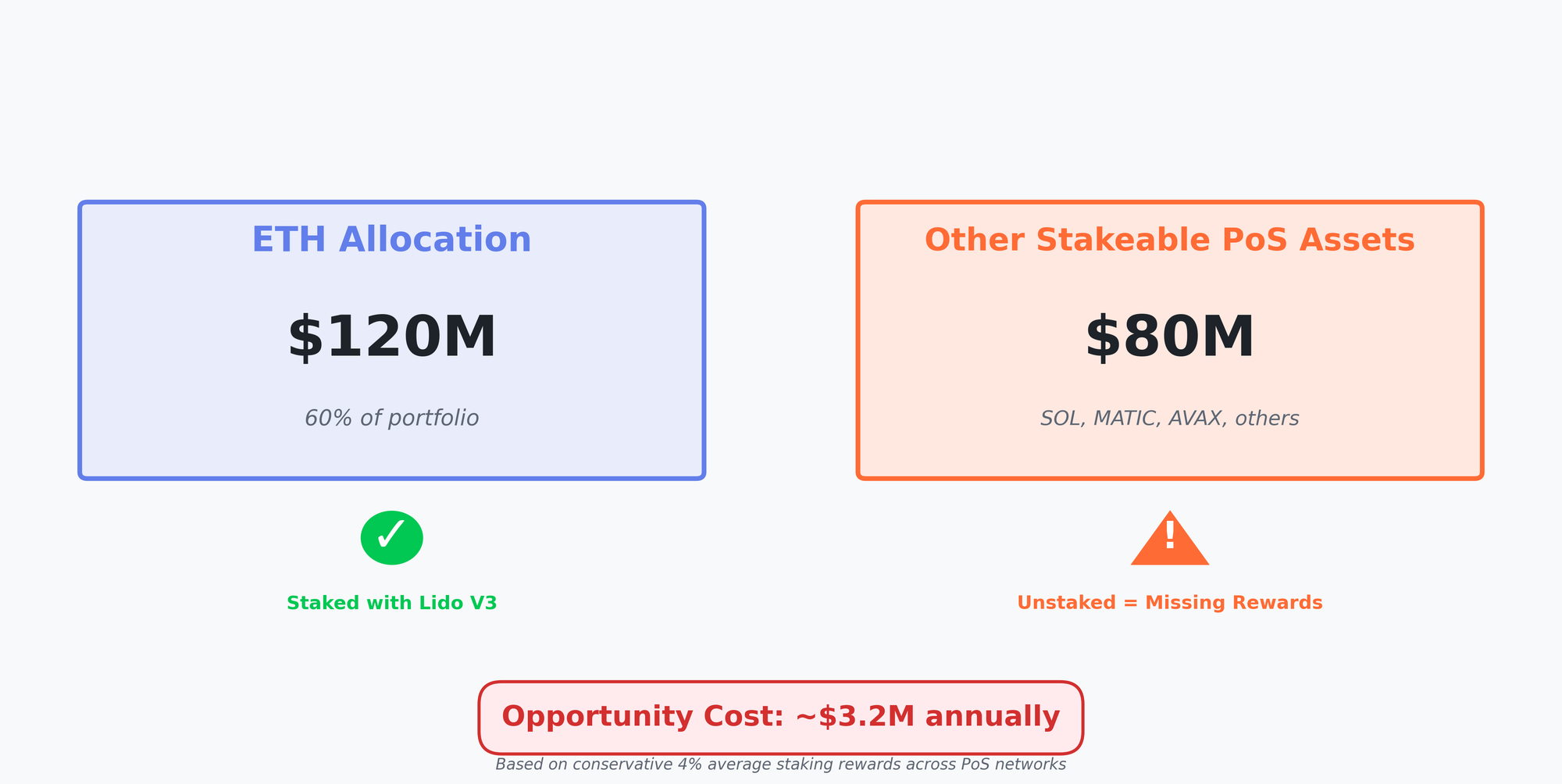

A treasury managing $200M in crypto might allocate $120M to ETH, but what about $40M in SOL, $25M in other proof-of-stake assets, and $15M in non-stakeable holdings? Should each network use different staking solutions, creating operational fragmentation? Or does a more coherent multi-chain strategy exist?

Institutional portfolios rarely consist of 100% Ethereum. Strategic diversification typically includes significant allocations to other proof-of-stake networks. If you're staking ETH while other assets sit idle, you're leaving rewards on the table.

For a $200M portfolio with $50M in unstaked proof-of-stake assets, the opportunity cost approaches $2M annually at a conservative 4% average reward rate. That's not theoretical — it's board-reportable capital sitting unproductive.

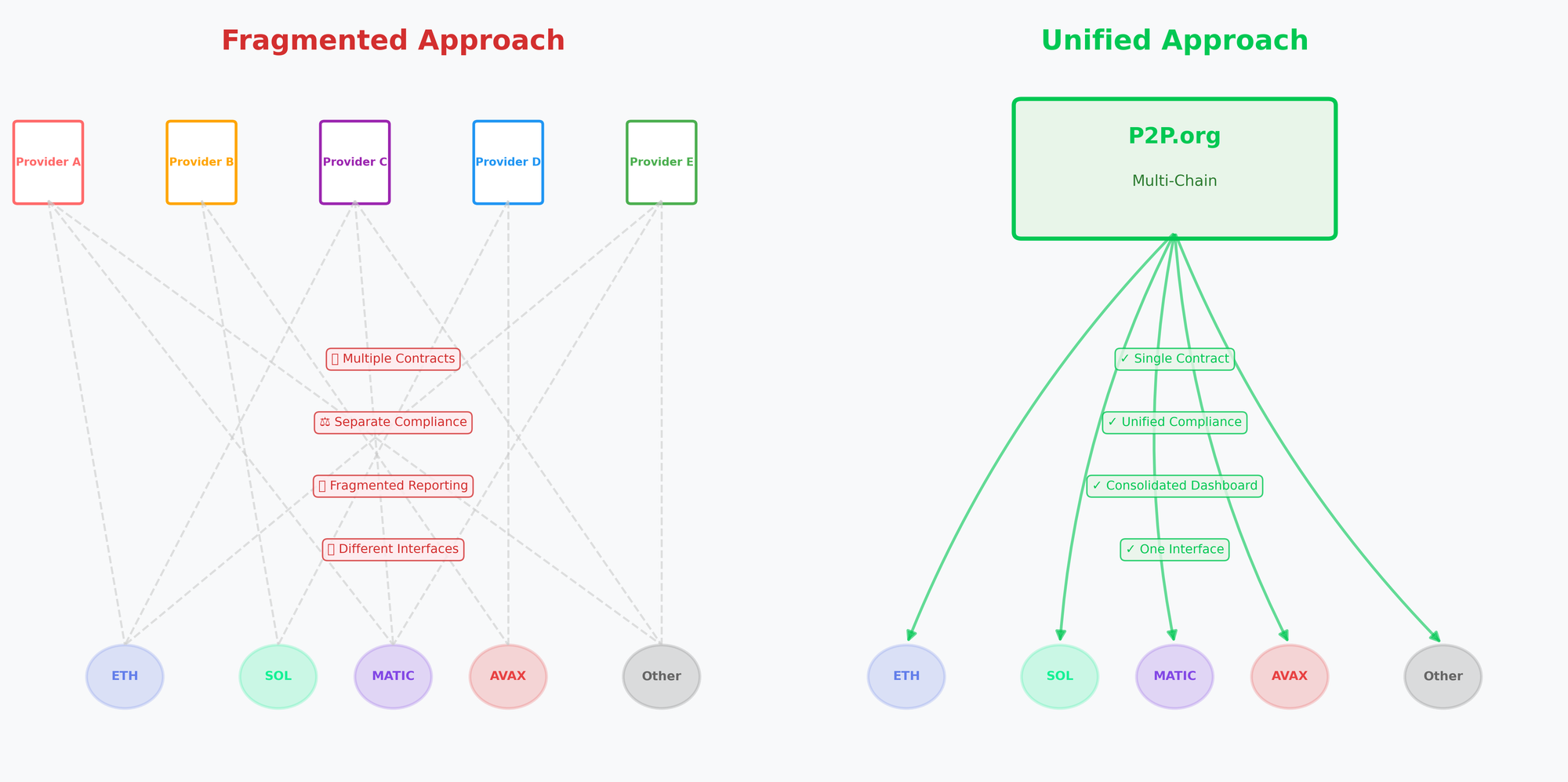

Managing multiple staking solutions creates compounding overhead. Different providers mean multiple vendor relationships, separate contracts, and independent compliance reviews. Different interfaces require training teams on various platforms. Different reporting standards mean aggregating disparate data for CFO dashboards.

At P2P.org, our institutional clients value operational consistency precisely because fragmentation costs real money. If one provider handles multiple networks with unified operations — one vendor relationship, one dashboard, consolidated reporting — the efficiency gains become substantial.

Three years ago, institutional crypto centered on Bitcoin and Ethereum. Today, Solana, Avalanche, and Polygon have institutional adoption. Three years from now, the landscape will shift again. Starting with multi-chain capable providers creates optionality for portfolio evolution.

Managing multiple staking solutions creates compounding overhead that institutions must weigh against the incremental rewards.

Different providers mean multiple vendor relationships, separate contracts, and independent compliance reviews for each. Different interfaces require training teams on multiple platforms and maintaining familiarity with various operational procedures. Different reporting standards mean aggregating disparate data sources for CFO dashboards and board presentations. Different risk frameworks demand separate evaluation and monitoring processes per network.

If a single provider can handle multiple networks with consistent operations, the efficiency gains are substantial. Imagine one vendor relationship, a unified dashboard, consolidated reporting, and one risk framework adapted across networks rather than rebuilt from scratch for each.

The institutional crypto landscape three years ago centered on Bitcoin and Ethereum. Today, Solana, Avalanche, and Polygon have genuine institutional adoption. Three years from now, new networks may command significant institutional attention while some current favorites fade.

Starting with multi-chain capable providers creates optionality for portfolio evolution. When you decide to add new networks or adjust allocations, operational infrastructure already supports expansion without requiring new vendor relationships or platform integrations.

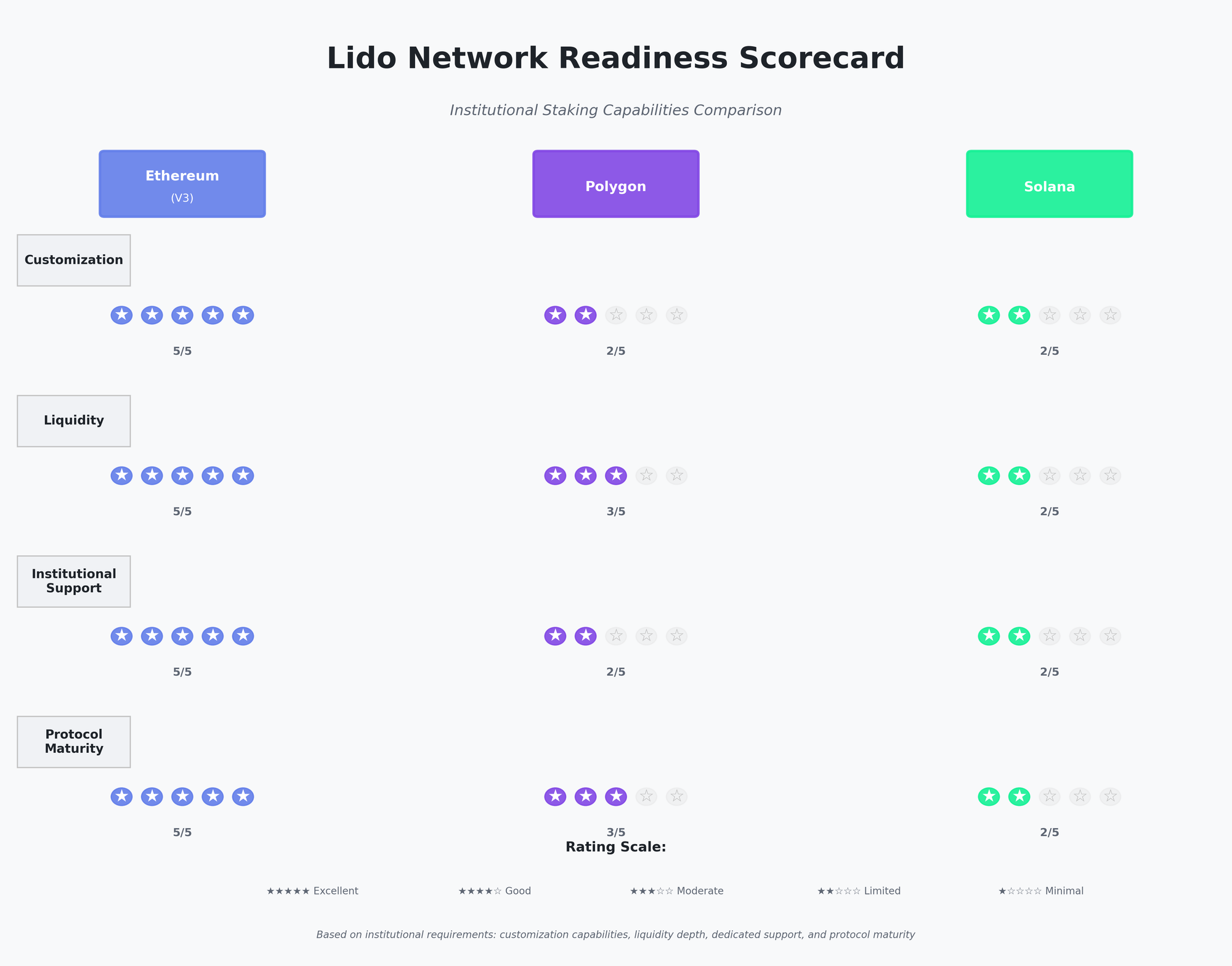

For institutions considering multi-chain strategies, understanding deployment maturity across networks is critical. Lido V3's exceptional institutional capabilities for Ethereum represent the gold standard, while other chains are at different stages of development.

Ethereum with V3's stVaults represents Lido's institutional flagship — mature protocol, customization capabilities, deep liquidity, extensive institutional support infrastructure, and proven track record with large positions. Institutional readiness is excellent across transparency, customization, liquidity, and operational support.

Polygon offers functional liquid staking via stMATIC that works well for moderate allocations, though it predates V3's advanced institutional features. For MATIC allocations of $5M-$25M, operational consistency with your Ethereum staking infrastructure can provide value.

For large positions requiring the full customization and institutional-grade support that Lido V3 delivers on Ethereum, institutions typically need to evaluate additional solutions as Lido's capabilities expand to other networks over time.

Solana and other networks show varying degrees of protocol maturity and institutional positioning. Understanding these differences matters when building multi-chain strategies, as Lido V3 on Ethereum sets a high bar that other solutions are working to match.

Lido's success on Ethereum, with V3 enhancing institutional capabilities, demonstrates how powerful well-designed liquid staking protocols can be for institutions. While Lido's multi-chain presence creates valuable consistency opportunities, institutions should understand that working with infrastructure providers who operate across multiple protocols enables optimization for each network's unique characteristics.

Professional multi-chain infrastructure providers operate validators across dozens of proof-of-stake networks, supporting various protocols based on what delivers optimal institutional outcomes for each specific chain.

For Ethereum, P2P.org is preparing to operate Lido V3 validators for institutional stVaults, where the protocol provides exceptional institutional characteristics — customization, liquidity, transparency, and governance control that set the industry standard.

For other networks, it means evaluating the best institutional approach per chain. Sometimes that's Lido deployments where available and mature. Sometimes it's native staking mechanisms. Sometimes, it's alternative liquid staking protocols more developed for particular chains.

At P2P.org, this flexibility means optimizing for the institutional outcomes you actually need (transparency, control, risk management) while leveraging the best available protocol for each network in your portfolio.

One of the most valuable aspects of working with multi-chain infrastructure providers is consolidated visibility across your entire staking portfolio, regardless of which specific protocols operate underneath.

A unified institutional dashboard provides all staked positions across all networks in one view, performance metrics calculated with consistent methodology, consolidated reward tracking, risk monitoring using frameworks adapted across networks, and custom reporting exports matching your treasury systems.

For treasury teams managing staking across multiple networks, this operational efficiency is substantial — one login, one interface, one support contact, unified reporting regardless of underlying mechanisms.

Start with strategic asset allocation, not infrastructure capabilities. The networks you hold should determine your staking strategy, not the reverse.

Portfolio assessment first: List all proof-of-stake assets in your current portfolio. Identify time horizons for each holding. Assess risk tolerance per network. Consider portfolio evolution plans.

Before staking any asset, evaluate infrastructure maturity. What institutional-grade staking solutions exist? Are there liquid staking options or only native mechanisms? How deep are secondary markets? Are there operators with institutional certifications? What monitoring infrastructure exists?

For Ethereum with Lido V3, these questions have excellent answers. For newer networks, significant gaps may exist that make staking premature until the infrastructure matures.

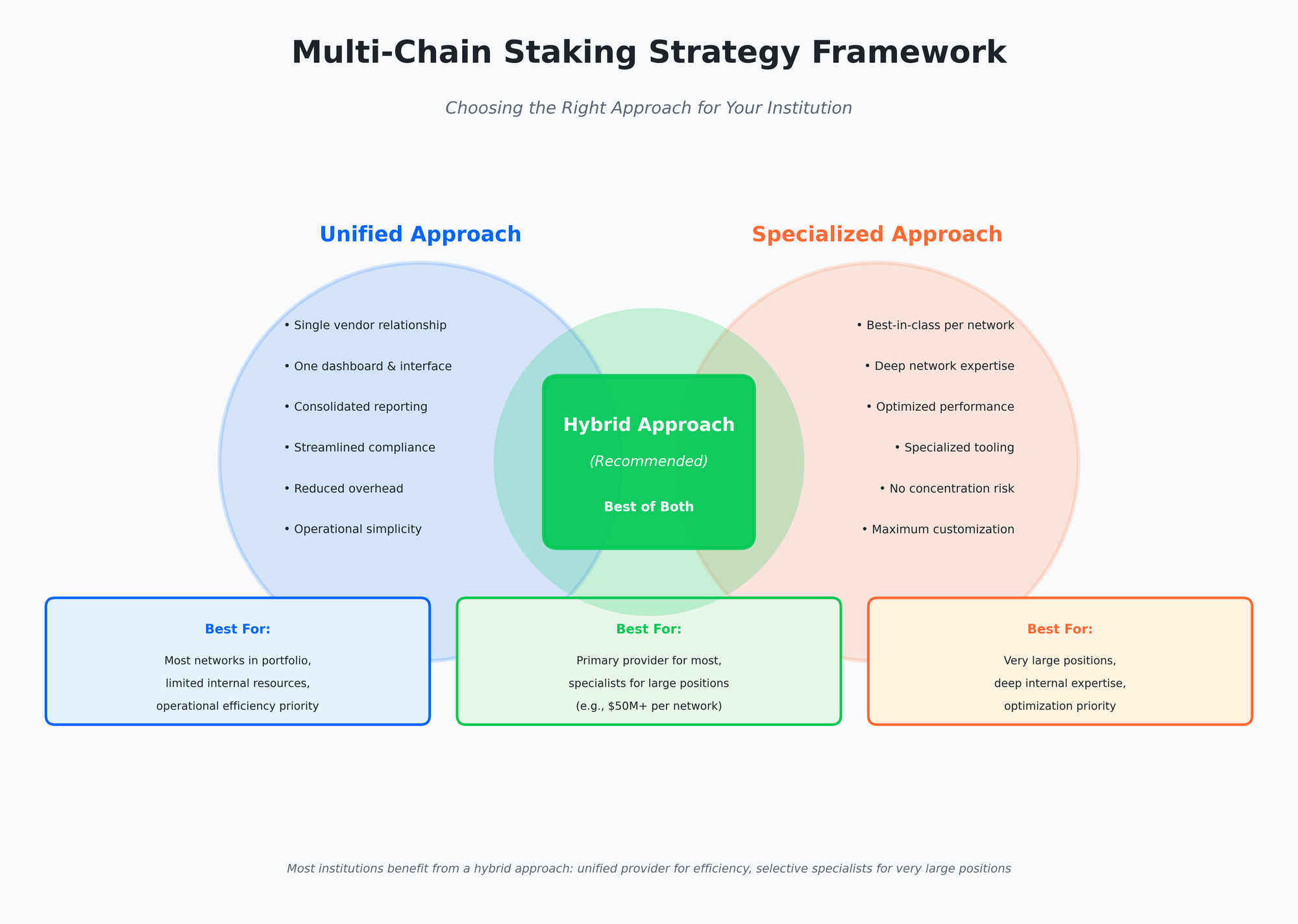

Most institutions benefit from a hybrid approach: Use a capable multi-chain provider as your primary partner for most networks, but selectively use specialists for networks where deep expertise creates meaningful value.

Example: Use a multi-chain provider for Ethereum (via Lido V3 when it launches on mainnet), Polygon, and smaller allocations, while considering Solana specialists for very large SOL positions where network-specific expertise delivers superior outcomes.

Don't attempt to stake everything immediately. Begin with networks representing your largest allocations — typically Ethereum, then one or two others based on portfolio weighting.

Master operations on major positions before adding smaller networks. Your $120M ETH position deserves immediate attention. Smaller positions can wait until you've built operational competence.

If your multi-chain provider offers 90% of best-in-class performance for a network, operational simplicity usually justifies accepting the 10% gap. Only for very large positions — typically $50M+ in a single network beyond Ethereum — does specialization overhead become worthwhile.

Calculate the actual dollar value of optimization. If specialized infrastructure might improve annual returns by 0.3% on a $20M position, that's $60K annually. If managing that specialized relationship requires 40 hours of internal time annually, you're paying for marginal improvement through your team's opportunity cost.

Add one network per quarter rather than attempting simultaneous multi-chain deployment. After adding each network, monitor intensively for the first 90 days before adding the next.

Three trends are shaping institutional multi-chain staking: cross-chain liquidity and interoperability, creating opportunities to use staked assets across multiple chains; regulatory frameworks developing independently per network and jurisdiction; and infrastructure maturing at different paces.

Institutions building multi-chain capabilities now position themselves to capture opportunities as infrastructure matures rather than playing catch-up when networks become institutionally viable.

The question facing treasury teams isn't whether to expand beyond Ethereum eventually, but when to start and how to execute strategically.

Lido V3 delivers exceptional institutional infrastructure for Ethereum, setting the standard for what customizable, compliant liquid staking should be. For other networks, evaluate whether Lido deployments meet your requirements or whether alternative approaches provide better institutional characteristics for those specific chains.

Work with infrastructure providers who optimize for your institutional outcomes across networks while leveraging the best available protocols. Build a monitoring and reporting infrastructure that consolidates visibility across your entire staking portfolio.

Most importantly, recognize that a multi-chain staking strategy is fundamentally about portfolio optimization and operational efficiency rather than chasing marginal reward differences across networks.

At P2P.org, we support institutional multi-chain strategies across 40+ proof-of-stake networks, using optimal approaches for each network rather than being constrained to single protocols.

Schedule a multi-chain strategy session with us to review your complete crypto portfolio, identify staking opportunities across networks, evaluate institutional readiness per network, and develop a phased multi-chain strategy aligned with your risk tolerance and operational capabilities.

We'll assess whether unified, hybrid, or specialized approaches make sense for your organization, provide network-specific infrastructure readiness analysis, and outline implementation timelines that build capabilities progressively rather than creating operational overwhelm.

<h2 id="at-a-glance"><strong>At a Glance:</strong></h2><ul><li>Network rewards increased from 5% to 20%+ NRR<strong> </strong>— a 4x jump in returns for $EIGEN restakers</li><li>EigenAI and EigenCompute launched on mainnet alpha, introducing verifiable AI infrastructure to solve enterprise trust gaps</li><li>Protocol inflation adjusted from 4% to 8% to fund the higher reward structure</li><li>P2P.org reduced commission from 10% to 5% through end of 2025 for all $EIGEN restakers</li></ul><p>EigenLayer made two major announcements this week that fundamentally shift the restaking landscape: a 4x increase in network rewards and the mainnet alpha launch of the first revenue-generating applications built on restaking infrastructure.</p><p>Here's what changed, why it matters for institutional allocators, and how the pieces connect.</p><h2 id="the-economics-from-5-to-20-nrr"><strong>The Economics: From 5% to 20%+ NRR</strong></h2><p>Programmatic Incentives v2 is now live, raising the Network Reward Rate (NRR) from 5% to over 20% annually for $EIGEN restakers.</p><h3 id="what-actually-changed"><strong>What actually changed</strong></h3><p><strong>Base rewards increased 4x.</strong> The 20% NRR is the new baseline, not a temporary promotion.</p><p><strong>Inflation rate doubled.</strong> Total $EIGEN issuance increased from 4% to 8% annually, directly funding the higher rewards. An additional 1% goes toward Ecosystem Growth initiatives.</p><p><strong>Incentive structure realigned.</strong> The new model rewards long-term restakers who provide consistent security to Actively Validated Services (AVS), rather than optimizing purely for TVL growth.</p><p><strong>Why this matters:</strong> At 5% NRR, restaking competed with traditional Ethereum staking (3-4% NRR) while adding operational complexity. At 20%+, it becomes one of the highest risk-adjusted yields in crypto infrastructure — a 16-17 percentage point premium that justifies the additional overhead for institutional treasuries.</p><h2 id="the-infrastructure-what-gets-secured"><strong>The Infrastructure: What Gets Secured</strong></h2><p>The 4x rewards increase raises an important question: what are restakers actually securing?</p><p>EigenCloud's mainnet alpha launch provides the answer: <strong>EigenAI</strong> and <strong>EigenCompute </strong>— the first real-world services that demonstrate restaking economics in practice.</p><h3 id="eigenai-verifiable-llm-inference"><strong>EigenAI: Verifiable LLM Inference</strong></h3><p>Enterprise AI deployment faces a fundamental trust gap. When you query an LLM through cloud providers, you're trusting the model hasn't been tampered with, the response came from the claimed model, and results haven't been altered.</p><p>For regulated institutions and compliance-heavy industries, this opacity is a blocker.</p><p><strong>What EigenAI does:</strong> Provides an API for LLM inference where every input, output, and model version is cryptographically guaranteed. Prompts, responses, and models remain provably unchanged, with complete audit trails for all interactions.</p><p><strong>Why enterprises care:</strong> Deterministic, reproducible AI outputs with full auditability. If you need to prove to regulators exactly what your AI system processed and returned, EigenAI provides cryptographic proof.</p><p><strong>OpenAI-compatible API:</strong> Developers can integrate verifiable inference into existing systems with minimal code changes.</p><p><strong>Use cases:</strong></p><ul><li>Financial institutions running AI-powered risk models</li><li>Healthcare applications requiring audit trails for diagnostic AI</li><li>Legal tech where AI-assisted research needs to be defensible</li><li>Any regulated industry where AI decisions require proof of execution</li></ul><p></p><h3 id="eigencompute-verifiable-off-chain-computation"><strong>EigenCompute: Verifiable Off-Chain Computation</strong></h3><p><strong>What it does:</strong> Executes complex computational tasks off-chain with on-chain-level trust guarantees.</p><p><strong>How it works:</strong> Current alpha leverages Trusted Execution Environments (TEEs) — hardware-based secure enclaves that prove code executed correctly. Future releases will add cryptoeconomic guarantees and zero-knowledge proofs.</p><p><strong>Why this matters:</strong> Many blockchain applications need heavy computation that's too expensive or slow to run on-chain. EigenCompute provides a verified alternative — execute off-chain, prove on-chain.</p><p><strong>Practical applications:</strong></p><ul><li>Complex financial modeling for DeFi protocols</li><li>AI model training and inference requiring verification</li><li>Data processing pipelines where results need on-chain confirmation</li><li>Any computation where proving correct execution matters more than running everything on-chain</li></ul><h2 id="how-the-pieces-connect-dual-revenue-model"><strong>How the Pieces Connect: Dual Revenue Model</strong></h2><p>EigenAI and EigenCompute represent the economic model of restaking playing out in practice.</p><p>When enterprises use these services, they pay fees. Those fees flow to:</p><ol><li>The AVS operators who validate the services</li><li>The restakers who provide economic security to those operators</li></ol><p>This creates a dual-revenue model for restakers:</p><ul><li><strong>Base protocol rewards</strong> (the 20%+ NRR from Programmatic Incentives v2)</li><li><strong>Service fee revenue</strong> from actual usage of EigenAI and EigenCompute</li></ul><p>As these services gain enterprise adoption, early restakers who secured them capture both yield streams. This is why the 4x rewards increase and the EigenCloud launch matter together — higher protocol rewards plus revenue-generating applications that those rewards secure.</p><h2 id="p2porg-5-commission-through-2025"><strong>P2P.org: 5% Commission Through 2025</strong></h2><p>To align with EigenLayer's new incentive structure, P2P.org has reduced commission from 10% to 5% through the end of 2025 for all $EIGEN restakers.</p><p><strong>What you get:</strong></p><ul><li><strong>Zero slashing events</strong> across 7 years of validator operations on 40+ networks</li><li><strong>Professional AVS management </strong>— we handle all technical implementation, including EigenAI and EigenCompute validation</li><li><strong>99.9% uptime</strong> with enterprise SLAs</li><li><strong>Dedicated institutional support</strong> for compliance and custom reporting</li><li><strong>5% commission applies to all yields </strong>— both base protocol rewards and AVS fee revenue</li></ul><p>*Important:** The 5% commission rate applies specifically to our dedicated <a href="https://app.eigenlayer.xyz/operator/0xd2bca64ad01f77de84be4a8acbd2e8beceed9ab3?ref=p2p.org"><u>EIGEN Restaking Operator</u></a>. P2P.org operates multiple EigenLayer validators — make sure you're delegating to the correct operator address to receive the promotional rate.</p><p><strong>Our AVS selection process evaluates:</strong></p><ul><li>Security architecture and audit history</li><li>Economic sustainability and revenue potential</li><li>Technical requirements relative to our infrastructure</li><li>Risk/reward profiles considering slashing conditions</li></ul><p>Both EigenAI and EigenCompute met our criteria for institutional-grade AVS participation.</p><h2 id="why-early-positioning-matters"><strong>Why Early Positioning Matters</strong></h2><p>The combination of 4x rewards and revenue-generating applications creates a compelling window for institutional restakers.</p><p><strong>Higher base rewards:</strong> 20%+ NRR changes the risk/reward calculation versus traditional staking and DeFi alternatives.</p><p><strong>Fee revenue upside:</strong> As EigenAI and EigenCompute move from alpha to production and gain enterprise adoption, fee revenue flows to validators and restakers.</p><p><strong>First-mover advantage:</strong> Early restakers capture both yield streams while building operational expertise before restaking becomes commoditized.</p><p>The shift from 5% to 20% NRR combined with the launch of actual revenue-generating services demonstrates restaking economics moving from theory to practice.</p><h2 id="next-steps"><strong>Next Steps</strong></h2><p>The shift from 5% to 20% NRR changes the strategic calculation for institutional restaking. Accessing those returns safely requires infrastructure built for institutional requirements — proven reliability, professional risk management, and dedicated support.</p><p>P2P.org has secured over $10 billion in assets for 130+ institutional clients across 40+ networks. Our EigenLayer infrastructure brings the same operational standards to restaking that we've delivered since 2018.</p><div class="kg-card kg-button-card kg-align-center"><a href="https://www.p2p.org/products/eigenlayer?ref=p2p.org" class="kg-btn kg-btn-accent">Restake $EIGEN with P2P.org</a></div>

from p2p validator

<p><strong>The infrastructure is live. The LST landscape is taking shape. Here's what we're seeing.</strong></p><p>With Monad delivering 10,000 TPS and sub-2-second finality, multiple liquid staking protocols are positioning to serve the ecosystem. Over 290 projects are building on Monad, and the LST layer will play a critical role in how capital flows through the network.</p><p>At P2P.org, we've been validating on Monad since Testnet-1. That early access has given us insight into how the liquid staking landscape is developing. As mainnet approaches, we're evaluating which LST protocols have the technical capabilities, funding, and ecosystem alignment to succeed.</p><p>Here's our overview of the major liquid staking protocols emerging on Monad.</p><h2 id="fastlane-holistic-liquid-staking-with-mev-infrastructure"><strong>Fastlane: Holistic Liquid Staking with MEV Infrastructure</strong></h2><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-3bfefbc1-199c-4aa1-8e3f-9430e4af509e.png" class="kg-image" alt="" loading="lazy" width="2000" height="603" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-3bfefbc1-199c-4aa1-8e3f-9430e4af509e.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/data-src-image-3bfefbc1-199c-4aa1-8e3f-9430e4af509e.png 1000w, https://p2p.org/economy/content/images/size/w1600/2025/11/data-src-image-3bfefbc1-199c-4aa1-8e3f-9430e4af509e.png 1600w, https://p2p.org/economy/content/images/2025/11/data-src-image-3bfefbc1-199c-4aa1-8e3f-9430e4af509e.png 2048w" sizes="(min-width: 720px) 720px"></figure><p><strong>What they do:</strong> MEV-aware liquid staking protocol with integrated infrastructure for execution abstraction</p><p><strong>Why it matters:</strong> First holistic LST combining staking, MEV capture, gas abstraction, and developer tools</p><h3 id="the-opportunity"><strong>The opportunity:</strong></h3><p><a href="https://www.fastlane.xyz/?ref=p2p.org" rel="noreferrer">Fastlane</a> represents a new category of liquid staking: the holistic LST. Users stake MON and receive shMON, but unlike traditional LSTs, shMON unlocks an entire suite of infrastructure capabilities. The protocol combines MEV capture through their Atlas framework with gas abstraction, account abstraction (4337 bundler), and on-chain task scheduling.</p><p>Their MEV infrastructure integrates directly with validators and dApps, capturing and redistributing MEV profits to shMON holders while providing smart contract-based MEV protection for users. This creates a positive-sum MEV environment where users, applications, and stakers all benefit.</p><p>For developers, Fastlane provides tools to automate smart contract executions without off-chain dependencies. For users, shMON can be used for gas payments while earning enhanced yields from both staking rewards and MEV redistribution.</p><p><strong>Funding:</strong> $8.3M total ($2.3M + $6M)<br><strong>Backers:</strong> Multicoin Capital (lead), Figment Capital (lead), DBA (lead), Coinbase Venture, Delphi Ventures, Hashkey Capital, Robot Ventures, P2 Ventures (Polygon Ventures)</p><p><strong>Why P2P.org is watching:</strong> Fastlane's approach to MEV infrastructure aligns with the future of validator economics on high-throughput chains. Their team's deep expertise in staking and MEV optimization positions them to capture significant value as Monad scales. We're already integrated as a validator partner and see Fastlane as critical infrastructure for the ecosystem's MEV layer.</p><h2 id="apriori-mev-driven-liquid-staking"><strong>aPriori: MEV-Driven Liquid Staking</strong></h2><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-698fe9f7-7a10-4a01-afbf-3c5ab4384c33.png" class="kg-image" alt="" loading="lazy" width="1600" height="869" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-698fe9f7-7a10-4a01-afbf-3c5ab4384c33.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/data-src-image-698fe9f7-7a10-4a01-afbf-3c5ab4384c33.png 1000w, https://p2p.org/economy/content/images/2025/11/data-src-image-698fe9f7-7a10-4a01-afbf-3c5ab4384c33.png 1600w" sizes="(min-width: 720px) 720px"></figure><p><strong>What they do:</strong> Liquid staking protocol that combines traditional staking rewards with MEV profits<strong>Why it matters:</strong> Rethinking how staking value accrues by capturing and redistributing MEV transparently</p><h3 id="the-opportunity-1"><strong>The opportunity:</strong></h3><p>Traditional liquid staking gives you a receipt token and calls it a day. <a href="https://www.apr.io/?ref=p2p.org" rel="noreferrer">aPriori</a> goes further by capturing and redistributing MEV profits back to stakers. On a network processing 10,000 TPS, MEV complexity increases exponentially, and aPriori is positioned to capture that value transparently.</p><p>Users stake MON and receive aprMON, which continues earning both staking rewards and MEV-enhanced yields. That composability unlocks DeFi participation without sacrificing staking income.</p><p><strong>Funding:</strong> $30M raised (most recent round: $20M in August 2025)<br><strong>Backers:</strong> Pantera Capital (lead), Hashed Fund (lead), Arrington XRP Capital (lead), YZi Labs (Prev. Binance Labs), ConsenSys, OKX Ventures, CSM Holdings</p><p><strong>Why P2P.org is watching:</strong> We're already integrated as a validator partner. Their approach to MEV transparency aligns with how we operate — no hidden extraction, just measurable performance. As Monad scales, aPriori's infrastructure will be critical for institutional stakers who want both yield and liquidity.</p><h2 id="magma-community-powered-liquid-staking-with-dvt"><strong>Magma: Community-Powered Liquid Staking with DVT</strong></h2><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-fc38ca9f-828e-447f-9878-183cb30d7e63.png" class="kg-image" alt="" loading="lazy" width="1201" height="1200" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-fc38ca9f-828e-447f-9878-183cb30d7e63.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/data-src-image-fc38ca9f-828e-447f-9878-183cb30d7e63.png 1000w, https://p2p.org/economy/content/images/2025/11/data-src-image-fc38ca9f-828e-447f-9878-183cb30d7e63.png 1201w" sizes="(min-width: 720px) 720px"></figure><p><strong>What they do:</strong> DAO-owned liquid staking protocol using Distributed Validator Technology and MEV-boosted yields</p><p><strong>Why it matters:</strong> First DVT implementation outside Ethereum, combining enhanced security with MEV capture</p><h3 id="the-opportunity-2"><strong>The opportunity:</strong></h3><p><a href="https://www.magmastaking.xyz/?ref=p2p.org" rel="noreferrer">Magma</a> combines DVT with MEV infrastructure on Monad. Users stake MON and receive gMON, which functions as composable collateral across the ecosystem. Magma's validator auctions capture and redistribute MEV rewards to stakers, while DVT reduces slashing risk through distributed validator operations.</p><p>The gMON token enables lending, borrowing, liquidity provision, and trading while earning staking yields, with additional restaking opportunities through EigenLayer integration.</p><p><strong>Funding:</strong> $3.9M seed round (October 2024)<br><strong>Backers:</strong> CMS Holdings, IVC, Animoca Brands, Maelstrom, Builder Capital, Stake Capital Group, Bloccelerate, RockTree Capital</p><p><strong>Why P2P.org is watching:</strong> DVT aligns with our validator philosophy on decentralization and security. The reduced slashing risk makes institutional staking more attractive, while MEV-boosted yields position Magma as foundational infrastructure for Monad's staking landscape. We're already integrated as a validator partner.</p><h2 id="kintsu-composable-liquid-staking"><strong>Kintsu: Composable Liquid Staking</strong></h2><figure class="kg-card kg-image-card"><img src="https://p2p.org/economy/content/images/2025/11/data-src-image-2d9bc744-49a6-4a7e-b2b3-f7e6462457ce.png" class="kg-image" alt="" loading="lazy" width="1398" height="586" srcset="https://p2p.org/economy/content/images/size/w600/2025/11/data-src-image-2d9bc744-49a6-4a7e-b2b3-f7e6462457ce.png 600w, https://p2p.org/economy/content/images/size/w1000/2025/11/data-src-image-2d9bc744-49a6-4a7e-b2b3-f7e6462457ce.png 1000w, https://p2p.org/economy/content/images/2025/11/data-src-image-2d9bc744-49a6-4a7e-b2b3-f7e6462457ce.png 1398w" sizes="(min-width: 720px) 720px"></figure><p><strong>What they do:</strong> Liquid staking protocol with vault staking and restaking integrations</p><p><strong>Why it matters:</strong> Building the yield infrastructure that powers Monad DeFi through maximum composability</p><h3 id="the-opportunity-3"><strong>The opportunity:</strong></h3><p>While aPriori focuses on MEV-enhanced yields, <a href="https://kintsu.xyz/staking?ref=p2p.org" rel="noreferrer">Kintsu</a> takes a different approach: maximum composability. Stake MON, receive sMON, then deploy that sMON across lending protocols, AMMs, and yield vaults without unstaking.</p><p>Kintsu's integration with restaking protocols means users can layer yield strategies — staking MON while simultaneously securing other networks or applications. For DeFi power users, this is the foundational tool. For protocols building on Monad, sMON becomes a composable asset they can build around.</p><p>The protocol maintains a decentralized validator registry controlled by the Kintsu DAO, ensuring staking is distributed across diverse network participants. This enhances both security and decentralization while allowing validators to compete on yield generation.</p><p><strong>Funding:</strong> $4M seed round<br><strong>Backers:</strong> Castle Island Ventures (lead), The Spartan Group, CSM Holding, CMT Digital, Animoca Brands, Brevan Howard Digital</p><p><strong>Why P2P.org is watching:</strong> Composability drives DeFi adoption. Liquid staking tokens that work seamlessly across protocols become the default collateral, the default LP tokens, the default building blocks. Kintsu is positioning to be that foundational layer. As validators, we see the demand for flexible staking solutions, and Kintsu delivers that flexibility without compromising security. We're already integrated as a validator partner.</p><h2 id="the-bottom-line"><strong>The Bottom Line</strong></h2><p>Monad's LST landscape is still developing, and market dynamics will ultimately determine which protocols gain traction. The protocols we've highlighted share some common characteristics:</p><ul><li>Technical teams with relevant experience (TradFi, HFT, or established DeFi backgrounds)</li><li>Funding from credible investors</li><li>Distinct approaches to liquid staking infrastructure</li><li>Varying degrees of validator and ecosystem integration</li></ul><p>The LST market on Monad likely won't be winner-take-all. Different protocols may serve different market segments based on their technical approaches, partnerships, and execution capabilities. As validators, we're taking a measured approach to understanding which models prove most effective.</p><h2 id="what-this-means-for-stakers"><strong>What This Means for Stakers</strong></h2><p>As validators, our job is to keep the network running at peak performance. We also have a responsibility to understand the liquid staking landscape developing on top of that infrastructure.</p><p>The LST protocols emerging on Monad represent different technical approaches:</p><ul><li><strong>MEV-focused models</strong> that capture and redistribute additional value through validator optimization</li><li><strong>Composability-focused models</strong> that emphasize flexibility across DeFi protocols</li><li><strong>Infrastructure-integrated models</strong> that combine staking with broader developer tooling</li><li><strong>Security-focused models</strong> that pioneer approaches like DVT for risk reduction</li></ul><p>The interplay between these different approaches will shape how capital flows through Monad's DeFi ecosystem. More LST diversity could enable more DeFi use cases, deeper liquidity pools, and increased protocol integrations — potentially leading to higher network activity and staking rewards.</p><p>P2P.org is evaluating these developments as the ecosystem matures, maintaining flexibility in our approach to LST partnerships.</p><h2 id="how-to-position-for-monads-lst-landscape"><strong>How to Position for Monad's LST Landscape</strong></h2><p>If you're an institutional staker, protocol builder, or wallet provider evaluating Monad's liquid staking options, here are some considerations:</p><ol><li><strong>Validator infrastructure matters.</strong> Look for validators with testnet experience and proven track records. Infrastructure quality affects performance regardless of which LST protocols gain dominance.</li><li><strong>Diversification may be prudent.</strong> The LST landscape is still developing, and different protocols offer different technical approaches. Maintaining optionality across multiple LSTs could reduce concentration risk.</li><li><strong>Integration flexibility.</strong> For DeFi protocol builders, designing systems that can integrate with multiple LST tokens provides flexibility as market dynamics play out.</li><li><strong>Monitor partnerships.</strong> Track which validators are working with which LST protocols, and how those relationships evolve as mainnet approaches.</li></ol><p></p><h2 id="why-p2porg"><strong>Why P2P.org?</strong></h2><p>We're taking a measured approach to the Monad LST landscape, maintaining flexibility as the market develops:</p><ul><li>Validating since Testnet-1</li><li>Evaluating partnerships with major LST protocols</li><li>Purpose-built infrastructure for parallel execution and MEV optimization</li><li>99.9% uptime, zero slashing across all networks</li><li>$10B+ in assets staked across multiple chains</li></ul><p>As the LST landscape evolves, we're focused on understanding which technical approaches prove most effective and which partnerships align with our validator philosophy. We're observing how these protocols develop and making partnership decisions based on execution, technical merit, and ecosystem fit.</p><p>The Monad LST landscape is taking shape. The infrastructure is live. The protocols are launching.</p><p><strong>Stake with certainty. Build with confidence.</strong></p><div class="kg-card kg-button-card kg-align-center"><a href="https://www.p2p.org/networks/monad?ref=p2p.org" class="kg-btn kg-btn-accent">Stake Monad with P2P.org</a></div><p>Have questions about Monad staking or ecosystem opportunities? Our team is here to help. <a href="https://link.p2p.org/bdteam?ref=p2p.org" rel="noreferrer"><u>Contact us</u></a></p>

from p2p validator